Quick Overview

Healthcare expenses in India have been rising steadily, and a single hospitalization can cost several lakhs depending on the condition and city. For many households, such expenses can disrupt savings or push families into debt. Government health insurance aims to address this gap by providing a basic safety net for eligible citizens, especially those who may not have private insurance or the means to afford it.

This guide breaks down what government health insurance is, the major schemes available in India, who is eligible, how claims work, and where these plans fall short.

List of Government Health Insurance Schemes in India

Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PM-JAY)

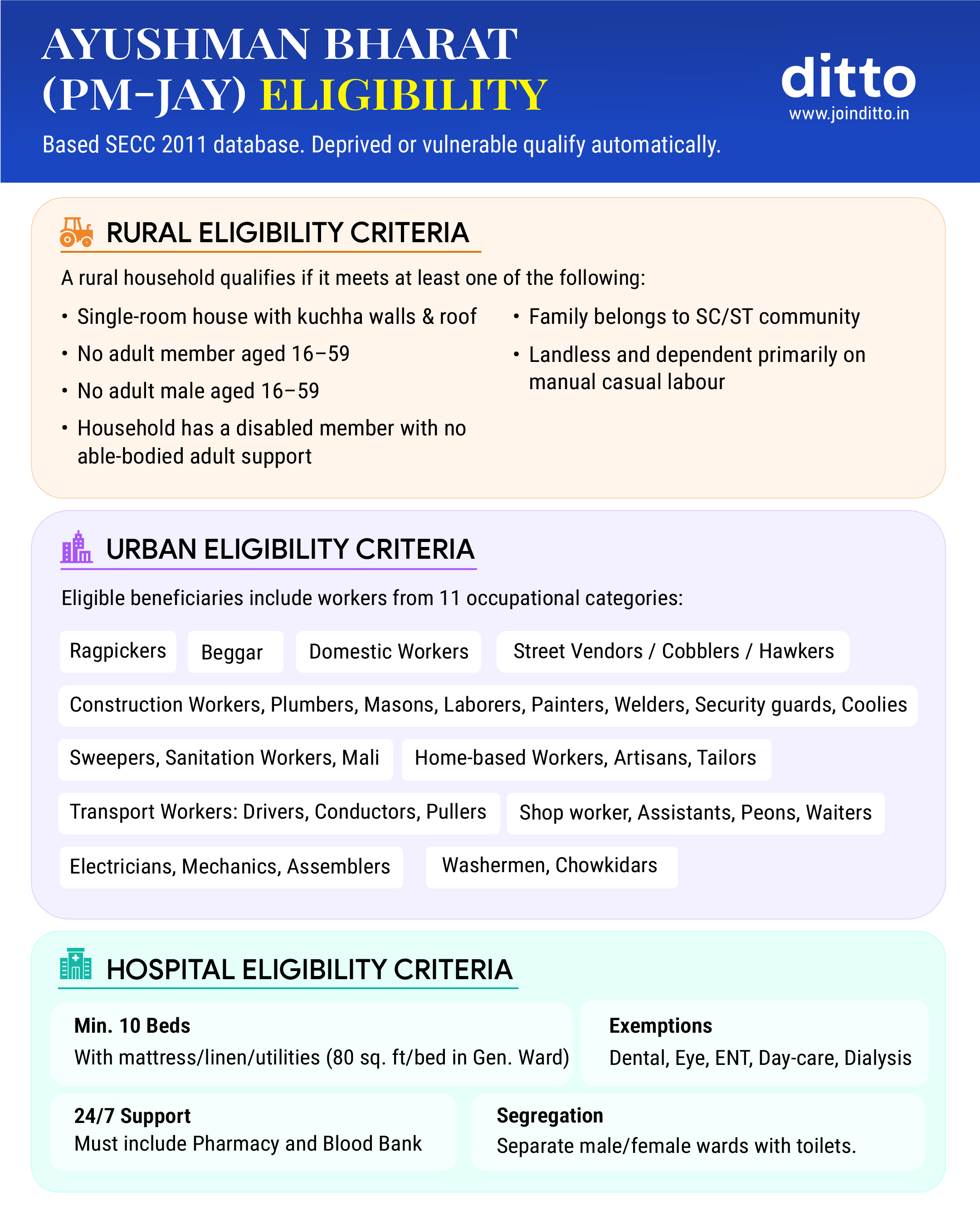

PM-JAY is India’s largest government health insurance scheme. It offers health cover of up to ₹5 lakh per family per year for secondary and tertiary hospitalization. The scheme targets economically weaker sections identified through socio-economic data and provides cashless treatment at empanelled hospitals.

It extends coverage to all senior citizens aged 70 and above, regardless of economic status. Coverage includes surgeries, medical procedures, diagnostics, medicines, and pre- and post-hospitalization expenses.

Central Government Health Scheme (CGHS)

CGHS caters to central government employees, pensioners, and their dependents. It offers comprehensive healthcare through government dispensaries and empanelled private hospitals. Unlike PM-JAY, CGHS covers outpatient care, consultations, diagnostics, and medicines, making it more comprehensive for daily healthcare needs.

Employees’ State Insurance Scheme (ESIC)

ESIC covers employees in the organized sector who fall within the prescribed wage limit, with contributions made by both employers and employees. It offers medical care, hospitalization, maternity benefits, disability benefits, and dependents’ cover in case of employment-related death. The current wage ceiling is ₹21,000 per month and ₹25,000 per month for persons with disabilities.

State Government Health Insurance Schemes

Several states in India run their own government-funded health insurance schemes to provide hospitalisation cover to eligible residents. These schemes vary by state in terms of coverage, eligibility, and benefits.

Some of the major state government health insurance schemes include:

- Chief Minister’s Comprehensive Health Insurance Scheme (Tamil Nadu).

- Mukhyamantri Amrutum and PMJAY-MA (Gujarat)

- Mukhyamantri Ayushman Arogya Yojana (Rajasthan)

- Swasthya Sathi (West Bengal)

- Karunya Arogya Suraksha Padhathi or KASP (Kerala)

- Arogya Karnataka and Ayushman Bharat–Arogya Karnataka (Karnataka)

- Mukh Mantri Sehat Bima Yojana (Punjab)

- Atal Amrit Abhiyan (Assam)

- HIMCARE (Himachal Pradesh)

- Chirayu Ayushman Haryana (Haryana)

- Dr YSR Aarogyasri (Andhra Pradesh)

- Aarogyasri (Telangana)

You can check our detailed guide on state government health insurance schemes for a complete, state-wise breakdown of these schemes.

Other Government-Supported Health Insurance Programs

Apart from PM-JAY, CGHS, and ESIC, the government also supports a few targeted health insurance programs for specific sections of the population. These schemes are usually co-funded by the government and administered through public insurers or welfare bodies.

Some well-known examples include:

- Niramaya Health Insurance Scheme for persons with disabilities.

- Aam Aadmi Bima Yojana for rural landless households and informal-sector. workers.

- Rashtriya Swasthya Bima Yojana (RSBY) for families below the poverty line.

- Yeshasvini Health Insurance Scheme for farmers and cooperative members in select states.

These programs are typically narrow in scope, offer limited coverage, and are best viewed as supplementary safety nets rather than comprehensive health insurance solutions.

Benefits of Government Health Insurance Schemes

Low or No Premium Cost

Most schemes are either fully funded by the government or require a very small contribution, making them accessible to vulnerable populations.

Financial Protection Against High Medical Expenses

Hospitalization costs, surgeries, and treatments are covered up to defined limits, reducing out-of-pocket spending.

Wide Network of Government and Private Hospitals

Many schemes allow cashless treatment across a large network of empanelled hospitals.

Coverage for Economically Weaker Sections

These schemes play a crucial role in providing healthcare access to families who otherwise couldn’t afford insurance.

Eligibility Criteria for Government Health Insurance

- Income and Socio-Economic Conditions: Many government health insurance schemes are targeted at low-income households. For example, PM-JAY uses socio-economic and caste census data to identify families that qualify for free coverage, without requiring a separate income test.

- Occupational and Employment-Based Eligibility: Certain schemes are tied to employment. CGHS is limited to central government employees, pensioners, and their dependents. ESIC covers organized-sector workers who fall within a prescribed wage limit.

- Age and Family Coverage Rules: Most government health insurance schemes offer family floater coverage and do not impose strict age limits. However, the number of family members covered and specific age-related rules can vary from one scheme to another.

How to Apply for Government Health Insurance in India

- Online Application Process: Many schemes, especially PM-JAY, allow beneficiaries to check eligibility and register through official portals, with digital health cards issued post-verification.

- Offline Enrollment Through Government Centers: Enrollment can also be completed offline at designated government offices, healthcare centers, or enrollment camps. Staff assist with application and documentation.

- Documents Required for Registration: Standard documents include Aadhaar card, income or ration card, address proof, and family details. Requirements vary by scheme.

PM-JAY Application Steps

Claim Process Under Government Health Insurance

Claims are usually cashless at empanelled hospitals, while reimbursement may be allowed in limited cases, with hospitals typically handling the paperwork and settlement process on behalf of the patient.

Limitations of Government Health Insurance

Coverage Limits and Sub-Limits

Most government health insurance schemes have fixed coverage caps and predefined treatment packages. Once these limits are exhausted, any additional medical expenses must be paid out of pocket.

Hospital Network Restrictions

Acceptance at private hospitals can be inconsistent. Government schemes are cashless only at empanelled hospitals. Public hospitals are generally deemed empanelled, while private hospitals must be formally empanelled and verified. Even then, some private hospitals may temporarily stop accepting cards or restrict services due to unpaid dues or unviable package rates.

Waiting Periods and Exclusions

Certain treatments or conditions may be subject to waiting periods or may not be covered at all, depending on the scheme and its rules.

Services Not Covered Under Government Schemes

Many schemes do not cover OPD consultations, routine diagnostics, medicines outside hospitalization, elective procedures, or advanced treatments, limiting overall healthcare coverage.

Government Health Insurance vs Private Health Insurance

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Abhinav below love us:

- No Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Ditto’s Take

Government health insurance is a useful safety net for basic hospitalization, especially for low-income households. However, for middle-class families and above who have the financial bandwidth and who prefer treatment at their choice of hospital, room type, and doctor, with fewer delays and a higher degree of care, a personal private health insurance policy is usually a more suitable option.

Frequently Asked Questions

Last updated on: