A term life insurance premium is the amount you pay (monthly or annually) to keep your term life policy active. It covers the cost of providing life cover for a fixed period. If the insured dies during the term, the insurer pays the sum assured to the nominee. Premiums vary according to age, health, policy term, and the amount of coverage.

What is Term Life Insurance Premium: Overview

In FY24, India's insurance penetration stood at just 3.7% of the GDP, with 2.8% from life insurance and a mere 0.9% from non-life insurance. While awareness is gradually increasing, a large number of Indians still remain underinsured or entirely uninsured.

One way to gauge this is by examining per capita premiums, which indicate the amount of money individuals spend on insurance. Investments went up slightly (from ₹8,035 (US$92) in FY22 to ₹8,297 (US$95) in FY23-24), which means despite rising incomes and risks, most people aren't investing enough in insurance.

That's where term life insurance comes in with high coverage at relatively low premiums.

In this article you’ll learn :

- What is term life insurance premium

- How term life insurance premium works

- How premiums are calculated

- What’s the average premiums by age

- Comparison of top term plans in 2025

- How to choose the right term policy

Ready to find the perfect term insurance plan? Book a free call with Ditto to get personalized recommendations based on your needs and budget.

How Does Term Life Insurance Work?

Term life insurance is a pure life risk cover that offers a fixed sum assured (death benefit) to the nominee if the insured dies during the policy term. The policyholder selects the sum assured, policy duration (e.g., 10 to 40 years), and premium payment frequency (regular, limited, or single pay).

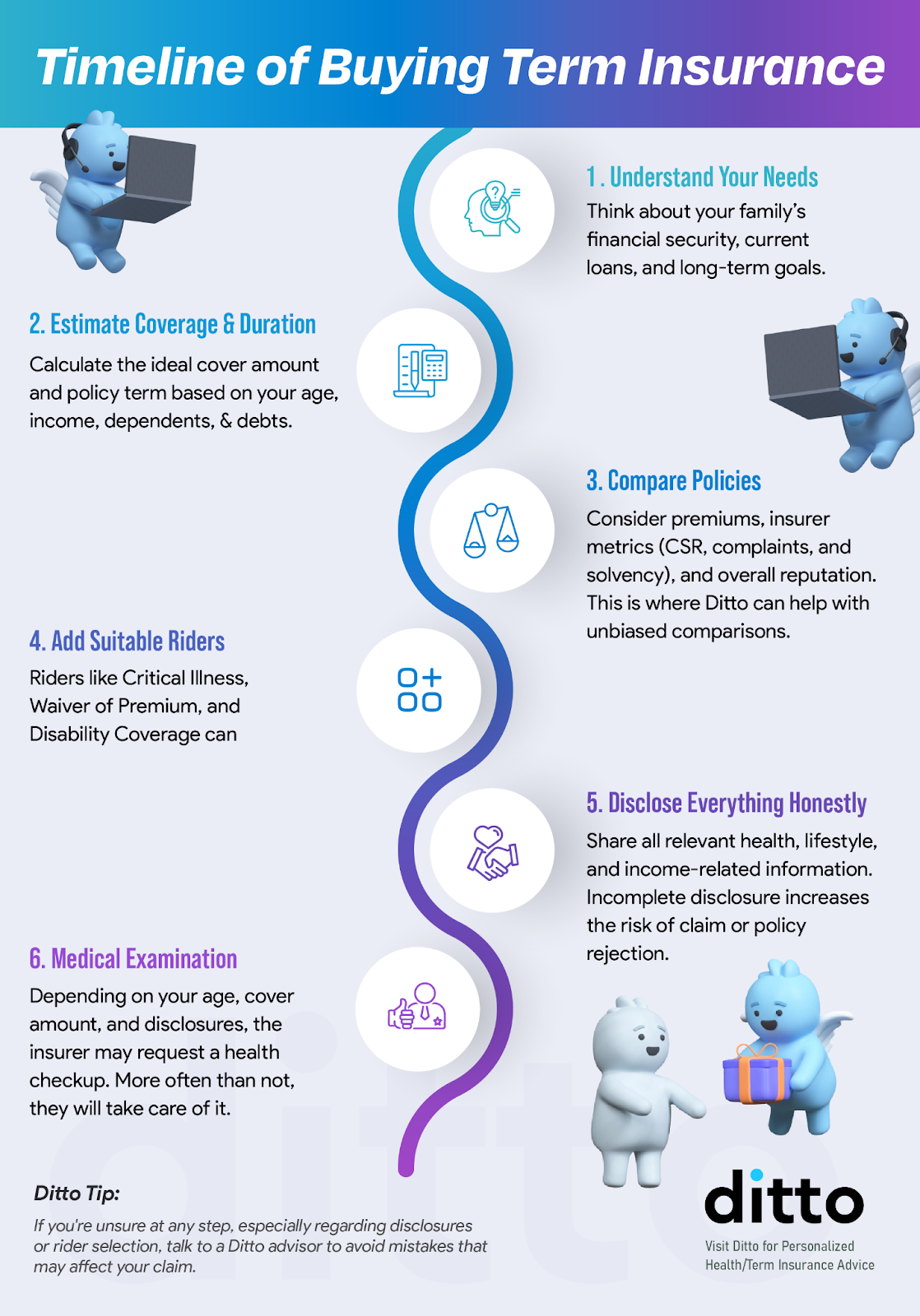

Here’s how a typical journey a buyer follows when getting a term plan:

If the insured survives the term, no maturity benefit is paid unless the plan includes a Return of Premium (ROP) option. Riders like accidental disability coverage, critical illness, or waiver of premium are beneficial add-ons.

How Do Term Life Insurance Premiums Work?

Understanding how these premiums work helps you make informed decisions about your policy structure, affordability, and long-term financial planning. Here’s what you need to know.

- Premium Payment Frequency: You can choose to pay premiums monthly, quarterly, half-yearly or annually depending on the policy terms.

- Calculation Factors: Premiums are determined based on age, sum assured, policy term, gender, occupation, health history, and tobacco consumption habits. Loading charges (additional premiums) may apply for pre-existing diseases and lifestyle habits.

- Payment Terms: Policies offer Regular Pay (throughout the term), Limited Pay (for a shorter duration), or Single Pay.

- Non-Payment Consequences: Missing payments can lead to a policy lapse, ending coverage unless revived during a specified grace period of 15 to 30 days.

Factors That Affect Your Term Life Insurance Premium

Your Age

The most critical factor in determining your premiums. Younger individuals pay significantly lower premiums because they have fewer health concerns and a longer life expectancy. As you age, insurers view you as higher-risk, resulting in higher premiums.

Your Health Status

It directly impacts your premium calculation. Pre-existing conditions, high blood pressure, or chronic diseases lead to loading charges (additional premiums). The insurer may also request medical tests or documents to assess your health accurately.

Lifestyle Habits

Addictions like smoking and tobacco consumption, substantially increase premiums. Smokers can pay 50-100% higher premiums than non-smokers for identical coverage. Alcohol consumption and high-risk activities also influence the premium.

Your Occupation

One’s profession also plays a role in determining risk. Individuals in hazardous professions like mining, construction, or aviation may face higher premiums than office workers.

Sum Assured (Coverage Amount)

The cover you choose directly affects your premium. Higher coverage means higher premiums. Your income and financial obligations typically determine the appropriate sum assured.

Policy Term (Duration of Coverage)

Your policy term impacts the premium amount. A longer term period generally means higher total premiums, but the per-unit premium is often lower when spread across years.

Your Gender

Gender affects premiums as well. Traditionally, women have been offered lower premiums due to higher life expectancy, though this varies by insurer.

Add-on Benefits

Adding riders like critical illness, accidental death benefit, and waiver of premium increases the base premium but offers enhanced protection.

Insurers feed such details into a risk engine to determine your term insurance premium based on the following :

- Mortality tables: show the base risk for your age/gender; this is the starting premium.

- Health underwriting: medical history, reports, and BMI can add “loading” if you're at higher risk.

- Lifestyle factors: smoking, alcohol, or risky hobbies push the premium up.

- Occupation risk: hazardous or field-heavy jobs are priced higher than desk jobs.

- Policy design: higher sum assured, longer term, or extra riders = higher payable premium.

- Market/pricing tweaks: insurers also factor in competition and inflation before finalizing the quote.

Want to see how insurers actually arrive at the final premium before and after adding riders? Here’s the full breakdown of how term insurance premiums are calculated.

How to Calculate Term Life Insurance Premium in India?

Calculating your term life insurance premium involves understanding the core formula and the variables.

Formula to Calculate the Basic Premium Calculation:

Premium = Base Rate × Sum Assured × Risk Factor × Duration Factor

Where:

- Base Rate is determined by the insurer based on actuarial data and mortality tables.

- Sum Assured is the coverage amount you choose (e.g., ₹1 crore).

- Risk Factor accounts for your age, health, occupation, and lifestyle.

- Duration Factor reflects the length of your policy term.

Let’s understand this with an example for a 30-year-old, healthy, non-smoker, salaried professional seeking ₹1 crore coverage for 35 years.

The base rate will be ₹14.78 per ₹1,000 sum assured per month (hypothetically) and sum assured is ₹1 crore (₹1,00,00,000)

So, the premium will be calculated as (₹14.78 ÷ 1,000) × ₹10,00,000 = ₹14,780 per year (approximately)

Note: Your actual premium may vary based on the insurer's underwriting criteria, current rates, and any health or lifestyle-related loading charges. The initial quote that you see is only the starting point.

Don’t know how much term cover you need? Fret not! Enter a few basic details and Ditto’s Term Plan Calculator will run the math for you.

Average Term Life Insurance Premiums at Different Ages

Here’s how the average term life insurance premiums look at different ages (from 25 to 45 years).

How to Reduce Your Term Life Insurance Premium?

- Buy insurance early: The younger you are when you purchase a policy, the lower your premiums will be. A 25-year-old pays approximately ₹9,864 annually for ₹1 crore coverage, while a 40-year-old can pay up to ₹21,140 for the same cover.

- Maintain a healthy lifestyle: Regular exercise, balanced diet, and avoiding smoking can significantly lower your premiums. Smoking, High BMI, lifestyle ailments like diabetes/hypertension/high cholesterol lead to apay 50-100% premium increase and rejection of riders too.

- Opt for regular pay mode: Choosing to pay premiums throughout the policy term (Regular Pay) is more affordable (considering inflation and time value of money) than Limited Pay options where you pay higher premiums for a shorter duration which makes sense considering convenience.

- Avoid high-risk activities: Hazardous hobbies or professions increase premiums. If possible, switch to safer occupations or avoid risky activities.

- Choose appropriate coverage: Don't over-insure or under-insure. Select a sum assured that matches your future financial obligations and income. Higher coverage means higher premiums but remember the increase is not linear.

- Opt for a longer term: A longer term lets you lock your premium today and keep up your protection for years (manageable annual premiums).

However, there’s a caveat. The longer you stay covered, the more your term policy will cost overall, because the insurer has to protect you across high-risk years.

For example, covering yourself only till 60 means the insurer is mainly covering you during your working years. Push it to 70, 75, or 80 and your insurer will be working hard to cover you during high mortality time. As a result, your premiums rise disproportionately, not linearly.

Term Insurance Premiums by Policy End Age

The table below shows how things play out according to your policy end age, term, annual premium amount and the percentage increase over 60 yrs.

- Compare multiple insurers: Different insurers have different premium structures. So, compare quotes from multiple reliable providers for the best rates.

- Avoid riders unless necessary: Term insurance riders provide additional coverage, but they increase your premium as well. So, only add those riders that you actually need. At Ditto, we usually do not recommend opting for an accidental death benefit rider if your base plan sufficiently covers your family’s requirements.

Best Term Insurance Plans in 2025 & Key Benefits

Tax Benefits on Term Life Insurance Premiums Under Section 80C

Section 80C of the Income Tax Act allows you to claim a tax deduction on the premiums paid for term life insurance, up to ₹1.5 lakh annually (under old tax regime). This is a significant benefit that reduces your taxable income.

How it works:

If you fall in the 30% tax bracket and pay ₹50,000 annually in premiums, you can deduct this amount from your gross income. The tax saving would be approximately ₹15,000 (30% of ₹50,000).

Key points to remember

Deduction Limit

New Tax Regime

Eligibility

Documentation

Smart Tip: If you're in a higher tax bracket, opt for a term plan as an investment and save more on tax.

Monthly vs. Annual Term Life Insurance Premium : Which Is Better?

Monthly premiums offer flexibility and make it easier to manage cash flow. However, monthly premiums are typically 2-5% higher than annual premiums due to administrative costs and increased collection risk for the insurer. On the flip side, paying annual premiums (or even half-yearly) although cost-effective, requires a larger lump-sum payment annually.

For example:

- Monthly Payment: ₹1,200/month × 12 = ₹14,400/year

- Annual Payment: ₹13,700/year (saving ₹700 annually)

Which option should you choose?

- Choose monthly payments for maximum cash flow and flexibility.

- Choose annual payments to save money without compromising convenience.

Why Choose Ditto For The Right Term Insurance

At Ditto, we've helped over 7,00,000 customers choose the right insurance policy by matching their unique needs and budget. That’s why customers like Piyush trust and recommend us.

✅ No-Spam & No Salesmen\

✅ Rated 4.9/5 on Google Reviews by 12,000+ happy customers

✅ Backed by Zerodha

✅ 100% Free Consultation

Final Thoughts

Term life insurance is a cornerstone of sound financial planning, offering high coverage at affordable premiums to protect your family's financial future. Choosing the right policy with suitable riders, leveraging tax benefits under Section 80C, and comparing payment frequency options can significantly reduce costs while ensuring comprehensive protection.

Ready to find the perfect term insurance plan? Book a free call with Ditto to get personalized recommendations based on your needs and budget.

FAQs

What happens if you miss a term life insurance premium payment?

If you miss a premium, your policy may lapse after the grace period (typically 15–30 days). You can revive it within a specified timeframe by paying the pending premiums and fulfilling any necessary health requirements.

How can I pay term life premiums?

You can pay your term life insurance premiums using several convenient methods, including UPI, net banking, credit or debit cards, and digital wallets like Amazon Pay. Note, that if you pay by credit card, there is usually a surcharge ranging from 1% to 5%, depending on the card issuer and the payment gateway. To avoid these extra costs, you might consider using UPI, net banking, or debit cards instead, as they typically do not include such surcharges.

What is the role of age and health in setting your term life insurance premium?

Age and health are the main factors that determine your term insurance premium. Younger and healthier individuals pay significantly lower premiums, while older age and pre-existing health conditions lead to higher costs due to increased risk for insurers. Maintaining good health helps secure better rates.

Is term life insurance premium tax-deductible?

Yes, premiums paid for term life insurance are eligible for tax deduction under Section 80C of the Income Tax Act, up to ₹1.5 lakh annually (old regime).

Does the premium change during the policy term?

No, once the policy is issued, the premium remains fixed throughout the term (for regular and limited pay options), unless you make changes to the policy (like add riders, increase S.A).

How can I reduce my term insurance premium?

You can reduce your premium by buying early, opting for a regular pay mode, maintaining a healthy lifestyle, and avoiding smoking or high-risk habits.

Do term insurance premiums differ between online and offline plans?

Yes, term insurance premiums bought online are generally cheaper compared to offline plans. This is mainly because online policies eliminate agent commissions and paperwork-related expenses, resulting in lower overall costs. Some reports suggest online term plans can be up to 40% more affordable, making them a cost-effective option for buyers who prefer a direct and streamlined purchase experience.

What discounts are available with term insurance plans?

Insurers offer various discounts on term insurance premiums to cater to different customer segments. Common discounts include those for salaried individuals, first-time insurance buyers, customers opting for digital policies, existing policyholders, and female policyholders. However, most of these discounts typically apply only to the first year's premium, so it is important to check the specific terms and conditions for each insurer to understand the overall savings.

Is the Return of Premium (ROP) option worth it?

Return of Premium (ROP) plans refund the total premiums you've paid (excluding taxes) if you survive the policy term. However, this isn't as beneficial as it sounds. You don't earn any interest, profit, or bonus on the refunded amount; it's simply your own money returned after years, with no real growth.

Plus, the premiums for ROP plans are significantly higher than regular term plans. Instead of opting for ROP, it's far more cost-effective to buy a pure term plan and invest the premium difference in instruments like PPF or mutual funds for better returns and liquidity.

Last updated on: