Quick Overview

When purchasing a health insurance policy, several questions come to mind. One of the most commonly asked questions is: What is copay in health insurance? As per IRDAI, copayment means a cost-sharing requirement under a health insurance policy that provides that the policyholder/insured will bear a specified percentage of the admissible claims amount.

This guide explains what copay in health insurance means, why insurers apply it, its types, and whether choosing a policy with copay actually makes financial sense for you.

How Does Copayment Work?

- Policy Sum Insured: This is the maximum amount your insurer will pay in a policy year for covered medical expenses.

- Claim Amount: The total admissible medical expenses approved by the insurer after deductibles and exclusions.

- Copayment Amount: A fixed percentage of the approved claim that you must pay from your own pocket, as per the policy terms.

- Amount Payable by Insurer: The remaining portion of the claim amount after deducting the copayment, which is settled by the insurance company.

- Additional Out-of-Pocket Expenses: Any costs not covered by the policy, such as non-payable items, sub-limits, room rent differences, or expenses beyond the sum insured, must be paid separately by the policyholder.

Insurers impose a copayment to control claim costs and reduce unnecessary or minor claims. It encourages policyholders to choose reasonably priced hospitals and use insurance only when truly needed. This helps insurers manage risk and keep premiums affordable, though it increases out-of-pocket expenses when claims are made.

Note: The copay amount you pay from your own pocket is not treated as an insurer payment. So, it does not reduce your remaining sum insured. Only the amount paid by the insurer is deducted from your available coverage.

Types of Copay in Health Insurance

Take Note: Plan names mentioned here are for illustrative purposes and should not be considered as recommendations. In some cases, you can remove a copay at renewal by switching plans or variants, but mandatory copay designs usually cannot be changed.

What Are the Benefits of Copay in Health Insurance?

Lowers Premiums

Choosing a copay can reduce your premiums as the insurer’s risk reduces. However, this saving often comes at the cost of higher out-of-pocket expenses during hospitalization, which can hurt more during large claims.

Prevents Unnecessary Claims

Since you bear a part of the final medical bill, you’re less likely to raise claims for minor treatments that can be managed through OPD or basic care. But this also means even essential treatments will require you to dip into your own savings each time you’re hospitalized.

Enables Higher Coverage

Lower premiums make it easier to afford a higher sum insured. Still, the benefit of higher cover is partly offset because you must pay a fixed percentage of every claim, reducing the real financial protection.

Encourages Cost-Conscious Hospital Choice

Copay applies regardless of hospital type, which discourages choosing very expensive hospitals. However, this limits flexibility during emergencies, when choice and quality matter most.

What is the Difference Between Copayment and Deductible?

Take Note: Deductibles are usually preferred over copay options as copayments can feel heavier on large claims because they are a percentage of the final bill, so your share increases as the hospital cost rises.

Impact of Copay on Premium Amount

Choosing a copay option reduces your health insurance premium because the insurer shares the claim risk with you. The higher the copay percentage, the lower the premium, since you agree to bear a part of future medical expenses.

Example

Note: The listed annual premiums are for ICICI Elevate Health Policy for a 25-year-old, residing in Delhi, for a sum insured of ₹15 lakh. In case you opt for a copay, you save per year on the premium. However, at the time of a claim, you must pay the copay percentage of the admissible claim amount from your own pocket.

How Does Copay Affect Your Health Insurance Claim?

When you make a claim, the insurer does not pay the full approved hospital bill if you opt for a copay clause in health insurance. Instead, the total admissible claim amount is split between you and the insurer based on the copay percentage mentioned in your policy.

Let’s understand this with a simple example:

- Hospital bill (approved claim amount): ₹1,00,000

- Copay clause: 20%

Your share (copay):20% of ₹1,00,000 = ₹20,000

Insurer’s share:80% of ₹1,00,000 = ₹80,000

So, out of the total approved claim of ₹1,00,000, you will pay ₹20,000, and the insurance company will settle ₹80,000.

Note: Any non-payable items (like consumables, registration charges, or items not covered under the policy) will be over and above the copay amount and must also be paid by you.

Who Should Buy Health Insurance with Copay?

Voluntary copay should be chosen very carefully. In most cases, the out-of-pocket expenses you bear at the time of a claim can be much higher than the premium savings you get upfront.

People with serious pre-existing diseases (PEDs), who are unable to get comprehensive plans without a copay, may still consider such policies. In their case, having some insurance cover is better than having none at all.

Note: Copay applies even on cashless claims, so you must pay your share at discharge. It is usually charged on every claim, not once per year, so check the policy wording carefully.

Why Approach Ditto for Health Insurance?

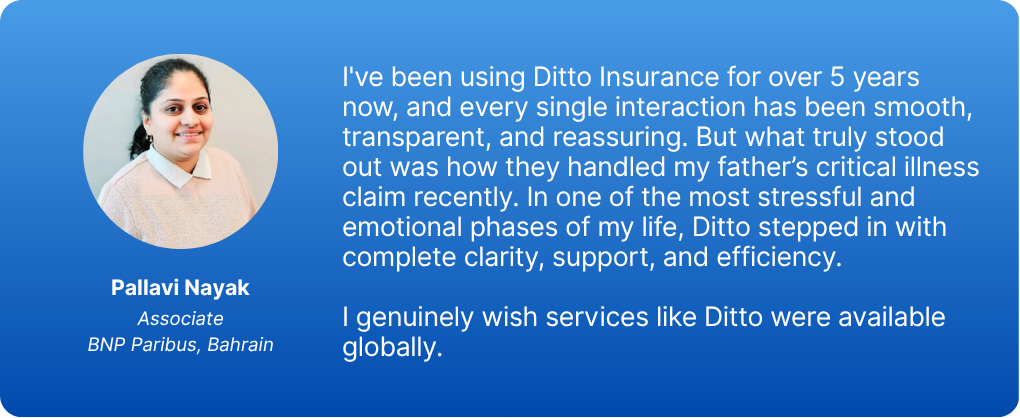

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or chat with us on WhatsApp now, slots fill up fast!

Ditto’s Take on Copay in Health Insurance

At Ditto, we advise avoiding copayments in health insurance where possible. It can sharply increase your out-of-pocket costs during major hospitalizations or costly treatments. Even with a high sum insured, copay reduces the real value of your cover since you must share every claim. Agents may push copays because it lowers the premiums and makes the policy look cheaper. But what often gets overlooked is that your out-of-pocket costs at the time of a claim become quite high.

If you are looking for a health plan from insurers with established track records, we recommend comprehensive plans without any copayment for 2026, which align with your long-term goals. Explore more about how our experts evaluate health plans through Ditto’s cut.

Frequently Asked Questions

Last updated on: