Quick Overview

When buying health insurance, most people compare premiums, network hospitals, and claim settlement ratios. But one of the most important financial indicators that often gets ignored is the Incurred Claim Ratio (ICR).

If you're evaluating insurers before purchasing a policy, understanding what is Incurred Claim Ratio, how it works, and how different insurers compare can help you make a smarter decision. Here’s everything you need to know.

What Is Incurred Claim Ratio in Health Insurance?

The Incurred Claim Ratio in health insurance measures how much of the total premium collected by an insurance company is paid out as claims during a financial year. The remaining amount can be used to cover operating costs, commissions, administrative costs, profit margins, and more.

IRDAI Guidelines on Incurred Claim Ratio

- IRDAI’s Definition

IRDAI defines ICR as “Net Incurred Claims to Net Earned Premium”. Because every insurer must follow this same formula in regulatory filings, you can confidently compare ICRs across companies without worrying about manipulation or creative accounting. - Public Disclosure Requirements

Insurers are required to publish analytical ratios (including ICR) in their annual disclosures (FORM NL-20). These details are also published in the IRDAI annual reports (page 142 for different segments such as health, motor, or fire). This makes the data publicly available and verifiable. If an insurer’s ICR isn’t easily accessible on their website or in public reports, that’s a red flag. Transparency matters. - Health Insurance Rule

IRDAI has clearly stated that Third Party Administrators (TPAs) cannot be compensated based on the ICR of the policies they service. This rule prevents TPAs from rejecting or delaying claims simply to reduce payouts and artificially improve the insurer’s ICR.

Incurred Claim Ratio Meaning, Formula & How It Is Calculated

Understanding the Incurred Claim Ratio meaning helps you learn more about an insurer’s financial efficiency and sustainability in paying claims relative to its earnings.

Here’s an overview of its formula:

Incurred Claim Ratio Formula: Incurred Claim Ratio (ICR) = (Total Claims Paid During the Year/ Total Premium Earned During the Year)*100

Let’s take two examples

Example 1: A Balanced ICR

- Premiums collected = ₹2,000 crore

- Claims paid = ₹1,400 crore

- ICR = (1,400/2,000)*100 = 70%

Example 2: Very Low ICR

- Premiums collected = ₹2,000 crore

- Claims paid = ₹700 crore

- ICR = (700/2,000)*100 = 35%

Example 3: Extremely High ICR

- Premiums collected = ₹2,000 crore

- Claims paid = ₹2,200 crore

- ICR = (2,200/2,000)*100 = 110%

Ideal Incurred Claim Ratio: What Is Considered Good?

Below 50%: Be Cautious

A consistently low Incurred Claim Ratio may indicate very strict underwriting or conservative claim approvals. While the insurer may be financially strong, such a low ratio can sometimes signal higher claim rejections or limited payouts. It may also suggest that the insurer’s primary focus is on maximizing profits.

50% to 80%: Ideal and Sustainable

This is generally considered the healthiest range. It shows the insurer is paying a reasonable portion of premiums as claims while still maintaining enough margin for expenses, reserves, and long-term stability. Most financially sound private insurers fall within this band.

Above 80%-100%: Monitor Carefully

Ratios above 80% indicate high claim payouts. While this may look customer-friendly, consistently high ICRs (especially near or above 100%) can strain profitability and may lead to future premium hikes or tighter underwriting.

Note: At Ditto, we believe in taking 3-year averages because stability across 3 consecutive years matters far more than a one-time spike or drop.

There is no universally “perfect” ICR, nor does IRDAI define or prescribe one. The ideal ratio depends on consistency, underwriting discipline, and long-term pricing stability. A mid-range ICR with steady performance is usually safer than extreme numbers on either end.

Incurred Claim Ratio of Health Insurance Companies in India

Key Insights for The Incurred Claim Ratio of Health Insurance Companies:

- General insurance companies offering health, motor, and travel insurance have an ICR of 70-80% due to their diversified portfolios, which allow them to manage risk. On the other hand, standalone health insurers whose sole focus is health insurance typically maintain an ICR between 50% and 70% due to stricter underwriting.

- A gradual increase across major private insurers shows higher claim utilization post-pandemic normalization.

- Sudden spikes above 85%, such as those seen in Bajaj General and SBI General, require monitoring over longer periods.

Industry-Wide Health Insurance ICR Trends in FY 24-25

- In FY 2024-25, the industry health ICR (excluding personal accident and travel) stood at 86.98%, down from 88.15% last year. This suggests that overall net claims outgo grew slightly slower than the premium base, indicating a marginal improvement in industry-wide underwriting balance.

- The gap across insurer types is significant. Public sector insurers reported a total health ICR of 100.59%, with their group book at 103.61%, indicating that claims are roughly equal to or exceed net earned premiums in those segments. Private sector insurers recorded a lower total ICR of 87.59%, while standalone health insurers were the lowest at 68.73%, reflecting tighter underwriting and portfolio control.

- Across business segments, individual policies had the lowest industry ICR at 77.93%, compared to 92.41% for group business and 95.25% for government business. This clearly indicates that claims intensity is structurally higher in group and government segments than in retail individual health insurance.

Incurred Claim Ratio of Public Sector Undertaking (PSU) Insurers (FY 22-25):

For the FY 2022-2025 period, PSU insurers recorded significantly elevated ICR levels. This suggests that the company is paying out more than it earns, essentially bleeding money, raising concerns about its long-term stability and sustainability in the market. This is also in line with PSU insurers that require frequent recapitalisation by the government, as reflected in their negative solvency ratios. Moreover, while high ICRs may appear attractive, operational inefficiencies and delayed servicing can still impact customer experience.

Social Mandate Over Market Focus

Incurred Claim Ratio vs Claim Settlement Ratio: Key Differences

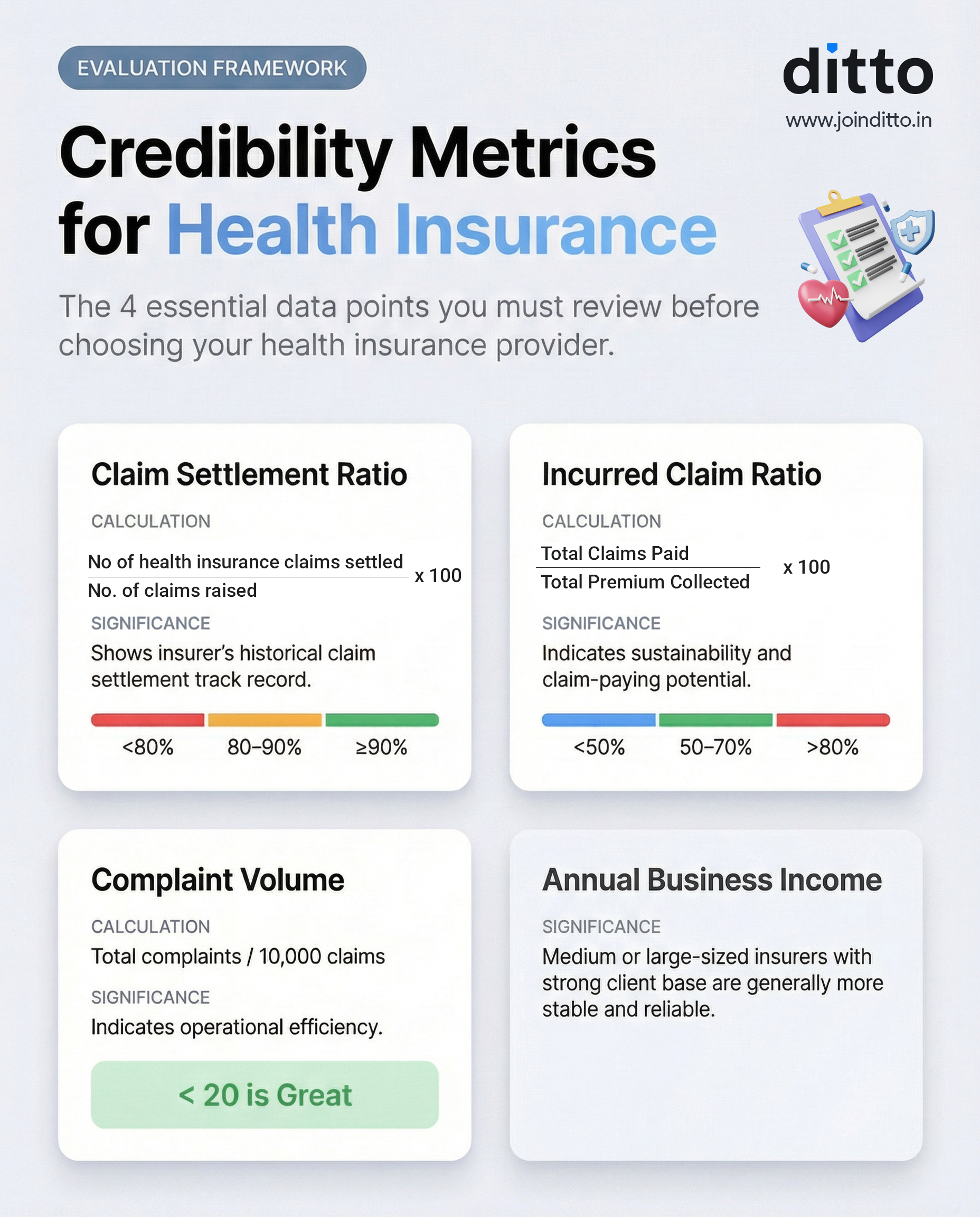

An insurer can have a 99% claim settlement ratio but still maintain a low Incurred Claim Ratio if it settles many small claims but rejects or partially settles high-value hospitalizations. This is why it’s crucial to consider all key operational metrics, such as CSR, ICR, complaint volume, and business volumes, as well as premiums, network hospitals, and policy features, when making a decision.

You can refer to the infographic attached below to understand the credibility metrics in health insurance:

If you’d like to learn more about the best health insurance companies in India, ranked by the above metrics, you can check out our detailed guide.

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or chat on WhatsApp with us now!

Ditto’s Take on Incurred Claim Ratio

At Ditto, we treat the Incurred Claim Ratio as a financial health indicator and not a marketing number. An ICR between 50% and 80% over a consistent 3-year period usually signals balance.

More importantly, ICR is just one piece of the puzzle. We always evaluate it alongside Claim Settlement Ratio, complaint data, business volumes, underwriting philosophy, and overall service quality before recommending a plan. A well-rounded insurer with stable metrics across the board is typically a safer bet than one that looks great on a single parameter.

Full Disclosure

Frequently Asked Questions

Last updated on: