| What Are Permanent Exclusions in Health Insurance? Permanent exclusions refer to specific diseases, medical conditions, or treatments that are never covered under any circumstance by a health insurance policy. Cosmetic surgeries and self-inflicted injuries are common examples of permanent exclusions in health insurance. The complete list of permanent exclusions is available in your policy document, as well as in the standard exclusion list issued by IRDAI. |

Permanent exclusions are one of the biggest reasons health insurance claims get rejected in India. Thousands of policyholders face this every year simply because they overlooked these clauses. After reviewing countless claim disputes, our advisors at Ditto found that exclusions were at the core of most rejections.

That’s why we created this guide by analyzing IRDAI’s standard exclusion list and product wordings from leading insurers. Let’s break down how permanent exclusions work, why insurers include them, and how you can use riders to bridge the gaps.

🗣 Save Time: Researching policies can take hours. Save time and get expert advice with Ditto’s FREE 30-minute consultation. No pressure, no spam, just honest insurance advice. Book your spot before it’s too late!

Why Do Health Insurance Policies Have Permanent Exclusions?

They exist for three key reasons:

- To make sure people buy health insurance before they fall sick (avoiding “moral hazard”).

- To protect the insurer’s financial health by leaving out uninsurable or predictable conditions.

- To ensure fairness across policyholders by preventing misuse and keeping premiums affordable for everyone.

For a clearer picture of what’s included and excluded in different health insurance plans, visit our ‘understand your policy’ page for a detailed breakdown.

List of Permanent Exclusions in Health Insurance

Exclusions in health insurance are usually broken down into two categories.

1) Time Bound Exclusions

Also called temporary exclusions, these refer to conditions or treatments that are excluded from a health insurance policy only for a specific period.

- Specific illnesses, such as hernia or cataract, with a compulsory waiting period of 1 to 2 years.

- Pre-existing conditions like asthma, diabetes, or hypertension, with a waiting period of up to 3 years.

- Maternity and newborn coverage (if it's an inbuilt feature or the policy covers it via a rider) with a waiting period of 9 months to 4 years. However, certain exceptions may apply for complications like ectopic pregnancies, often covered under standard inpatient coverage.

- An initial waiting period of 30 days during which hospitalizations won’t be covered unless it’s an accident (which are covered from day 1).

2) Permanent Exclusions

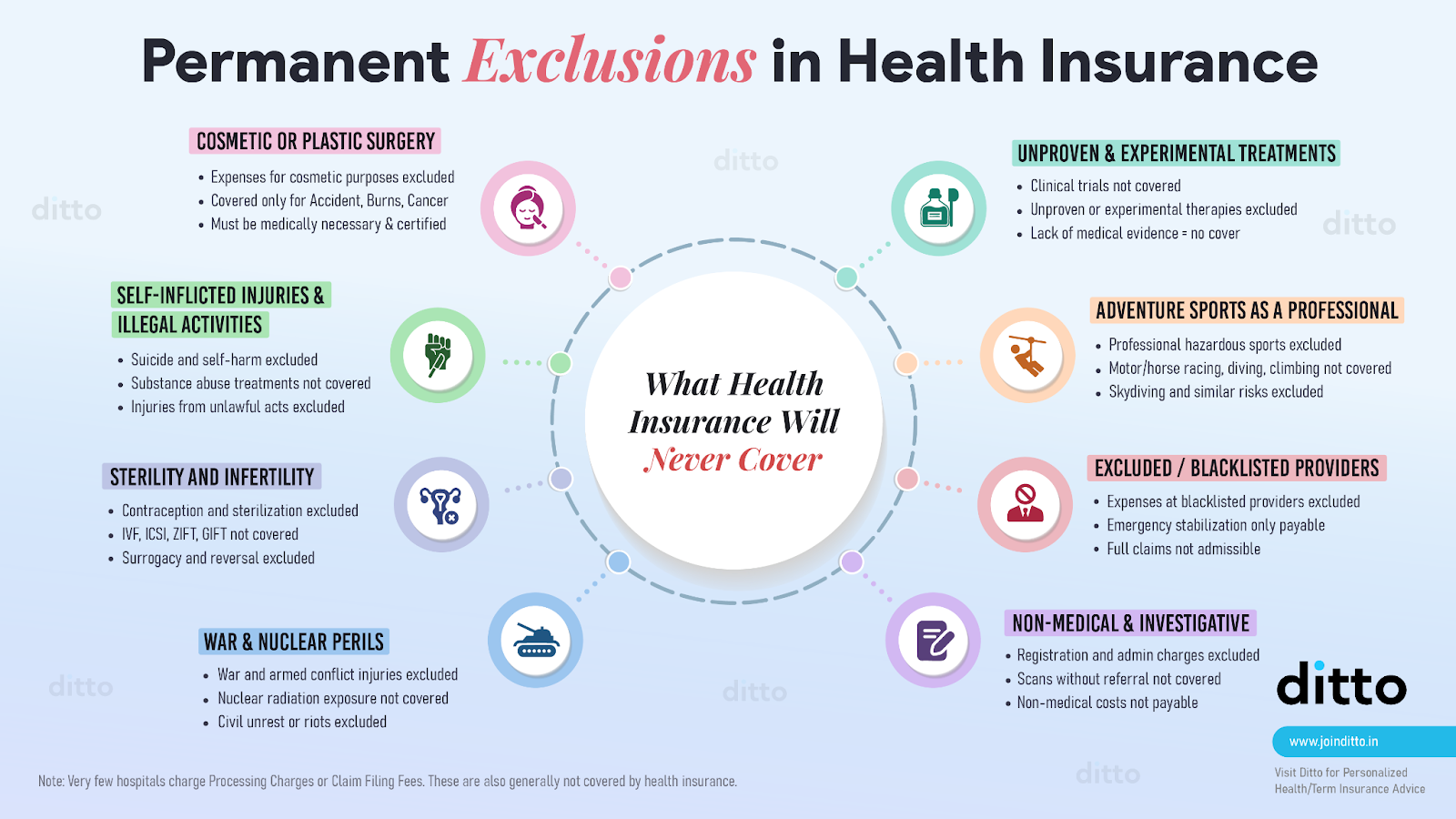

Unlike time bound exclusions, these are never covered by any policy. Here’s the complete list:

- Non-medical and investigative procedures, such as registration, admission or service charges, and diagnostic scans without a doctor’s referral which are not considered part of actual treatment.

- Aesthetic treatments like Botox, liposuction, rhinoplasty, and dental implants for cosmetic purposes.

- Self-inflicted injuries from attempted suicide, substance abuse, or illegal activities.

- Fertility and pregnancy-related procedures like IVF, IUI, surrogacy costs, or elective termination of pregnancy (sometimes covered by specialized policies).

- External congenital anomalies present since birth, e.g., cleft palate which are treated as lifelong pre-existing conditions.

- OPD and preventive procedures, such as routine vaccinations and annual health check-ups beyond the free quota.

- Alternative, experimental, and unapproved clinical trials or experimental treatments that lack proven effectiveness and cost certainty.

- Injuries from war, civil unrest, or nuclear radiation, considered catastrophic risks beyond the insurance scope.

- Adventure and hazardous sports-related injuries, unless specifically covered by a rider or special plan.

- Treatment from blacklisted or unrecognised providers, which insurers are not obligated to cover.

- Change-of-gender or sex reassignment treatments, which are considered lifestyle choices and not medical necessity.

- External aids, appliances, and prostheses for external use, such as hearing aids, spectacles, or braces, unless covered under a specific add-on.

Ditto’s Advice: If you are interested in specific benefits such as maternity, infertility, or dental cover, you may choose plans that are customized for these needs or opt for add-ons that provide extended coverage.

For instance, Aditya Birla ActiveFit Preferred offers maternity coverage, Star Health Women Care includes infertility benefits, while Tata AIG Medicare Premier provides dental coverage.

Are Mental Health Treatments Covered, or Do They Fall Under Exclusions?

Mental health coverage in India has improved significantly after the Mental Healthcare Act, 2017, and IRDAI’s 2022 directive, which made it mandatory for insurers to include mental health in health insurance. This means hospitalization expenses for psychiatric illnesses like depression, anxiety disorders, bipolar disorder, or schizophrenia must be covered under all compliant health insurance policies.

However, the scope is still limited in many cases. While inpatient care (hospitalizations) is included, outpatient counselling, long-term therapy sessions, and rehabilitation costs may still be excluded.

Bottom Line: While mental health is no longer a permanent exclusion, it’s important to read your policy wording carefully to understand exactly what is covered and what is not.

What Happens if I Don't Check Exclusions Before Buying the Policy?

This can leave you with significant, unexpected out-of-pocket expenses. Many customers focus only on premiums or coverage limits, but exclusions are just as important because they dictate the real value of your policy.

The Bottom Line: Always review the “Exclusions,” “Waiting Periods,” and “Not Covered” sections in policy wordings and prospectus documents before finalizing a plan.

Can Insurers Add New Permanent Exclusions After I’ve Already Bought the Policy?

No. Once your health insurance policy is issued, insurers cannot arbitrarily add new permanent exclusions to it. Your contract terms are locked at the time of purchase, and any changes can only be made with your consent (for example, if you voluntarily opt for a new rider or modification). New exclusions introduced by insurers or mandated by regulations will apply only to fresh policies or renewals.

Note: Insurers can update policy wordings for new customers or future versions of the product. So, it’s wise to review updated product brochures when renewing or switching plans.

Can I Remove Permanent Exclusions From My Policy?

Yes, it's possible to cover or override certain exclusions in health insurance policies through riders, such as:

- Maternity Cover Rider: Covers newborn baby care, C-section, vaccination costs, and maternity expenses (after the waiting period). It’s available across plans like HDFC Ergo Optima Secure, ICICI Lombard Elevate, and Star Health Super Star.

- Pre-Existing Disease (PED) Waiver: Removes or reduces the waiting period for pre-existing conditions like high cholesterol, diabetes, hypertension, asthma, coronary artery disease, obesity, and Chronic Obstructive Pulmonary Disease (COPD). For instance, Care Supreme provides instant cover for selected pre-existing conditions.

- Specific Illness Waiting Period Reduction: Insurers like Star Health Super Star and ICICI Lombard Elevate reduce the 2-year waiting period on certain illnesses to 1 year with add-ons. A few others, like Acko Platinum Health and Manipal Cigna Sarvah Param, remove it entirely.

- Consumables / Non-Medical Expense Cover: Pays for non-payable hospital items like PPE kits, gauze, gloves, syringes, and surgical tape. These can make up 5–15% of your bill. However, the policy coverage varies. For instance, Care health insurance covers only 68 of over 140 listed items, while HDFC Ergo covers all.

- Hospital Cash Benefit Rider: Provides a daily allowance to cover non-medical costs, such as meals, travel, or loss of income during hospitalization.

- OPD Cover Rider: Covers outpatient costs such as diagnostic tests, doctor visits, and medicines.

- Durable Equipment Cover: Pays for medically necessary equipment like prosthetic devices, ventilators, wheelchairs, and suction machines, up to a set limit.

Ditto’s Verdict: Not all the above riders are recommended or mandatory. Always read the policy wording carefully, as some exclusions may already be covered as in-built features.

Are All Major Medical Issues Treated as Permanent Exclusions?

If a critical illness is pre-existing, the insurer will require you to declare it and assess its severity. Depending on the risk, the condition may either be declined for coverage or permanently excluded, as seen in some policies like Care Freedom.

For example, if someone has a history of cancer, even if cured, it is usually treated as a permanent exclusion. The same applies to other high-risk conditions such as heart diseases, arthritis, and certain autoimmune disorders.

Ditto’s Take: While this may seem restrictive, having partial coverage is still better than having no health insurance at all.

Why Choose Ditto for Health Insurance

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Abhinav below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Ditto’s Take on Permanent Exclusions in Health Insurance

Exclusions are one of the foundational pillars of every health insurance policy because they tell you what’s covered and what’s not. Going forward, analyze the following compulsorily:

- Use riders like pre-existing condition waivers, maternity, or consumables add-ons as they’re often cheaper than increasing your base cover.

- Don’t compare premiums alone. Shorter waiting periods and modern treatment coverage can also save you more at claim time.

- Review your policy after major life changes to ensure the coverage still fits your needs.

Still confused about permanent exclusions in health insurance and their impact on your coverage? WhatsApp us or book a free call with our IRDAI-certified advisors to get better guidance.

FAQs

What are the diseases that are ‘Permanently Excluded’ under health insurance?

Diseases like external congenital anomalies, infertility treatments, and conditions caused by substance abuse or self-harm are permanently excluded from most health insurance plans.

What are the common exclusions in health insurance?

Common exclusions include cosmetic treatments, dental and vision expenses (unless covered by add-ons), self-inflicted injuries, injuries from hazardous activities, and treatments without medical necessity.

Can lifestyle habits like smoking or drinking lead to permanent exclusions?

You must always make full and honest declarations when purchasing a health insurance policy. If the insurer finds out that you withheld information, your claim will be rejected. Even if you declare everything, most insurance policies have an exclusion for substance abuse. This means that if a disease is diagnosed as being caused by substance abuse, and the doctor records it, the insurance company can reject your claim under this exclusion.

Do health insurance policies have exclusions for international or foreign individuals?

Yes, health insurance policies in India exclude foreign nationals from their coverage unless explicitly mentioned and included in the policy wording. Some insurers may offer special plans for foreign residents or request additional documentation that should be declared during purchase.

Are modern treatment methods covered under health insurance?

Yes. IRDAI has mandated that insurers must cover modern treatments like uterine artery embolization, robotic surgeries, oral chemotherapy, immunotherapy, stem cell therapy (for bone marrow transplant), and others when medically indicated. These can be availed as in-patient, day-care, or domiciliary treatment. Insurers may apply sub-limits, and they are also encouraged to include future advanced treatments as they become common.

Last updated on: