Quick Overview

Women play a critical role in their family’s financial stability, yet a large number still don’t have life insurance in their own name. This gap often comes from the belief that only the primary earner needs coverage or that insurance is unnecessary for non-earning women.

Women's term insurance addresses this gap by offering affordable life cover tailored to women’s financial roles, responsibilities, and life stages. Due to lower mortality risk and higher life expectancy, women usually get the same coverage at lower premiums, making term insurance one of the most cost-effective ways to protect their family’s future.

In this guide, we will break down what women's term insurance is, how it works, and how to choose the right cover.

What Is Term Insurance for Women?

Term insurance for women is not a separate product category under IRDAI rules. It is a regular term insurance plan purchased by a woman in her own name, with pricing and features adjusted based on actuarial risk.

If the insured woman passes away during the policy term, the insurer pays the sum assured to her nominee. If she survives the term, no maturity benefit is paid (unless it’s a return-of-premium variant).

How Term Insurance for Women Is Different?

The core structure remains the same for all genders, but differences arise in pricing and underwriting:

- Lower premiums due to higher life expectancy

- Access to certain women-specific features in some plans

- Different underwriting approach for homemakers and non-earning women

Can Women Buy Term Insurance in India?

Yes. Women across income and lifestyle categories can buy term insurance, subject to underwriting criteria related to age, income, education, and medical eligibility.

Who Can Apply?

Women from the following profiles are generally eligible:

- Salaried

- Self-employed

- Gig workers/freelancers

- Homemakers

- NRIs

- Single parents

Age & Medical Requirements

- Entry Age: 18–60/65 years

- Maximum Coverage Age: Up to 85–99 years, depending on the plan. Remember that your policy term should cover you until the later of

- Retirement age

- Youngest child’s financial independence

- Big loans fully repaid

- Medical Tests: Typically required for women above 35, or those having pre-existing health conditions or for higher sum-assured levels.

Working vs Non-Working Women

- Homemakers / Non-earning women: Eligible for limited coverage (₹25 lakh–₹1 crore), usually linked to the spouse’s income or the spouse’s existing term plan.

- Working Women: Eligible for standard term plans with higher coverage (₹1–5 crore or more) supported by income proofs such as salary slips and ITRs.

Women-Specific Term Insurance Benefits and Features

- Lower Premiums: Women typically pay less due to lower mortality risk and longer life expectancy.

- Women-Specific Riders: Optional riders may cover coverage enhancement during the husband’s death, female cancers, or child-related benefits.

- Flexible Sum Assured & Tenure: Coverage can range from ₹50 lakh to ₹5 crore+ with terms of 10–40 years or even whole-life (up to age 99/100 in select plans). You can use our cover calculator tool to estimate the ideal coverage amount based on your income, liabilities, and long-term financial goals.

- Multiple Payout Modes: Nominees can receive benefits as a lump sum, monthly income, or a combination for smoother household cash flow.

- Premium Payment Flexibility: Monthly, quarterly, annual, or limited-pay options allow better budgeting.

- Discounts & Pricing Incentives: Non-smoker discounts, higher cover discounts, and online purchase benefits are commonly available.

- Protection for Dependents: Helps families manage ongoing expenses such as rent, tuition fees, and healthcare without financial disruption.

- Supports Financial Independence: Ensures continuity in single-income or dual-income households and protects future goals.

- Tax Benefits: Premiums qualify under Section 80C under the old regime, and payouts are generally tax-exempt under Section 10(10D) regardless of the tax regime.

- Rider Add-Ons: Critical illness, waiver of premium, accidental disability. Riders enhance coverage under a single plan.

What Is Covered and Not Covered Under Term Insurance for Women?

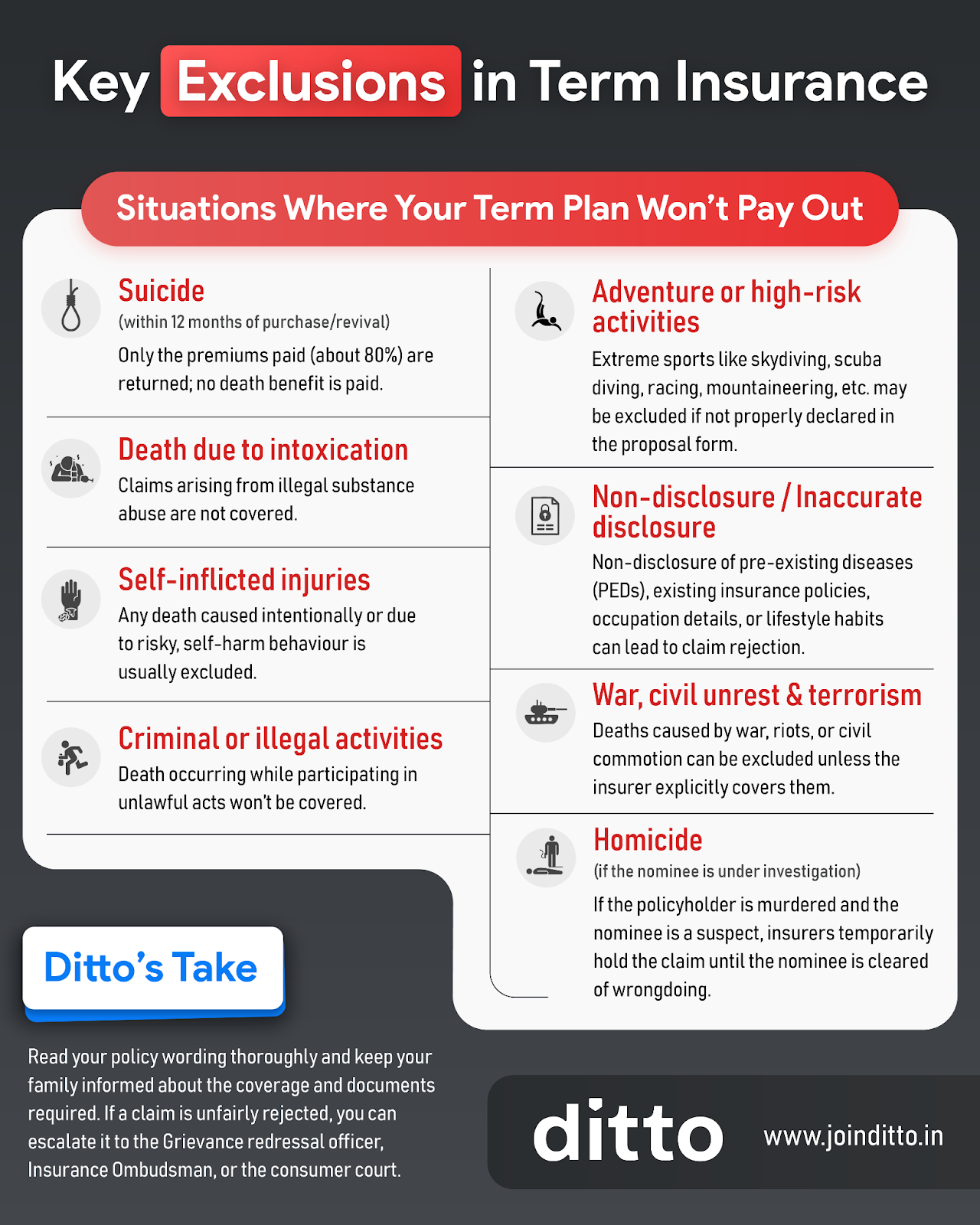

What Is Covered: Most women's term insurance plans generally cover death due to natural causes (for example, cardiac arrest), death resulting from terminal or critical illness, death caused by natural disasters or pandemics, and accidental death.

What Is Not Covered: The key exclusions are highlighted in the infographic below and are generally applicable across term insurance products.

Note: Term insurance provides life cover, not medical expense coverage. For maternity or hospitalisation costs, a separate health or maternity insurance plan is required.

Term Insurance for Women vs Men

Premium Comparison

Women typically pay 5–15% lower premiums than men for the same coverage due to actuarial pricing advantages.

Coverage & Benefits

The core benefits are similar for both genders, though women may access riders like increased coverage during spouse’s death, premium break or female cancer coverage, and homemakers may use joint-life options through a spouse.

Why Women Pay Less

Women have longer life expectancy and lower mortality risk, leading to lower claim probability and therefore lower premiums.

The table below compares annual premiums for male and female non-smokers across different age groups for a ₹2 crore term insurance policy with coverage till age 70.

Premium Comparison: Male vs Female

Note: Across typical term plans, female premiums tend to be lower than male premiums by up to 15 % for the same ₹2 crore cover and term till age 70, reflecting actuarial pricing differences.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now or chat on WhatsApp with our expert IRDAI-certified advisors.

Ditto’s Take

When choosing term insurance, focus on your actual financial role and long-term responsibilities. Pick a sum assured that can support your dependents, choose a policy tenure that covers key milestones, and add riders like critical illness or waiver of premium only if they genuinely add value.

Make sure your nominees are clearly defined to avoid claim delays later. It’s also important to check the insurer’s claim settlement record before buying a policy.

Disclosure

Frequently Asked Questions

Last updated on: