| What is PPN in insurance? In the Indian health insurance market, PPN stands for Preferred Provider Network, a set of empanelled hospitals that allows an insurer (or a group of public-sector insurers) to offer pre-negotiated tariff rates and cashless treatment. While public-sector general insurers share a PPN via GIPSA (General Insurance Public Sector Association), private insurers have their own PPNs. The list of hospitals and other quality indicators for a PPN are required to be publicly disclosed under IRDAI norms. However, the actual tariffs remain confidential under commercial terms. |

Rising hospital bills are no longer a headline; they're a trend.

By the end of 2025, India’s healthcare costs are projected to rise by 13% (compared to a 10% global increase). So, predictability matters more than ever. This is where PPNs in health insurance facilitate pre-agreed prices and processes, making cashless treatment a viable option.

This article draws reference to IRDAI circulars on TPA Regulations, Standardization of Health Insurance Products, Policyholder Protection, and the Master Circular on Health Insurance Business to give you a practical understanding of PPN in health insurance. By the end, you will know where the cashless facility actually works and how much you end up paying.

Book a free 30-minute call with Ditto. IRDAI-certified advice, zero spam, and clarity on your policy details before it’s too late.

Read on to learn more about:

- What is PPN in Insurance?

- How does the PPN Network Work: Cashless Claims & Empanelment

- GIPSA & the Role of PPN in Standardizing Treatment Rates in India

- Features of PPN Rates in Health Insurance

- How are PPN Rates Calculated?

- Benefits and Limitations of Using a PPN for Policyholders

What is PPN In Insurance: An Overview

A PPN or Preferred Provider Network is the insurer’s “preferred”, “agreed” and “pre-contracted” hospital network. All packages and services under a PPN rate are agreed in advance. This makes cashless claims at PPN hospitals fast, predictable, and smoother than ad-hoc cashless claims at non-network hospitals.

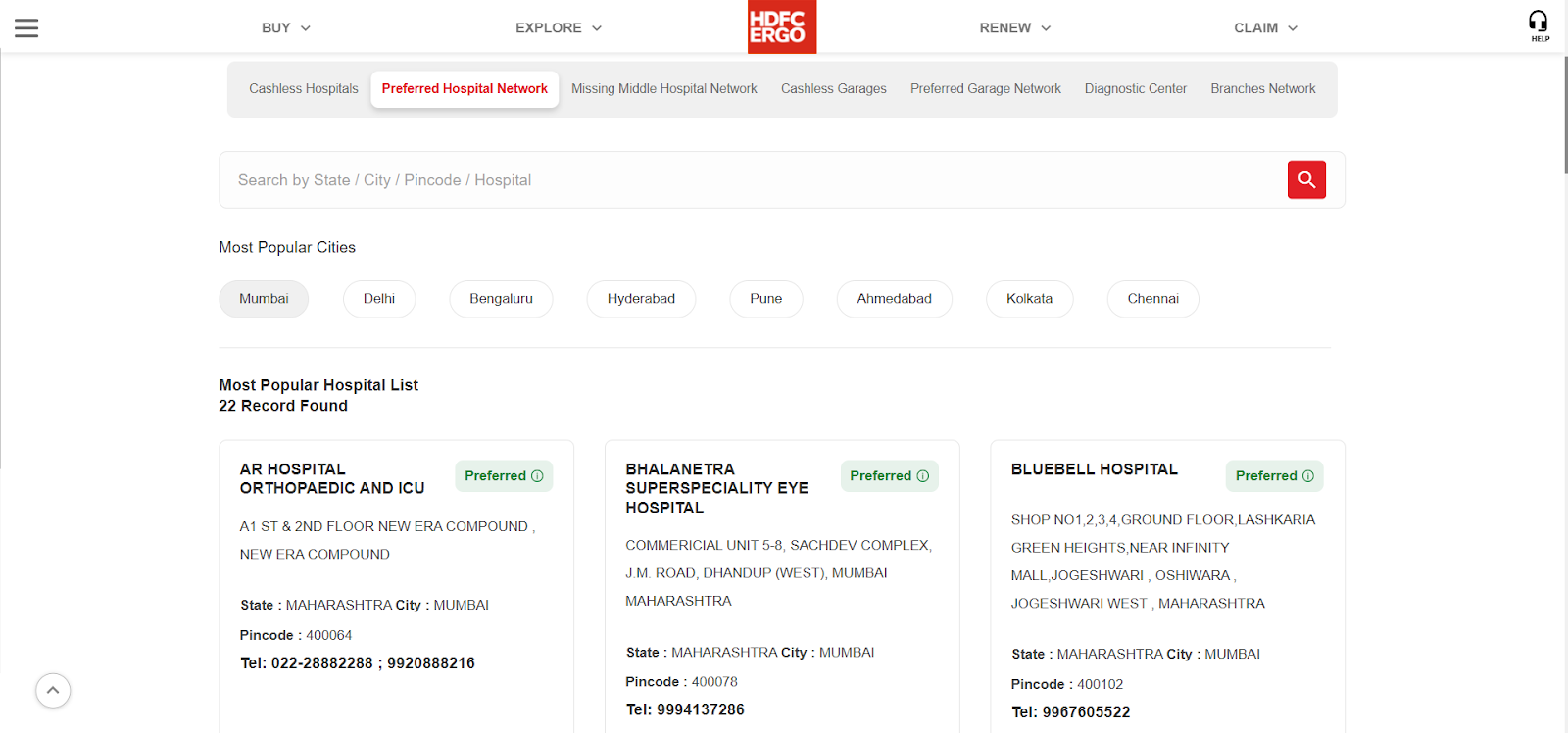

Public-sector general insurers use a shared, city-wise General Insurance Public Sector Association (GIPSA) PPN and private insurers maintain their own PPNs. These are often not labeled as a separate public list, but you can see “Preferred” or “Tier 1” tags on the insurer website.

“PPN” is actually an industry shorthand. In IRDAI documents, the formal term is always “Network Provider” and the standards that apply to networks (ROHINI registration, NABH/NQAS entry-level accreditation, standard discharge/billing formats) are set out in the IRDAI Master Circular on Standardization.

Are all network hospitals part of the PPN?

Every insurer and its TPAs maintain a network of hospitals for cashless treatment. Among them, some hospitals form a PPN, which is a selected group with pre-negotiated package rates and service-level agreements (SLA) for standard procedures, faster cashless approvals, and tighter cost control. On your insurer or TPA portal, “Network Hospital” means cashless is possible, while “Preferred,” “PPN,” or “Tier 1” indicates the availability of package-based cashless treatments with quicker processing.

So, all PPN hospitals are part of the network, but not all network hospitals are PPN.

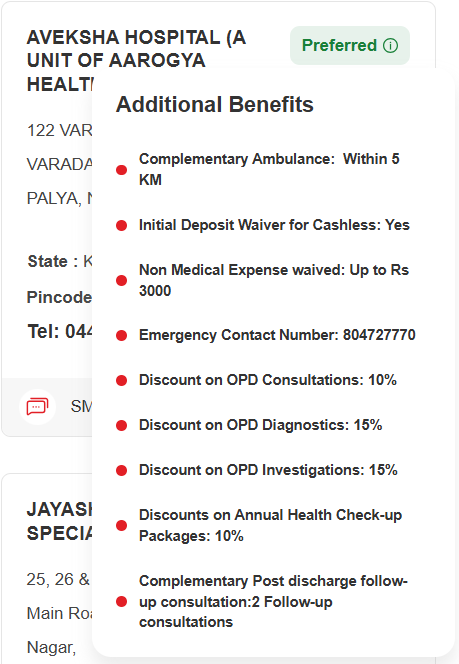

PPN hospitals often come with extra conveniences that sit outside your policy wording. These are set in the empanelment contract and can vary by hospitals and cities. Some insurers (like HDFC ERGO and Niva Bupa) also offer additional perks at PPN hospitals.

Here’s a snapshot of additional benefits offered by HDFC ERGO’s network hospitals:

How A PPN Network Works: Cashless Claims & Empanelment

Insurers empanel selected hospitals via contracts that set documentation, clinical protocols, package rates, and turnaround times. Once approved, the hospital joins the insurer/TPA cashless network. IRDAI standards and benchmarks require insurers/TPAs to publish details for network hospitals, like accreditation status and basic infrastructure and processing indicators. This helps the general public compare between two or more PPN hospitals.While at the PPN level, the same mutual agreement-based commercial contracts offer multiple perks (value-additions), they are not really IRDAI mandates. Instead, they’re contract-specific benefits (not in your policy wording) that vary by hospital and city.

Some of the common preferred-provider perks include:

- Ambulance support: complimentary within a fixed radius, say between 3-5 km

- Initial deposit waiver: no deposit for cashless admission, which would otherwise cost anywhere between ₹5,000 to ₹50,000.

- Non-medical expense waiver: small waiver on non-payables up to ₹2,000

- Dedicated helpline: 24×7 coordination number for policyholders/attendants and the hospital’s insurance/billing desk

- OPD benefits: one complimentary consultation or 10% off diagnostics

- Annual health checks: typical 10–15% discount on preventive packages

How a typical cashless flow works for PPN hospitals:

Step 1: Pre-authorization

This is where the hospital sends an estimate of treatment costs and clinical needs to the TPA/insurer.

Step 2: Approval

The insurer approves the estimate under the specific package for the indicated room class.

Step 3: Treatment

The treatment kicks off as per the approved package. If the stay is longer or the plan changes (extra days for medical observation or additional tests), the hospital sends an “enhancement” (a revised cost estimate) to increase the approved limit, and seeks approval from the insurer before continuing (except for emergencies).

Step 4: Discharge

During discharge of the insured, a direct settlement takes place between the hospital and insurer. The policyholder is only expected to pay for uncovered items like admin charges, consumables.

GIPSA & The Role Of PPN In Standardizing Treatment Rates In India

When public-sector insurers realized that hospital bills for insured patients were exceeding “reasonable cost” (i.e., when hospitals charge inflated amounts knowing one has insurance), they came together under GIPSA to create a shared Preferred Provider Network (PPN). The aim was to curb insured-only inflation with standardised packages and tighter cashless workflows. In time, it brought predictability to planned care.

Nevertheless, GIPSA PPN being metro-centric can limit access in smaller towns, and Public Sector Undertaking (PSU) insurers have faced criticism for such uneven spread.

In India, GIPSA comprises four PSUs, namely New India Assurance, Oriental Insurance, United India Insurance, and National Insurance. Private insurers have their own PPN with individual contract rates. So, it's only normal for one hospital to appear simultaneously on multiple PPNs (for both PSU and private insurers).

| The next big thing: In July 2025, the General Insurance Council and IRDAI discussed an independent healthcare regulator to strengthen price and quality standardization across the ecosystem. When it comes into effect, we will have clearer benchmarks and reduce billing shocks even outside PSU panels. |

Curious to know how a hospital joins a panel step-by-step and why it matters for cashless? Check out our detailed guide on Cashless Health Insurance in 2025.

Features of PPN Rates in Health Insurance

When it comes to PPN rates, the insurer and the hospital agree on a single package price that ties the cost to a specific medical procedure and a designated room class (prices vary between metro and non-metro cities). The package covers standard medical care expenses minus add-ons and upgrades.

For example, a typical package under a PPN for a single-knee replacement (single room limit) in a metro city typically covers:

- Surgeon and anaesthetist charges

- OT charges, standard surgical consumables, and any standard implant specified in the package

- ICU stay up to three days, ward stay up to four days

- Routine diagnostics and medicines

Items not covered include special consumables, premium implant upgrades, additional stays in the ICU or general ward beyond the cap, unrelated investigations related to the surgery, and other non-payable items.

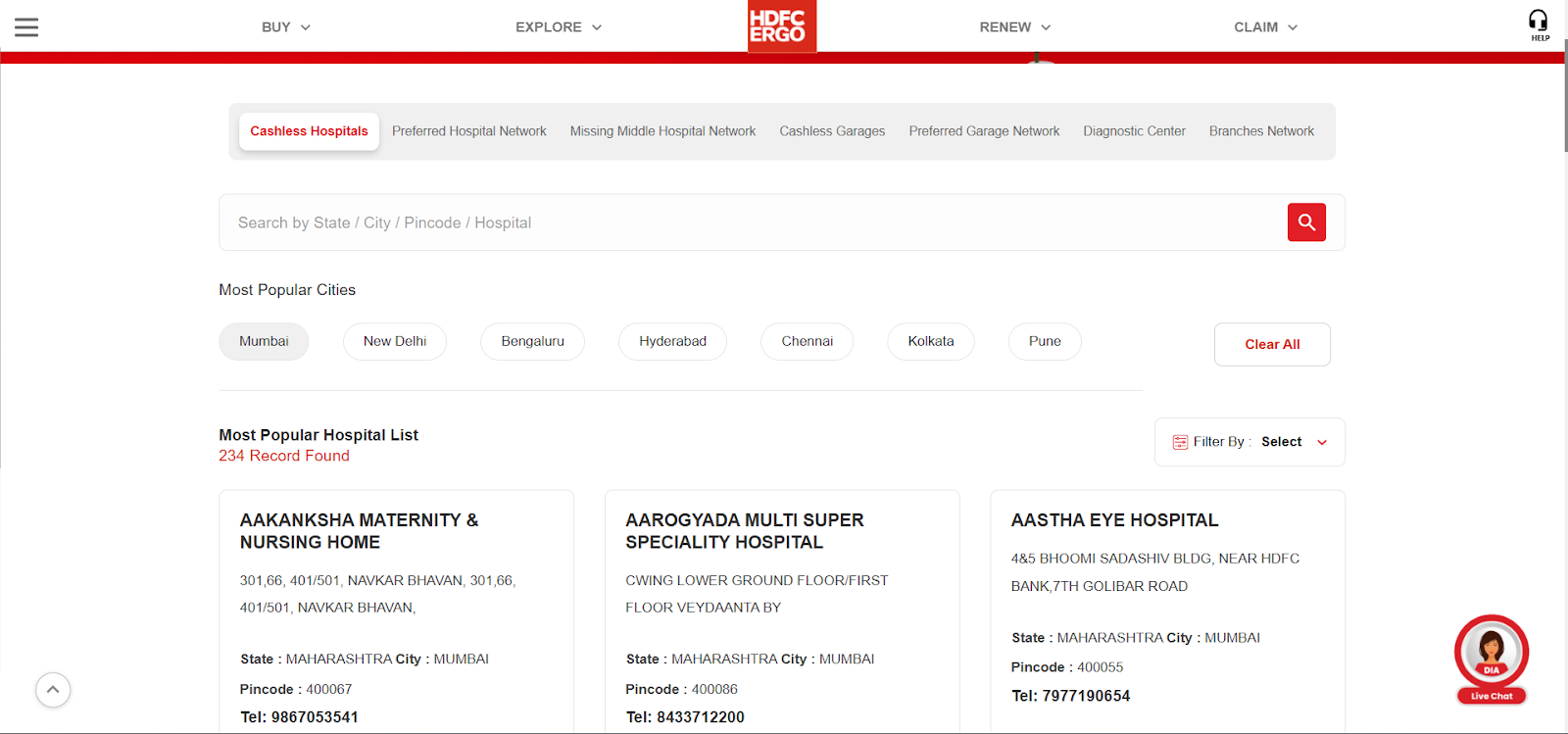

Here’s a snapshot of Preferred Hospital Networks under HDFC ERGO where you can look up a particular hospital in your city.

Note: Insurers/TPAs vet hospitals (ROHINI, NABH/NQAS), use standard forms, and report networks in regulator filings. However, there’s no blanket IRDAI mandate to publish granular metrics, such as ICU capacity or staffing ratios.

In daily practice, insurers publish network hospital lists and accordingly hospitals show whether cashless is available. However, on the pricing side, the TPA/insurer must, on request, share the applicable negotiated package/room-class rate for that member. Additionally, they should clearly state the authorized amount in the cashless approval (this is case-specific, not a public tariff).

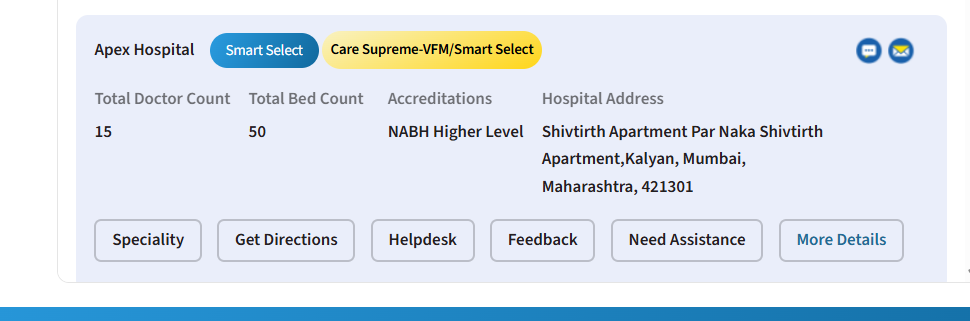

The following snapshots showcase how an insurer (HDFC ERGO) and hospital (Apex) disclose their information:

HDFC ERGO’s Preferred Hospital Network List

Disclosure of information by Apex Hospital

| Things to keep in mind : 1) Most packages map to a specific room class. If you upgrade a room, the insurer usually pays what your entitled room would have cost and the extra on room rent and room-linked items should be paid from your pocket (proportionate deduction). 2) Compared to inpatient treatment, day care procedures have tighter and more budget-friendly package options with multiple pre-inclusions. 3) Upgrades always cost more. So confirm the particular medical procedure, the room class provided, and what is covered before admission. 4) City-wise network hospital lists and basic information (like beds, ICU capacity, admission and discharge TATs, and NABH/NQAS status) are publicly available. However, exact package tariffs and detailed contract terms always remain buried in fine print. |

Heads-up: Even with the shared network push from IRDAI, package prices shall stay confidential and contract-specific. What’s improving is speed and standardization, but not public tariff sheets.

From room class to consumables, decoding PPN packages can be tricky. At the end, all you need to know is which hospital, which room, and which plan works for you. Book a free call with Ditto for absolute clarity.

How Are PPN Rates Calculated?

PPN rates are pre-negotiated package prices, where both parties have a say: the hospital and the insurer. The hospital offers a fixed price for a particular procedure and room type, and the price is built from the hospital’s cost stack. The exact figure always remains confidential, though.

The hospital’s cost stack generally includes :

- Clinical work (surgeon and anaesthetist fees, OT time)

- Bed days (time spent in ICU and general ward)

- Materials (standard implants and standard consumables for that procedure)

- Diagnostics and in-stay medicines

- Overheads and margin

Other factors that impact PPN rates are :

- City tier (metro vs non-metro)

- Room class (single vs twin sharing vs general ward)

- Procedure complexity

- Quality and process (documentation, pre-authorization and discharge)

- Commercial terms ( volume commitments, credit days, quick-pay discounts, and audit rights)

Here’s an illustrative example (not a quote) for the common cost structure in a single-knee replacement (standard implant) in a metro city.

| Components | Amount (₹) |

|---|---|

| Base components (surgeon, anaesthetist, OT, implant, meds, ICU stay, general ward stay, nursing) | ₹ 1,95,000 |

| 15% OH/margin | ₹ 2,24,250 |

| 8% metro factor | ₹ 2,42,190 |

| 10% single-room | ₹ 2,66,409 |

| 2% quick-pay | ₹ 2,61,081 |

So, the package price band would likely be about ₹2.61L for standard knee implant. Premium implants or extra days would sit outside the package and add to the expenses. Here, PSU insurers have an advantage as they standardise packages due to a shared PPN.

What does this mean for the Policyholder?

If your policy allows the “Any Room” option but the hospital–insurer PPN package is priced for a single private room, cashless will be capped at that single-room package. If you upgrade to a deluxe/suite and the hospital bills the same at a higher tariff, the insurer will pay only the single-room package to cover the gap.

Since your policy permits “any room”, you can always file a post-discharge reimbursement for the difference. Some insurers may approve cashless upgrades, but a sharp advisor in your corner can push for right approvals and cut needless out-of-pocket expenses.

Benefits And Limitations Of Using A PPN For Policyholders

A PPN in insurance is the easiest way to avail cashless treatment. Thanks to the package offering, expenses are much more predictable, with tighter timelines and transparent processes.

However, unplanned upgrades, wrong room class, or going out of network can always increase the costs. That’s why health insurance policyholders are recommended to use PPN for planned care. For emergencies, one can always visit their nearest hospital and explore cashless or reimbursement options.

Here’s a quick look at the key benefits and limitations of using a PPN.

| Benefits of PPN | Limitations of PPN |

|---|---|

| Cashless reliability is higher; disputes drop with pre-agreed packages. | Risk of mismatch if your doctor isn’t in the insurer’s PPN network. |

| More predictable costs including package & room class that balances proportionate deductions. | Package limits can block cashless facility and upgrades/implants/room changes add to costs. |

| IRDAI SLAs and documented steps speed pre-authorization and discharge. | Volatile tie-ups due to an insurer–hospital stand-off can restrict cashless access. |

So, always give first preference to PPN for planned care. During an emergency, rush to the nearest hospital. If it’s an in-network hospital, you can avail cashless facility. If not, keep all bills and discharge papers handy and file reimbursement.

Worried about a planned hospital admission in a non-network hospital? You might still be able to get a cashless treatment. Check out our detailed walkthrough on the “cashless everywhere" option.

PPN vs. Non-PPN vs. Cashless Everywhere: Ditto’s Take

Whether it's planned hospitalisation or emergencies, understanding how PPN, Non-PPN, and “Cashless Everywhere” work will help keep expenses in check. The table below draws a clear comparison of three options across different aspects:

| Aspect | PPN (Preferred Provider) | Non-PPN (Network) | Non-Network | Cashless Everywhere at Non-Network |

|---|---|---|---|---|

| Cashless availability | ✅ Faster cashless | ✅ Cashless available, but slower approval possible | ❌ Not available (reimbursement only) | ⚠️ Conditional — depends on hospital consent & insurer approval |

| Pre-auth & discharge timelines | SLA-driven → fastest | Standard → moderate | No pre-auth → reimbursement later | Case-to-case → often slower than PPN |

| Room-rent alignment | Usually matched to the package room class | Higher chance of proportionate deduction if upgrade | Always at hospital’s discretion | Depends on ad-hoc room class approved |

| Upgrade flexibility | Allowed — you pay the difference, reimbursement depends on policy type and insurer | Allowed — costs fully yours, reimbursement depends on policy type and insurer | Allowed — you bear all costs, claim later depending on policy t&c | Limited — upgrade may void cashless approval |

| Discharge surprises | ❌ Low — package covers fixed items | ⚠️ Moderate — extra tests or consumables may add up | ⚠️ High — no negotiated caps | ⚠️ Medium — depends on negotiated scope |

| Documentation burden | 🟢 Minimal — hospital & TPA handle most | 🟡 Moderate to Minimal | 🔴 High — full claim paperwork on you | 🟠 High — needs hospital coordination + insurer follow-up |

| Best suited for | Planned procedures at hospitals on your insurer’s PPN list | Planned & Emergency treatments | Unavoidable Emergency at a trusted hospital outside the network | Non-network hospital where you want to try cashless due to specific doctor/ treatment speciality |

| Limitations | Package boundaries still apply | Variable billing & slower approvals | Slower payout & higher dispute chance | Not guaranteed — hospital can decline participation |

Why Choose Ditto For Health Insurance

At Ditto, we are committed to making your insurance buying experience hassle-free. And it’s not suggesting the best health insurance plans, but genuinely understanding the unique needs of people and making them confident insurance buyers.

No wonder 7,00,000+ customers trust Ditto and recommend us to others.

✅ Honest advice – no sales pitches, no commission-driven recommendations

✅ 12,000+ 5-star reviews (Rated 4.9 on Google)

✅ Real claim experience – we've helped customers through actual claims

✅ Backed by Zerodha and other leading fintech companies

PPN in Insurance: Final Thoughts

Despite being a developing economy, the majority of the Indian population is yet to consider health insurance as a priority. But that doesn't prevent hospitalizations from happening, which is why understanding core concepts like GIPSA and PPN is vital. It's the only pre-agreed structure that puts price and process in one frame. Besides saving money, it ensures hassle-free admission and discharge from the hospital.

At Ditto, our IRDA-certified advisors can help you take the first step in becoming an informed health insurance buyer. From PPN to grace period in health insurance, we’ve got it all covered with simple, no-fuss guidance. Book a 30-minute free call with Ditto to get started!

FAQs:

What’s the difference between PPN and non-PPN hospitals?

At PPN hospitals, your insurer has a standing contract and package rates, so cashless is smoother and billing figures are more predictable. Non-PPN hospitals may still treat you, but cashless is not assured. Instead, reimbursement is more common.

When does the PPN rate apply?

PPN rates apply when the hospital is on your insurer’s PPN list and the treatment is listed among the packaged procedures covered for your room class/city under that contract. So, always confirm on the insurer/TPA site before a planned admission.

Is PPN a national network shared by all insurers?

No! GIPSA PSUs share a common PPN while private insurers manage separate PPNs. A hospital can be in multiple PPNs simultaneously. Refer to PPN scheme in health insurance to know more.

Are PPN tariffs public?

No! IRDAI requires public disclosure of network providers and quality metrics, but actual tariffs can still remain confidential due to commercial terms.

Last updated on: