What Is Term Insurance With Critical Illness Coverage?

Term insurance with critical illness coverage is a term life policy that, in addition to paying a death benefit to your nominee if you pass away during the term, also pays you a lump sum if you are diagnosed with a specified critical illness covered under the plan.

Critical illnesses like cancer, heart attacks, or strokes can come out of nowhere and disrupt every part of your life. The medical and recovery costs can pile up fast, especially if you're the main earner in the family. A critical illness rider helps you stay financially steady during such times by giving you a lump sum payout right when you’re diagnosed.

In this guide, we have compiled insights from Ditto’s IRDAI-certified advisors to help you understand:

- How do critical illness riders work?

- Standard vs. accelerated payouts

- Major illnesses covered

- Who should buy the critical illness rider?

- Key checks before choosing it

Since every insurer structures this rider differently, the right choice depends on your needs. If you’re unsure, Ditto’s IRDAI-certified advisors can help you figure out what fits best. So book a free call now.

How Does a Critical Illness Rider Work?

A critical illness rider is of two types:

1) Standard Critical Illness Rider: You get the full rider amount in addition to your life cover. A ₹25 lakh CI rider + ₹1 crore term cover means your family still receives ₹1 crore upon death even if the CI rider is paid out earlier.

2) Accelerated Critical Illness Rider: The payout comes from your base cover. If your rider pays ₹20 lakh on diagnosis, your remaining life cover reduces accordingly.

Note: Once the critical illness rider is paid, you no longer pay the rider premium. Your overall premium reduces because that part of your coverage has already been used.

IRDAI’s 2024 rules require insurers to fix term insurance rider premiums for the entire term, similar to the base plan. This means adding the rider early helps you lock in a lower cost. However, some insurers have reduced the rider tenure because of this regulation.

Diseases Covered Under Term Insurance With CI Rider

While the exact list of severe, high-impact medical conditions depends on the insurer, most riders cover major illnesses such as:

- Cancer of specified severity

- Heart-related conditions, including heart attack, angioplasty, heart valve surgery, and bypass surgery

- Stroke with lasting neurological damage

- Kidney failure requiring dialysis or transplant

- Major organ transplants, such as the heart, liver, lung, or bone marrow

- Permanent paralysis of limbs

- Other serious conditions, including major head trauma, blindness, deafness, loss of speech, or muscular dystrophy

The number of illnesses covered varies widely across plans and usually ranges between 10 and 64 conditions.

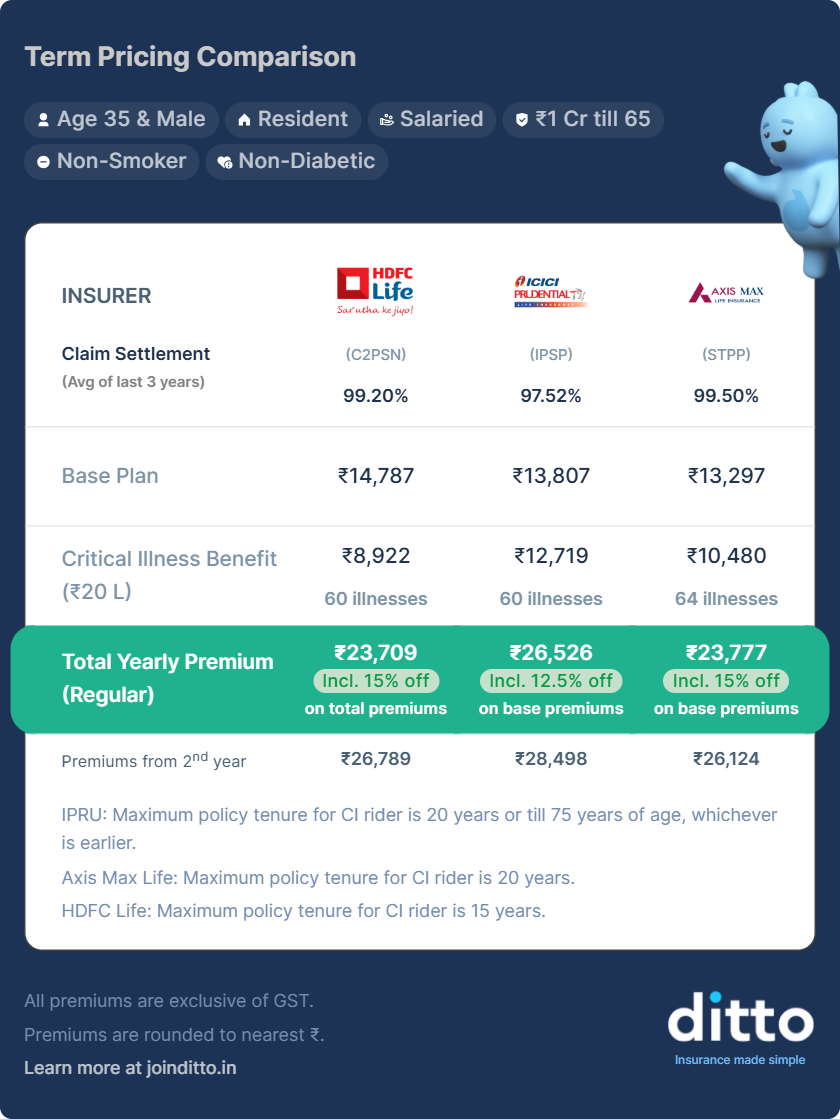

Term Plans Offering Critical Illness Rider Coverage (2025)

Note: CI rider coverage has shorter tenures than the base term plan.

- ICICI Prudential: Up to 20 years or age 75.

- Axis Max Life: Up to 20 years.

- HDFC Life: Up to 15 years.

Below are sample premium comparisons for term insurance plans with critical illness riders across different age profiles, along with a breakup of how much you pay for the base plan versus the CI rider.

Top Term Insurance Plans With Critical Illness Riders

Here is a quick look at how the top plans perform in terms of critical illness coverage.

What Is Not Covered Under Critical Illness Riders? (Key Exclusions)

- If you hide medical history or do not disclose pre-existing conditions, your claim can be rejected. Always share accurate health details at the time of purchase.

- Claims will not be paid for illnesses arising from intentional self-harm, drug use, or alcohol abuse.

- CI claims cannot be made during the initial waiting period (usually 30 to 180 days). You must survive a certain number of days after diagnosis (often 14 to 30 days) to receive the payout.

- Illnesses caused by war, riots, rebellions, or military duty are excluded.

- Any illness resulting from nuclear, chemical, or biological exposure is not covered.

- Jobs involving extreme risk, such as mining, tunneling, racing, or high-tension electrical work, may not be covered.

- Most plans exclude congenital and inherited disorders unless mentioned otherwise.

- Illness caused while participating in activities like skydiving, scuba diving, mountaineering, etc., is usually excluded.

- Coverage does not apply if the insured is flying as a pilot, crew member, or in a non-commercial aircraft.

- Complications of pregnancy, childbirth, abortion, or miscarriage are excluded, except for medically necessary cases such as ectopic pregnancy.

- Treatments that are not scientifically recognized or are experimental are excluded.

- Illness arising from involvement in illegal activities is excluded.

- Procedures like IVF, surrogacy, sterilization, and reversal surgeries are not covered.

Benefits of Adding a Critical Illness Rider: Who Should Buy It?

Primary Breadwinners

If your family depends on your income, a critical illness can disrupt cash flow. The rider payout helps cover expenses while you focus on recovery.

Self-Employed Individuals or Business Owners

With no paid leave or employer benefits, income can drop instantly if you fall ill. The payout gives you the flexibility to manage treatment and essential business expenses.

Those With Limited Emergency Savings

If you do not have a strong emergency corpus, this rider acts as a financial cushion during major illnesses and prevents you from taking loans or breaking investments.

Individuals With a Family History of Critical Illness

If illnesses like cancer, heart disease, or diabetes are common in your family, this rider strengthens your financial preparedness.

People Aged 35 and Above

Health risks rise with age. Adding a CI rider early ensures long-term protection, even though premiums may be higher for older buyers.

Homemakers

Critical illnesses can limit their ability to manage household responsibilities. The payout can help support caregiving costs and household assistance.

Eligibility Criteria for Critical Illness Riders

Most insurers offer critical illness riders to individuals between 18 and 65 years, but the exact limits vary. The eligibility criteria are broadly the same as the base term plan, except that insurers are usually more conservative when issuing CI riders. Medical tests are more likely, especially if you are above 45 or have health concerns.

Critical illness riders are usually available only at the time of buying the term plan. You cannot add them later unless the insurer specifically allows it

Click here to learn more about term insurance eligibility.

How to Buy Term Insurance With CI Coverage?

- Decide on your CI cover (aim for one to two years of income).

- Compare plans based on illness list, rider type, waiting periods, and tenure.

- Check the premium impact and confirm if the CI rider is standard or accelerated.

- Fill out health declarations and complete medical tests if required.

- Submit KYC and income documents and buy the rider at policy inception.

Documents Required for Claiming the CI Rider

- Medical diagnosis report confirming the illness and its severity

- Policy document or policy copy

- ID and address proof of the claimant

- Lab reports and test results supporting the diagnosis

- Medical records, past and current, related to the illness

- Cancelled cheque or bank passbook for payout processing

- Claim form completed and signed

Quick Note: Insurers usually rely on medical diagnoses and do not ask for treatment bills. Once approved, the rider pays out a lump sum, so you can choose how you want to use the payout. Requirements may vary slightly, so always check with your insurer for any additional documents.

Why Choose Ditto for Your Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron love us:

- No Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Term Insurance With a Critical Illness Rider (Ditto’s Take)

Adding a critical illness rider to your term insurance strengthens your protection by covering both life risks and major health setbacks in one affordable plan. Check the exclusions to understand which illnesses and scenarios are not covered. Be aware of the waiting and survival periods, since claims made too early may not be payable.

Choose a sufficient CI cover, ideally equal to one to two years of your income. Keep in mind that you cannot usually increase your CI cover later, so pick the right amount at the start. If adding a rider to your term plan is not possible, you can also explore a standalone critical illness policy for added protection.

Since every insurer structures this rider differently, the right choice depends on your needs. If you’re unsure, Ditto’s IRDAI-certified advisors can help you figure out what fits best. So book a free call now.

Frequently Asked Questions

Last updated on: