| ICICI or Kotak term insurance, which is better? Both ICICI Prudential and Kotak Mahindra Life offer reliable term insurance plans, but they cater to slightly different needs. Kotak excels in claim settlement ratio, solvency, and customer service, offering flexible plans with a focus on wellness benefits. ICICI, with its larger scale (almost twice that of Kotak), provides comprehensive coverage including whole-life options, premium refunds, and higher accidental death benefits, making it ideal for those seeking long-term financial security. |

When it comes to term insurance, most of us are looking for two things: reliability in claim payouts and flexibility in coverage. ICICI Prudential Life and Kotak Mahindra Life are both strong contenders, but they serve slightly different needs.

At Ditto, we track claim settlement data, solvency ratios, complaint volumes, and product features across insurers to help buyers make confident choices. For this analysis, we examined IRDAI-mandated public disclosures from 2021 to 2025, comparing ICICI and Kotak across both insurer-level performance and their flagship term plans.

By the end of this review, you’ll know exactly which insurer suits you better.

Still confused between ICICI and Kotak? Book a free call with a Ditto advisor today and get personalized recommendations based on your needs.

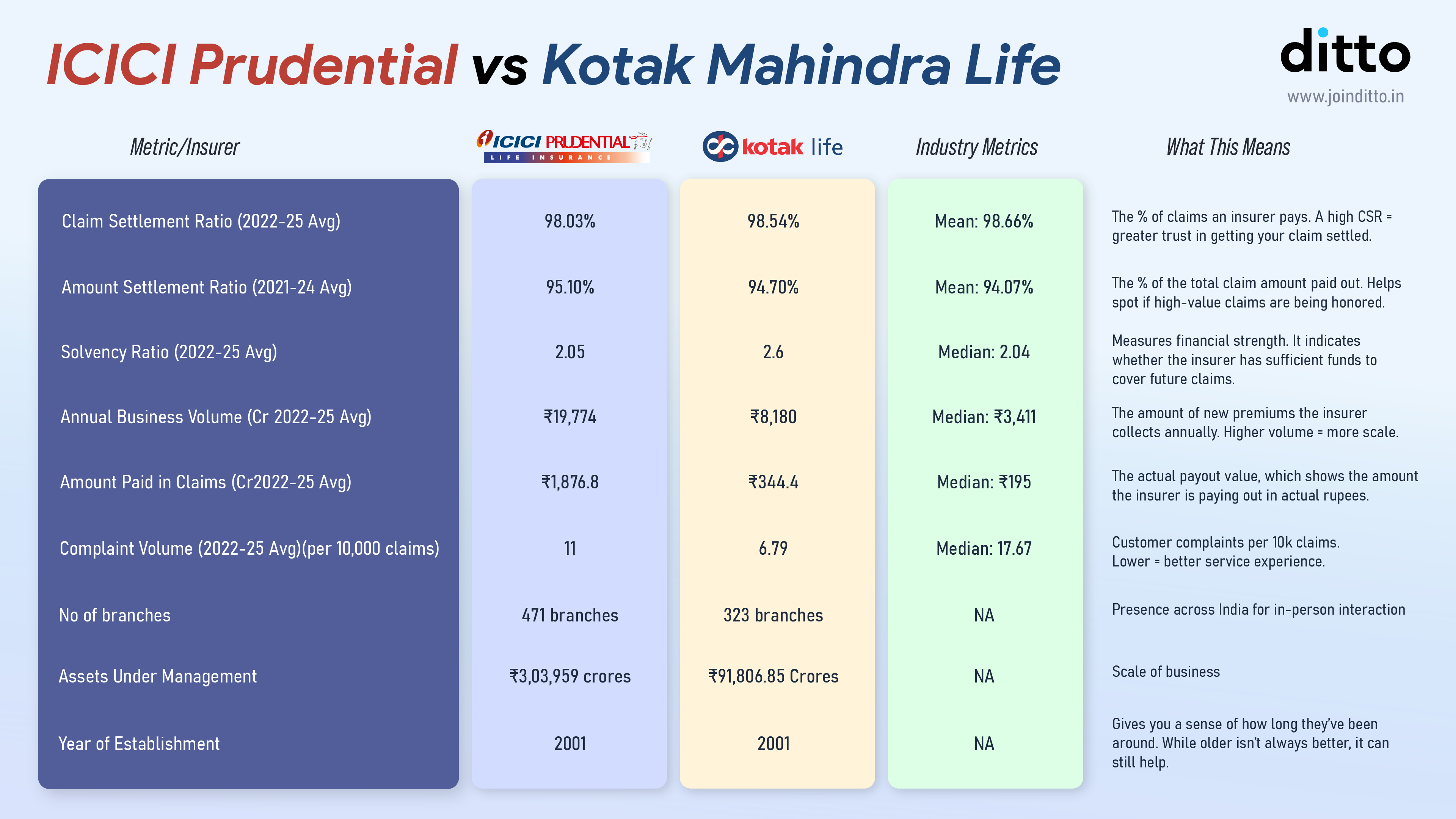

ICICI Prudential Vs Kotak Mahindra Life

When comparing ICICI Prudential Life Insurance and Kotak Life Insurance, one key differentiating factor is the strength of their parent companies, which plays a significant role in their financial stability, brand credibility, and ability to provide long-term support to policyholders.

ICICI Prudential and Kotak Life both benefit from strong financial backing, with ICICI Prudential having an advantage due to its global partnership with Prudential Plc, in addition to ICICI Bank's robust support. Kotak Life, while also financially stable, relies primarily on Kotak Mahindra Bank's strength. In terms of reputation, ICICI Prudential gains global credibility, whereas Kotak Life taps into the deep trust associated with Kotak Mahindra Bank in India.

Full disclosure, ICICI Prudential is a partner insurer for Ditto, and our advisors recommend their term plans if it suits the customer’s needs. On the other hand, while Kotak isn’t one of our partner insurers, we’ll admit that their numbers aren’t bad at all, as you’d see for yourself.

Now, let’s compare the two across key operational metrics.

1) Claim Settlement Ratio

The percentage of claims successfully settled by the insurer. A higher CSR indicates reliability in paying out policies. Kotak slightly leads here with a marginally higher CSR than ICICI. However, neither insurer features in our list of the top 10 term insurers ranked by CSR.

2) Amount Settlement Ratio

The total value of claims paid as a percentage of the total claim amount received. This highlights whether high-value claims are being fulfilled as much as low-value claims. ICICI comes out just ahead, indicating slightly better performance on high-value claims.

3) Solvency Ratio

It indicates the financial health of an insurer. IRDAI requires this to be at least 1.5 times the amount. The higher it is, the more financially prepared the insurer is for future payouts, and Kotak has the stronger solvency ratio of the two.

4) Annual Business Volume

The total new business premium collected in a year. High numbers = large operational scale. ICICI collects over twice the annual premium compared to Kotak, indicating that many more people have trust in the brand.

5) Amount Paid in Claims

The total amount of death claims paid out by the insurer on average annually. Gives real-world scale to claim settlements. ICICI pays nearly five times the total claim amount compared to Kotak, which indicates that it operates on a much larger scale.

6) Complaint Volume

Number of complaints received per 10,000 claims filed. A lower figure implies better customer service and a more positive experience. Kotak has a lower complaint volume, indicating smoother customer service.

Note: The above metrics have been taken from ICICI Prudential’s and Kotak’s annual reports, public disclosures, and the IRDAI-published statistics handbook.

Ditto’s Verdict:

Both ICICI Prudential Life and Kotak Mahindra Life have built a solid foundation across key insurance metrics. Kotak leads marginally in areas such as Claim Settlement Ratio, Solvency Ratio, and Complaint Volume, a notable feat.

However, when evaluating insurance providers, scale plays a critical role, particularly when you're dealing with high-value policies and long-term reliability. This is where ICICI Prudential Life clearly shines.

It records significantly higher annual business volumes and total claim payouts, reinforcing its credibility not just as a high performer, but as a high performer at scale. To put things in perspective, Kotak’s total annual claim payouts are roughly equivalent to what ICICI processes in just a few months.

In summary, while Kotak's performance is encouraging and certainly worth noting, the real challenge will be maintaining these standards as it scales further. ICICI, on the other hand, has already proven its ability to deliver at scale, making it a more reliable choice for those looking for long-term assurance and higher coverage.

Still unsure which insurer suits you best? Connect with a Ditto advisor today by booking a free call to explore your options and find the perfect fit for your needs.

| Did you know? In the general insurance sphere, Zurich has completed a 70% acquisition of Kotak Mahindra General Insurance, a landmark transaction and significant foreign investment in India's general insurance market. This could signal a shift in Kotak’s broader strategy, potentially setting the stage for similar moves in its life insurance business. It’s definitely a trend to keep an eye on. |

ICICI Prudential – iProtect Smart Plus Vs Kotak – e-Term

Now that we’ve examined the insurers themselves, let's dive into their flagship term insurance plans and compare them.

1) Kotak e-Term

The Kotak e-Term plan offers three variants.

Life variant offering standard death cover, The Life Plus variant includes an Accidental Death Benefit (ADB) capped at ₹1 crore. In contrast, the Life Secure variant provides a premium waiver in case of Total & Permanent Disability. Policyholders can adjust their coverage with a Step-Up option (up to 150%) or a one-time Step-Down option.

Death Benefit: Can be availed as a lump sum, a level recurring payout for 15 years, or an increasing recurring payout (10% increase each year for 15 years).

2) iProtect Smart Plus

The ICICI Pru iProtect Smart Plus plan offers four distinct variants.

The Life variant offers basic death cover. The Life Plus variant enhances this by including an Accidental Death Benefit (ADB), which can go up to three times the Sum Assured, offering additional security in the event of death due to an accident.

Death Benefit: Can be received as a lump sum, fixed monthly income for 10 years, a combination of lump sum + income, or an increasing monthly income (10% increase each year for 10 years).

3) Premium Comparison

For this comparison, we’re taking an example of different non-smoking profiles living in Tier I cities, with no PED and covered till the age of 65 years.

| Profile | Kotak e-Term | iProtect Smart Plus |

|---|---|---|

| Male, 30 yrs, ₹1 Cr Sum Assured | ₹13,098 | ₹14,343 |

| Female, 30 yrs, ₹1 Cr Sum Assured | ₹10,856 | ₹12,192 |

| Male, 35 yrs, ₹2 Cr Sum Assured | ₹33,984 | ₹30,412 |

| Female, 35 yrs, ₹2 Cr Sum Assured | ₹26,904 | ₹25,850 |

Note: We’ve calculated these premiums from the official Insurer websites.

For a lower sum assured, ICICI’s iProtect Smart Plus is slightly expensive, but as you start increasing your sum assured, the tiered pricing starts kicking in, and ICICI’s term plan starts becoming more cost-effective.

Unique Benefits

- Kotak e-term offers a range of unique wellness and health management services, including regular check-ups, telemedicine, and lifestyle coaching, to support overall well-being. The plan provides ample step-up flexibility, allowing increases of up to 150%, along with the convenience of an exit option at age 60, providing policyholders with greater control and adaptability over their coverage.

Note: The Step-Up option can be exercised at key life events such as marriage, purchase of a first house, birth or legal adoption of a child, or on the 1st, 3rd, and 5th policy anniversaries.

- iProtect Smart Plus stands out with its Premium Break feature, which acts as a financial cushion by offering premium relief. It allows policyholders to skip paying premiums for one policy year after completing 5 years. At the same time, the life cover continues uninterrupted, with the deferred premium payable along with the next due premium.

The Smart Exit option offers a premium refund after 25 years, while the whole life cover protects up to 99 years of age. Additionally, ICICI provides an instant relief payout of ₹3 lakh upon claim intimation.

The plan also includes a Life Stage Benefit, allowing incremental increases in cover at milestones such as marriage, childbirth, or taking a home loan, and comes with an inbuilt Terminal Illness Benefit that ensures an early payout on diagnosis of a terminal illness, a feature Kotak does not provide.

Riders Offered

- e-Term provides riders such as the Critical Illness Plus Rider, which covers 37 critical illnesses. This rider can remain in force for a maximum of 40 years or (75 - age at entry), making it a long-term protection tool. Additionally, Kotak offers a Permanent Disability Benefit Rider, which provides financial support in the event of a total and permanent disability. These riders significantly strengthen the core plan by covering serious health and disability risks over an extended period.

- iProtect Smart Plus offers riders, including Critical Illness coverage through the ICICI Pru Health Protect Rider, which covers a broader list of 60 critical illnesses. However, the CI coverage is available for a maximum of 20 years, which can be limiting if you want protection beyond that term. ICICI also includes an Accidental Death Benefit option, which enhances financial security in case of accidental death. On a negative note, the waiver of premium rider is currently not live with this plan, but it’s usually recommended.

Ditto’s Verdict

Both Kotak e-Term and ICICI Prudential iProtect Smart Plus offer valuable strengths, but they cater to slightly different needs.

Kotak e-Term stands out for its flexibility and added wellness support, making it ideal for individuals seeking customizable coverage and those who value additional health services. Its wide range of options for increasing coverage and the exit option at age 60 provides substantial adaptability for policyholders at various life stages.

On the other hand, ICICI Prudential iProtect Smart Plus offers a more comprehensive, long-term protection solution. It’s particularly well-suited for individuals with higher sum assured requirements (above ₹2 crore). For larger cover amounts, ICICI proves to be more affordable while still offering multiple financial safeguards such as the Premium Break and Life Stage Benefit. If you’re looking for more extensive, long-term coverage, ICICI provides a robust option with enhanced financial security.

Ultimately, your decision should depend on whether you prioritize cost-effectiveness for larger coverage or a more flexible, wellness-focused plan for smaller sums assured.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Amarnath below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 5,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation here. Slots are running out, so make sure you book a call now.

Conclusion

Kotak Mahindra Life stands out with its superior claim settlement ratio, strong solvency, and wellness-focused benefits, making it ideal for those seeking flexibility and customer support.

ICICI Prudential Life, on the other hand, excels with its larger scale, comprehensive coverage options, and robust claim payouts, offering long-term financial security for higher sum assured needs. Ultimately, your choice depends on whether you prioritize flexibility and cost-effectiveness or comprehensive, long-term protection.

Not sure which plan is right for you? Chat with a Ditto advisor and get personalized recommendations tailored to your requirements. Book a free call now!

FAQs

Which is better: ICICI Prudential Life Insurance or Kotak Mahindra Life Insurance?

If you’re looking for a straightforward plan with an insurer that has better metrics, you can opt for Kotak, depending on your needs. However, if you’re looking for more comprehensive in-built features, you should opt for ICICI.

How do ICICI Prudential and Kotak Mahindra Life Insurance differ in claim settlement ratios?

Kotak has a slightly higher average Claim Settlement Ratio (CSR) at 98.54% vs ICICI's 98.03% (2022-2025). However, ICICI performs marginally better on high-value claims, as indicated by a higher Amount Settlement Ratio (95.1% vs 94.7%).

Who is financially stronger: ICICI or Kotak?

Kotak has a higher solvency ratio (2.6 vs ICICI’s 2.05), but ICICI handles a much larger business volume and claim payout scale, making it more battle-tested.

Which plan is cheaper: ICICI iProtect Smart Plus or Kotak e-Term?

For a ₹1 crore cover, Kotak is generally more affordable, while ICICI tends to be competitive at higher cover amounts.

Which plan offers better riders?

Kotak’s Critical Illness Plus Rider covers 37 illnesses with long-term validity. ICICI’s Health Protect Rider covers 60 illnesses, but only for up to 20 years. Moreover, Kotak offers a premium waiver on TPD only, but ICICI currently does not have the waiver of premium rider at all.

Last updated on: