ICICI Prudential Claim Settlement Ratio

When you buy a life or term insurance policy, one question matters most: Will the insurer pay the claim when your family needs it? That’s where the claim settlement ratio (CSR) becomes a key indicator.

ICICI Prudential Life Insurance Company Limited, established in 2000, is a joint venture between ICICI Bank and UK-based Prudential Plc. It has grown to become India’s third-largest private life insurer and is known for its customer-centric approach and innovative insurance solutions.

In this article, we break down the ICICI Prudential claim settlement ratio, review its performance over the past years, and assess how reliably it settles claims for policyholders.

How to Calculate the ICICI Prudential Claim Settlement Ratio?

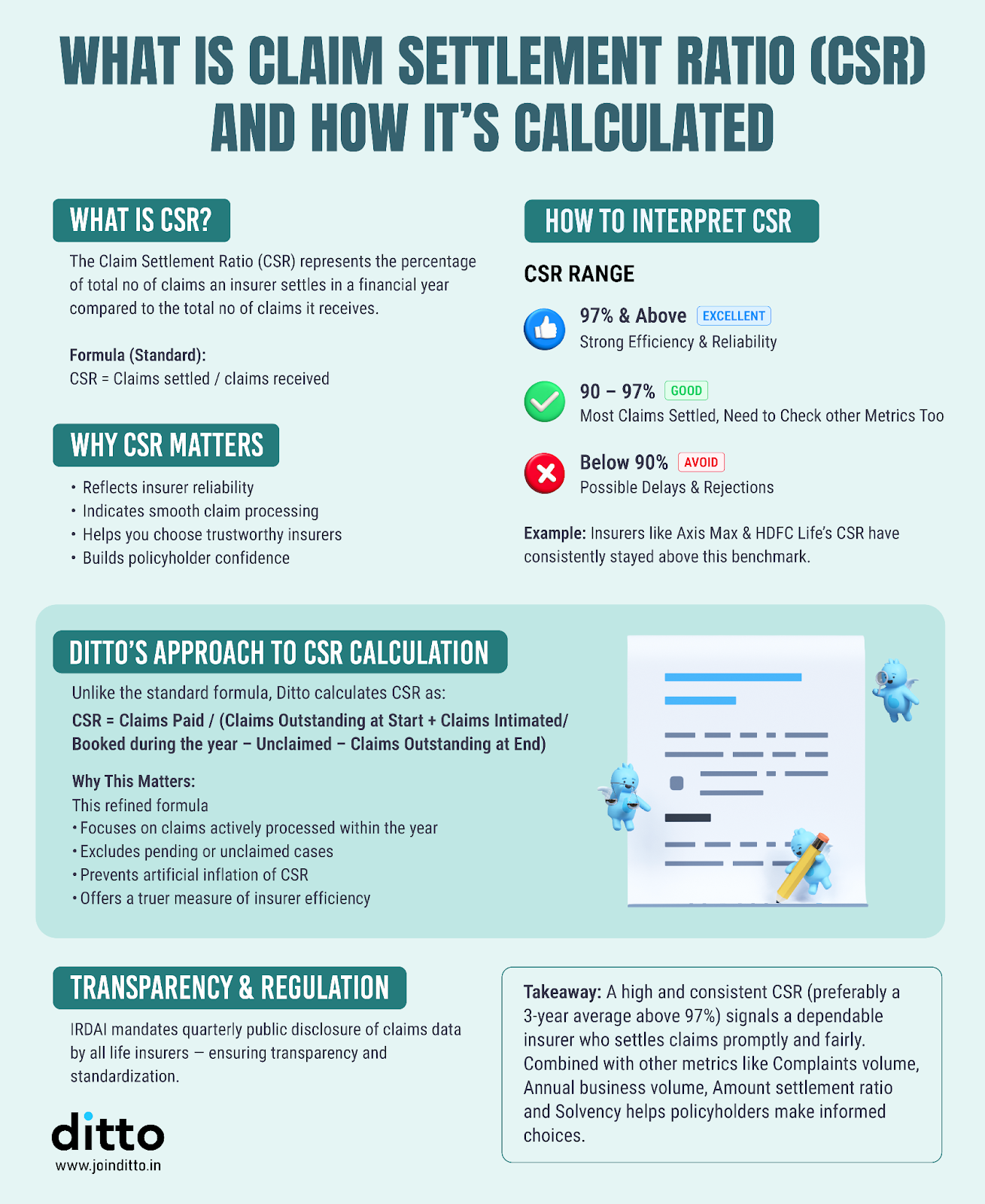

The infographic above breaks down what the claim settlement ratio is and how it’s calculated. You can use it as a simple guide if you want to work out ICICI Prudential’s CSR on your own.

ICICI Prudential Claim Settlement Ratio (Past 5 Years)

Insights: After a dip to 95.54% in FY 2022–23, ICICI Prudential bounced back strongly with 99.20% and 99.34% in the next two years. Its three-year average CSR of 98.03% puts it slightly below the industry average (98.66%), but still within a strong and reliable range.

Top insurers like Axis Max, HDFC Life, and Bajaj Life have average CSRs above 99%, placing ICICI Prudential in the mid-to-upper range of the market. You can further analyze other term insurers based on their CSR.

Note: The CSR published by insurers like ICICI Prudential covers their entire life insurance portfolio (term insurance, ULIPs, whole life plans, endowment plans, and other life insurance products). Still, it remains a strong indicator of overall claim-handling reliability.

Where Can I Find ICICI Prudential Claim Settlement Ratio?

You can check the ICICI Prudential claim settlement ratio from:

- IRDAI’s Handbook on Indian Insurance Statistics

- ICICI Prudential Public Disclosures (Form L-40)

- Trusted comparison platforms like Ditto that regularly update the CSR data from IRDAI

Other Key Performance Metrics of ICICI Prudential

Note: CSR is important, but it’s not the only factor to consider. Here are other key metrics of ICICI Prudential that prove its claims efficiency, financial strength, and reliability.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

Confused about the right term insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now, slots fill up fast!

What Does ICICI Prudential CSR Mean For You?

As a partner insurer of Ditto, ICICI Prudential claim settlement ratio offers strong reassurance. With a 99.34% CSR in FY 2024–25 and a three-year average of 98.03%, the company shows consistent reliability. Settling ₹1,877 crore in death claims (2022–25) with a 95.1% amount settlement ratio (2021–24) further reflects its financial strength and fair claim handling.

Based on the average CSR and other performance metrics, ICICI Prudential demonstrates consistent reliability, financial strength, and efficient claim handling, making it a dependable choice for term insurance.

You can also read our detailed guide on ICICI Prudential term insurance plans for a complete overview.

Frequently Asked Questions

Last updated on: