Quick Overview

SBI Life Smart Shield Plus is a straightforward term insurance offering from SBI Life Insurance, a joint venture between the State Bank of India and BNP Paribas Cardif. The plan is designed for individuals seeking clean risk protection rather than bundled investment-linked benefits.

The product is part of the Smart Shield family, which offers two variants: Smart Shield Plus and Smart Shield Premier. While Premier is positioned for higher sum assured levels, Smart Shield Plus SBI Life is chosen by buyers looking for flexible coverage structures at moderate pricing.

Unlike many modern term plans, SBI Life Smart Shield Plus keeps the structure simple, offering only death benefit protection and minimal add-ons.

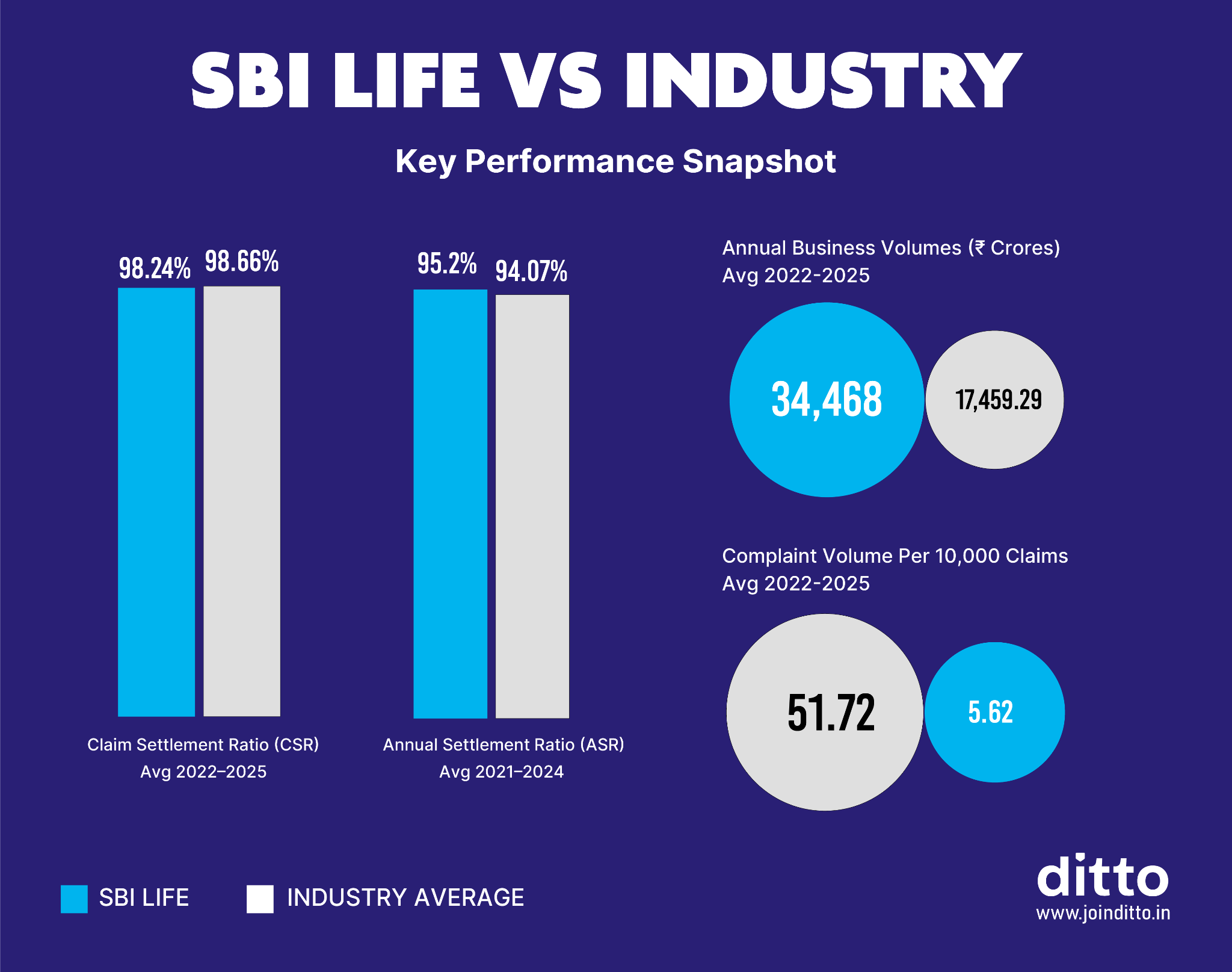

Performance Metrics Of SBI Life Insurance

Key Insights: SBI Life shows strong reliability with a 98.24% claim settlement ratio, low complaint levels, and a healthy solvency position, indicating stable long-term performance.

Features of the SBI Life Smart Shield Plus Plan

For more information, refer to the official SBI Life Smart Shield Plus brochure.

Riders Available in SBI Life Smart Shield Plus

What’s Not Included?

SBI Life Smart Shield Plus does not offer Critical Illness cover, Waiver of Premium, Terminal Illness benefits, or wellness features. Protection beyond the base cover is available only through the accident-related riders, making the plan relatively minimal compared to feature-rich term insurance options available with private life insurers.

Benefits and Drawbacks of SBI Life Smart Shield Plus

Benefits

- Simple and easy-to-understand plan structure focused purely on protection.

- Backed by SBI Life, a financially strong and well-established insurer.

- Flexible premium payment options, including single, limited, and regular pay.

- The Future Proofing feature allows you to increase coverage during major life events.

- Multiple death benefit payout options are available for nominees.

Drawbacks

- Limited rider options compared to many modern term insurance plans.

- Does not offer living benefits such as critical illness or waiver of premium.

- The overall feature set is relatively basic when compared to newer, more comprehensive plans.

Premium Comparison of SBI Life Smart Shield Plus vs Other Plans

Profile Considered: Premiums are illustrative for a ₹2 crore sum assured, coverage up to age 70, for a non-smoking male, without riders or first-year discounts.

SBI Life Smart Shield Plus is priced in the mid-range, aligned with large insurers, though slightly higher than some aggressively priced private plans, while the Premier variant becomes more competitive at higher cover levels.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now or chat on WhatsApp with our expert IRDAI-certified advisors.

Ditto’s Take on SBI Life Smart Shield Plus

The SBI Life Smart Shield Plus term plan is a straightforward, protection-focused product from a well-established and financially strong insurer. It delivers dependable life cover with flexible payout choices but offers limited features, riders, and customization.

If you value brand credibility, consistent claim performance, and simplicity over additional add-ons, this plan can be a suitable option. However, those seeking more comprehensive benefits, such as critical illness coverage or waiver of premium, may find greater value in other feature-rich term plans.

Note: This review covers a non-partner insurer. All details have been sourced from policy documents available on the SBI Life website and other publicly disclosed sources. For Ditto’s methodology on how we assess insurers and plans, please refer to Ditto’s Cut.

Frequently Asked Questions

Last updated on: