Quick Overview

With healthcare costs rising by 12% to 15% annually in India, a single hospital stay for a surgery or a critical illness can leave you with a massive bill. Indemnity insurance, often referred to as a health plan, becomes crucial amid rising medical inflation and unpredictable healthcare needs. An indemnity health insurance policy ensures that you aren't left paying for expensive treatments out-of-pocket.

The Insurance Regulatory and Development Authority of India (IRDAI) defines indemnity insurance as a policy where insured losses are covered up to the sum insured under the policy.

In this article, we explore the top indemnity policy in health insurance, how it differs from fixed-benefit plans, and what it includes and excludes.

Difference Between Indemnity and Fixed Benefit Insurance

Inclusions of Indemnity Health Insurance

Indemnity insurance plans usually provide coverage for:

- Inpatient Hospitalization: Indemnity health plan pays for treatment when you are admitted for more than 24 hours.

- Room Rent: Indemnity insurance takes care of daily room charges as per policy limits and room category.

- Surgeries and Procedures: Includes surgery costs, operation theatre charges, anesthesia, and recovery care.

- Accidents and Emergency Care: Applies to hospitalization due to accidents or medical emergencies.

- Pre- and Post-hospitalization: Reimburses diagnostics, consultations, and medicines before admission and after discharge within allowed time limits.

- Domiciliary Hospitalization: Indemnity plans cover treatment taken at home when hospital admission is not possible or medically advised against.

- Daycare Treatments: Daycare treatment includes procedures that do not need 24-hour admission, such as dialysis and chemotherapy.

- AYUSH Treatments: Applies to hospitalizations under Ayurveda, Yoga, Unani, Siddha, Homeopathy, and Naturopathy.

- Annual Health Check-ups: Provides preventive tests after the waiting period, including blood sugar, cholesterol, blood pressure, and BMI.

- OPD Treatments: Usually available as an add-on in select plans. Covers consultations, diagnostics, and medicines without hospitalization.

- Consumables and Non-Medical Expenses: Items such as gloves, masks, syringes, PPE kits, and other hospital consumables are typically excluded. However, many comprehensive modern indemnity plans now offer coverage for these either as an inbuilt feature or through an add-on (for example, HDFC Optima Secure has an in-built consumables benefit).

Exclusions of Indemnity Health Insurance

Certain conditions, treatments, and situations are standard exclusions across most policies. Understanding these helps avoid unexpected out-of-pocket costs.

- Cosmetic or Plastic Surgery: Procedures performed for aesthetic reasons, such as rhinoplasty or liposuction, are not covered unless they are necessary due to an accident or medical condition.

- Diagnostic Expenses: Tests or lab work conducted purely for investigation without an actual diagnosis or subsequent hospitalization are not reimbursed.

- Self-inflicted Injuries: Medical costs resulting from intentional harm, such as attempted suicide, are strictly excluded.

- Substance Abuse: Treatment for health issues arising from the use of alcohol or drugs is not covered.

- Maternity and Newborn Care: Pregnancy-related expenses, including childbirth and prenatal care, are often excluded unless you purchase a specific plan covering them or an add-on.

- Vision and Dental Care: Routine dental work, hearing aids, and corrective eye surgeries are generally excluded unless they result from an injury.

- Experimental Treatments: Any medical procedure, drug, or therapy that is not clinically proven or remains in the trial stage is not eligible for reimbursement.

- War and Terrorism: Injuries sustained during acts of war, nuclear radiation, or civil unrest are standard exclusions.

Note: The exclusions listed above are not exhaustive. Coverage and exclusions can vary across insurers and plans, so always review your specific policy wording carefully. Additionally, claims are not allowed in the first 30 days of policy inception except for accidents. Pre-existing diseases (PEDs) are covered only after the waiting period, usually up to three years. Certain specific illnesses or treatments, like hernia, piles, or joint replacement, also have separate waiting periods of up to two years.

Top Indemnity Health Insurance Plans

Below are our top picks, based on Ditto’s 6-point evaluation framework. It considers factors like restoration benefits, claim settlement track record, hospital network size, and overall policy value.

Here, CSR stands for claim settlement ratio, ICR denotes incurred claims ratio, SI denotes sum insured, and PA implies per annum.

Why Choose Ditto for Health Insurance?

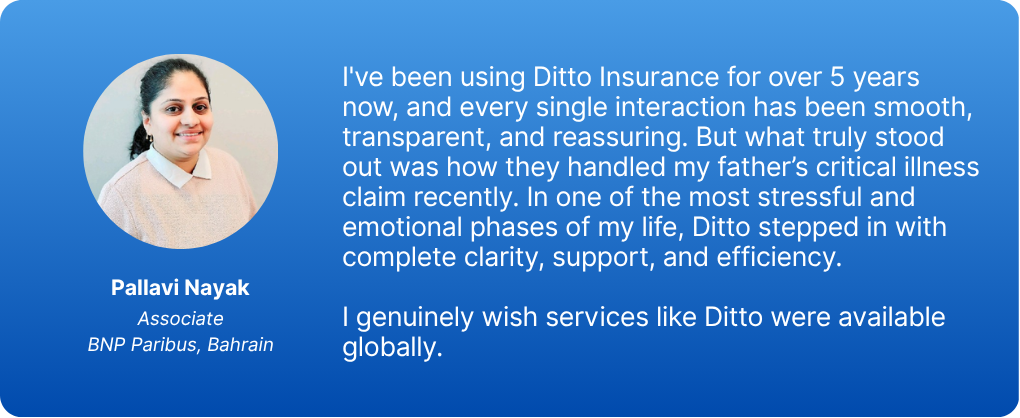

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or chat on WhatsApp with us now!

Conclusion

Indemnity insurance works as the foundation of your health cover. It pays for actual hospital bills, protects your savings during medical emergencies, and scales with rising healthcare costs. But the benefits you get depend heavily on policy wording, waiting periods, sub-limits, and restoration features. Before you buy or renew an indemnity insurance plan, review your sum insured, check exclusions, and compare features that matter for your age, family size, and medical history. For a deeper dive into selecting the right plan, see our guide on the best health insurance plans in India 2026.

Disclaimer: The information here is for informational purposes and is based on publicly available sources. Policy terms can change, so always read the policy wording and consult a licensed advisor before buying. Ditto has partnerships with HDFC ERGO, Care, Aditya Birla, and Niva Bupa. For more details on how we evaluate and recommend their plans, refer to Ditto’s Cut.

Frequently Asked Questions

Last updated on: