A ₹1 Crore term insurance plan is often the first “serious” life cover most people consider, and for good reason. It offers a meaningful safety net at a relatively affordable premium, especially if you buy the policy early.

For young earners and small families with moderate expenses, ₹1 crore can replace income, clear basic liabilities, and give dependents enough runway to rebuild financially. However, whether ₹1 crore is sufficient depends on your lifestyle, dependents, loans, and long-term goals.

So instead of asking “Which is the cheapest ₹1 crore plan?,” the better question is: “Is ₹1 crore the right cover for me?” Let’s break it down.

Who Should Buy a ₹1 Crore Term Insurance Plan?

Salaried Individuals

Self-Employed and Business Owners

Married Individuals and Parents

Young Professionals Planning Early

Note

Best Term Insurance Plans for ₹1 Crore

Before we discuss the list, here’s how we decide what plans to feature.

At Ditto, every term plan goes through our six-point evaluation framework. It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars.

You can learn more about how we evaluate term insurance plans here.

Talk to an expert

today and

find

the right

insurance for you.

Premiums of the Best Term Insurance Plans for ₹1 Crore

Premiums are calculated for a person seeking a ₹1 crore sum assured, with coverage up to age 70, for a non-smoking male, with no added riders or 1st year discounts.

Premiums of the Best Term Insurance Plans for ₹2 Crore

Premiums are calculated for a person seeking a ₹2 crore sum assured, with coverage up to age 70, for a non-smoking male, with no added riders or 1st year discounts.

Insights: A key takeaway from the tables is that term insurance premiums do not increase proportionately with the sum assured. Moving from a ₹1 crore to a ₹2 crore cover typically raises the premium by only about 60%–80%, not 100%. In other words, you get nearly double the coverage without paying double the price. This makes higher covers far more cost-effective and better suited to replace income and support dependents for a longer period, especially in the face of inflation and rising living costs.

How to Choose the Best Term Insurance Plan for 1 Crore?

Before finalizing a term insurance plan for 1 crore, take a look at the following pointers:

1) Coverage vs Premium Balance

The cheapest plan is rarely the best plan. A good ₹1 crore term policy should strike a balance between affordability and meaningful protection. Look for reasonable premiums, strong core benefits, and useful riders such as waiver of premium, critical illness cover, disability cover, and flexible payout options. Also, remember that once you buy a term plan, the premium usually stays fixed for the entire policy duration, so over time, its real cost becomes relatively insignificant. Saving a small amount every year makes little sense if your family struggles during claims.

2) Insurer Reputation and Claim Settlement Record

Your nominee will deal with the insurer, not you. That’s why it’s important to check the insurer’s claim settlement ratio, amount settlement ratio, customer complaint volumes, solvency ratio, and how transparent their claims process is. A reliable insurer often matters more than marginally lower premiums.

3) Policy Term and Payout Options

Ideally, your policy should cover you until at least age 60 or 65. You should also evaluate how the payout will be made, whether as a lump sum, a monthly income, or a combination of both. Longer coverage periods generally offer better financial security for dependents.

4) Importance of Policy Wordings

Policy documents decide what actually gets paid. Always review how “death” is defined, the exclusions (such as suicide or non-disclosure), rider conditions, and disability definitions. Two plans may look identical on paper, but perform very differently during claims.

Note

How to Buy the Best 1 Crore Term Insurance Plan Online

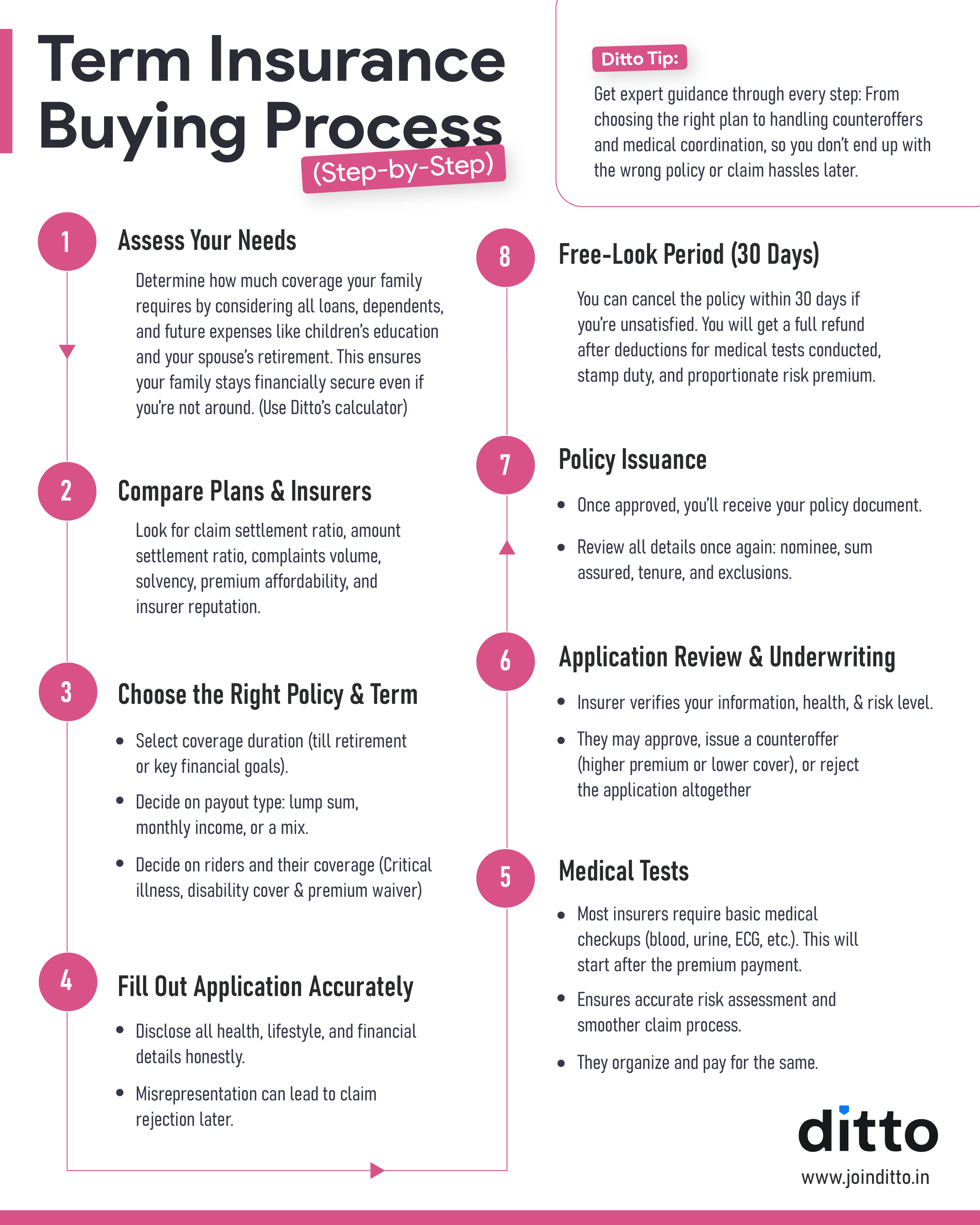

The following infographic neatly sums up the step-by-step purchase process for the best term insurance plan for 1 crore in India:

Remember: Hiding or misreporting details such as smoking habits, alcohol consumption, past illnesses, or existing medical conditions is one of the most common reasons claims get rejected. Always disclose everything honestly, even if it slightly increases your premium, because an unpaid claim costs your family far more than a higher premium ever will.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call or WhatsApp us now!

Conclusion

A ₹1 crore term insurance plan is a strong starting point for building financial security, especially if you’re young, have moderate expenses, and want affordable long-term protection. It can replace income, cover basic liabilities, and give your family the breathing room they need during difficult times.

However, the right plan is about choosing reliable insurers, adequate coverage duration, and clear policy terms. As your income and responsibilities grow, revisiting and increasing your cover can make your protection truly future-proof.

Quick Note

Frequently Asked Questions

Why People Trust Ditto

Last updated on: