Quick Overview

Most people buy health insurance assuming their sum insured will be enough until they make a claim. Then, something else goes wrong in the same year. That’s when reality sets in.

At Ditto, we often see this happen. One large hospital bill depletes the coverage, and then a second hospitalization follows. Without restoration, the remaining coverage falls short, and the rest comes out of pocket. With restoration, the cover resets, and the insurer continues paying.

In this article, we will walk you through what restoration benefit actually means, how it works during claims, the different ways insurers structure it, and when it genuinely helps.

What is Restoration Benefit in Health Insurance?

Restoration benefit in health insurance refills your sum insured if it’s used during a policy year. Some policies call it refill, recharge, reinstatement, or reset, but they all mean the same thing: restoration.

For example, if you have a ₹15 lakh health insurance plan and make a claim that uses part of this amount, the restoration benefit will add back the used coverage, ensuring you're protected for future hospitalizations within the same year. This refill happens automatically according to the policy terms, with no extra premium required.

Restoration does not increase your base cover permanently. It only helps you stay covered within the same policy year after one or more claims.

How Does Restoration Benefit Work?

Let’s see how the restoration benefit works during real claims. The table below compares what happens with and without a restoration benefit.

In most health insurance plans, claims are paid from the base sum insured first, followed by any accumulated bonus, if the policy allows it. Most commonly once the base sum insured or base plus bonus is exhausted, depending on the policy wording. Also, restoration typically refills only the base sum insured.

Types of Restoration Benefit

- Complete vs. Partial Exhaustion

Some plans restore the sum insured only after the entire cover is exhausted. For example, Bajaj Health Guard Silver restores coverage only after full exhaustion. Others restore it even after a claim partially exhausts the SI, such as HDFC ERGO Optima Secure.

Partial exhaustion restoration is better because it activates sooner, as not all claims will utilize the SI fully. - Different vs. Same Illness

Certain insurers allow the restored amount to be used only for a different illness. For example, ManipalCigna ProHealth Prime Active restricts restoration to unrelated conditions. Others allow restoration even for the same or related illness, like Care Supreme.

Plans that allow restoration for the same illness are more useful during follow-up treatments. - Once Per Year vs. Unlimited Times

Some policies restore the sum insured only once in a policy year. For instance, ManipalCigna ProHealth Select allows a single restoration. Others offer unlimited restorations, such as Aditya Birla Activ One Max.

Unlimited restoration offers stronger protection when multiple claims occur. - With or Without Waiting Period

A few plans impose a waiting or cooling-off period between restorations. For example, TATA AIG Medicare has a 45-day cooling period for restoration for the same illness. This can reduce usage during closely spaced hospitalizations.

Plans without restrictions, like HDFC ERGO Optima Secure, work better in real scenarios.

Why Should You Opt For A Plan With Restoration Benefit?

Better Financial Coverage

Claim More Than Once

Budget Friendly

Protection Against Medical Costs

Not all restoration benefits are equally useful. Some look good on paper but fall short during actual claims. At Ditto, we have reviewed hundreds of health insurance policies and shortlisted plans where restoration genuinely adds value. Here’s an overview:

Top 5 Health Insurance Plans In India With The Best Restoration Benefit

Note: The numbers for Claim Settlement Ratio (CSR) and average complaints per 10,000 claims are based on the average of FY 2022-25. Meanwhile, SI stands for the sum insured.

Why Approach Ditto For Health Insurance?

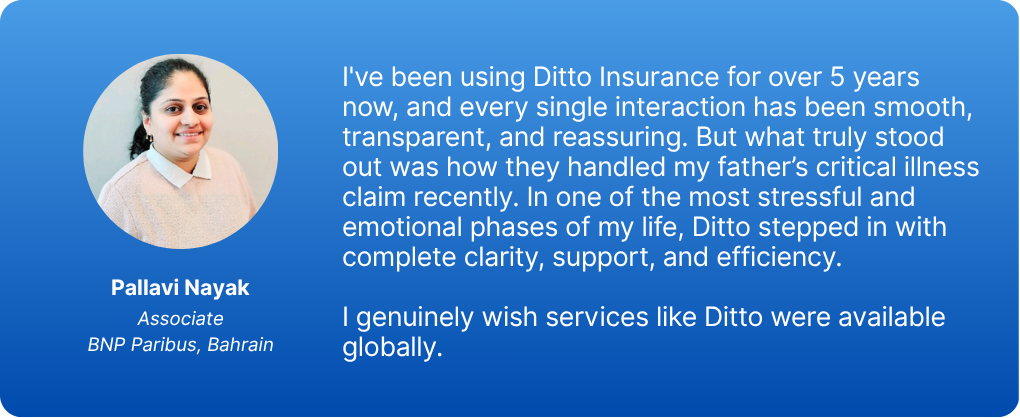

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Ditto’s Take On Restoration Benefit

When structured properly, a restoration benefit can transform an average health insurance plan into a reliable safety net. But when it's poorly designed, it can create a false sense of security.

At Ditto, we recommend choosing a plan where the restoration kicks in after partial exhaustion, applies to the same illness, allows multiple restorations within the year, and has no cooling-off period. This version holds up best during real claims.

We’ve seen families assume they’re covered, only to discover too late that restoration won’t apply for the same illness or that it’s already been used for the year. That’s why reading the fine print matters.

Frequently Asked Questions

Last updated on: