What is Axis Max Life’s Current CSR?

When choosing a term insurance policy, the claim settlement ratio is one of the most important factors to consider. Axis Max Life has proven to be one of the most consistent and reliable insurers in terms of CSR, constantly surpassing the 99% mark for several years. But how is CSR calculated, and why is it such an important metric?

What is the Claim Settlement Ratio?

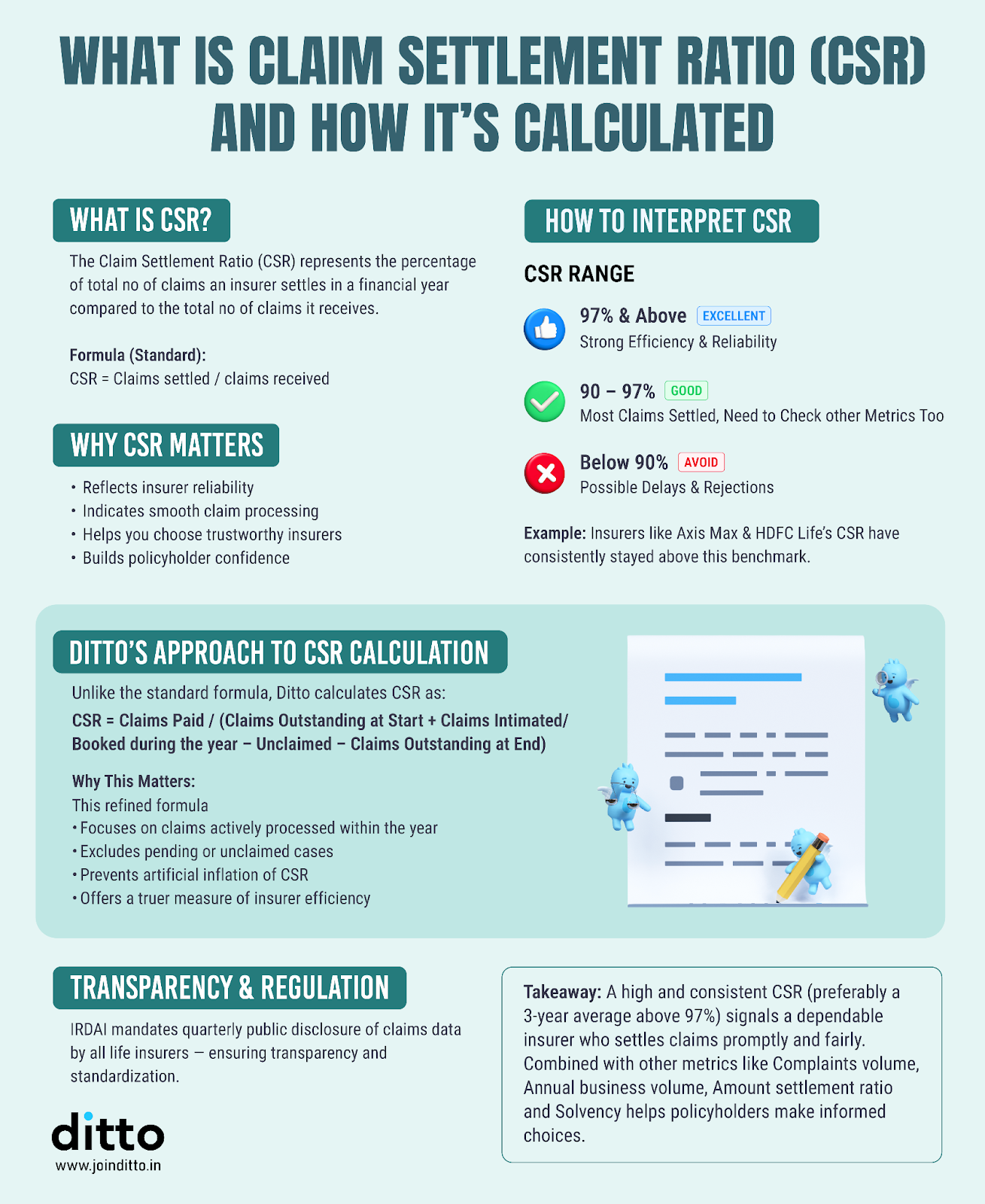

The CSR is the percentage of claims an insurance company settles relative to the total number of claims it receives in a given period, typically one year. For example, if Axis Max Life receives 100 claims in a year and settles 99 of them, its CSR for that year would be 99%.

It's important to note that the CSR reported by insurers like Axis Max Life reflects their entire life insurance portfolio, not just their term insurance policies. However, this number is still a strong indicator of how well an insurer handles claims across all product offerings, including term insurance.

Axis Max Life Claim Settlement Ratio (Last 5 Years)

As you can see, Axis Max Life has consistently outperformed its competitors, achieving an average CSR of 99.62% from FY 2022 to FY 2025. This places it firmly at the top of the CSR rankings in India, highlighting the insurer's strong claim settlement practices. You can check out other term insurers ranked by their CSR.

Axis Max Life Insurance: Other Key Metrics

*The data for the amount settlement ratio for FY (2024-2025) isn’t available yet, so we’re considering the values for FY (2021-2024).

To sum it up, Axis Max Life performs well on all parameters and is an excellent choice for your term insurance plan. You can also read our detailed review of Axis Max Life Insurance for more clarity.

Where Can I Find the Claim Settlement Ratio for Axis Max Life?

IRDAI’s Handbook on Indian Insurance Statistics:

The IRDAI releases CSR data annually for all insurers operating in the country.

Axis Max Life’s Public Disclosures:

Axis Max Life, like most insurers, publishes its CSR in its annual reports and Public disclosures (Form L-40), which are available on its website.

Trusted Comparison Platforms:

Websites like ours (Ditto) regularly update and publish CSR data, giving you easy access to the most recent information.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

While Axis Max Life's CSR is excellent, it’s essential to consider other factors, such as the amount settlement ratio (ASR), complaint volume, annual business volume, solvency ratio, premium rates, policy features, and customer service, when choosing the right term insurance policy.

For further details, you can book a free consultation call with us, and our expert advisors can help you find the perfect insurer and term insurance plan.

Note: Axis Max Life is also a partner insurer of Ditto. If you’d like to learn more about how we select plans or insurers, check this guide on our evaluation framework.

Frequently Asked Questions

Last updated on: