Quick Overview

The Mental Healthcare Act, 2017, requires insurers in India to provide medical insurance for the treatment of mental illness on the same basis as physical illness. IRDAI reiterated this requirement and asked insurers to confirm compliance by October 31, 2022.

At Ditto, we’ve helped thousands of families understand these complexities of mental health insurance claims. Drawing from IRDAI rules, insurer practices, and real claim cases, this guide explains how mental health insurance in India works, why coverage matters, and what to watch for when choosing a plan.

How Does Mental Illness Health Insurance Work?

Mental health insurance coverage includes inpatient treatment, such as hospitalization, counseling, prescription medication, and other medically necessary interventions. Here’s how it usually works:

- Coverage Activation: Complete waiting periods or pre-existing condition clauses specified in the plan.

- Seeking Treatment: Consult healthcare providers or mental health professionals within the insurer’s network.

- Claim Process: Depending on your policy, you may receive cashless treatment at network hospitals or pay out-of-pocket and claim reimbursement.

- Financial Assistance: Insurance covers costs up to the policy limits for hospital stays, medications, and diagnostic procedures.

Best Health Insurance for Mental Health Coverage in India

All health insurance plans in India cover hospitalization for mental illnesses by default, but some offer extra benefits like outpatient therapy and counseling. Here are some notable plans with enhanced mental health features. But remember, coverage and issuance always depend on the insurer’s underwriting.

1) Care Supreme

The Care OPD Rider under Care Supreme offers the insured mental health support through specialist psychiatrist and neurologist consultations up to ₹500 per visit, for 4 in-person visits, and unlimited e-consultations with general physicians.

Here’s a quick look at how premiums for this plan vary for a sum insured of ₹15 lakh for someone residing in Delhi who has also opted for an OPD care add-on.

Premium Comparison for Care Supreme

2) TATA AIG’s Medicare Select

The mental wellbeing rider is available with Tata AIG’s Medicare Select Plan. It enhances your health insurance by covering annual mental health screenings and essential diagnostic tests each policy year. The plan also offers up to 10 cashless psychological therapy sessions and four diet consultations every year. Its unlimited stress management rider offers continuous support in the form of consultative services for anxiety, work-life balance, and emotional wellbeing.

Take a glance at how premiums for this plan vary for a sum insured of ₹15 lakh for an individual choosing the mental wellbeing rider:

Premium Comparison for TATA AIG Medicare Select

3) HDFC ERGO Optima Secure

The Optima Wellbeing Add-on is available with HDFC Ergo Optima Secure, providing clear mental illness hospitalization coverage. With this rider, the insured can access unlimited e-counseling with psychologists for mental health, stress, anxiety, and related disorders via digital platforms. These sessions, available via video, audio, or chat, offer convenient, on-demand mental health care support.

Here’s how premiums for this plan vary for a sum insured of ₹15 lakh for a person choosing the Optima wellbeing add-on:

Premium Comparison for HDFC ERGO Optima Secure

Did You Know?

Benefits of Buying Health Insurance for Mental Illness

Rising Prevalence

High Treatment Costs

Early Intervention

Peace of Mind

Inclusions and Exclusions of Mental Health Insurance

Who Should Buy Mental Health Insurance?

Mental health is not something to opt for because it is present across all policies and is best suited for:

- Anyone buying health insurance should ensure their plan does not exclude mental illness hospitalization (this is now expected to be covered).

- People who actively want therapy/counseling coverage should shortlist plans with OPD riders

- People with prior diagnosis should plan for underwriting and consider the “specific cover” option if standard retail underwriting becomes hard

How to Choose a Mental Illness Health Insurance Policy?

- Coverage Scope: Ensure the policy includes a wide range of mental health conditions and covers inpatient and outpatient treatments.

- Network of Providers: Access to a broad network of hospitals and mental health professionals is crucial.

- Exclusions and Waiting Periods: Review exclusions and understand waiting periods before claims.

- Policy Limits: Check treatment and therapy coverage limits.

- Claim Process and Support: Assess the insurer's claim process and customer service.

How to Claim Health Insurance for Mental Health?

The process for making mental health insurance claims is the same as for other conditions. Refer to our guide on how to claim health insurance for further details.

Ditto’s Experience with Mental Health Insurance Claims

Akshat Bhatia, our Claims Manager, says:

We understand that mental health care is deeply important. At Ditto, we have received a few claims related to mental health conditions, but most of them were denied because the need for hospitalization couldn’t be medically justified. In many cases, mental health treatments such as therapy and counselling are appropriately provided on an outpatient (OPD) basis. Since OPD isn’t covered in most plans, the claims don’t qualify for admission-based coverage.

Why Choose Ditto for Health Insurance?

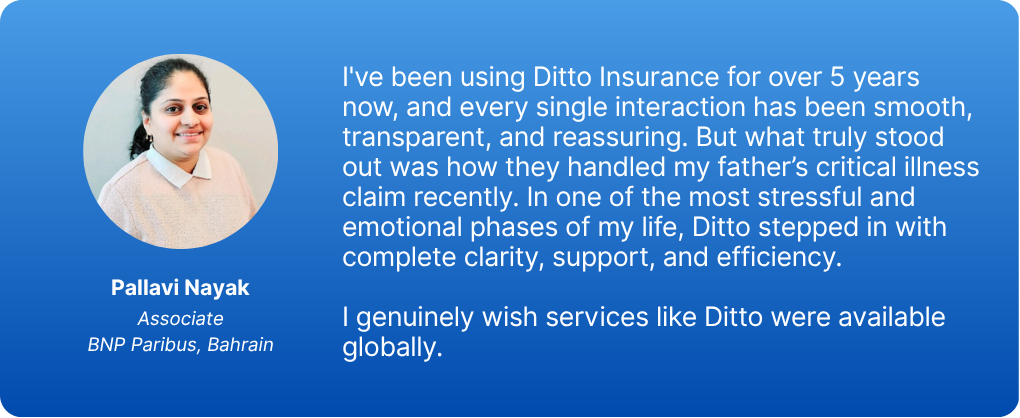

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or chat on WhatsApp us now!

Ditto’s Take on Mental Health Insurance

Many insurers offer policies supporting your mental well-being through OPD riders or add-ons. While choosing a plan, look for clear mental illness coverage, reasonable waiting periods, and easy claims processing.

Always disclose your mental health history honestly, as non-disclosure can lead to claim denials or cancellations. Ask yourself, “Will this plan support me when I need it most?” If yes, you’ve found the proper coverage. You can also seek expert guidance if you are still unsure if the plans offering mental health insurance are the right fit for your needs.

Disclaimer

Frequently Asked Questions

Last updated on: