What is Terminal Illness in Term Insurance?

In term insurance, a terminal illness is a life-threatening condition that can’t be cured and is expected to lead to death within 180 days of diagnosis, as certified by a doctor.

If your policy includes a terminal illness benefit (or accelerated death benefit), the insurer pays out the benefit amount early (either fully or partially) rather than waiting until death. This is usually an in-built (free) rider, and an early payout of the death benefit to help cover medical or personal expenses in those final months.

What are the Benefits of a Terminal Illness Benefit in Term Insurance?

Suppose you are diagnosed with a terminal illness that is expected to lead to death within six months. In that case, the insurer offers an advance payout of the cover amount (often within a specified limit). This amount can be used for treatment, home care, or even to settle any outstanding financial obligations.

However, there is no specific list (unlike critical illness). Examples of terminal illness may include:

- End-stage liver failure,

- Certain cancers,

- Motor-neuron disease, etc.

Note that terminal illness riders can have a 6-month waiting period from the date the policy is issued. However, it is not common. This waiting period is in place to prevent misuse or adverse selection by people who may already be aware of their medical condition.

For example, there is a 6-month waiting period before you can use the terminal illness cover in HDFC Life Click2Protect Ultimate. Tata AIA plans, such as Sampoorna Raksha Promise and Maharaksha Supreme Select, explicitly state a 2-year waiting period.

Heads up! We know that life insurance can be overwhelming – but it doesn’t have to be! Our IRDAI-certified advisors at Ditto assess your requirements and can help you pick the right policy. And the best part? We don’t spam or pressure you to buy.

How Does a Terminal Illness Claim Work in Term Insurance?

Any terminal illness claim will be passed only if two doctors confirm the diagnosis: the patient’s treating doctor and another one from the insurer’s end, who is usually a specialist.

There are multiple ways in which the insurer can payout a terminal illness benefit:

- Whole Sum Assured

The entire cover amount will be paid. - Partial (up to a Certain Amount, say ₹2 crore)

If you have a Rs. 4 crore policy, Rs. 2 crore will be paid upon diagnosing the illness. And the remaining will be paid out upon death. - Partial (up to a Certain Percentage, say 50%):

If you have a Rs. 2 crore policy, Rs. 1 crore will be paid upon diagnosing the illness. And the remaining will be paid out upon death.

We had a term insurance case where the policyholder passed away within two years of the policy issuance due to a terminal illness. The insurer went to the extent of interviewing the nominees and their family members, and even visited the hospital to speak with the treating doctor.

This shows that if the policyholder passes away within 3 years, the insurer will go to great lengths to investigate the claim. However, if it's been more than 3 years, they are a little more relaxed.

Note: If you bought a policy via Ditto, we have an in-house claims team to help you if you ever need it.

While both terminal illness and critical illness sound similar, there are some important distinctions. Here’s a closer look at them:

What is the Difference Between a Terminal Illness and a Critical Illness Rider?

Who Should Consider a Terminal Illness Benefit in Term Insurance?

A terminal illness plan allows an early payout when diagnosed with a life-ending disease, helping you cover medical or family expenses. It’s handy if you’re the primary earner or don’t have separate critical illness or health coverage.

Here is a list of terminal illness coverage options from the popular insurers offering term plans:

Why Choose Ditto for Term Insurance?

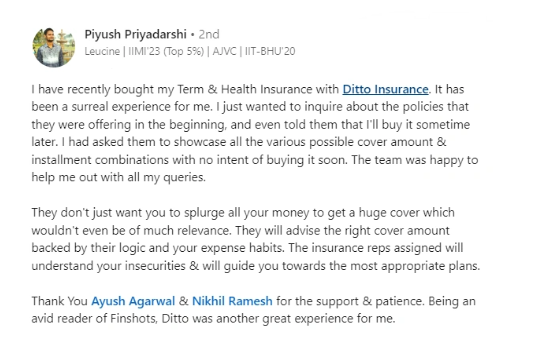

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Piyush below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

A terminal illness benefit ensures your family gets financial help when it’s needed most, not after. It provides early access to the cover amount if you’re diagnosed with a life-ending condition, easing the burden of medical and personal expenses. If you’re the primary earner, this feature can be a vital safety net.

FAQs

Is a terminal illness rider subject to taxes?

No, you don’t have to pay GST on a term insurance policy or its riders.

Is there a list of terminal illnesses in term insurance in India?

There is no ‘list’ of terminal illnesses that an insurer covers. It depends on the doctor's diagnosis.

Can you buy term insurance with terminal illness cover after being diagnosed with one?

Unfortunately, no.

Are there waiting periods or pre-existing disease limitations for terminal illness claims?

If PED is declared during purchase and the insurer issues the policy, terminal illness for the pre-existing disease will be covered. No waiting periods are there for retail term plans.

Does the terminal illness rider have any caps or limits?

Most terminal illness riders are built into the policy, and they usually come with limits. However, certain insurers, such as ICICI Prudential, allow payout of the entire base cover amount.

If I am diagnosed with a terminal illness, but I live even after 6 months, will I have to pay back the cover amount?

No, you don’t have to pay it back.

Is the terminal illness payout taxable?

Since it's a kind of death benefit, it remains exempt under Section 10(10D). However, always consult a tax professional.

Last updated on: