Quick Overview

India continues to be a lower-middle-income country, with a per capita income of around ₹27,3237 as of 2025. So, individuals may not always prioritize health insurance due to other financial responsibilities. However, it’s important to understand that health coverage plays a key role in ensuring financial security. In this case, the solution lies in starting small since some cover is exponentially better than no cover.

This is where 5 lakh health insurance comes in. Although the amount is considered an affordable starting point, will it protect you as medical costs rise? Let's delve deeper into the details in this guide.

What Does 5 Lakh Health Insurance Cover?

A 5 lakh health insurance plan covers medical expenses up to ₹5 lakh every policy year. This coverage acts as a financial cushion against high healthcare costs, but only for the expenses outlined in your policy. Generally, you’ll be covered for the circumstances like:

- Medically necessary hospitalization expenses for accidents, severe illnesses, or planned surgeries

- Daycare treatments like chemotherapy, dialysis, cataract surgery, or tonsillectomy

- Domiciliary hospitalization

- Ayurveda, Yoga, Unani, Siddha, and Homeopathy (AYUSH) Hospitalization Coverage

5 Lakh Health Insurance Premium Calculator

A 5 lakh health insurance premium calculator is an online tool that helps you estimate the premium you'll need to pay for the specific plan you choose. By adding details such as your age, cover amount, pre-existing diseases, and more, you can get a quick estimate of how much your health insurance will cost annually or monthly.

Best 5 Lakh Health Insurance Plans

Here, CSR stands for claim settlement ratio, ICR denotes incurred claims ratio, and PA implies per annum.

For more details, refer to our guide on Best Health Insurance Plans in India 2026.

Now that we have analyzed the best plans, let’s compare sample premiums of 5 lakh health insurance and higher sum insured options for a tier 1 city (New Delhi: 110001). The comparisons are for HDFC ERGO Optima Secure.

Premium Comparison for 5 Lakh Health Insurance

Here, ‘A’ refers to an adult, and ‘C’ denotes a child.

Key Insight: The above table shows that the price difference between a 5 lakh health insurance plan and other plans with higher sum insured options is quite small. In short, the premiums for a higher SI don't necessarily increase linearly.

Benefits and Drawbacks of 5 Lakh Health Insurance

Is 5 Lakh Health Insurance Worth It?

Despite the minimal price difference, if you have difficulty affording the premiums for a higher sum insured, a 5 lakh plan isn’t a bad option. However, it may also not be reliable in the long run due to the following reasons:

- Difficulty in Increasing Sum Insured: If you get diagnosed with a serious medical condition at a later stage, the insurers may reject increasing the sum insured.

- Black Swan Analogy: A health emergency could turn your life upside down without insurance. The most common examples are high-cost medical transplants or treatments like cancer (bone marrow transplant) that impact lives directly.

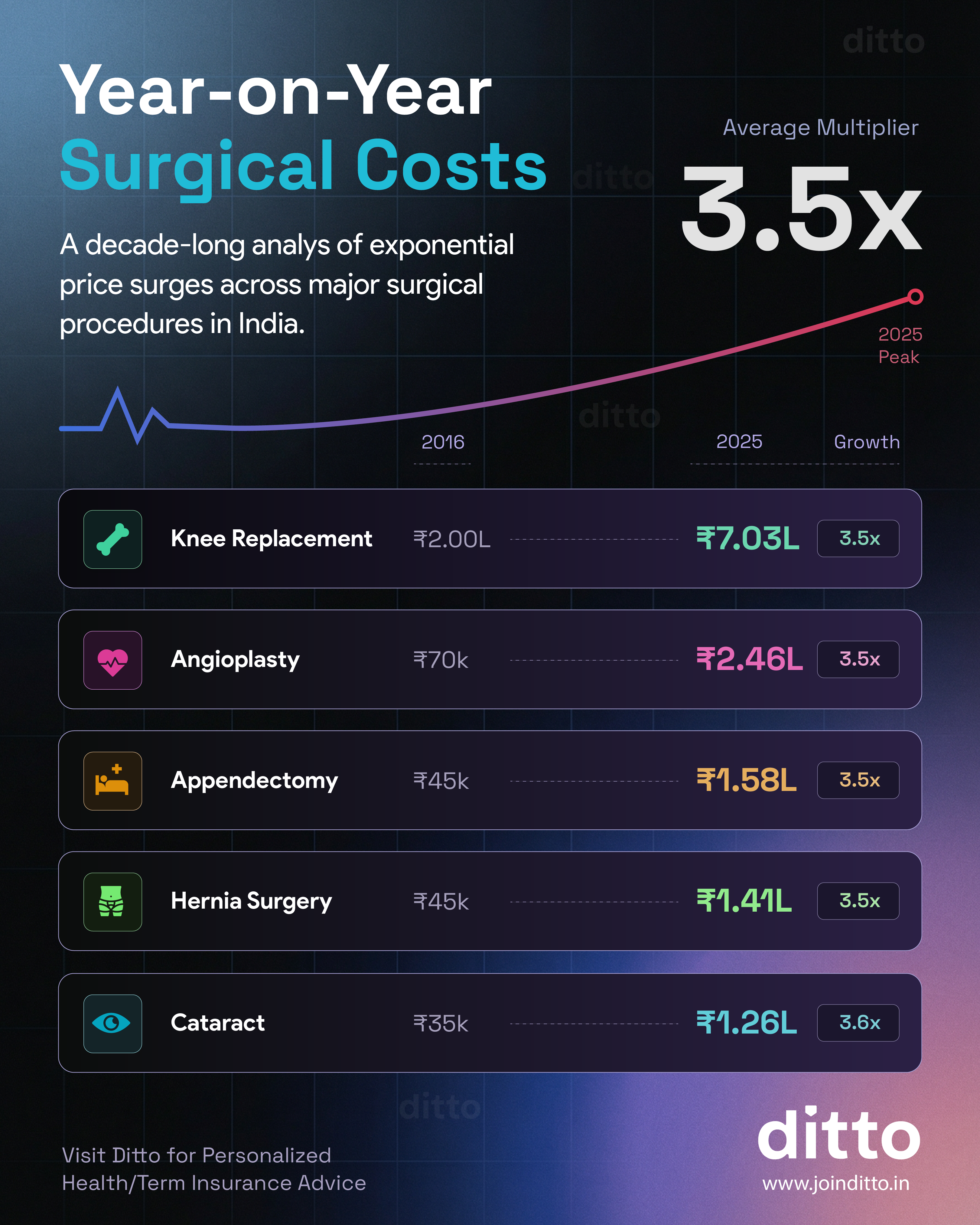

- Medical Inflation: Rise in medical expenses that may happen every 2-3 years. What you consider as a ₹5 lakh cover today will be a mere ₹2.5 lakh a few years later.

Here’s an infographic showcasing the differences between surgical costs in India between the years 2016 and 2025:

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or chat on WhatsApp with us now!

Ditto’s Take on 5 Lakh Health Insurance

Most insurers have a minimum sum insured requirement depending on the location of policy purchase. Tier-1 cities like Mumbai and New Delhi may not offer the option of availing a 5 lakh health insurance plan. Considering the hospital bills, how much they cost today, and how difficult it is to make changes to your policy later, we recommend a health insurance cover between ₹15 lakh and ₹25 lakh instead. Most importantly, a comprehensive cover with features like unlimited restoration of cover and sufficient bonuses will also give you peace of mind in the long run.

Disclaimer

Frequently Asked Questions

Last updated on: