Quick Overview

TATA AIA Life Insurance, established in 2001, is a joint venture between Tata Sons (51%) and AIA Group (49%). Over the years, it has built a sizable presence, with a growing push toward digital distribution.

While the AIA partnership has strengthened underwriting and product design, there have been operational friction points, including heavier documentation requirements, reliance on physical paperwork in some cases, and a less seamless online journey. Recently, the insurer has focused on ULIPs and investor education initiatives, though its term plans remain fairly comprehensive with unique riders like Hospicare.

In this TATA AIA Life Insurance review, we’ll cover its claim metrics, premiums, flagship plans, riders, and our final verdict.

TATA AIA Life Insurance Performance Metrics

In the table above, CSR means claim settlement ratio, ASR stands for amount settlement ratio, and GWP refers to gross written premium. At Ditto, we prefer analyzing 3-year averages to avoid one good or bad year distorting performance evaluation.

Key Insights:

- At 99.21% CSR, TATA AIA Life Insurance stands above the industry average, indicating a highly reliable track record of settling claims.

- At 95.1% ASR, it is slightly above the industry mean, suggesting fair and consistent claim payouts without aggressive deductions.

- With just 3 complaints per 10,000 claims, it significantly outperforms the industry median, reflecting strong customer service and a smoother claims experience.

- The ₹9,253 crore GWP highlights TATA AIA as a large, well-established insurer, far exceeding the industry median in scale and market presence.

- The 1.82x solvency ratio, while healthy and above the regulatory requirement of 1.5x, is slightly below the industry median, indicating relatively tighter capital buffers compared to peers.

Here’s a quick look at all the categories of plans that Tata AIA Life Insurance Company Limited offers:

Top Plans Offered by TATA AIA Life Insurance

Note: The list above covers the most-marketed Tata AIA Life Insurance Plans and does not provide a complete view of all plans offered by the insurer.

Now that we’ve covered the lineup, let’s zoom in on TATA AIA Life Insurance Company Limited’s flagship term plan, Sampoorna Raksha Promise. It is a flexible term insurance plan that provides high-value coverage for the policy term. The following is its eligibility criteria:

Spotlight: TATA AIA Sampoorna Raksha Promise

| Parameter | Details |

|---|---|

| Entry Age | 18 - 55/60/65 years (depending on the variant) |

| Maximum Maturity Age | 100 years |

| Sum Assured | ₹50 Lakhs - No Limit (subject to Board Approved Underwriting Policy) |

| Premium Payment Frequency | Monthly / Quarterly/ Half Yearly / Yearly |

| Premium Payment Term | Regular, Single, Limited pay (for example, 5, 10, 15, 20 Pay) |

| Death Benefit Payout Options | Lump sum and/or monthly instalments |

Note: The plan offers four variants: Life Promise, Life Promise Plus, Joint Life Promise, and Joint Life Promise Plus. At Ditto, we don’t recommend ROP variants (Life Promise Plus and Joint Life Promise Plus). They refund your base premiums (excluding rider premiums, taxes, and discounts) if you survive, but they aren’t cost-efficient. Also, Joint Life variants may not always be available, so it’s best to confirm with the insurer.

In-Built Features of TATA AIA Sampoorna Raksha Promise

Immediate Payout on Claim Intimation

The plan offers an instant payout of ₹3 lakhs within 1 working day, upon claim intimation in case of death. However, this feature is available only after 3 years, with a minimum sum assured of ₹1 crore. This acts as immediate financial support for the family while the full claim is being processed.

Early Payout on Terminal Illness

If the policyholder is diagnosed with a terminal illness, 50% of the life cover is paid immediately, with the remaining 50% paid upon death. This helps manage urgent medical or personal expenses. Moreover, all future premiums are waived once a terminal illness claim is triggered, while the policy continues with full benefits intact.

Life Stage Option

You can increase your sum assured at milestones (50%+ for marriage, 25%+ for first child, 25%+ for second child, and up to 100% for home loan, subject to underwriting). It may also require additional documentation.

Free Health & Wellness Benefits

The plan includes complimentary health benefits (valued over ₹30,000 per year), which may include preventive care, consultations, or wellness services, depending on the insurer’s ecosystem.

Premium Deferment Option

After completing 5 policy years, you can defer premiums for up to 12 months without interest, offering temporary financial flexibility. This option can be used multiple times with a 5-year gap.

For more information and detailed exclusions (like the 1-year suicide clause), you can download the Tata AIA Sampoorna Raksha Promise brochure from the official website.

Premium Comparison: TATA AIA Life Insurance vs. Other Insurers

For this example, we’ve taken healthy profiles of non-smoking, salaried individuals, covered for a sum assured of ₹2 Crores till the age of 70. The premiums are indicative in nature and can vary based on your age, health condition, lifestyle choices, and underwriting decisions. Moreover, the figures exclude first-year discounts (2nd year onwards premiums).

Key Insights:

TATA AIA’s premiums sit in the mid-range, higher than Axis Max Life but lower than HDFC Life, making it a fairly balanced option. Pricing is also consistent across ages and genders, suggesting stable underwriting. That said, while it’s reasonably priced, you may find better value with insurers that offer lower premiums or more features for a similar cost.

Riders Available in TATA AIA Life Insurance Plans

Accidental Death Benefit Rider (ADB rider)

In case of death due to an accident, the nominee receives an additional payout over and above the base sum assured. However, at Ditto, we generally don’t recommend ADB riders since their coverage is limited to specific scenarios, and the base cover already includes accidental deaths.

Accidental Total Permanent Disability Rider (ATPD rider)

If the policyholder suffers permanent disability due to an accident, an additional payout is provided through the ATPD rider. This helps compensate for loss of income and supports long-term lifestyle adjustments or rehabilitation expenses.

Critical Illness Rider (CI rider)

On diagnosis of any of the covered critical illnesses (40 conditions), a lump sum payout is made through the CI rider. This amount can be used flexibly, for treatment, recovery, or even managing income loss during the illness period.

Hospicare (Hospital Cash) Benefit Rider

Provides fixed daily and lump sum payouts for hospitalization of more than 24 hours. You get 0.5% of the sum assured per day (max 30 days/year) plus an additional 0.5% for ICU stays (max 15 days/year). A 1.5% lump sum is paid for 7+ consecutive days of hospitalization, regardless of actual expenses.

Super Retirement Benefit

By paying an additional 1% premium, policyholders can opt to exit the policy and receive a full refund of premiums paid (anytime after the 30th policy year or upon reaching age 70, whichever comes first). This is only available in Life Promise and Joint Life Promise variants and comes with additional conditions, like the entry age being less than 50.

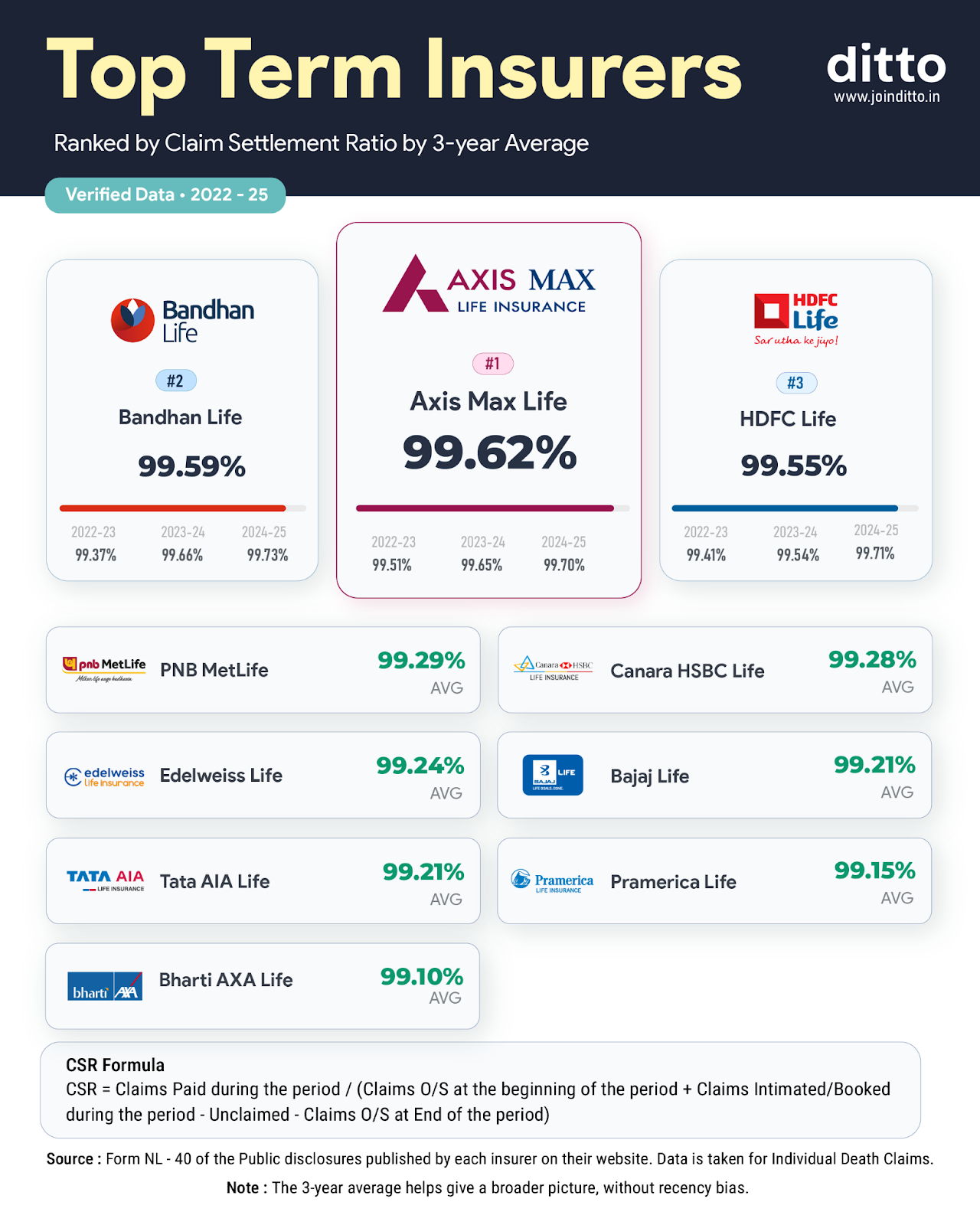

Top 10 Life Insurance Companies in India by Claim Settlement Ratio

Disclaimer: CSR reflects the overall claim settlement performance of the insurer across all life insurance products, including term plans, and is not specific to any single policy or policy category. For complete exclusions, benefits, and conditions, always refer to the official policy brochure before making a decision.

Insight: TATA AIA occupies the 8th position on this list of top 10 term insurers ranked by CSR, which is excellent, given how tight the competition is at the top.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Vijay below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right term insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or WhatsApp us now, slots fill up fast!

Conclusion

TATA AIA Life Insurance is a strong and credible insurer, with excellent claim settlement metrics, low complaint ratios, and fairly competitive pricing. On paper, it ticks many of the right boxes for a dependable term insurance provider.

However, from a practical standpoint, operational friction, particularly during onboarding and post-sales support, along with complex policy documents, can create confusion, as some features are mentioned but not always currently active. Additionally, product gaps, such as relatively limited critical illness coverage in its rider offering, may affect its overall appeal.

While TATA AIA remains a trusted partner, there are other insurers like Axis Max Life or HDFC Life that offer a more seamless experience. They also provide better pricing and more comprehensive features, making them more compelling choices for most buyers today. If you’re looking for a more balanced plan with strong claims experience and useful features, it’s worth exploring our best term insurance plans in India (2026) instead.

Disclaimer

Frequently Asked Questions

Last updated on: