What is NRI health insurance?

Living abroad is exciting, until an unplanned hospitalization in India, either during a family visit or a permanent move back, disrupts everything. Fortunately, recent trends show a remarkable shift in how non-resident Indians (NRIs) approach health insurance. It’s no more a “just in case” option, but a vital part of an NRI’s finance and travel planning.

According to industry surveys, NRI health insurance purchases jumped 150% year-on-year in FY25, led by younger buyers and women. Besides insuring their parents, NRIs are also buying cover for themselves.

Here’s your ultimate NRI health insurance buying guide to understand:

- Why should NRIs get health Insurance in India?

- How does the NRI health insurance claim process work?

- Types of Health Insurance for NRIs in India and popular plans, How Can NRIs Purchase Health Insurance In India, and

- How to choose the right Health Insurance for NRIs in India?

Book a free 30-minute call with Ditto. IRDAI-certified advice, zero spam, and clarity on your policy details before it’s too late.

NRI Health Insurance: An Overview

NRI health insurance is a medical policy issued by an Indian insurer to a Non-Resident Indian [also available for a Overseas Citizen of India (OCI) and Person of Indian Origin (PIO)].

Similar to normal health insurance plans, NRI health insurance also comes with a waiting period. So, buying early is an advantage.

Why Should NRIs Get Health Insurance in India?

If India is where you wish to avail treatment (during a planned visit or after a move back), an India-issued health plan is a must. From cashless access to matured waiting periods, an India policy makes a smart base for NRIs. Here are some key advantages:

- You get cashless care in India at network hospitals: Buying a medical plan in India gives you access to network hospitals with minimal out-of-pocket expenses.IRDAI’s 2024 Master Circular on Health Insurance Business is pushing for faster turnarounds, including 1-hour cashless authorisation and 3-hour discharge approvals, and penalties on delays.This is useful for the nearly 16 million NRIs who routinely visit or move to India.

- You spend significantly less on treatment in India than abroad: Medical costs in India are comparatively lower than many developed countries. This is why many NRIs visit India to undergo critical surgeries through domestic health plans that offer higher sum insureds for the same (or lower) premium than overseas offerings.

Heads-up on NRI discounts: Several insurers advertise explicit NRI premium discounts (e.g., HDFC ERGO offers 40% NRI discount if you’re abroad the full policy year; and ICICI Lombard gives 25% “NRI Advantage” discount on the base premium for treatment while visiting or staying in India).

However, these discounts can be reversed at claim time if conditions aren’t met. For example, if you claim in India or don’t remain abroad for the full policy year, the insurer may bill the differential premium first, then process the claim. So, read the fine print before you sign papers.

- You can take advantage of cleared waiting periods: Starting April 2024, IRDAI has capped the waiting period for Pre-existing Diseases (PED) and other specific-diseases at up to 36 months.So as an NRI, buying a health plan in India 24–36 months ahead of your trip gives you leverage. Insurers allow you to reduce these with add-ons at an extra cost. Porting to another insurer with waiting-period credits is also allowed if you maintain continuity.

- You can claim Section 80D benefits: NRIs filing tax in India under the old regime can claim 80D benefits on health premiums paid through like card/UPI/cheque. The limits vary by age and members covered (self/family/parents). Cash is allowed only for preventive check-ups up to ₹5,000, and the new regime disallows 80D)

How Does The NRI Health Insurance Claim Process Work?

Similar to a normal mediclaim policy, NRI health insurance claims also work in two ways; cashless at a network hospital in India and reimbursement. However, to keep it smooth, check the network status and use a cashless facility where available. If your policy includes worldwide cover, follow the insurer’s overseas assistance and pre-authorization instructions.

Steps to follow when using an NRI health insurance plan with a worldwide cover:

- Call the overseas assistance number on your e-card before treatment (mandatory for planned admissions).

- Ask upfront if cashless abroad is available via an assistance partner.

- Confirm scope (emergency vs. planned), country exclusions, caps/co-pays, and document requirements.

- Save the pre-approval, other bills and reports, and follow the preferred submission route (through the insurer app/portal/email).

For a hassle-free claim (cashless/reimbursement), prefer cashless where available and follow your health insurer’s overseas claim process, not travel-policy rules. If there’s a delay on the insurer’s part, ask the hospital TPA desk to re-submit with clarifications.

If the issue is not resolved, call the insurer helpline, quote your claim/reference ID and ask for a status update or escalate the matter using the regulator’s grievance portal with all case IDs and documents.

What Are The Different Types of Health Insurance for NRIs in India?

Health insurance for NRIs in India has various types. There are India-only base plans, Indian plans with worldwide-cover, and some other alternatives. Here’s a closer look at each type, when to use it, top-up options, and riders.

- India-only base plan (indemnity): This plan is the best pick if the majority of treatment is scheduled to take place in India, say during family visits or after a permanent move back. One can get cashless access at Indian network/PPN hospitals with predictable premiums, but waiting periods (PED/specific ailments) still apply.

For example, an NRI visits India twice a year and plans to return for good in 24 months. In this case, one can buy a ₹10–25L base plan so that the waiting period is cleared before they relocate. - India-based plans with worldwide-cover riders: The scope of India-based health plans with overseas protection varies by insurer (caps, co-pays and pre-authorization limits can be tight).

Say you work in Dubai, plan for a surgery in India, and want cover for overseas emergency fallback. In this scenario, you’ll need to keep a strong India-based policy, add a rider that covers emergency hospitalization overseas, and confirm how cashless works aboard. Additionally, check for assistance partners, country list, and limits of the opted policy. - Global / Expat health insurance: This type of health insurance plan works best if you live and get most medical treatment outside India and want a single policy to cover across countries. It gives you access to broader direct-billing networks, optional OPD/maternity, and evacuation, but comes at higher premiums and region-based pricing.

For example, you stay in Singapore and have a planned maternity. So, pick an expat policy with your region of cover, check deductibles/co-insurance, and add India as a covered region. - Travel insurance with medical cover (short-stay only): This type of health plans for NRIs in India are actually trip-linked emergency cover for brief visits. They work great for visas and sudden mishaps, but not for year-round healthcare needs.

Let’s say you’re on a two-week US trip from India (or your parents are visiting you abroad). So, you buy a travel medical plan for that particular window. However, always rely on your base/expat policy for ongoing care.

Learn more about how to choose between travel Insurance and medical insurance with international coverage.

Key questions to ask yourself when choosing the right type of NRI health insurance plan in India:

- Do you mostly stay abroad and visit India rarely?

Choose a global/expat plan as the primary cover and add India cover for planned treatments. - Do you visit India twice a year or have plans to move back in 2–3 yrs?

Go for a comprehensive India-base plan. This will clear the waiting period and help accumulate bonuses. - Do you travel often or live abroad temporarily with most treatments expected in India?

Pick an India-based plan as the primary cover and add a worldwide rider for limited overseas stay or take up a travel insurance. - Do you want a high cover on a budget?

Pick an India-based plan with a super top-up to hit ₹50L–₹1Cr. For maximum benefits, set the super top-up deductible equal to your base plan’s sum insured.

How Can NRIs Purchase Health Insurance In India?

NRIs can purchase health insurance in India while still being overseas. You’ll need a regulator-approved eKYC that allows you to pay in Indian Rupee (INR) via a Non-Resident External (NRE) or Non-Resident Ordinary (NRO) account. Then, you’ll receive an e-policy with a 30-day free-look period.

Here’s a step-by-step process for NRIs to purchase health insurance in India.

- Confirm the KYC route: According to IRDAI’s AML/CFT Master Guidelines (2022), insurers can onboard an NRI using any of the IRDAI-approved methods, like Aadhaar (online/offline), Digital KYC, VBIP (video-KYC), CKYC identifier, or officially valid documents, and by submitting PAN/Form 60.

- Proposal and medical underwriting: An NRI will need to fill a disclosure form and depending on the age/sum insured/medical history, a tele-medical or lab test will be scheduled (varies by insurer).Insurers will also need a board-approved underwriting policy covering all conditions. Using the same approval, these tests will be conducted in-person when the NRI visits India.

- Pay the premium in INR: An NRI can use INR from their NRE/NRO account or use an Indian instrument to pay the premium amount. This is classified as local disbursements by the RBI and a permissible debit from NRE/NRO accounts.

- Get the policy digitally and use the free-look: Insurers can issue an e-policy and an NRI gets 30 days from receipt to review and cancel if terms don’t fit their needs.

- Add a nominee immediately: Nomination for the health policy that an NRI buys is required immediately and can be updated anytime.

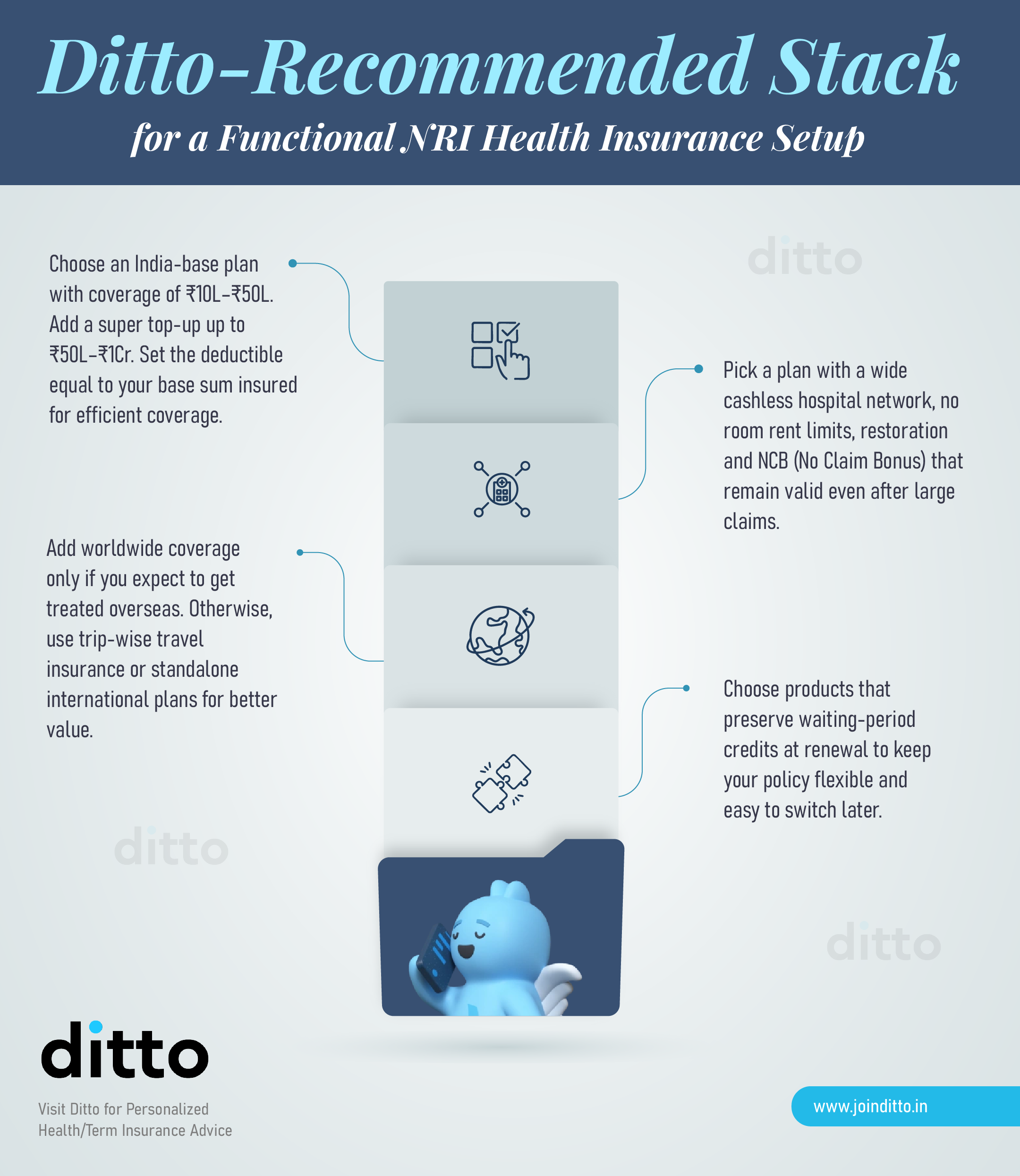

How to Choose the Right NRI Health Insurance: Ditto’s Take

Choosing the right NRI health insurance can be tricky. So, always start with where you actually want to get treated. Then, check and confirm cashless hospitals near your city and avoid plans with room-rent caps, disease sub-limits, or co-pays.

Popular NRI Health Insurance Plans: Ditto’s Recommendations

Here’s a quick look at some of the popular health insurance plans that NRIs can consider for India-only hospitalization. Pick any one health insurance as your India base plan. You can add a super top-up later and set the deductible to match the base cover. If you expect most treatment outside India, choose a global or expat policy instead.

Before we discuss the list, here’s how we decide what plans to feature.

At Ditto, every health plan goes through our six-point evaluation framework. It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars.

You can learn more about how we evaluate health insurance plans here.

1) HDFC ERGO Optima Secure

A solid “first base” plan with upgrade-style features that enhances protection with time. Works well as a family floater and when paired with a super top-up, it offers a wide coverage without wrecking premiums.

2) Care Supreme

A reliable India-first cover with practical benefits and decent modern-treatment breadth for the price. A good fit for young families who want straightforward coverage and clean servicing.

3) Aditya Birla Activ One Max

A feature-dense plan with flexible sum insured options and strong wellness/OPD ecosystem. The plan offers a good network and add-ons with coverage for pre- and post-hospitalization as well as day-care treatments and modern procedures.

4) SBI Super Surplus Platinum Infinite

A plan that offers high coverage on budget and can be layered on top of your base plan. You can also set the deductible to match the base cover. Ideal if you want ₹50L–₹1Cr total protection without paying base-plan rates for all of it.

5) Niva Bupa ReAssure 2.0 Platinum+

An India-focused health plan with generous restoration and continuity mechanics that preserve cover across years. Stands out with its long-term value especially when you want the “buy once, hold for years” benefit.

If you’re also planning life cover from India, do check out our dedicated guide on NRI term insurance plans.

Why Choose Ditto For NRI Health Insurance

At Ditto, we’re India’s most trusted place to buy insurance with IRDAI-certified advisors, and a no-fluff, only functional advice policy. And to date, we’ve helped 8,00,000+ people make smart insurance choices that fit their unique life needs. In doing so, we’ve earned what we call ourselves; “Ditto” because we recommend only what we’d buy ourselves.

For NRI health insurance, planning is everything, and we can help you design a robust, global-ready setup (with an India-based plan, super top-up, and the right expat layer) that covers you at home and overseas.

However, cross-border claims for OCI/NRI applicants can get messy with different medical formats and languages, “medical necessity” checks, and coordination with overseas doctors across time zones.

Because of these friction points, we’re not currently assisting with the purchase of policies for OCI/NRI applicants. But we’re already ready to help with general queries, insurance coverage design, and placing India-only policies for a NRI’s family living in India.

Key Takeaways:

- NRI health insurance is issued by an Indian insurer and covers hospitalization in India by default. Add a worldwide rider or pick a global plan to cover overseas treatment.

- Buy an NRI health insurance plan 24 to 36 months before a planned treatment to clear waiting periods. IRDAI caps Pre-existing Diseases (PED) and specific-disease waiting periods for up to 36 months.

- Prefer cashless at network hospitals in India. IRDAI timelines target pre-auth within 1 hour and discharge approval within 3 hours.

- Build your NRI health cover in layers. Take an India-based plan, add a super top-up, and set the deductible equal to the base sum insured.

No matter how you want it, always prioritise hospital network strength and clean terms and conditions. Still unsure? We’ve got you! Book your free call now to have full clarity on NRI health insurance in 30 minutes flat!

FAQs

Does an India-issued health policy cover treatment abroad?

No, base policies cover treatment in India only. You will need a worldwide rider or choose a global or expat health plan for overseas treatment. Check the scope, cap limit, co-pay clause, and covered country list before buying.

Where can I buy NRI Health Insurance?

NRI health insurance can be purchased either through a qualified, IRDAI-licensed advisor/broker with a proven NRI claims track record or via a dedicated claims/post-sales desk. If you’re comfortable with self-serving, you can consider buying directly from the insurer. Avoid inexperienced or secondary channels (banks/fintech marketplaces) that can’t back you up on documentation, cashless, and claim follow-through.

Can an NRI buy health insurance in India while living abroad most of the year?

Yes, insurers can onboard NRIs/OCI/PIO using approved KYC methods (Digital KYC/OVD, CKYC, or VBIP). Premiums can be paid in INR from NRE/NRO accounts, and policies can be issued digitally with a free-look window.

What documents/KYC do I need if I apply from overseas?

The common documents you need to apply for an NRI health insurance plan from overseas are passport/OCI card, PAN or Form 60, and address proof. The insurer may use Digital KYC/OVD, CKYC, or VBIP to complete your onboarding.

How do cashless timelines work for hospitalizations in India?

The pre-authorization for a hospitalisation in India is required by the IRDAI to be decided within 1 hour and discharge approval within 3 hours. The reimbursement (non-cashless) claims have a 15-day settlement timeline. Delays beyond the discharge TAT are borne by the insurer.

Can I port an existing India health policy as an NRI?

Yes, you can port an existing India health policy as an NRI only at renewal. Start at least 45 days before expiry to carry waiting-period credits to the new insurer.

How do I pay the premium from abroad?

You can pay your health insurance premium from abroad in INR via NRE/NRO account. According to the RBI, all such payments are classified as local disbursements and permissible debits.

If I bought health insurance as a resident and later became an NRI, can a claim be rejected because I didn’t update my status?

Unlikely, if the claim is otherwise valid and you submit complete KYC at claim time. That said, promptly intimate your insurer and get an endorsement updating your residency to avoid delays, differential premium issues, or territorial-cover disputes.

How should I pick the right cover and add-ons for an NRI health insurance?

For NRI health insurance, choose your primary treatment location first. If India is primary, get a strong base plan with no room-rent caps and add a super top-up. Add worldwide cover only if you expect overseas care.

Is there a free-look period if I buy my policy digitally?

Yes, there’s a 30 day free-look period for your health policy across all channels (online, offline, and distance-mode)

How early should an NRI buy to clear waiting periods?

NRIs should buy at least 24 to 36 months before a planned visit or move back. IRDAI caps PED and specific-disease waiting periods at up to 36 months.

Can I claim Section 80D benefits as an NRI?

If you file in India under the section 80D of the old regime, health premiums paid by non-cash modes may qualify within prescribed limits. The new regime however doesn’t allow deductions.

Last updated on: