What is MDIndia Health Insurance?

MDIndia Health Insurance, a IRDAI-licensed service provide, is among India’s earliest licensed Third Party Administrators (TPAs). Many insurers, such as Bajaj General, Tata AIG & Oriental Insurance Company, use MD India to handle cashless and reimbursement claims.

Introduction

Looking for a reliable TPA to simplify your health insurance claims? MDIndia Health Insurance is one of India’s largest third-party administrators, which helps policyholders manage claims smoothly and connect with hospitals nationwide. At Ditto, we simplify such decisions and help people make the right choice.

This guide helps you understand:

- MDIndia Health insurance benefits and claim process

- Documents required for claims and how to track your claim

- Should you opt for a TPA

Take Note: If your health card shows MDIndia TPA, it means they handle your claims. Your actual policy is still issued and managed by your insurer.

MD India Health Insurance TPA: Overview

MDIndia Health Insurance TPA Pvt. Ltd. started in November 2000 under the leadership of Mr Brij Sharma. The TPA functions with 19500 facilities and 10700 network hospitals. MD India operates more than 152 branches nationwide.

Learn more about MDIndia Health Insurance through their digital guidebook.

Benefits of MDIndia Health Insurance

Expertise

Cost-effective

Broader network hospitals

Lower premiums

What is the Cashless Claims Settlement Process at MDIndia Health Insurance?

Cashless treatment is where your insurer, via MDIndia, will directly settle hospital bills on your behalf. Here is the step-by-step flow:

- Select a hospital from MD India’s network list. You can look for your nearest hospital here.

- Show your ID card or policy number at the hospital desk.

- Request a pre-authorisation form and fill it carefully. The hospital will then send it to MDIndia.

- MD India reviews your form and sends an approval or query. Once verified, your insurer settles the claim with the hospital.

Note: In an emergency hospitalization, the patient can get admitted to a network hospital first and follow the steps afterwards.

What is the Reimbursement Claims Settlement Process at MDIndia Health Insurance?

You file a reimbursement claim when you go to a non-network hospital or when the hospital does not support cashless treatment. Here is the process:

- Inform MDIndia about the hospitalisation, preferably before getting admitted or at the most within 24 hours of being hospitalized.

- Collect all the invoices/receipts generated by your hospital and pay the final bill from your own pocket.

- Post-discharge, file the claim settlement form and submit it to your insurer, preferably within a week.

- Once the insurer reaches out to you, within 15 working days, submit the required documents.

Click here to file a claim with MDIndia.

What are the Documents Required to Be Submitted to MDIndia for a Reimbursement Claim Settlement?

Here’s the list of documents required for reimbursement claim submission:

- Claim Form duly signed by the insured.

- A photocopy of the insurance card and policy copy

- Original discharge card/summary

- Original hospital bills, for consolidated amounts, with a detailed breakup of the amount

- Original medicine bills, along with a valid doctor’s prescription carrying the hospital seal.

- Investigation reports and bills, supported by the doctor’s note recommending those tests.

- Certificates for surgeries, home treatment approval, and proof of full recovery, along with related bills and receipts.

- In case of accident, FIR/MLC from the hospital, signed discharge Voucher (DV)

- Cancelled cheque of your bank account

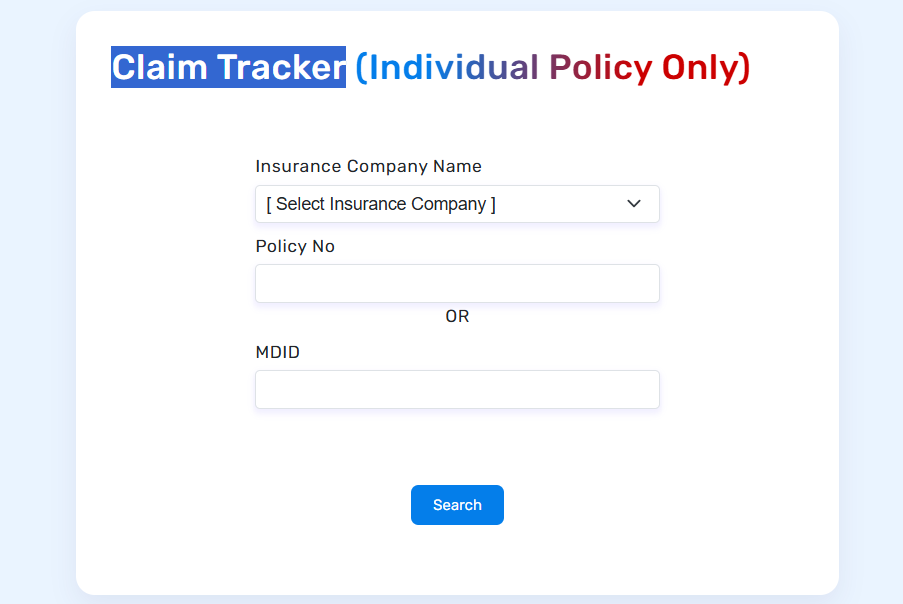

How Do I Track the Claim Status with MD India Health Insurance?

Tracking your claim is super simple:

- Visit the online portal for tracking your policy claim.

- Select your insurance company and then enter either the policy number or MDID.

- Search and check status.

Alternatively, you can call their customer care number or visit a nearby MDIndia Health Insurance branch for offline assistance.

How Do I Contact MDIndia Health Insurance?

MDIndia is operational 24/7, 365 days a year. You can reach them easily through any of the following ways:

- For cashless claims, you can call 1800-209-7800. For non-cashless queries, call 1800-209-7777.

- For cashless claims, drop an email to authorisation@mdindia.com. For non-cashless queries, please email customercare@mdindia.com.

- If you are a senior citizen, you can call at 020-25300126 between 09:00 AM and 06:00 PM.

- A nearby branch office or call their general helpline number at 020-66381101.

Ditto’s Take on TPAs

At Ditto, we do not work with TPAs. If you still want to choose one, pick a TPA with a strong hospital network and a good record of handling genuine claims without trouble.

That said, insurers with their own in-house claims team are usually a better option. They handle the entire process directly, which makes approvals faster and more reliable. You avoid multiple touchpoints and get smoother coordination with hospitals. In case you bought a policy through Ditto, contact us here.

Why Talk to Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Rajan below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Thoughts

Although TPAs like MDIndia Health Insurance play a crucial role in the functioning of health insurance in India, longer claims chains can create communication gaps. You may not get to interact directly with your insurer, and small administrative errors by the TPA can cause delays or mistakes in claim settlement.

Still unsure about choosing the correct insurer? Book a free call with us and let our experts guide you in making an informed decision.