Quick Overview

When it comes to term insurance, CSR is one of the most important factors. It gives a first impression of the insurer’s reliability when it comes to claims. But is it the only factor that you should consider? How reliable is this metric when it comes to real life reliability? What are the other factors you should consider?

In this article, we will learn about what a claim settlement ratio is, how it’s calculated, the top 10 term insurance claim settlement ratios, and how to choose the best one.

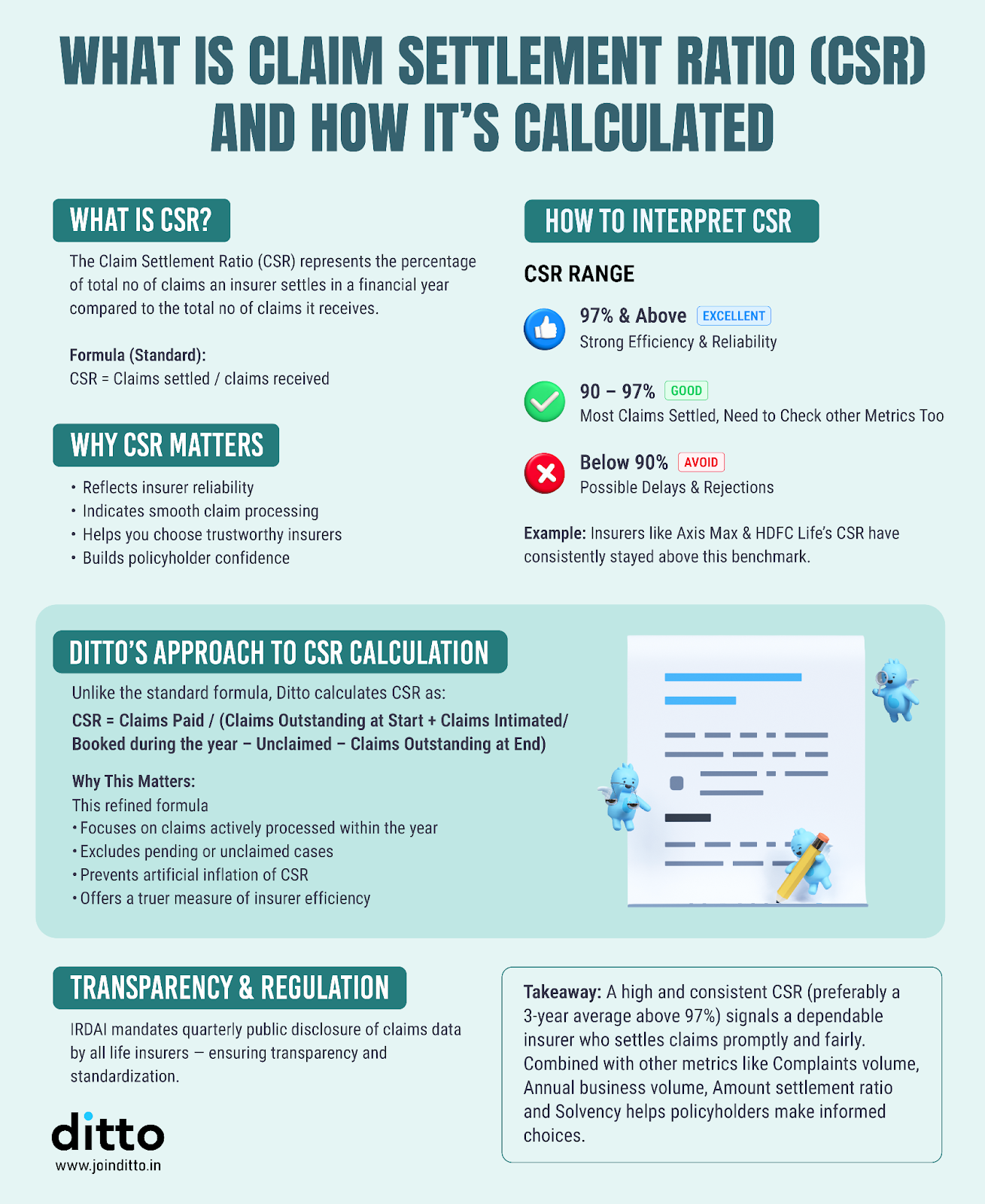

What is the Claim Settlement Ratio of Life Insurance?

It is a percentage of the total number of claims settled by the insurer in a year to the total number of claims available to settle.

CSR = (Total claims settled / Total claims available to settle) X 100Where-

‘Total Claims Settled’ includes partly and fully settled claims‘Total claims available to settle’ = (Claims carried forward from the previous year) + (New claims reported) - (Claims closed without payment + Claims still pending at year's end)

Top 10 Life Insurance Companies in India by Claim Settlement Ratio

Note: The above figures have been sourced from public declarations from individual insurers under Form L-40.

Why is The Claim Settlement Ratio Important?

- Gives You a Clear Picture

When choosing a term insurance provider, one of the most important things you want is confidence that your claim will be settled without hassle. This is where CSR helps. It gives you a quick snapshot of how dependable the insurer has been when it comes to settling claims. - Builds a Strong Reputation

CSR is not just a statistic. It plays a big role in how an insurer is perceived by customers. Since most buyers check CSR while comparing plans, a high CSR can significantly improve an insurer’s image. It signals that the company generally follows through on its promises, which makes it more attractive to new policyholders. - Gives Peace of Mind to Policyholders

For someone buying insurance, a strong CSR instantly builds trust. It reassures them that the insurer has a proven history of paying claims, which can make an important and emotional financial decision feel far more secure.

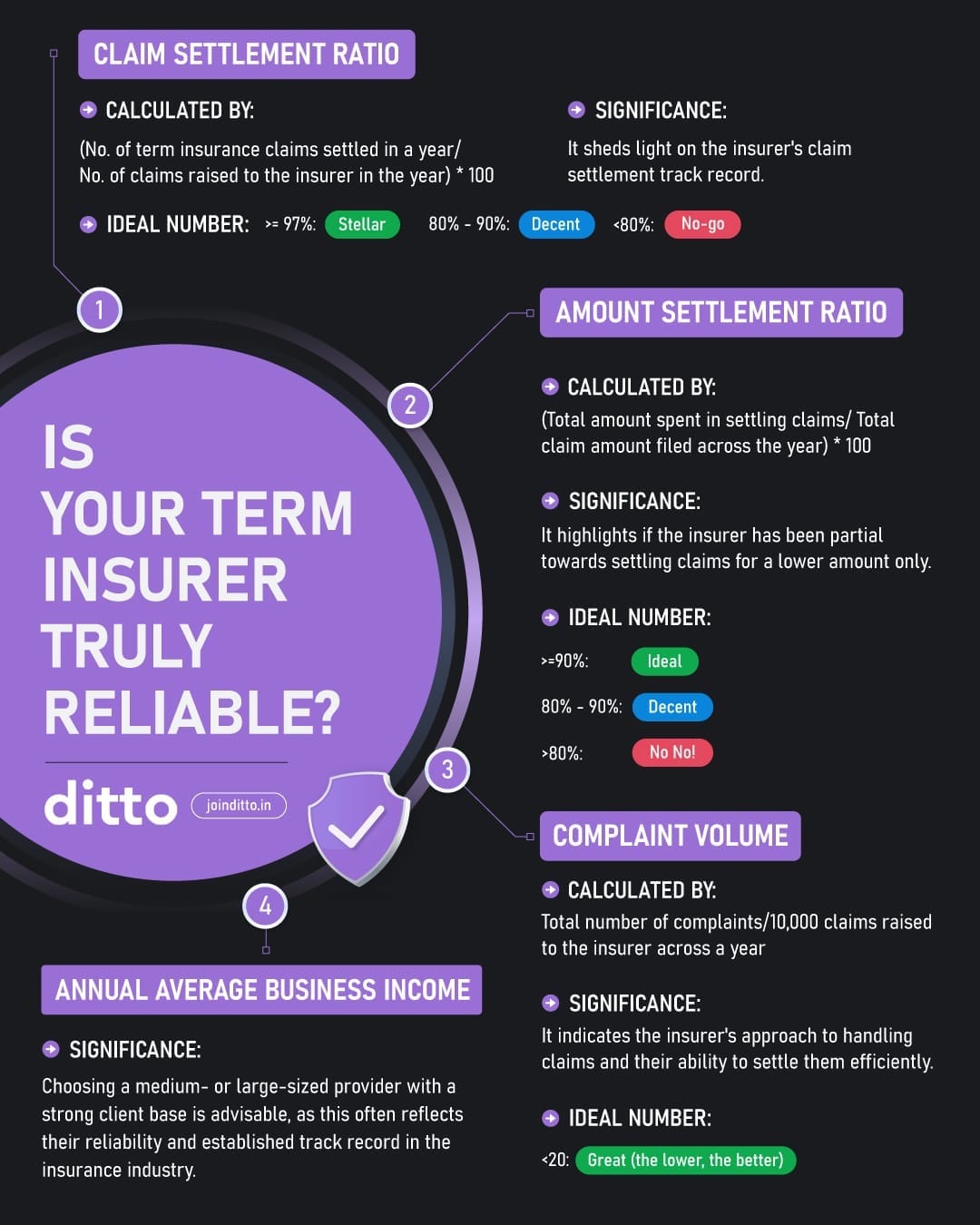

How To Choose the Best Term Insurance Company in India?

While CSR is a key indicator of an insurer’s reliability, it should not be the only factor you consider. It is equally important to compare the policy’s amount settlement ratio, complaint figures, features, premiums, and overall customer service before making a final decision. Here’s an infographic explaining it in detail:

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now or chat over WhatsApp, slots fill up fast!

Conclusion

Selecting a term insurance company with a high claim settlement ratio is important to ensure your loved ones receive the promised benefits without hassle. While CSR is a key indicator of an insurer’s reliability, it shouldn’t be the only factor you look at. It’s just as important to compare policy Amount settlement ratio, Complaints figures, features, premiums, and customer service before making a final decision.

Always make sure to compare all the plan and insurer options, and read the terms of the plan carefully to make sure there are no surprises in the future.

Note

Frequently Asked Questions

Last updated on: