| Top Reasons Why Your Health Insurance Claim Can Get Rejected Claim denials often occur due to reasons like an active waiting period, non-disclosure of pre-existing conditions, policy exclusions for specific treatments, and incomplete or incorrect documentation. Delayed intimation to the insurer or opting for a non-network hospital without following procedure can also lead to rejection of claims. |

When you buy a health insurance policy, the last thing you expect is for your claim to get denied. Most leading insurers in India boast impressive Claim Settlement Ratios (CSRs), with companies like HDFC ERGO (98%), New India Assurance (99%), SBI General (97%), and Digit Insurance (97%) maintaining figures well above 90% between 2021 and 2024.

That said, not every insurer is at the top of the game. Some, like Navi (64%) and Raheja QBE (60%), fall significantly behind the industry average. This means your chances of facing a claim rejection are largely dependent on the insurer you choose.

But here’s the truth: even if you go with a reputed insurer with a stellar CSR, rejections can still happen. At Ditto, we’ve seen cases where claims, both cashless and reimbursement, have been denied despite policyholders doing (almost) everything right.

So why does this happen? In this article, we’ll break down some of the most common reasons why your health insurance claim could be denied, and what you can do to avoid being caught off guard.

Reasons Why Your Health Insurance Claim Could Be Rejected

Even if you have the best health insurance policy, claims can still get denied due to technicalities or policy conditions. Based on Ditto’s in-house claims data, here are the most common reasons (and how you can avoid them):

1. Waiting Period Denials

In our experience, this is the number one reason for claim rejection. Every health insurance policy has waiting periods: an initial 30-day period during which no claims are allowed except for accidents, a 24-month period for specific illnesses or procedures such as hernia, cataract, and knee replacement, and up to 3 years for pre-existing diseases (varies by insurer). If you raise a claim during these timelines, it’s almost certain to be rejected.

Example: Hernia surgery within 24 months of policy purchase.

How to avoid it:

- Always review your policy’s waiting period clauses—initial, disease-specific, and PED-specific—before filing a claim.

- Plan for non-urgent surgeries (like cataract or hernia repair) after the applicable waiting period ends.

2. Permanent Exclusions (Non-Coverage)

A lot of claim rejections happen because the treatment isn’t covered at all. Cosmetic surgeries, infertility treatments, dental work (unless due to accidents and oral cancer, some insurers may provide minimal coverage), and drug/alcohol abuse-related cases usually fall in this bucket.

How to avoid it: Review your policy exclusions or confirm with your advisor before admission.

Book your FREE consultation with Ditto today. Our experts will guide you in selecting the right health insurance plan and provide support throughout the claims process. Slots are filling fast - secure yours now!

3. Incorrect or Incomplete Information on Claim Papers

One of the most common errors is failing to disclose pre-existing conditions or providing incomplete details. Even a small discrepancy can trigger a rejection.

How to avoid it: Disclose every past illness when buying the policy and double-check all details when submitting the claim. If you are diagnosed with a new ailment after purchasing the policy, inform the insurer proactively and obtain their acknowledgement, so that future claims do not get delayed.

4. Missing or Improper Documentation

If essential paperwork like discharge summaries, indoor case papers, original bills, prescriptions, or investigation reports are missing, the insurer can’t process the claim.

For cashless claims, the hospital usually handles most of this, but you should keep ID proof, policy details, and your health card handy. For reimbursement claims, you’ll also need the filled claim form, bills, prescriptions, test reports, and a cancelled cheque for bank details. Accident cases may require an FIR, Panchnama, or an MLC (Medico-Legal Case) number, as specified in your policy.

How to avoid it: Keep every document organized and submit them promptly after discharge.

5. Unnecessary Hospitalization

A large percentage of rejections happen because hospitalization wasn’t medically necessary. For example, getting admitted for a simple fever that could be treated on an OPD basis or being hospitalized only for diagnostic or investigative tests when no active treatment is required.

How to avoid it: Only get admitted when it’s clinically justified (although, truth be told, it is highly subjective) and make sure the discharge summary states this clearly. If hospitalization is done for investigations, ensure that the treating doctor specifies why admission was essential (e.g., the patient's severe condition required observation).

6. Blacklisted Hospitals

Some rejections occur because treatment was taken at a blacklisted hospital. If the treatment is done at a non-network hospital, a claim cannot be registered, so we don't have any data regarding its rejection.

How to avoid it: Check if your hospital is on your insurer’s network list before admission, and also that the hospital is not blacklisted. If not in the network list, prepare for reimbursement or rejection instead of a cashless payment.

7. Policy Lapse

If your policy expired and wasn’t renewed before hospitalization, your claim will be outright rejected, even if the lapse was just a day. A cashless claim won't get registered as the plan will be inactive on the portal, and a reimbursement claim will be rejected as the claim was made during a period where the client was not covered by the plan.

How to avoid it:

- For planned hospitalizations, always take pre-authorization approval in advance to avoid cashless denial.

- For emergency hospitalizations, please notify the insurer within 24 hours and submit the necessary documents promptly after discharge.

- Don’t wait till the last day; file the claim as soon as possible.

- Set up auto-renewals or calendar reminders to stay on top of renewal payments. Grace periods don’t cover claims.

8. Suspected Pre-Existing Disease (PED)

If the insurer suspects that your illness existed before you purchased the policy and was not disclosed, they may initially reject the cashless claim request. In such cases, they often ask you to apply for reimbursement instead, as this gives them time to conduct a detailed investigation before making a final decision.

This scrutiny becomes more likely if the condition is diagnosed immediately after policy issuance, as it raises red flags about whether it was pre-existing.

How to avoid it:

- Disclose every past medical condition, even minor ones, when applying for the policy.

- If such an investigation is triggered, ensure your diagnosis reports and treating doctor’s statements are absolutely clear and consistent to prove the condition was not pre-existing.

9. Fraudulent or Misrepresented Claims

Any attempt to mislead, like forging bills or inflating costs by colluding with the hospital, results in immediate rejection and possibly blacklisting of the hospital.

How to avoid it: Be 100% honest. Fraud has serious legal consequences.

Note: These insights and percentages are based on Ditto’s in-house claims team data.

What to do if your Health Insurance Claim is Rejected

1) Stay calm & read the rejection carefully.

Note the exact reason the insurer gave. That determines whether the rejection is procedural (missing docs, late filing) or substantive (exclusion, PED, fraud).

2) Check and organise your documents.

Confirm you submitted all required paperwork (claim form, discharge summary, original bills, investigation reports, prescriptions, ID, policy copy, bank details, FIR/MLC if applicable). If anything’s missing, get it ready immediately.

3) Contact your hospital / TPA to verify

For cashless cases, the hospital/TPA often handles paperwork — ask them to re-check what was sent and correct any hospital-side errors (missing reports, wrong bill copies, etc.).

4) If you have an advisor (e.g., Ditto), contact them first.

Advisors can liaise with the insurer, their grievance cell, and, if needed, the Ombudsman on your behalf to push admissible claims. This is often the fastest way to get a rejected claim reopened.

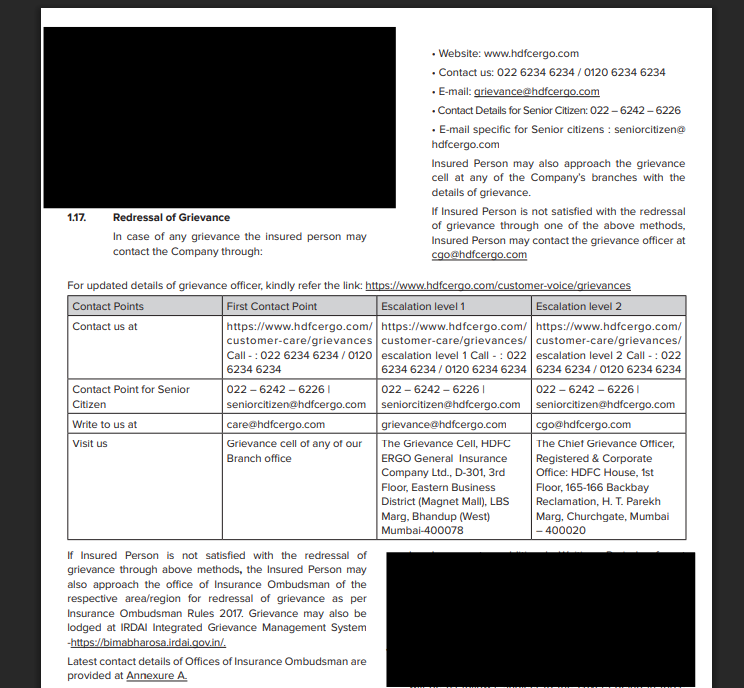

5) Approach the insurer’s grievance cell or 𝐆𝐫𝐢𝐞𝐯𝐚𝐧𝐜𝐞 𝐑𝐞𝐝𝐫𝐞𝐬𝐬𝐚𝐥 𝐎𝐟𝐟𝐢𝐜𝐞𝐫 (𝐆𝐑𝐎).

If you don’t have an advisor, file a formal grievance with the insurer. Do this in writing (email + registered post if possible) and include: policy number, claim reference, why you believe the claim is admissible, and all supporting documents.

Note: You can find the email addresses of the grievance cells of different insurers here.

6) Track timelines and escalate if needed

If the insurer’s response is delayed or unsatisfactory, note the dates. If you don’t receive a satisfactory reply within 30 days, you can escalate the matter.

7) File a complaint with IRDAI.

Use IRDAI’s Bima Bharosa platform to escalate the issue. The insurer will have to reassess the claim rejection once again.

8) Make a representation to the Insurance Ombudsman.

If the insurer’s grievance process and complaining through the Bima Bharosa platform haven’t worked (or if you’ve waited the required period), lodge a representation with the Insurance Ombudsman. Include your complaint letter, insurer’s reply (if any), and all supporting documents. Another option is to file a complaint with the Consumer Court. However, we usually recommend doing this

9) Keep records of everything.

Save copies of all emails, letters, bills, medical reports, and notes/recordings of phone calls (date/time/person). These make escalation and Ombudsman complaints far easier to resolve.

After all is said and done from your end, the Insurance Ombudsman or the Consumer Court will hear both parties out and take a decision accordingly. Note that IRDAI explicitly mentions that all health claims (other than cashless) are to be settled within 15 days of claim intimation (Question 40, Sl. No. 2).

Claim Rejection Stories and the Steps Taken to Fix Them

Case 1: Non-Disclosure of a Pre-Existing Condition

A customer had purchased a health insurance plan for his parents in late 2022. In April 2024, his father was hospitalized at a network hospital after developing a high fever, painful urination, and repeated vomiting. After investigations, doctors diagnosed him with a kidney infection (Pyelonephritis).

The family applied for a cashless claim of ₹1,00,000, but the insurer denied it, citing non-disclosure of hypertension. It turned out the patient had been on medication for high blood pressure for over a decade but hadn’t declared this when buying the policy.

Naturally, the client was unhappy with the decision. We guided him through the next best option—filing a reimbursement claim. During the process, the insurer investigated for any additional non-disclosures but confirmed that only hypertension was missed. Underwriting then treated hypertension as a pre-existing disease, applying the applicable waiting period.

Outcome: The reimbursement claim was approved for ₹1,06,339, even though the initial cashless request was rejected.

Note: Although the insurer was lenient in this particular case, they could cancel the policy if there was a deliberate case of non-disclosure.

Case 2: Error in Policy Inception Date After Porting

Another customer had ported his father’s long-standing health policy to a new insurer in April 2023. He had been continuously insured since 2017 and declared all pre-existing conditions, including osteoarthritis.

In January 2024, doctors recommended a knee replacement surgery due to advanced osteoarthritis. The surgery was planned at a network hospital, and the family applied for a cashless claim of ₹4,00,000. To their shock, the claim was denied, stating that the waiting period for pre-existing diseases wasn’t over.

When we checked the new policy, the inception date showed as April 2022 instead of 2017, an error made during policy issuance. This made it appear as though the customer had only two years of coverage. We immediately requested previous policy documents to prove the original inception date. Once submitted, the insurer corrected the date in their records and issued an updated policy copy.

Outcome: The corrected details allowed the cashless claim to be approved in full, and the surgery went ahead without financial stress.

Why Consider Ditto for Health Insurance

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right IPD or OPD health insurance policy. Here’s why customers like Akshay love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Thoughts

Claim rejections can be stressful, but most of them stem from avoidable issues like non-disclosures, documentation gaps, or technical errors. It’s also important to note that sometimes an insurer may deny a cashless claim but advise you to apply for reimbursement instead. This is not an outright rejection; it’s usually a way for the insurer to investigate further, check whether the hospitalization was necessary, or verify if there was any non-disclosure.

The key is to understand your policy inside out, maintain complete transparency, and act quickly when problems arise. With the right guidance and preparation, you can significantly reduce the chances of rejection—and even if it happens, there’s always a structured way to fight back.

FAQs

Why was my health insurance claim rejected even though I paid my premiums on time?

Claims can be rejected for several reasons, including non-disclosure of pre-existing conditions, incomplete documentation, or policy exclusions. Even if premiums are paid, failing to meet the policy's terms or missing critical details can lead to a denial.

What is the waiting period for health insurance claims?

Health insurance policies have specific waiting periods for various conditions, typically ranging from 30 days for general illnesses to 2-3 years for pre-existing diseases and specific listed illnesses. Claims raised during these periods will be rejected unless they are related to an accident.

How can I avoid my health insurance claim being denied?

To avoid claim rejection, ensure all required documentation is submitted correctly, disclose pre-existing conditions, and understand your policy’s waiting periods and exclusions. Always confirm your hospital is in-network, and file claims promptly after hospitalization.

What should I do if my claim is rejected?

First, read the rejection carefully to understand why. If it's due to missing documents or an error, gather the necessary paperwork and reapply. If the rejection seems unjustified, approach the insurer’s grievance cell or contact an advisor for further assistance.

Last updated on: