What is HDFC Life Insurance's Claim Settlement Ratio?

The claim settlement ratio (CSR) for HDFC Life Insurance Company is 99.71% for the Financial Year (FY) 2024-2025 (one of the best in the industry) and the 3-year running average is 99.55% which is above the industry average.

Introduction

When you buy a term insurance plan, you are trusting the insurer to support your family if something happens to you, and the best way to gauge that trust is by checking the insurer’s CSR. In the case of HDFC Life Insurance, the strong 99.71% CSR for FY 2024–25 reflects the company’s reliability and commitment to settling claims quickly.

In this guide, we’ll cover:

- What exactly a CSR is and how we calculate it.

- How HDFC Life has performed over the past few years across other operational metrics.

- A quick comparison of CSR across leading life insurance providers in India.

What is a Claim Settlement Ratio?

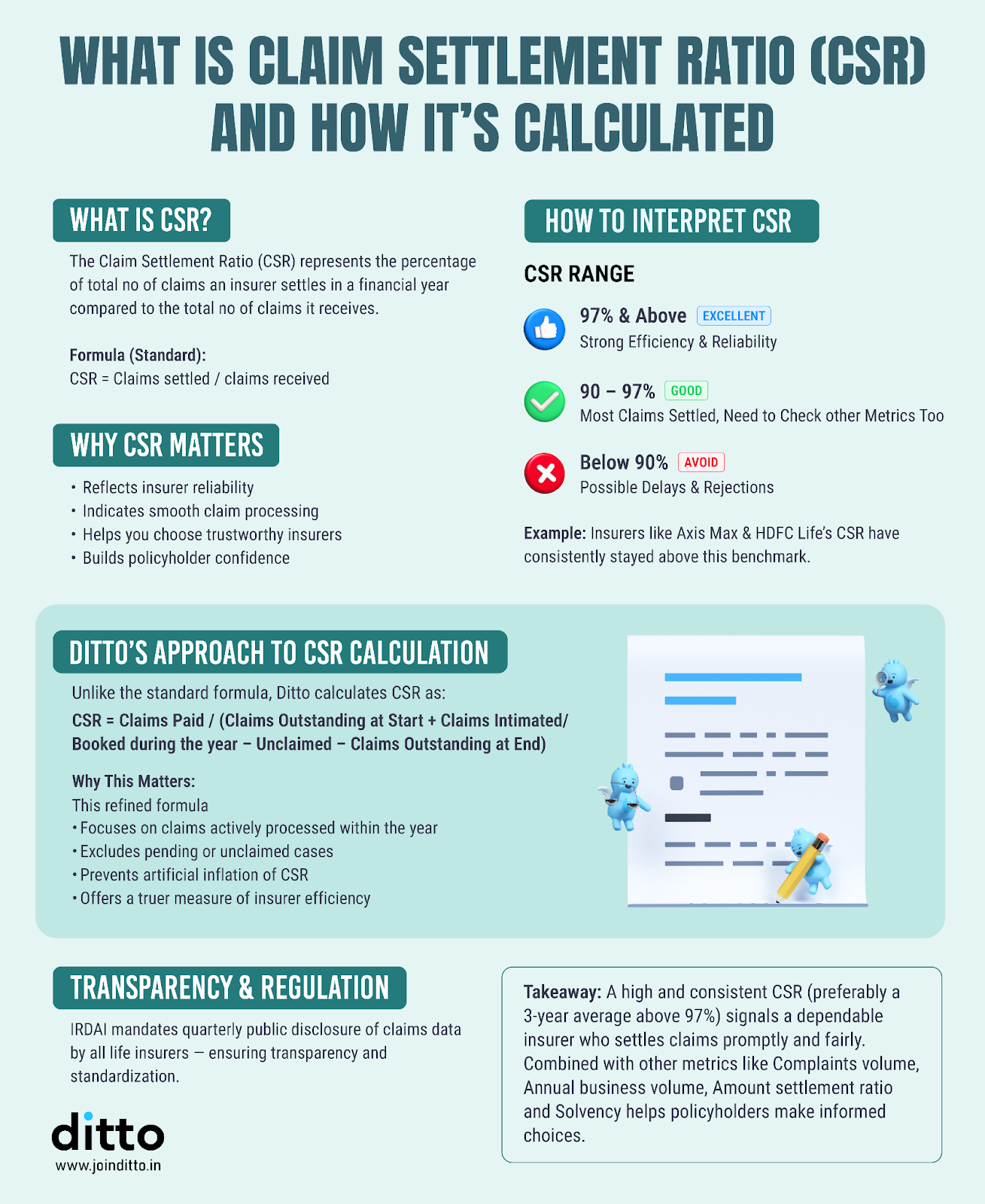

The Claim Settlement Ratio is the percentage of total claims an insurer settles in a given financial year against the total number of claims it receives.

A CSR above 97% is generally considered excellent. This indicates strong operational efficiency and a solid track record of settling claims. It is generally advised to avoid any insurer with a CSR below 90%. The HDFC Life Insurance claim settlement ratio has remained consistently above this benchmark in the last few years.

At Ditto, we evaluate insurers based on their three-year average CSR rather than a single year’s data. This gives a more accurate picture of an insurer’s consistency and reliability in processing and paying claims on time.

How to Calculate Claim Settlement Ratio?

The general method used by the IRDAI/insurers to calculate the CSR is by taking the total number of claims settled and dividing it by the total number of claims received in a financial year. To get a clearer understanding on how Ditto calculates CSR, check out the following infographic:

Note: The IRDAI mandates all life insurers to publish their claims data every quarter as part of their public disclosures to ensure complete transparency for all policy buyers.

HDFC Life Insurance Claim Settlement Ratio (Last 5 Years)

Note: The figures above are sourced from IRDAI's Statistics Handbook and company public data.

The high and improving HDFC Life insurance claim settlement ratio over the last 5 years shows the insurer's strong claims process and commitment to its customers' financial security. In the latest IRDAI disclosures, HDFC Life's performance places it among the Top 3 life insurers by CSR.

Top 10 Life Insurance Providers by Claim Settlement Ratio (CSR) in 2025

Here’s a quick look at the top 10 life insurance providers ranked by their average CSR over the last 3 financial years, so you can understand how HDFC Life compares with its peers in settling claims quickly and efficiently.

If you’re exploring more than just HDFC Life and want to compare other top-performing insurers in India, check out our detailed guide on the Best Term Insurance Companies in India.

How to Choose the Best Life Insurance Company?

While the HDFC Life Insurance's claim settlement ratio is impressive, it’s just one part of the picture. Consider other key metrics too for a complete view of the insurer’s performance.

- Amount Settlement Ratio (ASR): While the CSR tracks the number of claims settled, the ASR shows the total amount paid versus claimed. HDFC Life’s rising ASR is a great sign, especially for high-value policies. An ASR above 90% indicates fair settlement across both large and small claims.

- 30-day Claim Settlement: This shows how many claims are processed within 30 days of filing. HDFC Life’s near-perfect record here means payouts happen fast, not just efficiently.

- Complaint Volume: Lesser complaints is a strong sign of smoother claim handling and happier customers.

- Solvency Ratio: This measures an insurer’s ability to meet long-term obligations. The regulatory minimum is 1.5, but HDFC Life’s average of 1.94 (FY22–25) shows excellent financial strength and reliability.

- Annual Business: Represents the insurer’s total premium income each year. HDFC Life’s steady growth here reflects strong market trust, customer confidence and successful business growth.

The above are a few metrics you should look at to get a complete picture before choosing a life insurance company and not just the CSR.

Beyond these numbers, it’s worth checking the actual policy features. Add-ons or term insurance riders like the Waiver of Premium, Accidental Death Benefit, or Terminal Illness Benefit can really enhance your protection and are often worth paying a slightly higher premium for.

Finally, make sure the plan lets you customize it to fit your family’s specific needs. A good example from HDFC Life's portfolio is the Click 2 Protect Supreme plan, which includes important add-ons and allows a good level of customization.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Rajan below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation here. Slots are running out, so make sure you book a free call now.

Conclusion

The numbers speak for themselves. The HDFC Life Insurance claim settlement ratio is consistently among the best in the industry. But choosing the right term plan is about more than just the ratio.

So if you’re trying to find the best term insurance plan, you don’t need to dig through reports or decode policy wordings yourself. Our IRDAI-certified advisors can help you compare HDFC Life with other top insurers based on key factors like CSR, ASR, and actual policy benefits.

Frequently Asked Questions

Last updated on: