A joint term insurance plan allows two individuals, typically spouses, to be covered under a single life-insurance policy. It provides a safety net in the event one partner passes away, helping the surviving partner and family maintain financial stability. These plans can be more cost-efficient and straightforward to manage than separate policies, but they also come with certain limitations. It is usually recommended to obtain separate term insurance policies.

Introduction

When you’ve built a life together, sharing dreams, responsibilities, and financial commitments, protecting your future becomes essential. That’s where a joint term insurance plan comes into play. By combining coverage for both partners, you’re ensuring that your family’s standard of living isn’t jeopardised if one of you is no longer around. At the same time, choosing the right policy requires understanding how these plans differ from traditional individual term insurance, their advantages and drawbacks, and whether they are the right fit for your situation. Let’s dive right in.

Should you opt for a joint term insurance plan or select separate policies for yourself and your partner? Don’t worry! Book a free consultation call, and our expert advisors will help you find the right fit.

How Do Joint Term Insurance Plans Work?

Here’s a simplified breakdown of how a joint term insurance plan works:

- Both partners are insured under one contract. You jointly agree on the sum assured, policy term, and premium payment mode (monthly/annual/other).

- Depending on the policy type, the death benefit is paid when one or both insured persons die.

- The age, health status, and lifestyle habits of both partners affect premiums.

What Are the Types of Joint Life Term Insurance?

There are three broad types of joint term insurance plans:

- First-to-die (or first death) Plans:

The benefit is paid out when the first insured person dies, and the policy usually terminates thereafter. - Second-to-die (or joint life last survivor) plans:

The benefit is paid only after both insured persons have passed away. - Survivor benefit plans:

Here, the surviving partner receives the full sum assured regardless of who dies first; sometimes coverage continues for the surviving partner.

Each type has its own structure, and picking the right one depends on your goals and financial circumstances. For example, Edelweiss Zindago Protect Plus (Better Half Benefit) offers spouse cover only after the primary dies. If both die together, only the base sum assured is paid out.

List of Joint Term Insurance Plans

Here are some of the standout plans in India that cater to joint life coverage:

Benefits of a Joint Term Insurance Plan

Here are some of the major advantages of opting for a joint term plan:

- Cost efficiency:

One policy covering both may cost less than buying two separate term-insurance policies, especially if you’re similar in age and health. - Simplified logic and administration:

Managing one policy (with a single due date and premium stream) instead of two can reduce the chances of oversights or missed payments. - Flexibility in coverage (to some extent):

Some joint plans allow the sum assured to reflect combined liabilities or shared goals rather than separate individual needs.

Drawbacks of Joint Term Insurance Plans

- Limited Coverage for the Secondary:

In most joint policies, the secondary life assured (usually the wife or spouse) has a capped or limited coverage amount, often significantly lower than that of the primary life assured. - No Double Tax Benefits:

Tax deductions under Section 80C apply only to the policyholder who pays the premium. Neither partners can claim tax benefits separately for the same joint plan. - Limited Product Availability: Not all insurers offer joint term insurance plans, which restricts your choice of features, riders, and benefits compared to individual term policies.

- Complicated Claims in Case of Separation or Divorce

If the relationship status changes, it can be challenging to split or modify the joint policy, which may lead to financial or legal complications. - Reduced Flexibility in Future Planning:

If one partner wishes to increase coverage, add riders, or change beneficiaries later, joint plans may not offer the same flexibility as separate policies.

Ditto’s Take: It is recommended to opt for individual term insurance policies as compared to joint term insurance plans. While joint policies may seem convenient or slightly cheaper at first glance, the flexibility and long-term benefits of individual term plans far outweigh the short-term savings.

Why Choose Ditto for Term Insurance?

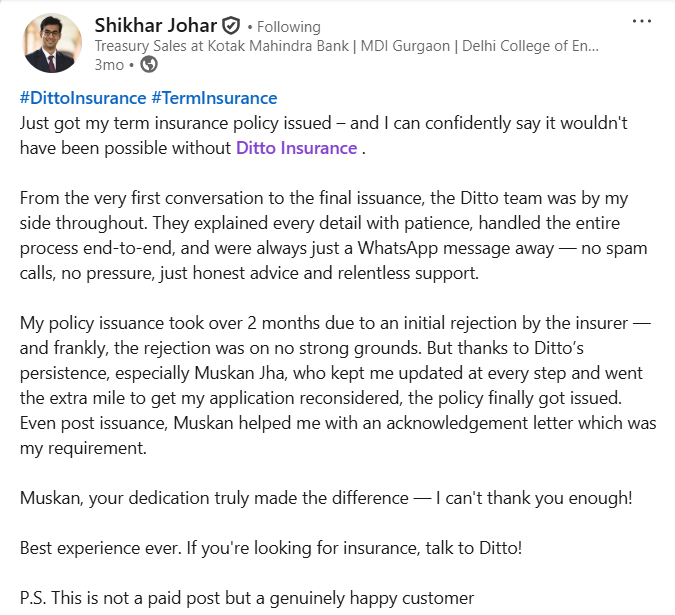

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Shikhar below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

A joint term insurance plan can be a decent tool for couples looking to secure their shared financial future, offering affordability and administrative simplicity. However, it’s rarely the best fit. If one partner is significantly older, has health issues, or has financial responsibilities that differ greatly, separate individual term policies may offer better outcomes.

In short, evaluate your ages, incomes, liabilities, health statuses, and future obligations, and compare both joint and separate plans. If you need help deciding which is better, our expert advisors can assist you.

Frequently Asked Questions

Is there a joint term life insurance policy? Can term insurance be joint?

Yes. Many insurers offer joint term life insurance policies that cover two individuals under a single contract.

Are joint term insurance plans cost-effective?

Yes. In some instances, these plans can be more cost-effective because one policy often has a lower combined premium as compared to two separate policies (especially if both partners are similar in age and health)

Are joint term insurance plans only for husband and wife?

No. While spouses are the most common pair, the concept can extend to other combinations (for example, a parent and child) in some policies.

What are the disadvantages of joint term insurance?

Some drawbacks include: more rigid policy structure (you and your partner are locked in together), fewer rider options for the non-primary insured, complexities if one wants to withdraw or change the policy, and potential disadvantage if one partner has significantly worse health.

Which company offers joint term insurance?

Several insurers do. Examples include: Aditya Birla Sun Life (DigiShield with Joint Life Protection), PNB MetLife (Mera Term Plan Plus), among others.

Last updated on: