How do insurance companies make money? That’s a question many people ask. You might wonder, “Where does all the money go?” when you pay your premiums, how insurers remain profitable while still being able to pay claims and will they be able to pay it going forward?

In this article, we cover this in detail. You’ll get a clear breakdown of:

- the financial mechanisms behind the industry, and

- how insurance companies manage risk, revenue, and claims.

By the end, you’ll have a solid understanding of how insurance companies make money and the strategies they use to turn premiums into profit.

The “best” plan depends on your individual needs. That’s why it’s important to research carefully or, even better, consult one of Ditto’s IRDAI-certified experts for reliable guidance. Schedule a 30-minute call with us today to get personalized insurance advice!

How do Insurance Companies Make Money?

Insurance companies make money in mainly two ways: through underwriting and investing.

How do Insurance Companies Make Money?

Underwriting

Underwriting is how insurers evaluate risk and set premiums. They collect policy payments, assess the likelihood of claims, and aim to earn a profit when total premiums exceed claims and operating costs. Careful claims management and risk assessment strategies help make underwriting profitable.

Investments

Insurance companies invest the premiums they collect in safe, stable assets like government bonds and fixed deposits. The income from these investments such as interest, dividends, and capital gains, provides a steady profit stream that often exceeds underwriting earnings, while ensuring funds are available to pay claims.

Underwriting

Underwriting is the core business of evaluating risk. This is where an insurer decides if they should cover you and how much they should charge.

- Premiums: This is the cash flow into the business. It’s the amount you pay for your policy. The collective pool of premiums is what they use to cover losses.

- Risk assessment: Actuaries (insurance mathematicians) analyze massive amounts of data. They determine the likelihood of you filing a claim.In health insurance, for example, someone with a history of chronic illness, such as diabetes, may pay higher premiums, while a younger, healthy person pays less because they are less likely to need expensive medical care. Smokers or people with high-risk lifestyles may also face higher premiums (loading charges) due to their increased health risks.

- Underwriting profit: This profit is made when the total premiums collected outweigh the total claims paid plus the operating costs. If a company can consistently do this, they have a healthy core business.

- Claims Management as a Strategy: In health insurance, careful strategies like contracting with a tight network of hospitals, pre-authorization controls, and fraud detection analytics, can turn loss-making operations into profitable ones, often without increasing premiums.

Investments

When an insurance company collects your premium, they don't hold it in a vault waiting for a claim to happen. They invest it. This money is sometimes called the "float" or "reserves."

- Portfolio management: An insurance company’s finance team carefully selects investments, primarily focusing on safe, stable assets like government bonds, treasury bills, fixed deposits, and high-quality approved securities, as mandated by IRDAI’s Investment Regulations (Section 27/27A of the Insurance Act). These investments ensure funds are available when major claims arise.

- Investment income: The interest, dividends, and capital gains earned from these investments form the investment income. For many large insurers, this income stream is actually larger and more consistent than their underwriting profit.

- Risk management: They must balance the need for high returns with the absolute necessity of safety and liquidity. They need to be able to sell the investment quickly to pay a claim.

The impact of these strategies is reflected in the recent profits of India’s leading insurers.

Recent Profit Leaders in Indian Insurance Market (FY 2024–25)

The latest audited results show strong profitability across major insurers, driven by better investment income and improved underwriting:

| Life Insurance (₹ Crore) | General Insurance (₹ Crore) | Standalone Health Insurance (₹ Crore) |

|---|---|---|

| LIC: 48,151 | ICICI Lombard: 2,508 | Star Health: 787 |

| SBI Life: 2,413 (+27% Year over year (YoY) | Bajaj Allianz GI: 1,832 (+18% YoY) | Niva Bupa: 203 |

| HDFC Life: 1,802 (+15% YoY) | New India Assurance: 988 | Care Health: 155 |

| ICICI Prudential Life: 1,189 (+8% YoY) |

Other sources of revenue

While underwriting and investments are the main drivers, some smaller revenue streams also add to the bottom line.

- Administrative fees: These are smaller fees charged for things like policy modifications, late payments, or document issuance.

- Reinsurance: This is "insurance for insurance companies." When an insurer passes off a portion of a big risk to another company (a reinsurer), they also pass on a portion of the premium. This fee contributes to revenue.

- Ancillary services: Some companies offer extra services like roadside assistance for car insurance, health consultation add-ons, or travel assistance. Fees for these optional services add to revenue.

How Do Insurance Companies Manage Claims and Costs?

The simplest way to think about insurance is as a massive pooling of money. Everyone pays in, and only a few take money out when a covered event happens. The company’s goal is to ensure that the total money in (premiums) is significantly more than the money out (claims and costs).

To maintain this balance, they focus heavily on managing claims and costs:

1) Loss Ratio Control

To ensure profitability, insurance companies closely monitor how much of the premiums collected are paid out in claims. One key metric they track is the Loss Ratio or Incurred Claim Ratio, which measures the percentage of premium income used to cover claims. By carefully assessing and managing claims, insurers aim to keep this ratio low (for example, 60% instead of 80%), ensuring that more money remains within the company.

2) Claims Assessment and Management

- Claims assessment: Insurance companies carefully assess every claim. They make sure the claim is valid and covered by the policy.

- Claims negotiation: Sometimes, the initially requested claim amount is negotiated down with the hospital. This is to ensure a fair settlement that reflects the actual loss suffered.

- Subrogation: This means they seek to recover costs from a third party. For example, if your car is damaged by another driver, the insurer pays you, and then they legally pursue the at-fault driver's insurance company to get that money back.

3) Efficient Claims Processing

A smooth and quick claims process doesn't just make customers happy; it saves the company money. Below are some key strategies they use to cut costs:

- Reduced administrative costs: By using technology, a company can automate processes. Less paperwork and manual work mean fewer operational expenses.

- Faster claim settlement: Quicker resolutions save on the costs associated with prolonged legal disputes and processing delays.

- Customer retention: When customers have a smooth claims experience, they are more likely to renew policies, buy additional products, and recommend the insurer to others. Stable customer numbers mean a stable flow of premium revenue.

4) Fraud Prevention and Detection

Fraud is a major cost for the insurance industry. Every rupee paid out on a fraudulent claim is a direct loss. Here’s how they prevent it:

- Identify fraudulent claims: Companies use advanced data analytics and algorithms to spot patterns typical of fake or exaggerated claims. By analyzing large volumes of historical claim data, insurers can flag claims that deviate from typical trends that help them catch potential fraud early and reduce unnecessary payouts. Health insurers use the reasonable and customary (R&C) clause, which ensures that only standard and customary medical expenses are covered. This prevents overbilling or inflated claims.

- Investigate suspicious claims: When a claim raises a red flag such as inconsistent or incomplete information, repeated claims by the same policyholder, or suspicious timing (made immediately after purchase), insurance companies deploy specialized investigation teams to examine it in detail. These teams gather evidence, interview relevant parties, and verify documentation to ensure the claim is legitimate. This careful scrutiny not only prevents financial losses but also acts as a strong deterrent against future fraudulent attempts.

- Fraud awareness and training: Educating employees and sometimes even customers help to recognize and prevent fraudulent attempts before they become a loss.

ULIPs generate more revenue from commissions and fees, and they are attractive to customers who want both insurance and investment benefits. These products also offer long-term opportunities for upselling and cross-selling, making them more lucrative for insurers and widely marketed compared to simple term insurance plans.

Regulations That Affect How Insurance Companies Make Money

Insurance companies’ profits are heavily shaped by regulatory rules. Key areas include:

- Solvency Ratio (≥150%): Insurers must maintain at least ₹1.50 of assets for every ₹1 of risk. Falling below 150% requires raising capital or slowing sales, which can reduce short-term profits. A higher ratio ensures financial health but ties up funds.

- Investment Regulations: IRDAI limits where insurers can invest premiums (“the float”) to protect policyholders. Safe assets like government securities dominate, while equities and real estate are capped. This ensures moderate returns (typically 5–7%) that influence overall profitability.

- Product & Charge Rules: Standardized pricing, caps on ULIP charges, and regulated guarantees prevent overcharging but limit fee income. Transparency and consistency also improve long-term policy retention and profits.

- Expenses & Commissions: Boards set disciplined spending limits under flexible rules. Controlling management expenses lowers the combined ratio in health insurance or increases life insurance margins.

Why Choose Ditto for Insurance?

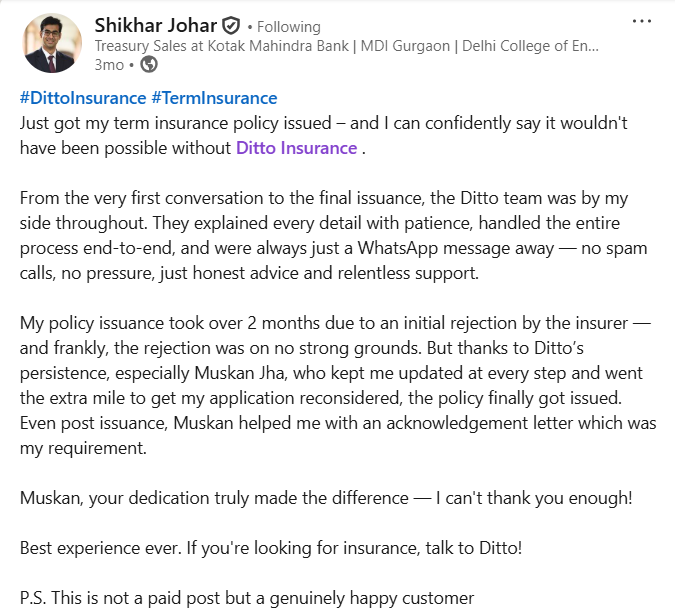

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Srinivas below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

Ultimately, “how do insurance companies make money” comes down to two key abilities: being a successful risk manager and a savvy investor. They need to be excellent at predicting the future (actuarial science) and managing their costs (efficient operations).

The two engines: collecting more in premiums than they pay out, and earning significant returns on their invested reserves without taking on too much risk, work together to ensure the company remains profitable and financially stable enough to pay your claims when you need them the most.

In India, insurance profitability varies by product and business model. Life insurance grows slowly due to long contracts and high initial costs, with margins improving after 5–7 years. ULIPs earn mainly from fees, non-linked plans depend on interest spreads, and participating plans share most surplus with policyholders.

Health insurance operates annually, relying on a combined ratio below 100% or investment income for profit. Overall, profitability depends on product mix, cost control, claims efficiency, regulatory compliance, reinsurance, and customer retention, ensuring balanced and sustainable returns.

FAQs

What affects the profit margins of insurance companies?

Key factors affecting insurance company profits include the number of policies sold, premiums charged, claims paid, investment returns, and operational costs. Catastrophic events, poor investments, or high fraud can reduce profitability, while strong competition can lower premiums. Efficient operations and a controlled loss ratio are crucial for healthy margins.

Do insurers profit if I surrender or lapse a policy?

Sometimes. In ULIPs (Unit Linked Insurance Plans), insurers may earn some profit through regulated discontinuance charges or because they avoid paying long-term benefits. However, in other types of policies, early lapses can actually hurt profitability since the company loses out on future premiums and margins. The impact varies case by case, depending on the product design and timing of the lapse or surrender.

What is the 'Loss Ratio' in insurance and why does it matter?

The Loss Ratio is a core financial metric. It is the percentage of collected premiums that an insurer pays out in claims. For example, if a company collects ₹100 in premiums and pays ₹65 in claims, the loss ratio is 65%. A lower loss ratio is always better for the company’s profitability.

What is the 'Combined Ratio' in insurance?

The Combined Ratio gives a complete picture of underwriting profitability. It is calculated by adding the Loss Ratio (claims-to-premiums) and the Expense Ratio (operational costs-to-premiums). If the combined ratio is less than 100%, the company is making an underwriting profit. If it is above 100%, underwriting operations are running at a loss since claim and expense costs exceed premium income. However, the combined ratio does not include investment income, which is a crucial part of an insurer’s total profit.

Why do insurance companies invest the premiums?

They invest the premiums because they don't need all the money right away. There is a delay, sometimes years, between collecting a premium and paying a claim. This cash pile, known as the "float," is put to work earning investment income. This allows them to keep premiums lower than they otherwise would have to be.

What is the difference between an insurance company and a reinsurance company?

An insurance company sells policies directly to individuals or businesses (like you and me). A reinsurance company sells policies to other insurance companies. Reinsurance helps the primary insurer manage and spread very large or risky losses, ensuring they don't go bankrupt after a major disaster.

Last updated on: