Quick Overview

Acko Life Insurance recently made headlines for focusing exclusively on “pure protection” products. In an industry often criticized for mis-selling bundled products like ULIPs and endowment plans, this is a bold move.

But does that automatically make Acko Life Insurance a trustworthy choice?

In this detailed Acko Life Insurance review, we evaluate its financial metrics, plan features, riders, premium comparison, and overall reliability, so you can decide whether the insurer deserves your trust.

Acko Life Insurance Performance Metrics

Note: The above data has been taken from Acko Life’s public disclosures.

At Ditto, we prefer analyzing 3-year averages to avoid one good or bad year distorting performance evaluation. However, since Acko Life Insurance began operations recently, sufficient multi-year data related to its Claim Settlement Ratio (CSR), Amount Settlement Ratio (ASR), complaint volume, and large-scale claims experience isn’t available yet.

Insights

- The annual business volume of ₹63.64 crores indicates that Acko Life is still operating at a relatively small scale.

- The solvency ratio is above IRDAI’s mandatory requirement of 1.5, which is a positive sign for the insurer, but it’s still below the industry median.

Overall, the limited track record and relatively small business scale make it difficult to draw strong conclusions about Acko Life’s long-term claims reliability compared to established players.

For context, larger and more established insurers such as HDFC Life report substantially higher annual business volumes (₹30,560 crores), reflecting scale advantages and operational maturity.

Take Note: If you’re buying life cover for the first time, having a simple term insurance checklist can make things much easier. It helps you figure out how much coverage you actually need, how long the policy should last, and which riders are worth adding.

Top Plans Offered by Acko Life Insurance

Acko Life Flexi Term Plan

In-Built Features of Acko Life Flexi Term Plan

- Flexible Sum Assured Adjustment

Policyholders can increase or decrease their coverage in units of ₹25 Lakhs. Although an increase is allowed only once per year (subject to underwriting), you can decrease your sum assured only after 3 policy years have elapsed. However, no changes are allowed in the last 13 months of your policy term. - Flexible Policy Term Changes

You can extend policy term or premium payment term (subject to underwriting), up to age 70 at maturity. - Complimentary Will Writing Service

The insurer provides a do-it-yourself will-writing module while the policy is active. You can create, edit, and download it as many times as you like in PDF format. This is a thoughtful value-added feature, especially for first-time policyholders.

For more details, you can check out our detailed guide on the Acko Life Flexi Term Plan review.

Apart from Acko Life Insurance’s flagship product (Flexi Term Plan), the insurer also offers:

Acko Life Saral Jeevan Bima

Acko Life Group Credit Protect

Acko Life Group Credit Shield Combi Plan

Acko Life Group Term Protect

Riders Available in Acko Life Insurance Plans

Accidental Death Benefit Rider

If death occurs due to an accident, an additional payout is made along with base coverage if you opt for the Accidental Death Benefit (ADB) rider.

Critical Illness Benefit Rider

The Critical Illness (CI) rider pays a lump sum and waives premiums if diagnosed with one of 21 listed illnesses and survival of 30 days post diagnosis. Coverage includes 21 illnesses such as cancer, heart attack, stroke, kidney failure, organ transplant, etc. It has a waiting period of 90 days from issuance.

Accidental Total Permanent Disability Benefit Rider

The Accidental Total Permanent Disability (ATPD) rider pays a lump sum and waives future premiums if the insured suffers a qualifying permanent disability lasting at least 180 days.

To learn more about which riders we typically recommend at Ditto, you can check out our detailed guide on Term Insurance Riders.

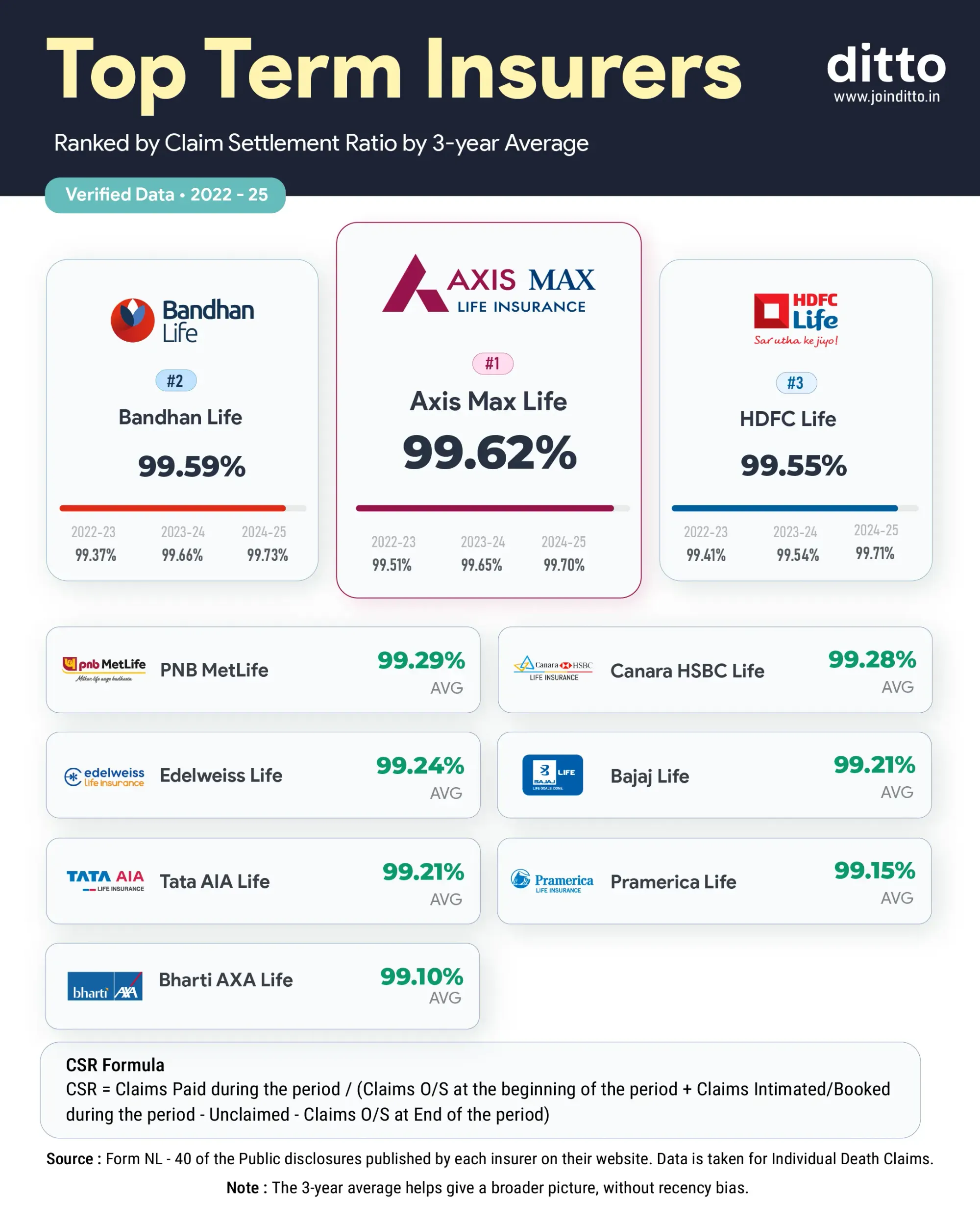

Top 10 Life Insurance Companies in India by Claim Settlement Ratio

Some of the top insurers by CSR include:

Compared to these established players, Acko Life Insurance does not yet have a long claims history to benchmark against.

Premium Comparison: Acko Life Insurance vs. Other Insurers

For this example, we’ve taken healthy profiles of non-smoking, salaried individuals, covered for a sum assured of ₹2 Crores till the age of 65. The premiums are indicative in nature and can vary based on your age, health condition, lifestyle choices, and underwriting decisions.

In this comparison, Acko Life Insurance appears competitively priced, especially for younger profiles.

Note: For Flexi Term Plan, a coupon code of lifetime validity “LIFE1500” has been applied.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call or chat on WhatsApp now!

Ditto's Take on Acko Life Insurance

Acko Life Insurance is innovative, affordable, and digitally streamlined. However, because the insurer is still building its claims history and financial track record, conservative buyers may prefer established insurers such as Axis Max Life and HDFC Life for now.

If you’re comfortable with a new-age insurer and value flexibility and cost efficiency, Acko Life Insurance can be considered. Otherwise, waiting for stronger performance data may be the safer route.

If you are looking for comprehensive term coverage that align your medical needs, we recommend the best term insurance companies for 2026. Explore more about how our experts evaluate term plans through Ditto’s cut.

Full Disclosure

Frequently Asked Questions

Last updated on: