What is Cashless Health Insurance for a Family?

Cashless health insurance for families allows you to receive hospital treatment without any massive upfront payment. A health plan for your family, also known as a family floater plan, covers the entire family under one sum insured, shared by all members in the policy. The insurer directly settles bills with the hospital.

Introduction

Hospital bills can strain any family’s finances, especially during emergencies. At Ditto, we analyzed top IRDAI-approved health plans to help you find the best cashless options that make quality healthcare accessible without any hassle.

This guide helps you understand:

- What is a cashless health plan for a family?

- Which are some leading insurers offering family floater health plans

- What you should keep in mind when purchasing a family health plan

Still unsure about purchasing a cashless family floater? Book a free call with us and let our experts guide you in making an informed decision.

What Are the Best Cashless Health Insurance Plans for Families in 2025?

Let’s take a quick look at some leading health plans for families as of 2025:

Before we discuss the list, here’s how we decide what plans to feature.

At Ditto, every health plan goes through our six-point evaluation framework. It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars.

You can learn more about how we evaluate health insurance plans here.

P.S.: *Can be reduced with add-ons; **Can be increased with an add-on

Take Note: Even in a cashless hospitalization, you may need to pay a small deposit, usually ranging from ₹5,000 to ₹50,000, upon admission. Although it’s not a significant upfront cost, some hospitals require this refundable amount as part of their standard process.

How Does Cashless Family Health Insurance Work?

Cashless family health insurance allows your entire family to share a single coverage amount under a single plan. Any member can use the full sum insured if needed. If multiple claims occur, they all draw from the same pool. When purchasing, look for plans with unlimited restoration benefits for stronger protection.

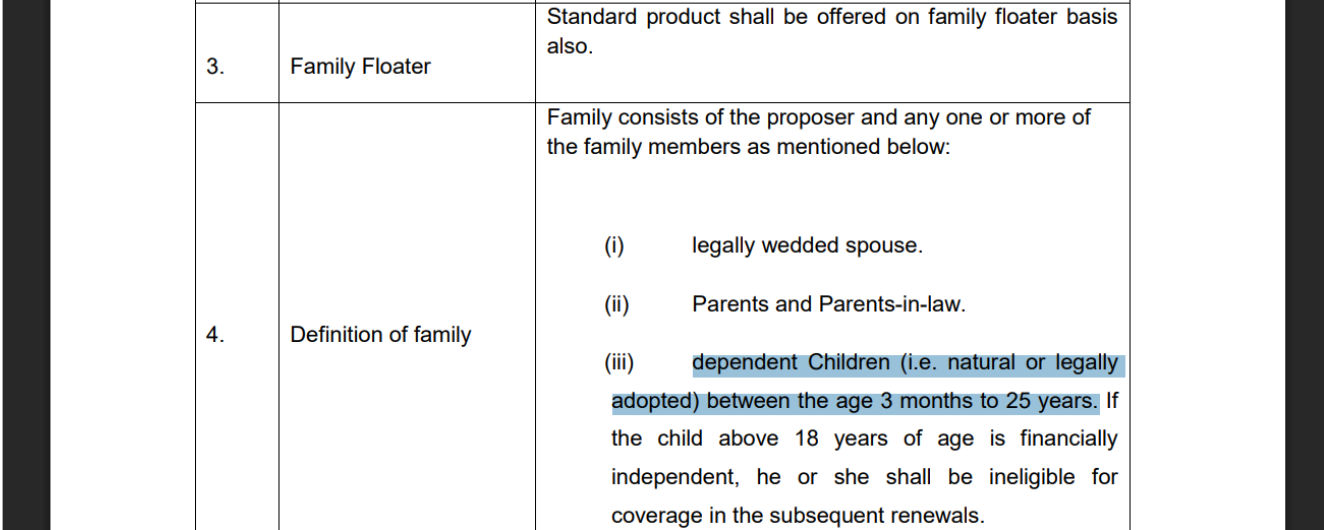

Here’s a snippet from IRDAI’s Master Circular on Standardization of Health Insurance Products about eligibility for a family floater:

Why Should You Get a Cashless Family Health Insurance Plan?

A cashless family floater plan offers comfort when it matters most. Here's why you should buy one:

- No Upfront Costs: Avoid paying out of your own pocket during emergencies.

- One Plan for All: Protect your whole family under one single policy.

- Quick & Easy Claims: Policyholders receive faster, smoother claim settlement without any hassle.

- Tax & Continuity Benefits: Save on taxes while keeping coverage active year after year.

Let’s take a quick look at the premium range for different family compositions, and sum insured of ₹15L, residing in Delhi:

Estimated Annual Premiums for Different Family Structures (HDFC Term Insurance)

What Is Covered and Not Covered in Cashless Health Insurance?

Let’s take a look at what is included and excluded in a cashless family floater:

How Can Your Family Avail Cashless Treatment at Network Hospitals?

Here’s how your family can easily get cashless treatment at any network hospital:

- Locate a Network Hospital: Check your insurer’s hospital network list online or through their app before admission.

- Show Your Health Card: Present your e-card or policy details at the hospital’s Third Party Administrator desk.

- Pre-Authorization: The hospital sends your treatment details to the insurer for approval.

- Claim Settlement: Once approved, the insurer pays the hospital directly.

Did You Know?

Multi-individual health plans provide each family member with a separate sum insured under a single policy, managed by a single proposer. This means that one member’s claim won’t affect the coverage of others.

Plans like HDFC ERGO Optima Secure offer this option. It’s usually more affordable than buying separate policies for everyone.

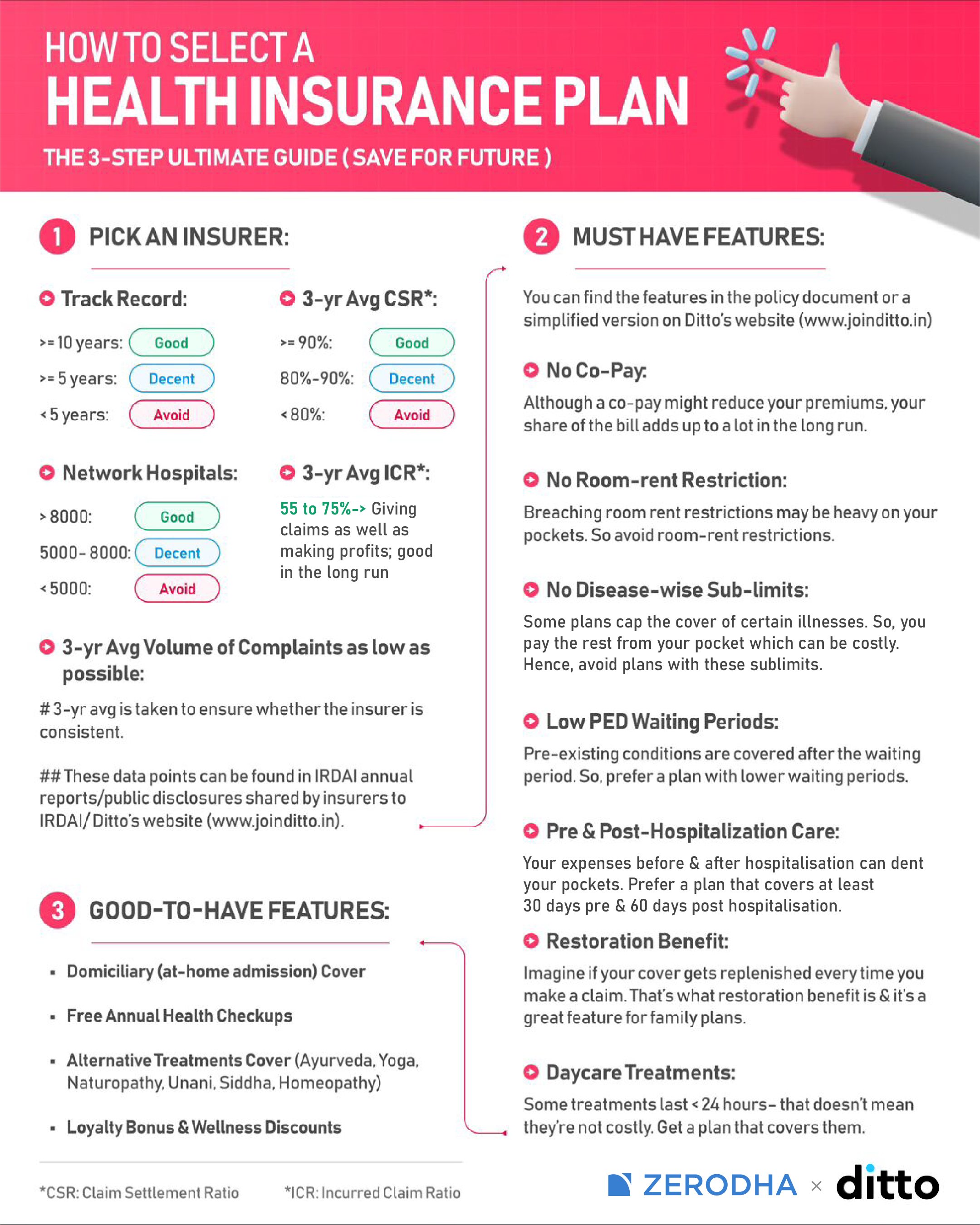

How to Choose the Best Cashless Family Health Insurance Plan? Ditto’s Take

Your plan should match your city and budget.

- In metro cities, choose a base cover of ₹20–25 lakhs.

- In non-metro areas, ₹10–20 lakhs is usually enough.

Note: Add a super top-up if required.

- A family floater works well for young families with fewer health issues.

- For couples with children, consider a floater plan.

- For parents over 60, consider purchasing separate senior insurance to keep your coverage simple and affordable.

Why Talk to Ditto for Your Health Coverage?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Arun below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 5,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Thoughts

A cashless family health plan safeguards your family's health during medical emergencies. However, if your family has complex health issues, it's better to purchase individual comprehensive health plans.

How long are children covered in a family floater?

Children are covered under a family floater plan until age 24–25. After that, insurers offer them individual policies with all waiting periods and bonuses carried forward.

Can I port my family floater policy?

Yes. IRDAI allows portability. Begin the process 45–60 days before renewal to ensure a seamless transfer.

Who can be included in a family floater?

Usually self, spouse, kids, and parents (often separately). Siblings, grandparents, or extended family members aren’t allowed.

What if the proposer dies or there’s a divorce?

The policy remains in effect for the remaining members. A new proposer can be added, or the policy can be split without losing benefits.

Last updated on: