Quick Overview

IndiaFirst Life Insurance may not be the flashiest name in the market, but it’s quietly gaining attention. This is due to the recent buzz around a possible stake sale, where BNP Paribas is reportedly eyeing Warburg Pincus’ shareholding. Strategies like this usually signal growing confidence in the insurer’s long-term potential.

But does investor interest translate into a good experience for policyholders?

That’s what we’ll answer in this detailed IndiaFirst Life Insurance review.

IndiaFirst Life Insurance Performance Metrics

In the table above, CSR means claim settlement ratio, ASR stands for amount settlement ratio, and GWP refers to gross written premium. At Ditto, we prefer analyzing 3-year averages to avoid one good or bad year distorting performance evaluation.

Key Insights:

- At 97.98%, IndiaFirst’s CSR is reliable but slightly below the industry average, placing it in the mid-tier bracket.

- At 92.4%, its ASR is slightly below average, suggesting marginally conservative claim payouts compared to leading insurers.

- The ₹2,969 crore GWP indicates a mid-sized insurer, trailing the industry median in scale and market share. However, its solvency ratio is solid, given that the minimum IRDAI-mandated solvency ratio is 1.5x.

- The complaint volume is significantly higher than the industry median, indicating potential service and claims experience concerns.

- IndiaFirst Life Insurance’s solvency ratio is much higher than the IRDAI-mandated minimum of 1.5x. Evidently, it’s also more than the industry average, which signifies a healthy capital buffer.

Note: A simple term insurance checklist can help you compare insurers, check claim settlement ratios, and understand exclusions without feeling overwhelmed.

For convenience, here’s a quick look at all the categories of plans that the IndiaFirst Life Insurance company offers:

Top Plans Offered by IndiaFirst Life Insurance

Note: The list above covers the most-marketed plans and does not provide a complete view of all plans offered by IndiaFirst.

Now that we’ve covered the lineup, let’s zoom in on IndiaFirst’s flagship term plan.

Spotlight: IndiaFirst Life Elite Term Plan

Important: This is a pure vanilla term plan that focuses only on basic life cover (no survival or maturity benefits). It does not offer advanced features like riders, increasing cover, life stage benefits, auto cover continuance, terminal illness benefits, or instant claim payouts. In simple terms, you’re getting straightforward protection at a lower premium, but with limited flexibility and add-ons.

Premium Comparison: IndiaFirst Life Insurance vs. Other Insurers

For this example, we’ve taken healthy profiles of non-smoking, salaried individuals, covered for a sum assured of ₹2 Crores till the age of 70. The premiums are indicative in nature and can vary based on your age, health condition, lifestyle choices, and underwriting decisions. Moreover, the figures exclude first-year discounts (2nd year premiums).

Insights: IndiaFirst clearly offers lower premiums across profiles, but the difference with top insurers is relatively small. Given that premiums naturally increase with age and vary by risk factors, this small price advantage may not fully justify the lack of features and riders.

Riders Available in IndiaFirst Life Insurance Plans

IndiaFirst Term Rider

IndiaFirst Life Waiver of Premium Rider

IndiaFirst Life Accidental Death Benefit (ADB) Rider

IndiaFirst Life Total and Permanent Disability (TPD) Rider

Note: None of these riders is available with the above-mentioned Life Elite Term Plan, which is marketed as IndiaFirst Life Insurance’s primary term offering. However, the Accidental Death Benefit rider and Total and Permanent Disability rider are available with the Super Protection Plan. To learn more about which riders we typically recommend at Ditto, you can check out our detailed guide on Term Insurance Riders.

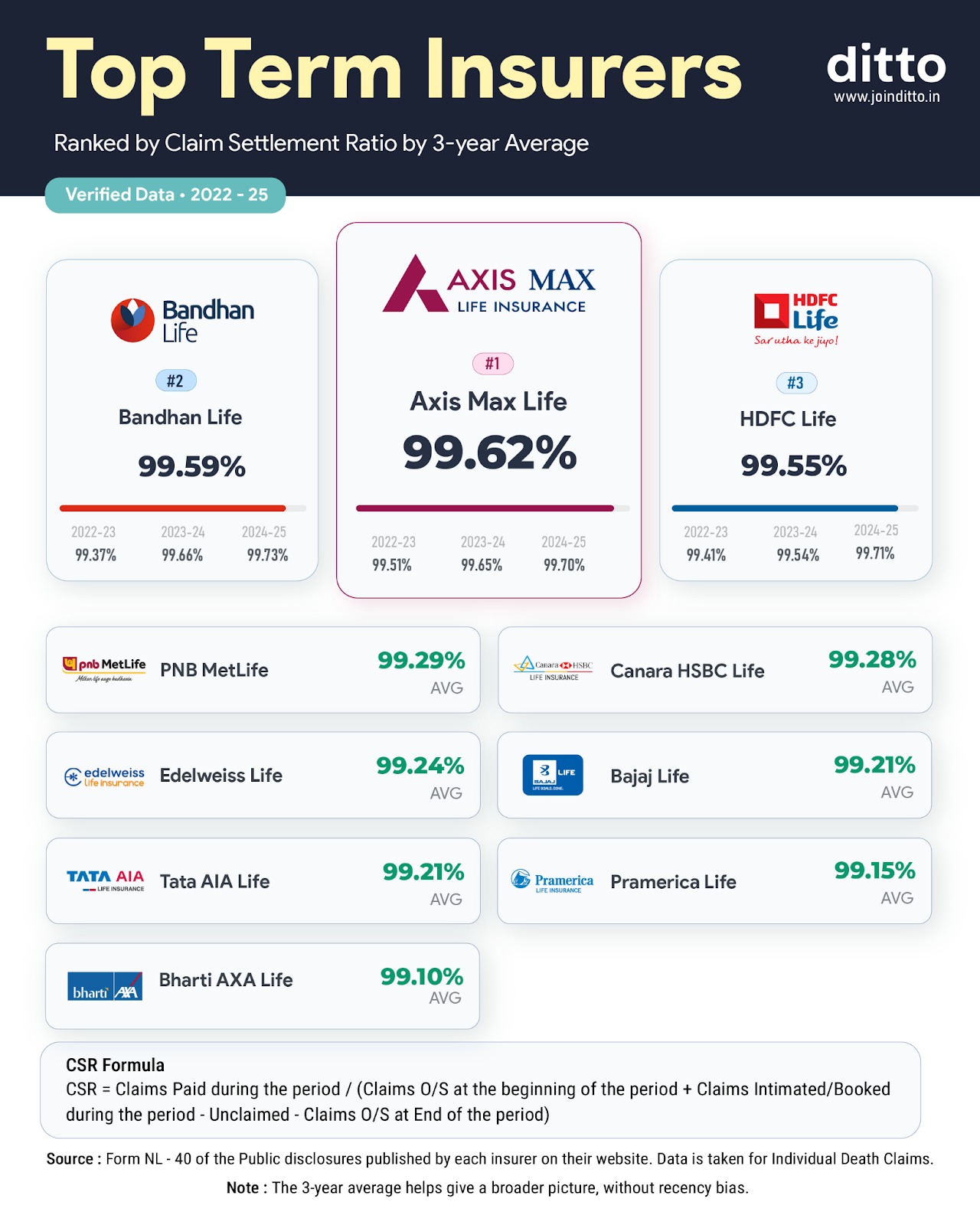

Top 10 Life Insurance Companies in India by Claim Settlement Ratio

Some of the top insurers by CSR include:

Disclaimer: CSR reflects the overall claim settlement performance of the insurer across all life insurance products, including term plans, and is not specific to any single policy or policy category. For complete exclusions, benefits, and conditions, always refer to the official policy brochure before making a decision.

Insight: Clearly, IndiaFirst Life Insurance Company does not make the cut because its claim settlement ratio is lower than that of the top 10 insurers by CSR.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Vijay below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right term insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or WhatsApp us now, slots fill up fast!

Conclusion

IndiaFirst Life Insurance is a fairly average insurer; not the best, but not the worst either. Its claim metrics are decent, but not strong enough to stand out. While the premiums for its flagship Elite Term Plan are slightly cheaper, it is extremely basic, offering none of the features or flexibility that most top insurers provide today.

So you’re essentially saving a bit on price, but also giving up riders, advanced benefits, and overall product depth. For most people, that trade-off just doesn’t make much sense, especially when better-rounded options are available at only a slightly higher premium.

If you are looking for comprehensive term coverage that align your long-term goals, we recommend the best term insurance companies for 2026. Explore more about how our experts evaluate term plans through Ditto’s cut.

Frequently Asked Questions

Last updated on: