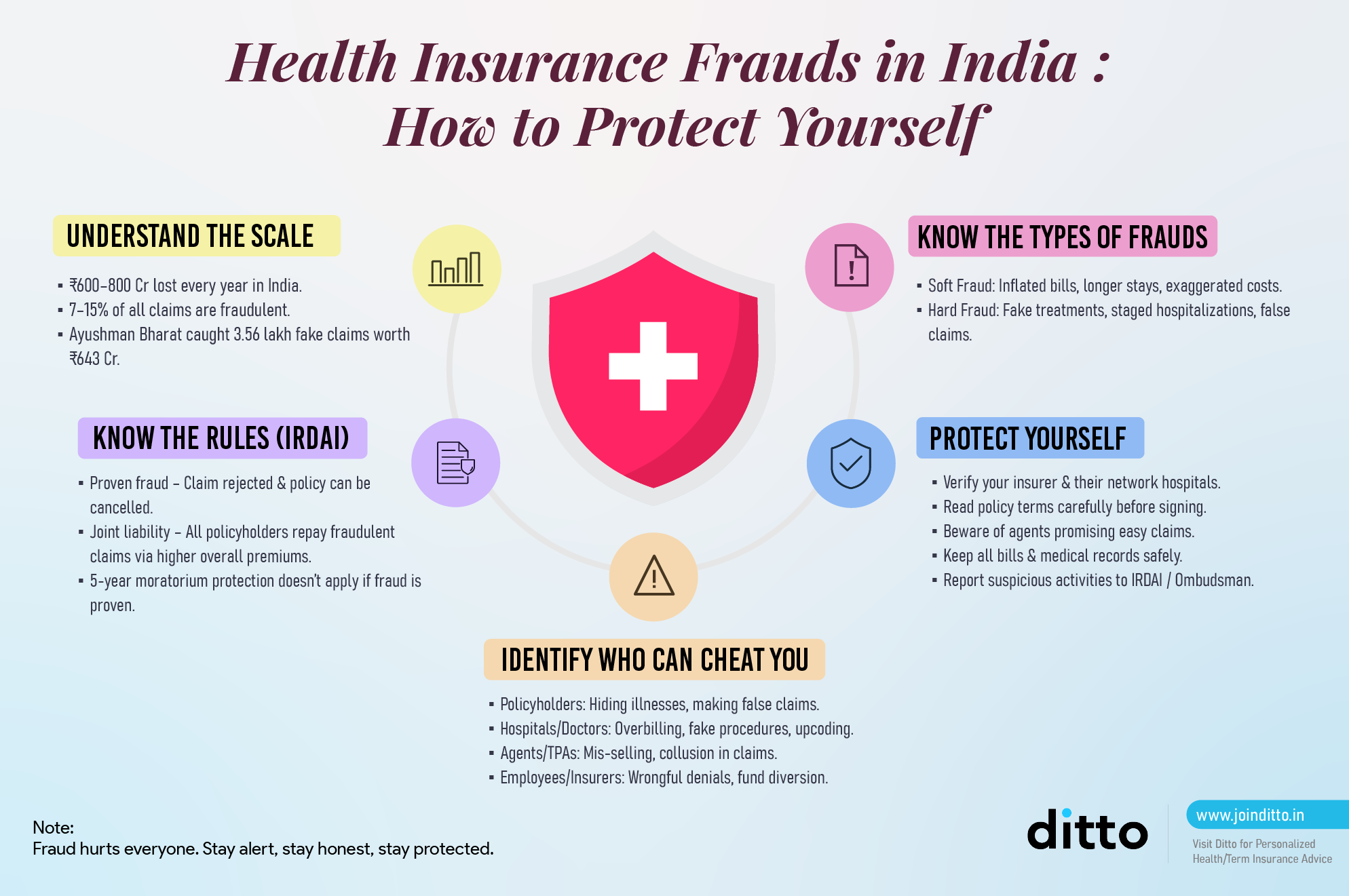

Health insurance has become a vital financial safeguard in India, offering essential protection against the rising costs of medical expenses. However, as the industry grows, so does the threat of fraud. In FY 2024 alone, the Government rejected 3.56 lakh fraudulent health insurance claims amounting to ₹643 crore, and de-empanelled 1,114 hospitals involved for Ayushman Bharat.

Additionally, the Insurance Institute of India and Deloitte reports estimate an annual loss of ₹600-800 crores for insurers due to fraudulent healthcare claims. Such dishonest activities not only undermine the credibility of the health insurance sector but also pose significant risks to both insurers and policyholders.

In this blog, we will explore

- The different types of health insurance fraud in India

- The penalties for committing such fraud

- How to protect yourself from becoming a victim

- What actions to take if you encounter fraud

Protect your health insurance today – Verify your policy, choose trusted providers, and stay alert against fraud. Get started with Ditto now!

Health Insurance Fraud in India

IRDAI’s guidelines on standardisation of health insurance products state that the expression "fraud" means any of the following acts committed by the Insured Person or by his agent, with intent to deceive the insurer or to induce the insurer to issue an insurance Policy:

- The suggestion, as a fact of that which is not true, and which the Insured Person does not believe to be true

- The active concealment of a fact by the Insured Person having knowledge or belief of the fact

- Any other act fitted to deceive

- Any such act or omission as the law specially declares to be fraudulent

Did You Know?

Now that we have a basic understanding of what constitutes health insurance fraud, let’s look at the different types.

Types of Health Insurance Frauds

According to the Insurance Institute of India, health insurance fraud can take many forms, but it can be broadly classified into two types: Hard and Soft.

1) Soft Health Insurance Frauds in India

Soft frauds are opportunistic and usually involve exaggerating the extent of a genuine loss. In health insurance, this could mean:

- A patient is being hospitalized for a legitimate illness, but is inflating the length of stay or claiming higher-priced room charges than actually incurred.

- Submitting inflated bills for medicines, diagnostic tests, or procedures.

Example: A person undergoes surgery that costs ₹1.5 lakh but submits manipulated bills showing ₹2 lakh to claim a higher reimbursement.

2) Hard Health Insurance Frauds in India

Hard frauds involve fabricating or staging a loss that does not exist. Here, the claim itself is not valid. In health insurance, this could mean:

- Claiming for treatment that never occurred.

- Getting admitted to a hospital under false pretenses (e.g., for a non-covered condition but misreporting it as a covered illness).

Example: A person claims hospitalization for a heart procedure during the policy period, but in reality, the procedure was performed before purchasing the policy or not at all.

Health insurance fraud can also be classified based on who commits it:

3) Fraud by Employee

Employees of insurance companies, due to their access to sensitive data and systems, may abuse their position. Common forms include:

- Forgery or document manipulation: Altering claim records or customer details.

- Diversion of funds: Redirecting claim settlements or premium payments to personal accounts.

- Collusion: Partnering with insureds or external parties to approve fraudulent claims.

- Policy manipulation: Backdating or altering coverage terms to favour a claimant.

Example: A claims officer approves inflated hospital bills in exchange for kickbacks from a hospital administrator. Or an employee selling personal info of the insurer's customer (like policy renewal date, premiums, contact details) to rival insurers so that they can poach and coerce customers into porting to their plan.

4) Fraud by Insurance Intermediaries

Insurance intermediaries such as agents, brokers, third-party administrators (TPAs), and surveyors often act as the link between insurers and customers. They can also commit fraud. Common forms of fraud by them include:

- Premium siphoning: Collecting premiums from customers but not depositing them with the insurer.

- Mis-selling: Selling unsuitable policies by concealing exclusions or overstating benefits.

- Claim facilitation fraud: Colluding with hospitals or insureds to create fake or inflated claims.

Example: An agent collaborates with a hospital to submit claims for treatments that never occurred, sharing the payout.

5) Fraud by the Insured (Policyholder)

These frauds occur when policyholders deliberately misrepresent facts or exploit loopholes to gain unlawful benefits. Common forms include:

- Pre-existing condition concealment: Withholding information about existing illnesses at the time of buying a policy.

- Exaggerated claims: Inflating hospital bills, length of stay, or treatment costs.

- Staged or false claims: Claiming for treatments never undertaken or for illnesses that predate the policy.

- Collusion with providers: Partnering with hospitals to generate fabricated claims.

Example: A policyholder claims reimbursement for an expensive surgery performed before the policy's start date by presenting manipulated bills.

6) Misconduct or Fraud by Insurers

While not always labelled “fraud” in textbooks (such as IC-39, which is insurer-centric), insurers themselves can engage in practices that effectively defraud policyholders. Forms of misconduct include:

- Unjustified claim repudiation: Wrongfully denying valid claims on flimsy grounds.

- Deliberate delay in settlements: Using delay tactics to discourage or financially pressure claimants.

- Misrepresentation at sale: Marketing policies in misleading ways, hiding exclusions or restrictions.

- Overcharging or hidden costs: Imposing charges not disclosed at the time of purchase.

Example: An insurer routinely rejects high-value hospitalization claims, citing “pre-existing illness” without proper investigation, forcing customers into lengthy disputes.

These actions fall under Unfair Trade Practices, deficiency of service (as per the Consumer Protection Act), and are subject to IRDAI regulation and the Insurance Ombudsman system.

7) Frauds by Hospitals / Healthcare Providers

Hospitals, doctors, and diagnostic centers play a direct role in claim generation, and sometimes engage in fraud either independently or in collusion with patients, agents, or employees. Common Forms of Hospital-Related Fraud:

- Overbilling / Inflated Charges: Charging higher room rents, procedure costs, or consumables than actually used. Example: Billing for a “private room” while the patient stayed in a shared ward.

- Phantom Billing (Fake Treatments): Raising claims for procedures, tests, or admissions that never took place. Example: Claiming ICU admission charges when the patient was treated in a general ward.

- Upcoding / Unbundling: Charging for more expensive procedures than the ones actually performed, or splitting bundled procedures into multiple billable items. Example: Coding a minor laparoscopic surgery as a significant open surgery to inflate claim amounts.

- Collusion with Patients/Agents: Hospitals admitting healthy individuals under false pretenses to generate insurance claims. Example: Recording a cosmetic procedure (not covered) as a medically necessary one (covered) with the patient’s consent.

Role of IRDAI in Preventing Health Insurance Fraud

The IRDAI plays a pivotal role in setting guidelines to help prevent health insurance fraud. Insurers must comply with IRDAI's anti-fraud policies, which include implementing fraud detection systems, conducting regular audits, and reporting suspected cases of fraud to the regulator.

Bima Manthan is an IRDAI initiative that involves high-level consultations with insurance CEOs and stakeholders to review industry challenges and propose reforms. While not a fraud-specific forum, it frequently addresses fraud through discussions on risk management, governance, market conduct, and distribution oversight.

By promoting data analytics, hospital/agent accountability, and standardized products, Bima Manthan strengthens the sector’s ability to detect, prevent, and penalize fraud. It also includes a stress testing system and organizing a hackathon. Ultimately, it aims to build a more transparent and trustworthy insurance ecosystem.

Other than that, IRDAI also introduced the IRDAI Insurance Fraud Monitoring Framework, 2024, but it is not yet fully operational as per the latest regulation. As of late 2024, they were in the draft or "exposure draft" stage, and insurers were given a deadline to submit comments and suggestions. As it’s expected to go live soon, here’s a summary of what it says:

Objective:

Create a uniform, zero-tolerance system to prevent, detect, monitor, and report fraud; protect policyholders; and maintain industry trust.

Types of Fraud:

- Internal Fraud: by employees/management (e.g., fund diversion, collusion, forgery).

- Distribution Channel Fraud: by agents, brokers, TPAs (e.g., premium siphoning, mis-selling, fake policies).

- Policyholder/Claims Fraud: by insureds (e.g., concealment, false documents, impersonation).

- External Fraud: by hospitals/vendors (e.g., inflated bills, fake reports, unauthorized access).

Governance:

- Board-approved Anti-Fraud Policy.

- Fraud Monitoring Committee (FMC) with an independent Fraud Monitoring Unit (FMU).

- Annual risk assessments and use of Red Flag Indicators (RFIs).

Monitoring & Reporting:

- Maintain a fraud incident database.

- Report to law enforcement & IRDAI.

- File the annual Fraud Monitoring Report (FMR-1) with case details and financial impact.

- Cyber/New Age Frauds: Strong cybersecurity, tighter access controls, and specialized monitoring teams.

Did you know?

What Happens When a Fraud is Detected?

If the insured person is found to have made a false claim or used any dishonest means to get benefits from the policy, all benefits will be canceled. This includes situations where the insured person or anyone acting on their behalf makes false statements or tries to deceive the insurer in any way.

If any claims were paid out but later found to be fraudulent, the person(s) listed on the policy must reimburse the money.

Will the Policy Be Cancelled? What if I Didn’t Commit Fraud?

The insurance company won't cancel the policy for fraud if you can show that any wrong information was given by mistake or without intent to deceive. If this happens, the burden is on the policyholder or beneficiaries to prove that the information was honest and that there was no intention to conceal the truth.

Health Insurance Frauds Punishment in India

The Insurance Act, 1938, in conjunction with provisions from the Indian Penal Code (IPC), imposes stringent punishments for those convicted of committing insurance fraud.

1) Under the Insurance Act, 1938

- Any person found guilty of knowingly making false or misleading statements to obtain an insurance policy or claim can face imprisonment of up to 3 years, a fine that may extend to ₹10 lakh, or both.

- Intermediaries, such as agents, brokers, or corporate bodies, involved in fraudulent practices may face cancellation of their license, debarment from the insurance sector, and financial penalties.

2) Under the Indian Penal Code (IPC)

- Fraudulent acts such as forgery of medical documents, misrepresentation, and conspiracy to cheat insurers are punishable under sections dealing with cheating (Section 420), forgery (Sections 463-471), and criminal breach of trust (Section 406).

- Punishments may include imprisonment of up to 7 years, along with fines, depending on the gravity of the offense.

3) Corporate and Hospital-Level Penalties

- Hospitals found to be complicit in inflating bills, conducting unnecessary procedures, or filing fraudulent claims risk de-empanelment, substantial fines, and blacklisting by insurers and government health schemes.

- Corporate fraud cases can also lead to action by the Enforcement Directorate under the Prevention of Money Laundering Act (PMLA), 2002.

In essence, health insurance fraud in India carries severe consequences, ranging from monetary penalties to imprisonment, as well as professional and reputational loss. These strict measures aim to protect genuine policyholders and maintain the integrity of the insurance system.

Did you know?

How to Protect Yourself From Health Insurance Frauds?

Protecting yourself from health insurance fraud requires awareness and proactive measures. Here are some steps you can take:

1) Choose a Reputable Insurer, Agent, and Hospital

Before purchasing health insurance, it’s essential to verify the credibility and reputation of the insurance provider. Choose an insurer with a strong track record of claim settlements and positive customer reviews. Research online for ratings, and check if the insurer is registered with the Insurance Regulatory and Development Authority of India (IRDAI).

If you’re buying health insurance through an agent or an intermediary, always ensure that they’re reliable and look for hospitals that understand the claims process and are committed to supporting patients rather than obstructing them.

2) Examine Policy Documents Carefully

Always read the fine print of your health insurance policy. Look for hidden clauses, exclusions, or limitations that could affect your coverage in the event of a claim. Pay attention to the terms related to premiums, the sum assured, co-payments, and exclusions, as these can help you avoid surprises later.

3) Beware of Suspicious Agents and Online Offers

Fraudulent agents often use aggressive tactics, promising lower premiums or better coverage than what is actually offered. Be cautious of unsolicited calls or online ads that seem too good to be true. Always verify offers with the insurance company directly before making any decisions or sharing personal information.

4) Verify Premium and Claim Procedures

When purchasing health insurance, make sure you understand the premium payment process and claim procedures. Ensure that the premium amounts align with the coverage provided and are in line with the agreed-upon terms. If you’re unsure about the process, consult with a legitimate insurance advisor or representative.

5) Keep Records and Stay Alert

Always maintain copies of important documents, such as medical bills, hospital receipts, prescriptions, and policy details, to ensure you have a record of them. In case of any discrepancies or fraudulent activity, you will have a record of what has been submitted to the insurer. Stay alert for any suspicious activities or errors in your medical records or claims.

6) Be Cautious with Your Personal Information

Avoid sharing your health insurance details or personal information with untrusted individuals. Identity theft is a growing issue, and fraudsters often rely on personal data to commit fraudulent activities.

If you suspect or come across a fraudulent activity, it’s essential to take immediate action:

1) Report to Your Insurer

The first step is to inform your insurance company. Most insurers have dedicated fraud detection units that handle such cases. You can also reach out to your insurance ombudsman or the IRDAI.

2) File a Police Complaint

If you believe that you’ve encountered serious fraud, such as identity theft or large-scale fraudulent claims, file a complaint with the police. The authorities will investigate the matter and take appropriate legal action.

3) Gather Evidence

Collect all necessary documentation and evidence related to the fraud. This may include emails, receipts, hospital records, or communications with the fraudster.

Impact of Health Insurance Frauds on Premiums

Ditto’s Take on Health Insurance Fraud in India

Health insurance fraud is a serious issue, but the way it’s handled today often punishes the honest while failing to deter the fraudsters meaningfully.

Let’s draw a parallel.

Banks deal with fraud, too. But do they treat every customer trying to withdraw ₹5,000 as a potential scammer? No. They’ve built intelligent systems to detect suspicious patterns, collaborate with law enforcement, and hold the guilty accountable. Health insurers could take a page from that book.

Instead of making every claimant feel like a suspect, insurers should focus on smarter fraud detection, rather than relying on blanket suspicion. Fraud prevention shouldn’t mean benefit denial by default. It should mean prosecuting the guilty, not penalizing the sick.

There’s another side to this conversation that rarely gets attention: abuse of power. When an insurer delays or denies a genuine claim under the guise of “fraud investigation,” who holds them accountable? Right now, no one. But they should be.

Unreasonable delays in medical claim processing, especially during emergencies, can be as damaging as fraud itself. The stakes are life and death, and if insurers misuse their authority, they must face regulatory consequences. That means fines, blacklisting, or loss of license for repeated offenders, just like it would for a fraudulent hospital or agent. Fraud shouldn't become an excuse for inefficiency or exploitation.

In short, until fraud is met with strict, swift consequences across all parties, it will continue to flourish in the loopholes.

Why Choose Ditto for Health Insurance

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Abhinav below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

Health insurance fraud is a significant challenge that affects everyone, from policyholders to insurers and healthcare providers alike. Fraud in insurance is not one-sided. While insureds, employees, and intermediaries can and do exploit the system, insurers themselves may also engage in practices that amount to fraud or unfairness. Recognizing fraud across all stakeholders ensures a fairer and more transparent insurance ecosystem, where both financial stability and consumer protection are upheld.

While the industry is taking steps to combat fraud, consumers also play a critical role in protecting themselves from falling victim to such schemes. Being vigilant, informed, and proactive is the key to safeguarding your health insurance benefits and ensuring that you are not adversely affected by fraudulent activities.

FAQs

What is the most common type of health insurance fraud in India?

The most common types of fraud include fake claims, overcharging, and unnecessary treatments. These often involve collusion between the insured, healthcare providers, and sometimes agents.

How can I detect a fraudulent health insurance claim?

Review your medical records carefully and verify that all treatments align with the services actually provided. If you notice discrepancies, contact your insurer immediately.

What happens if I make a fraudulent health insurance claim?

If you are caught making a fraudulent claim, you could face imprisonment, hefty fines, and your policy may be canceled.

Can health insurance fraud be prevented?

Yes, by choosing reputable insurers, being aware of the terms of your policy, regularly checking your medical records, and reporting suspicious activity, you can protect yourself from fraud. The truth is that there will always be fraud, especially undetected, but it can be minimised to the best extent.

What is the Insurance Information Bureau of India (IIB), and what does it do?

The Insurance Information Bureau of India (IIB) is a data and analytics organization set up by the Insurance Regulatory and Development Authority of India (IRDAI). It serves as a central repository for insurance data across life, general, and health insurance sectors. Its primary role is to collect, maintain, and analyze industry-wide data, which helps insurers detect fraud, identify high-risk entities, and improve overall transparency in the insurance sector.

How does IIB help combat insurance fraud?

IIB plays a key role in detecting and preventing fraud in the insurance industry. It operates a common fraud monitoring platform that allows insurers to detect suspicious claims, track repeat offenders, and share intelligence about fraudulent activities. IIB also maintains a caution list of blacklisted agents, hospitals, Third-Party Administrators (TPAs), and distribution channels, helping insurers avoid associations with high-risk entities.

What tools and services does IIB offer to insurers?

In 2023–24, IIB expanded its technology and leadership to meet industry needs, and served insurers through key products such as:

- HI Portability: a tool for seamless exchange of policy, member, and claims data during health insurance portability.

- Bima Satark: a real-time fraud analytics platform that generates early warning triggers via APIs to flag suspicious entities.

- ROHINI: a validated registry of hospitals and day-care centres that helps health insurers control provider-level fraud.

Together, these tools strengthen insurers’ ability to detect, prevent, and combat fraud while enhancing transparency and efficiency across the sector.

Last updated on: