| Should You Opt for the Single Premium Payment Option in Term Insurance? Yes, if you prefer paying once and staying worry-free. A single premium term plan means one upfront payment for long-term cover and no recurring payments. However, there are a few trade-offs, like limited rider options, weaker yearly tax benefits under Section 80C, and the need for a large lump-sum payment. |

Paying one big cheque for term insurance sounds tempting. But is it a wise call? At Ditto, our IRDAI-certified advisors help hundreds of customers pick the right term insurance for their needs. But when it comes to choosing the payment mode, everyone has a different mindset. That’s why we compare single, regular, and limited pay options against customer profiles and IRDAI rules to ensure maximum value.

This article will help you understand:

- Whether a single premium payment option in term insurance is good

- When it silently hurts liquidity, and

- Which payment mode to go with

Are you a first-time term insurance buyer ? Here’s a must-read, ultimate term insurance guide to get started.Should You Opt for the Single Premium Payment Option in Term Insurance?

At first glance, single premium term insurance looks simple. Pay a lump-sum once and let your cover last for the full term (usually 10 to 40 years).

But the big question is: Is the single premium term insurance ideal for you?

Well, multiple factors come to play. At Ditto, we recommend single premium term insurance to only those customers who :

- have irregular income

- have surplus funds (either from a bonus, sale of assets, or inheritance)

- prefer a set-and-forget coverage option, and

- don’t like to worry about renewals or fear missed payments

And like all good things, a single premium term plan has its downsides too, like significantly reduced liquidity and fewer term insurance rider options.

For example, ICICI Prudential's flagship term plan, iProtect Smart Plus, doesn’t allow critical illness riders and caps tenure at 20 years when you opt for its single premium payment option. Tax benefits under Section 80C are also one-time.

Why Do Insurers Offer Single Premium Term Payment Option?

When you pay the entire premium upfront, insurers instantly get access to a large lump sum. They invest this in safe instruments like government bonds or fixed-income assets, earning steady returns even with the claim risk.

Book a free 30-minute call with Ditto. IRDAI-certified advice, zero spam, and clarity on best term insurance riders you actually need.

Simply put, single premium term payment option is a sure win strategy for insurers because it:

- Gives them money upfront

- Saves them from tracking yearly renewals

- Reduces the risk of lapses or missed payments

That’s why it appeals to NRIs who want to lock cover from abroad and HNIs (High net worth individuals) who dislike recurring payments.

How To Choose Your Term Insurance Premium Option: What’s Good, What’s Not

When buying term insurance, the toughest call is how to pay; once, regularly, or for a limited period. Each option fits different financial profiles. Here's a no-nonsense look at different premium options, how they work, and their pros and cons.

Single Premium Option

How it works : One-time payment at the time of buying the policyPros :

- Zero risk of policy lapse

- May cost less overall

- Effective use of surplus funds (from a bonus, inheritance, asset sale)

- Convenient for NRIs/HNIs

- Simple “pay once, forget renewals” option

Cons:

- Lump sum pay hurts liquidity

- Limited rider options

- One-time 80C benefit ( maximum of ₹1.5L)

- Missed opportunity to invest lump sum elsewhere (like mutual funds, fixed deposits, PPF)

Regular Premium

How it works: Pay throughout the policy term (Annually, Quarterly, Monthly or Half yearly)

Pros:

- Budget-friendly and preserves liquidity for emergencies

- Offers yearly tax deductions under Section 80C (under old regime)

- Flexible for policyholders to align payments within their income cycles

Cons:

- Runs the risk of policy lapse if payments are missed

- The total cost is often higher than single or limited pay (ignoring inflation and time value of money)

Limited PremiumHow it works: Pay for a short duration (5–10 years) but stay covered 30–40 years

Pros:

- Early closing of payments means less burden going forward

- Good tax deductions (only under old tax regime) during pay years

- Best suited for high-income earners with fewer dependents early on

Cons:

- High policy lapse risk during short, heavy pay window

- More expensive on paper than regular pay but less than single pay

The bottom line :

- Single pay is the most convenient and straightforward premium payment option with one-time commitment.

- Regular pay is the most flexible payment option and tax-efficient for salaried individuals.

- Limited pay is a smart, middle path for anyone who doesn't like paying upfront or pay-and-forget options.

Pro Tip: Always choose your term plan premium option based on your cash flow, existing spending/investment mix, and the duration for which you want to stay financially committed.

Do you want to weigh your premium pay options quickly? Here’s a smart comparison table to give you the big picture.

| Feature | Single Premium | Regular Premium | Limited Premium |

|---|---|---|---|

| Payment Type | One Lump Sum | Paid throughout the policy term | Limited no. of years, like 5, 10 or 15 years |

| Risk of Lapse | None | Possibility still exists during the payment years, but lesser than regular pay | Zero after the end of the payment period |

| Option to add riders | Limited/None | Available | Available |

| Liquidity Impact | High | Low | Medium |

| Tax Benefits (Under Sec 80C) | One-time deduction | Recurring deductions (annually) | Deductions limited to the pay period (annually) |

| Best For | Buyers with irregular income and surplus cash | Salaried individuals who crave flexibility | Anyone who wants long protection with shorter payment period |

For example, take a 30-year-old individual buying a ₹1 crore term plan for 30 years. A single premium in this case could mean a few lakhs to be paid upfront. In comparison, a regular pay would cost about ₹10–15k a year, and a limited pay would attract a much bigger annual sum for only 5 or 10 years.

On paper, a single premium payment option in term insurance looks cheaper. But once you factor in compounding, regular or limited pay gives better value.

For example, a ₹1crore term plan for a 30-year-old male, getting covered till age 65, non non-smoker, including GST, and without 1st year discounts.

| Plan Name | Single Pay | Limited Pay - 10 years | Regular Pay - 35 years |

|---|---|---|---|

| HDFC Click2Protect Supreme | ₹ 2,65,803 | ₹ 37,082 | ₹ 16,804 |

| ICICI Prudential Iprotect Smart Plus | NA - Max duration offered for single pay is 20 years only | ₹ 31,124 | ₹ 14,343 |

| Axis Max Smart Term Plan Plus | ₹ 2,61,328 | ₹ 31,553 | ₹ 14,086 |

| SBI Smart Shield Plus | ₹ 2,83,709 | ₹ 34,746 | ₹ 14,476 |

Lowest Outflow (Total) → Axis Max Life Single Pay at ₹2.61 lakh (almost half of regular pay)

Lowest Limited Pay → ICICI Prudential at ₹3.11 lakh

Lowest Regular Pay → Axis Max Life at ₹4.93 lakh

Instead of locking ₹2.4 lakh into a single pay term plan, if you chose regular pay and invested the ₹2.4 lakh difference in a long-term instrument (stocks, bonds) at 7% annually for 35 years, it would grow to over ₹25 lakhs.

What This Means

While single pay looks cheapest in raw outflow, the opportunity cost is massive.

By choosing regular/limited pay and investing the surplus wisely, you could build an additional corpus, which far outweighs the savings from paying upfront.

When Single Premium Payment Option In Term Insurance Works Vs. When It Doesn't

By now, you’ve seen that a single premium term plan isn’t for everyone. Whether it works for you depends on your financial situation and near-term goals.

Choose single pay if you:

- Have enough surplus funds without touching your emergency savings

- Earn irregular income and want lapse-free coverage

- Prefer hassle-free coverage despite limited riders option

Avoid single pay if you:

- Need liquidity for other priorities

- Want riders like Critical Illness or Accidental Disability cover

- Value small but steady 80C tax benefits each year

Still unsure? Book a free call with our advisors to map your financial goals with the right premium option.

Rules and Regulations That Impact Premium Payments

A single premium term insurance demands upfront pay which makes liquidity, surrender value, and tax benefits more important than in a regular pay plan. Here’s a look at some vital regulatory updates directly impacting the value you get from a single-pay term plan.

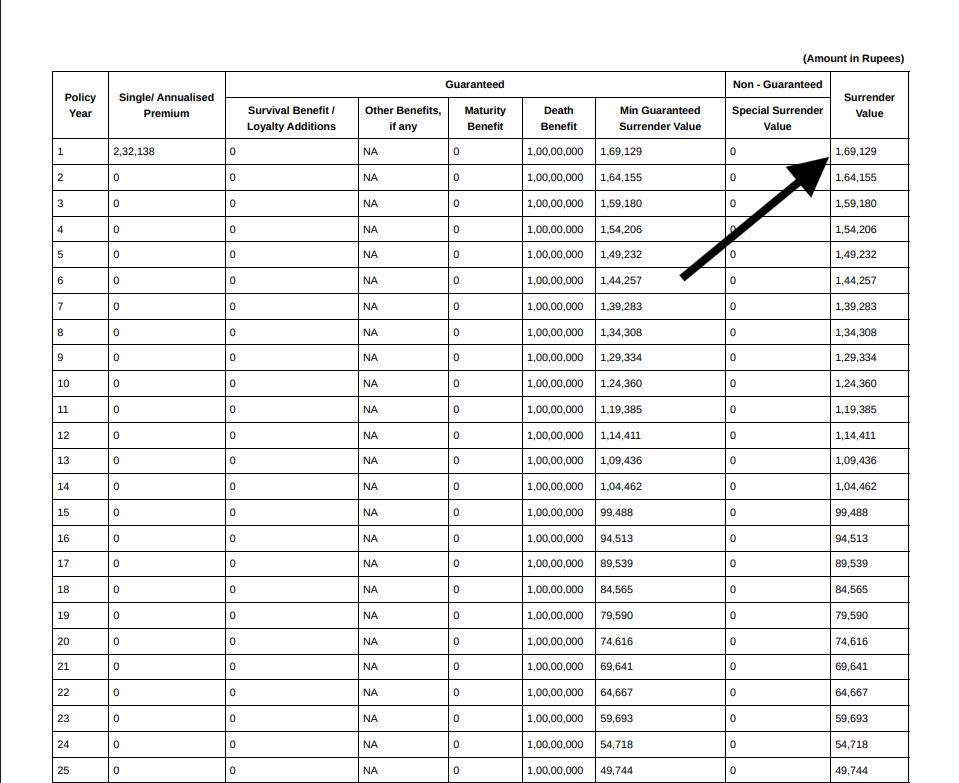

IRDAI Surrender Value Update 2024

Under the 2024 Insurance Products Regulations, IRDAI mandates all single-premium life policies to provide a minimum Guaranteed Surrender Value (GSV). For term insurance, this means only a partial refund; about 70–75% of unused premium, rising to around 90% after fourth year. So, one never recovers the full amount, and refunds shrink over time, making these plans ideal only if held till maturity, not for early exits.

Section 10(10D) and the 10% Rule

If you want your policy’s maturity and survival benefits to stay tax-free, make sure your annual premium doesn’t cross 10% of the sum assured (for policies taken on or after 1 April 2012). The good news? Death benefits for nominees are always tax-free, no matter what.

What This Means for You:

- Single pay will give a one-time 80C deduction but no recurring future deductions.

- Return of Premium term plan buyers must check for the 10% ratio and stay under the ₹5 lakh premium cap to keep their maturity proceeds tax-free.

- Surrender values improved under 2024 rules, but liquidity remains limited unless stated in the policy.

Note: Always check the benefit illustration document to understand what is the surrender value available in any particular year (as illustrated below).

Should You Opt for the Single Premium Payment Option In Term Insurance: Ditto’s Take

Choosing the right premium mode isn’t about comparing the total costs. Use these pointers to avoid common mistakes.

- Coverage comes first, payment later: Don’t lower your cover for single-pay. Term insurance is pure protection meant to replace income and cover liabilities. So, fix the right sum assured, term, and riders before deciding the payment mode.

- Check policy wordings & benefit illustration for surrender value and rider terms: New IRDAI rules have improved surrender values, but most pure term plans still don’t refund unless explicitly stated in the policy. Rider availability may also be restricted.

- Be cautious with ROP: Return of Premium looks appealing but offers no growth. It may also be taxable if you cross the 10% ratio or ₹5 lakh cap.

Choosing the wrong premium mode can hurt liquidity and tax benefits. So, save yourself from running the math and book a free call with Ditto’s advisors to compare options and avoid costly mistakes.

| Key takeaways: Single premium term insurance is for people with surplus funds and irregular income. Regular or limited pay is for most buyers who want liquidity, riders, and recurring tax benefits. Never lower your cover/ duration or skip riders to make single pay look affordable. With a single premium term plan, exits may return only 70–75% of unused premiums, so always factor in liquidity and opportunity cost. |

How Ditto Helps You Make Smart Insurance Decisions

Insurance plans are often sold for the seller’s benefit, not the buyer’s need. At Ditto, we do the opposite. No pitches, no agendas, only clarity on insurance with the right cover, riders, and payment options. We guide you to functional insurance plans that fits your life and finances, trusted by 700,000+ customers.

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

✅Personalized recommendations

✅Real-time claim support

Conclusion

Choosing the right premium mode isn’t about the cheapest option, but about matching your cash flow, goals, and tax needs. Single premium payment option in term insurance suits those with surplus cash or irregular income, while regular or limited pay works better for most buyers by protecting their liquidity.

Still confused? book a free call with Ditto where we guide you to choose between single, regular, or limited premium plans with confidence.

Is single premium term insurance cheaper?

Single-pay may look cheaper in total, but add opportunity cost and 80C limits. For salaried buyers, regular or limited usually work better.

Can I change my premium payment term or policy later if I choose single pay?

With a single-pay term plan, your premium mode is locked, which means you can’t switch to regular or limited pay later. Conversion to other products isn’t allowed either. The only flexibility you get is adding or removing riders or surrendering your policy for a small refund.

Are riders available with a single premium payment option in term insurance ?

Term insurance riders like critical illness benefits with single pay premiums are often not available. Further, single pay plans don’t need a waiver of premium rider since everything is prepaid.

Is Return of Premium tax free with a single premium pay in term insurance ?

Maturity proceeds are tax free only under the conditions laid down by Section 10(10D), including the 10% premium to sum assured ratio. Additionally, one should not cross the 5 lakh threshold for applicable non ULIP policies issued after 1 April, 2023. Death benefits are tax free, regardless.

Can I surrender a single premium term plan?

The updated 2024 framework of IRDAI has raised the minimum surrender value for single premium life products. However, there’s no substantial refund for pure term plans unless explicitly specified in the policy document.

Last updated on: