Quick Overview

Till recently, one of the biggest hurdles to buying personal health insurance was the price. This is something we heard time and again while helping over 8,00,000 people find the right cover. Even though health insurance is a necessity, it attracted a Goods and Services Tax of 18% - higher than what you’d pay on discretionary spends like a packet of namkeen, which was taxed at 12%.

To fix this imbalance, the central and state governments came together to remove GST from retail health insurance products, while continuing to levy it on group health insurance plans.

In this article, we’ll break down what GST is, how it applies to health insurance, and what these changes actually mean for your real-world savings.

GST on Health Insurance: Rules in India

Pro Tips:

- Group health insurance plans, such as those offered by employers, banks, or alumni associations, continue to attract 18% GST.

- While GST has been removed from health insurance premiums, a 5% GST still applies to non-ICU hospital rooms with rent exceeding ₹5,000 per day.

Impact of GST on Health Insurance

Before the Removal of GST

Earlier, health insurance premiums attracted 18% GST. This hit senior citizens the hardest, where the GST alone could run into tens of thousands of rupees for some family floater plans. To stay within budget, many people ended up choosing lower sum insured options. This continued partly because the government was collecting significant revenue of around ₹8,263 crore in FY 2023–24 from health insurance alone.

After the Removal of GST

After GST was removed, premiums have dropped noticeably, especially for senior citizens. That said, insurers have also lost the Input Tax Credit (ITC) they earlier used to offset their own GST costs. When a supply becomes exempt, insurers generally can’t claim ITC on expenses linked to that exempt supply (commissions, operations, vendor GST, etc.) Over time, this could lead to an increase in base premiums to make up for that loss.

Sample Premium Differences

Note: The above premiums are for the HDFC Ergo Optima Secure plan for individuals or families residing in Delhi. To know the methodology behind why we recommend certain plans, refer to Ditto’s Cut and Framework.

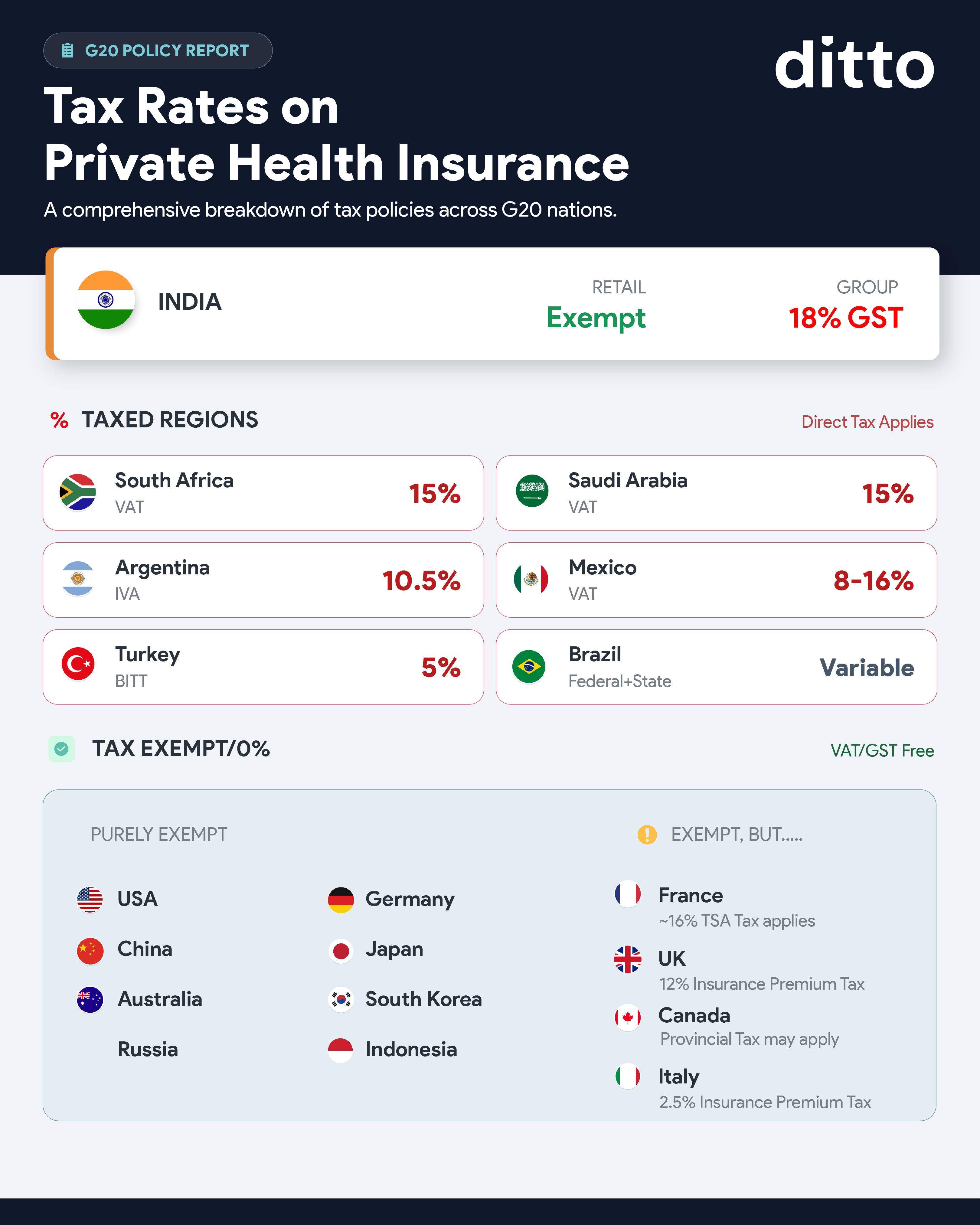

The following infographic shows the tax rates on private health insurance across G20 countries, including India.

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now, slots fill up fast!

Ditto’s Take on Removal of GST in Health Insurance

With insurers losing ITC benefits, experts expect base premiums to rise over time. Locking in a 2 or 3-year policy today could lead to meaningful savings if that happens.

- If your budget allows, consider using the GST savings to opt for a higher sum insured. At Ditto, we generally recommend ₹15 -25 lakh of cover to create a buffer against rising medical costs.

- If the room you choose during hospitalisation costs more than ₹5,000 per day (non-ICU), a 5% GST will still apply. While health insurance should cover this cost as per policy limits, it helps to factor this in while planning.

- The GST exemption does not apply to certain group health insurance policies. So, always confirm whether you’re buying an individual or group plan.

There is no denying that health insurance has become quite affordable with the reduction in GST. If you are also looking to buy a policy anytime soon, refer to these health insurance plans that make it to Ditto’s cut.

Frequently Asked Questions

Last updated on: