How Much Term Insurance Do I Need: Overview

There’s no one-size-fits-all number. The term insurance coverage that you need depends on your income, expenses, goals, and other financial obligations. Usually, you can determine the sum assured using three proven methods: the income-based method (HLV + income replacement), the expense and liabilities replacement method, and the underwriter's rule.

Introduction

Most Indians end up under-insuring themselves, either by picking a random number like ₹1 crore or by depending on outdated rules of thumb. And when inflation pushes monthly expenses from ₹40,000 to nearly ₹1 lakh over 15 to 20 years, even a “big” cover can fall short.

At Ditto, our advisors speak to numerous customers every month about choosing the right term plan, and a recurring problem we see is people miscalculating the ideal sum assured.

In this article, we will help you understand how much term insurance you need using proven, industry-accepted methods.

Need personalized insurance advice from Ditto? Get free consultation with zero spam! Book a call now.

How to Calculate Term Insurance Coverage?

As mentioned, three proven methods can help you answer the question: how much term insurance do I need?

- Income-Based Method (HLV + Income Replacement)

This method combines the logic of Human Life Value (HLV) and Income Replacement to calculate term insurance coverage.

Formula: Annual income × Number of working years left

Example: If you earn ₹10 lakhs annually and plan to work for the next 30 years,

₹10 lakhs × 30 = ₹3 Crore term insurance coverage

Benefit: If you’re the sole or primary earner in the family, calculating coverage through this method ensures your family continues to live comfortably, even in your absence.

Drawback: This method doesn’t consider increments, job changes, or even starting up your own business. Moreover, insurers may restrict it to a maximum of 25x of your annual income due to underwriting rules.

- Expense and Liabilities Replacement Method

This method adds up all future financial needs such as monthly expenses, children’s education, marriage, your spouse’s retirement (adjusted for inflation), and other outstanding liabilities like home, education, or personal loans.

Formula: Total future expenses + Outstanding liabilities = Cover required

Benefit: This method ensures you're not under or over-insured since it's based on actual life goals.

At Ditto, we use the expense and liabilities replacement method to give you an estimate of your required term cover. To get a better understanding, use this calculator or talk to our certified experts to precisely know the ideal cover for you.

- Underwriter’s Rule

It’s a general thumb rule based on insurers’ internal underwriting and risk management policies. It usually suggests a maximum cover of around 10 to 25 times your annual income.

Example:

- If you earn ₹10 lakhs a year, your ideal term cover should be somewhere between ₹1 Crore to ₹2.5 Crore.

- If you’re younger, with more financial goals ahead, aim for the higher end (20x to 25x).

- If you are older and already have wealth or fewer responsibilities, the lower end may suffice (10 to 20x).

While it’s not foolproof, this method gives you a quick estimate when you're short on time or just starting your planning journey.

How Does Term Insurance Coverage Work?

- Term insurance coverage is based on the sum assured you choose, but the maximum limit depends on factors like your age, education, occupation type and income.

- If your highest education is below graduation or you’re above 35, the eligible coverage multiplier reduces.

- For self-employed individuals or those without traditional income proof, insurers like ICICI Prudential iProtect Super and the Bajaj Life iSecure II use surrogate indicators such as credit scores, credit card limits, or investment proofs.

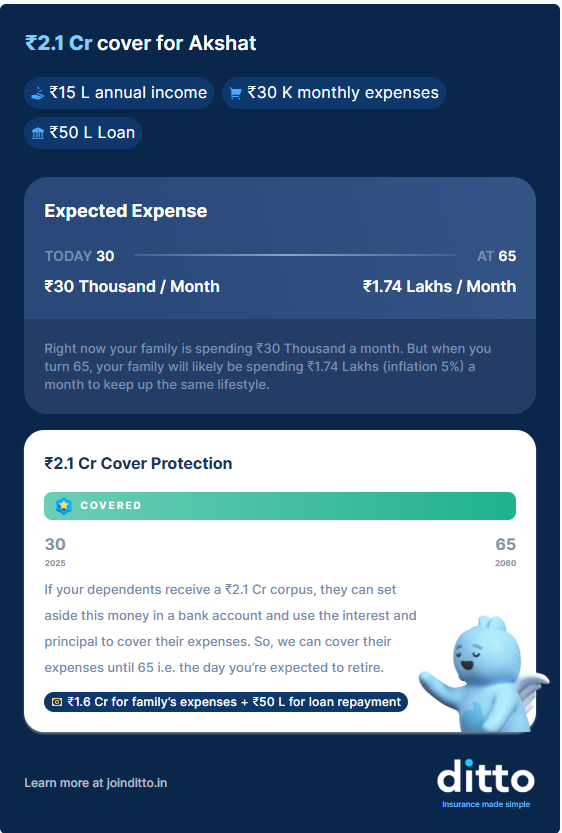

The following snippet includes the term insurance coverage calculation for a 30-year-old individual with 30,000 monthly expenses and a 50 lakh home loan seeking a cover up to 65 years.

Points to Note While Calculating Your Term Insurance Cover

Check Your Expenses

Account for monthly expenses and inflation so your cover reflects rising living costs and dependent needs.

Add All Liabilities

Add all existing loans and consider future liabilities to avoid leaving unpaid debt behind.

Include Future Goals

Include future goals like children’s education, weddings, and spouse’s plans by estimating their inflated cost.

Set An Amount Aside

Set aside part of your cover (e.g. allocate 50 lakhs or 1 crore until retirement) to ensure your spouse has long-term financial stability even after the children are independent.

Subtract and Declare

Subtract only existing life insurance covers from your maximum eligible amount and declare them when applying for a new policy.

Include Additional Calculations

Consider assets or investments like mutual funds or FDs for long-term financial goals.

Did You Know?

Insurers do not increase premiums linearly just because you seek higher coverage. For example, if you opt for a ₹1 crore cover with the Axis Max Life Smart Term Plan Plus as a 30-year-old (up to 65 years), it will cost you ₹11,937 annually. Conversely, a ₹2 crore cover will cost you ₹20,054. Put simply, double the cover does not mean double the premium.

How Much Term Insurance Do I Need (Ditto’s Take)?

Before you lock in your term insurance cover, there are a few personal factors that deserve a closer look.

- If you’re in your 20s or early 30s, you can choose a longer tenure and get higher coverage at a lower premium.

- Your coverage should increase with the total number of people relying on your income, such as your spouse, young children, or aging parents.

- Consider whether your income is stable or likely to grow, and choose slightly higher coverage now to stay future-ready.

- Health conditions, smoking, or family illness history can raise premiums or affect eligibility, so getting a policy early and maintaining a healthy lifestyle helps you lock in better rates.

Quick Note:

There’s no single, regulator-fixed cap for the maximum allowable sum assured in term insurance. The ceiling is set depending on how much risk the insurer (and its reinsurer) is willing to hold per life, as per the IRDAI Master Circular on Life Insurance Products (2024).

Why Choose Ditto for Your Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi love us:

- No Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Recommendation

Different methods suggest a range between ₹1 crore and ₹2.5 crore. This cover hits the sweet spot because it covers liabilities and key life goals, provides 10 to 15 years of income replacement, and balances affordability with adequate protection.

A ₹1 or ₹2.5 crore cover might sound like a lot, but for many families, it may fall short in the long run. Instead of guessing, use trusted methods like the Underwriter’s Rule, Human Life Value (HLV), or Expense Replacement Method to get a realistic estimate.

Better yet, speak to a trusted advisor who can help you personalize your plan.

Frequently Asked Questions

Last updated on: