What is Vidal Health?

Vidal Health TPA is an IRDAI-licensed Third-Party Administrator that bridges the gap between health insurance companies, hospitals, and policyholders. It manages both cashless and reimbursement claims, ensuring smoother coordination during medical treatments.

With a network of over 12,000 hospitals across India, 24/7 customer support, and online tools for claim tracking, Vidal Health TPA helps policyholders access timely care without unnecessary hassle.

Introduction

In India’s rapidly growing health insurance sector, TPAs have become an integral part of the system, although their role isn’t always clear to everyone. This blog breaks it down for you, focusing on Vidal Health Insurance TPA and how it works, from cashless and reimbursement claims to claim tracking and the key benefits you should be aware of.

Are you confused about TPAs or unsure which insurer is right for you? Book a free call with Ditto and our expert advisors can help guide you.

What Is A Third-Party Administrator (TPA) in India?

A TPA in India is an IRDAI-licensed company that acts as an intermediary between the policyholder (you) and the insurance company.

In simple terms, when you buy a health insurance policy, you pay premiums to an insurer. However, when you use the policy (e.g., you visit the hospital), you need someone to coordinate between you, the hospital, and the insurer. That’s where a TPA comes in.

If you’d like to learn more about TPA in Health Insurance, you can check out our detailed guide on it.

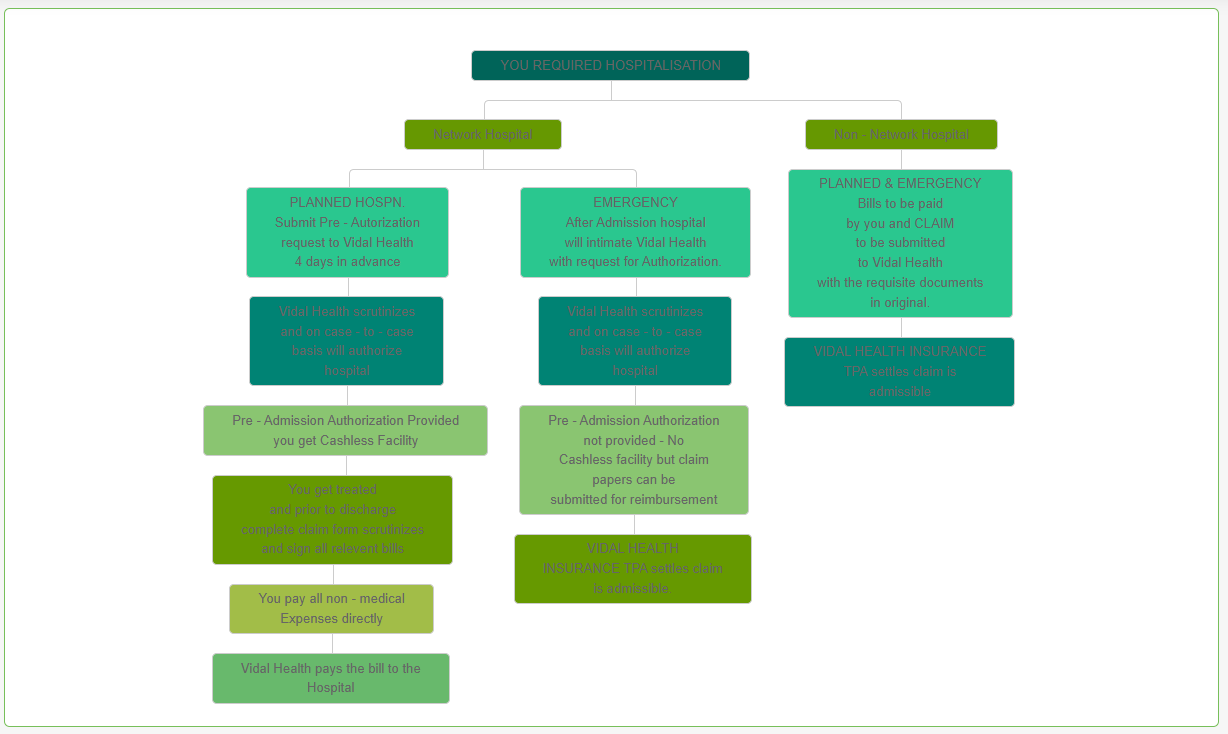

What Is The Cashless Claims Settlement Process at Vidal Health Insurance TPA?

Here’s the flow when you opt for cashless treatment under Vidal’s network:

Source: Vidal Health TPA

- Check you’re at a network hospital:

Before admission, ensure the hospital is in Vidal’s network. - Pre-Authorisation Form:

Obtain the pre-authorisation form from the hospital (available at the hospital or downloadable). Fill it in.

For planned hospitalisation: submit the form about 4 days in advance (or per policy).

For emergency: notify as soon as possible. - Authorisation by Vidal:

Vidal reviews, then provides an “authorisation letter” (approved or rejected) to the hospital before treatment/cashless services commence. - During hospital stay:

You pay non-medical expenses (if any) and sign claim/authorisation documents before discharge. - After discharge:

If approved, hospital bills are settled directly (subject to terms). If rejected, you may need to pursue reimbursement.

What Is The Reimbursement Claims Settlement Process at Vidal Health Insurance TPA?

Vidal Health TPA: Reimbursement Claims Settlement Process

Ditto’s Tip: Keep copies of all documents and note the timelines (check the policy for TAT).

What Are The Documents Required to Be Submitted to Vidal for A Reimbursement Claim Settlement?

- Your e-Card issued by Vidal (if applicable)

- Photo ID: PAN card, Driving Licence, Passport, Voter ID or any Govt photo-ID

- Valid Address Proof (telephone bill/mobile/landline, bank statement with address, electricity bill, ration card, valid lease agreement with rent receipt, employer certificate). Note: must be recent (varies: e.g., telephone bill not older than 6 months)

- Hospital/discharge bills, doctor’s invoices, diagnostic reports

- Claim form (downloadable) filled by you + medical certificate from treating doctor with hospital seal & doctor’s signature

How Do I Track The Claim Status with Vidal TPA?

Tracking your claim is super simple:

Vidal TPA List of Network Hospitals

Vidal has empanelled 12,000+ network hospitals, diagnostic centres & labs across 800+ cities in India. This means access is wide, whether you’re in a metro or a tier-2 city.

Why does this matter? A strong network provides better chances of receiving cashless treatment.

You can check out the complete list of network hospitals on their official website.

How Do I Contact Vidal TPA?

- General enquiries / Pan-India: 080-46267018 / 1800-042-57878

- Senior Citizen helpline: 080-46267070 / 1800-120-03348

- Email: care@vidalhealth.com

- Regional numbers: (Karnataka/AP/, Telangana, North & East, Gujarat, Maharashtra, Tamil Nadu, and Kerala) are listed on their site.

What Are The Benefits of Vidal Health Insurance TPA?

24/7 Helpline & Corporate Help-desk

If something happens, you don’t want to wait until next week. Vidal offers round-the-clock support.

Real-time Alerts

You’ll get SMS or email updates about pre-authorisation or claim status, so you’re never in the dark.

Claim Status Tracking

You can track your claim using their online portal (more below).

Cashless Hospitalisation

Because of the network of 12,000+ hospitals, you (or your family) can go for treatment without paying full upfront bills in many cases.

Paperless Operations & Online Platform

Reduced admin hassle, less paperwork, digital forms. Vidal emphasises this.

E-Card after Online Enrolment

A card (digital or physical) that identifies you as the beneficiary under their services.

If you’re looking for health insurance support and smooth service, Vidal ticks a lot of boxes.

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Abhinav below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a free call now!

Conclusion

On paper, Vidal Health TPA checks all the right boxes: a massive hospital network, 24/7 helpline, paperless operations, and a smooth-looking claims process.

However, here’s the thing we’ve learned from helping thousands of people with health insurance: involving a third-party administrator (TPA), no matter how effective, often adds an extra layer to the claims process. That can sometimes mean:

- A bit more waiting time for approvals

- Extra communication between the hospital, the TPA, and the insurer

- Less control for you (since the insurer isn’t directly handling the claim)

- Moreover, one of the primary goals for a TPA is to reduce claim costs for insurance companies, so they attempt to encourage customers to seek treatment at hospitals with more affordable options. This creates hassles for the policyholder and is another reason to avoid TPAs whenever possible.

So, while TPAs like Vidal do their best, claims can take longer to process compared to those managed in-house by insurers.

If you value speed, simplicity, and direct accountability, it’s usually better to go for an insurer that has its own in-house claims settlement team, like HDFC ERGO.

With these insurers, the claim doesn’t go through a third party, and it’s handled directly by the company that issued your policy. That often means fewer hoops to jump through and faster resolutions.

Frequently Asked Questions

Is Vidal a TPA?

Yes. Vidal Health Insurance TPA Services is a licensed Third-Party Administrator (IRDAI Registration No. 016) that facilitates health insurance claims and provides access to a network of hospitals.

How to check vidal claim status TPA?

As explained in the blog above, you can access their portal and log in using either your policy number or TPA ID to check your claim status.

What to do if Vidal rejects my claims?

If Vidal rejects your claim, the first thing you should do is to try to understand the reason behind the rejection, go through your policy and documents to see if anything is missing, and then resubmit. If that doesn’t work, you can check our blog on Steps to Appeal a Claim Denial for more details.

Is Vidal Healthcare cashless?

Yes. If you are at a Vidal-empanelled hospital, you follow the pre-authorisation process, and your policy & hospital stay meet terms, you can avail cashless treatment via Vidal.

Which insurance companies use Vidal as TPA?

Vidal’s insurer partners include Aditya Birla, Bajaj, Care Health, Cholamandalam MS General, Go Digit, HDFC Ergo, ICICI Lombard, IFFCO-TOKIO, Liberty General, LIC, Magma HDI, ManipalCigna, Niva Bupa, National Insurance, Reliance, Royal Sundaram, SBI, Tata AIG, New India Assurance, Oriental Insurance, United India Insurance, Future General Total Insurance Solutions, and Universal Sompo.

Last updated on: