Quick Overview

Imagine paying health insurance premiums for years, and then a claim gets questioned because you forgot to mention an old health issue while buying the policy. The moratorium period is meant to prevent this situation.

In this article, we explain what the moratorium period is, how it works, and the key IRDAI rules you should know.

What is the Moratorium Period in Health Insurance?

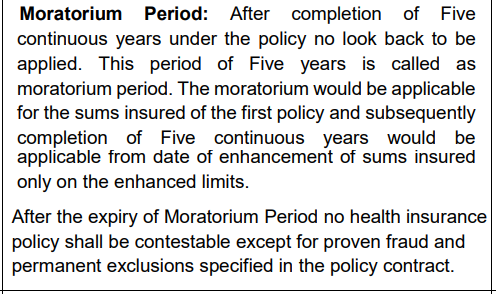

Here’s the exact IRDAI wording for the moratorium period, from the master circular:

In simple terms, if you keep your health policy active for 5 continuous years, the insurer cannot go back to your old proposal form details and reject a claim only because you missed disclosing something or made a mistake. They can still reject or contest a claim in cases of proven fraud and for permanent exclusions written in the policy.

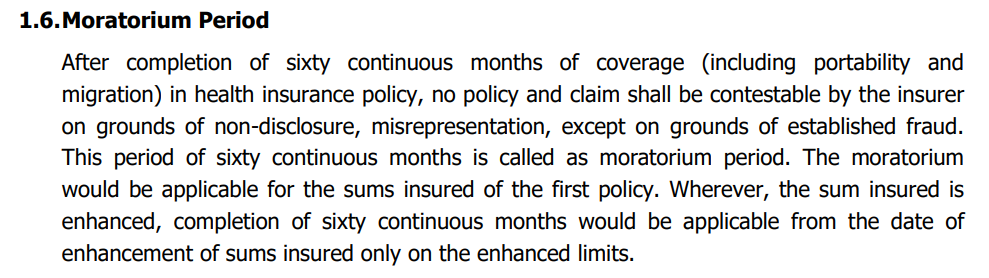

You will also find the definition mentioned in your respective policy wording. Below is an example from HDFC ERGO Optima Secure’s policy wordings.

How Does the Moratorium Period Work?

Check out this video by our experts to learn more about how a moratorium period works:

Why Does Moratorium Period Matter in Health Insurance?

Peace of Mind After 5 Years

If you’ve renewed your policy for years, the moratorium period gives you real peace of mind as you don't need to worry when a claim comes up. After 60 months of continuous coverage, the insurer cannot reject the claim or contest your policy on grounds of non-disclosure or misrepresentation, except in cases of proven fraud and permanent exclusions.

Encourages Buying Early

The moratorium period is also why many insurers emphasize “buying early”. If you start your policy sooner and keep it continuous, you hit that 5-year milestone earlier. So there’s less chance of a claim getting stuck in proposal-form back and forth.

Keeps Premiums Fair and Stable

Moratorium exists to keep the system balanced: it discourages “buy health insurance only after developing a condition” behavior, which can otherwise push premiums up. In simple terms, it supports more stable pricing over time. It helps insurers price policies more sustainably, which ultimately benefits long-term policyholders.

Makes Switching Insurers Easier

If you port or migrate, the moratorium credit is carried forward. So you can change insurers without losing your already-served years, as long as continuity is maintained. This gives you the flexibility to switch without losing the benefits of time already spent insured.

Difference Between Moratorium and Waiting Period

Moratorium Period and Claim Rejection

Even after the moratorium period is over, a claim can still be rejected in two situations:

Proven Fraud

This is when the insurer can show there was an intentional attempt to cheat, like submitting forged documents, fake hospital records, or inflated bills. In such cases, the moratorium protection does not apply.

Permanent Exclusions

These are exclusions written into the policy contract that are never covered, for example, hospitalization due to substance abuse, or any cosmetic surgeries. So even after the moratorium ends, claims falling under permanent exclusions are denied.

Key IRDAI Rules on Moratorium Period

Continuous Renewals

Renewal Lapse

Portability Credit

Sum Insured Hike

Why Choose Ditto for Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or chat on WhatsApp with us now!

Ditto’s Take on Moratorium Period

The moratorium period is a useful safety net, but it should not change how you fill your proposal form. Our view is simple: disclose everything you know, even if it feels minor.

Why? Because the moratorium helps only after years of continuous coverage, and even then, insurers can deny claims for proven fraud and for permanent exclusions written in the policy. Plus, many claim disputes happen in the first few years, when the moratorium is not yet available.

So, treat moratorium as a backup and avoid claim settlement troubles with honest disclosures.

Frequently Asked Questions

Last updated on: