LIC Term Insurance (Overview)

For many Indians, LIC isn’t just an insurance company; it’s a household name. Whether you remember its old advertisements or the classic promise “Zindagi ke saath bhi, zindagi ke baad bhi,” LIC has built decades of credibility.

But when it comes to term insurance in 2025, the question is simple: Does LIC still make sense for a pure life cover?

Well, LIC’s current term insurance portfolio focuses on digital-first, no-frills protection that aims to offer financial security without complicated features. The plans are basic and familiar in structure, which appeals to buyers who prefer simplicity over innovation.

If you’re unsure which LIC or private term plan fits your needs, book a free call with our advisors. We’re here to guide you every step of the way.

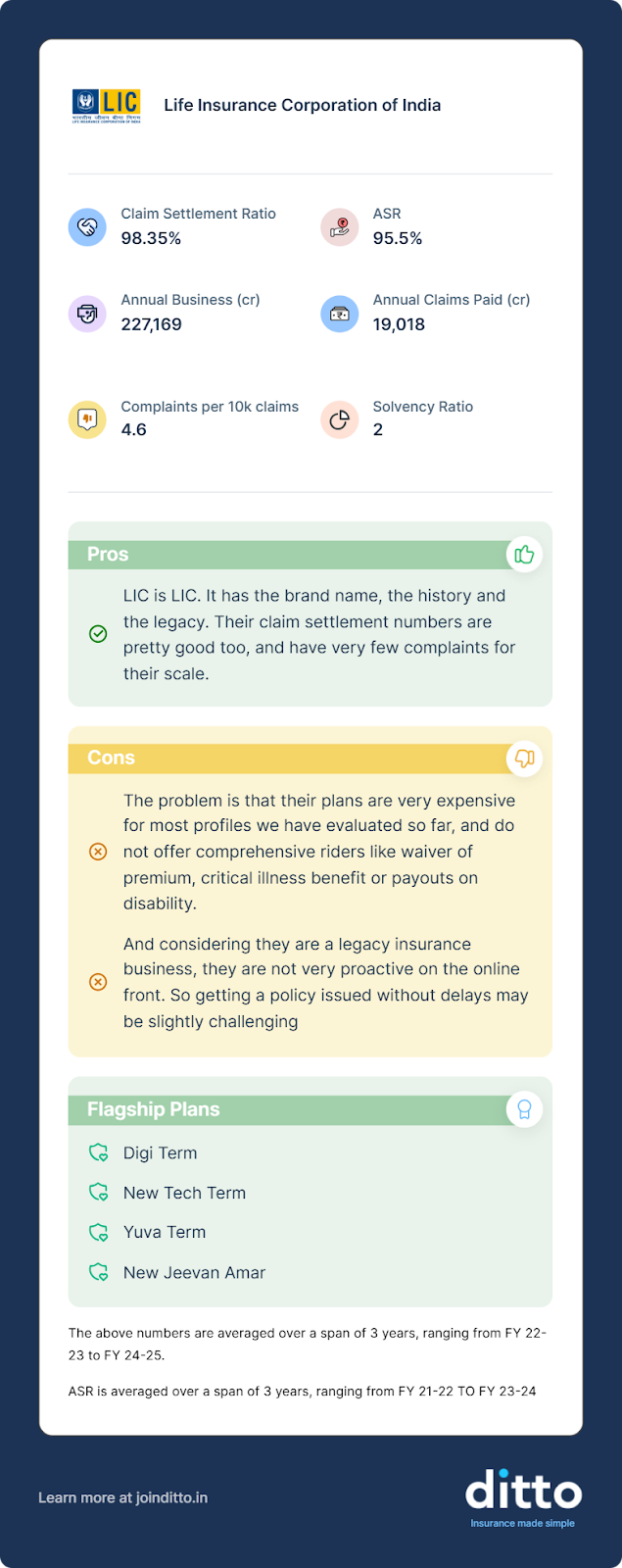

LIC Performance Metrics (3-Year Average: 2022–2025)

(Source: Compiled from IRDAI annual reports, insurer disclosures, and Ditto’s analysis of FY 2022–25 data.)

1. LIC Digi Term (Plan 876)

LIC Digi Term is a simple term insurance plan designed for buyers who prefer a digital purchase and straightforward protection. It offers pure life cover with level cover and increasing cover options, and the minimum sum assured starts at ₹50 lakh. The plan focuses on essential protection without add-ons, which is suitable for younger, tech-friendly applicants.

Features of LIC Digi Term:

- Online-only plan: Can be purchased exclusively on LIC’s digital platform.

- Youth-focused entry limits: Entry age capped at 45 years.

- Lower maturity age: Coverage available only up to age 75.

- Exclusive limited-pay options: 10-pay and 15-pay available only under Digi Term.

- No riders at all: Does not offer the accident benefit rider available in New Tech Term.

- Mandatory education criteria: Requires applicants to have completed Class 12.

- Sum assured capped at ₹5 crore: Higher cover may need reinsurer approval if it exceeds LIC’s risk limits.

2. LIC New Tech Term (Plan 954)

LIC New Tech Term shares some standard elements with Digi Term, including level/increasing cover, pure protection design, and the ₹50 lakh minimum cover. While both plans deliver the same basic purpose, New Tech Term includes additional flexibility that caters to a broader demographic.

Features of LIC New Tech Term:

- Widest eligibility: Open to individuals aged 18 to 65 years, which makes it suitable for mid-career and older buyers.

- Longest coverage: Protection available up to age 85, the highest among LIC term plans.

- No upper limit on sum assured: High-income earners can opt for very large covers.

- Accident Benefit Rider available: Provides an additional payout for accidental death.

- Flexible premium options: Includes limited-pay choices where premiums stop 5 or 10 years before the policy ends.

- Multiple payout options: The death benefit can be taken in installments over 5, 10, or 15 years (monthly, quarterly, half-yearly, or yearly) instead of a lump sum.

- More inclusive design: Works well for both online-savvy buyers and those needing advisory guidance.

LIC Term Plans vs Private Insurer Policies: Premiums

Note: These premiums are for non-smoker profiles earning ₹10 LPA in Delhi. Actual premiums may vary based on health, smoking status, and underwriting.

Key Insight: LIC’s premiums are higher across all profiles, while private insurers offer similar coverage at lower costs. For most buyers, private plans offer better value unless they specifically prefer LIC’s brand and offline support.

How to Claim LIC Term Insurance?

The process to file a claim for LIC term insurance is the same as that for any other term plan. Check out this infographic to get a clearer understanding:

Inclusions and Exclusions of LIC Term Plans

Inclusions: LIC term plans generally cover:

- Death due to natural causes such as illness or age-related health conditions (during the policy term).

- Death due to critical illness, including lifestyle diseases, organ failure, infections, etc.

- Accidental death, with an additional payout only if the Accident Benefit Rider is selected under the New Tech Term plan.

- All other causes of death, apart from the ones mentioned in the exclusions.

Exclusions: Claims may be denied or limited in the following situations:

- For suicide within 12 months of policy start or revival, LIC refunds 80% of premiums paid, not the full sum assured.

- Death while committing illegal or criminal acts, such as theft, assault, or escaping law enforcement.

- Death from high-risk or extreme sports (e.g., paragliding, scuba diving, skydiving) if these were not declared and approved at policy inception.

- Death due to intoxication, alcohol abuse, or consumption of narcotics not prescribed by a doctor.

- Deliberate non-disclosure of pre-existing illnesses: if LIC proves intentional concealment, the claim can be rejected.

- Self-inflicted injury leading to death (applicable under accidental riders).

- Death due to war, terrorism, or riots if the insured was actively participating.

- In homicide cases involving the nominee, the claim is placed on hold until the nominee is cleared legally.

Why Choose Ditto for Your Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron love us:

- No Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Ditto’s Take on LIC Term Insurance

Here’s a snapshot of Ditto’s verdict on LIC as an insurer:

As seen above, LIC term insurance is a dependable option backed by a strong claim track record and decades of public trust. While it is not a Ditto partner insurer, the plans themselves are reliable, although they tend to be simpler and less flexible than many private insurers' offerings.

Final Thoughts

LIC’s term plans are basic compared to private insurers. They lack many modern in-built features such as instant payout on claim intimation, health management services, special exit options, cover continuance, and life-stage upgrades. Rider options are also limited, with no waiver of premium, critical illness cover, or accidental disability benefits.

Bottom line, if you prefer straightforward coverage and value LIC's reputation, its term plans serve the purpose well. But if you want richer features, greater flexibility, or lower premiums, it is worth comparing LIC with other leading insurers before making a decision. The right choice ultimately depends on your budget, needs, and long-term financial goals.

If you’re unsure which LIC or private term plan fits your needs, book a free call with our advisors. We’re here to guide you every step of the way.

Frequently Asked Questions

Last updated on: