₹ 1 Crore Health Insurance Plans

Introduction

The healthcare industry has witnessed a considerable spike in expenses over the years. This significant hike in costs can be attributed to the collaborative impact of national economic inflation, advancements in the medical sector, the aftermath of the pandemic outbreak, and the rising cost of medical equipment and services.

Given this situation, it may make sense to reconsider your current coverage (especially if you have opted for a family health insurance policy). With this in mind, a ₹ 1 Crore health insurance plan sounds adequate to cover any hospitalisation expenses that can include advanced treatments, long-term treatments for chronic ailments, transplants, and more. Additionally, in most cases, a ₹ 1 Crore health insurance plan can also offer coverage for international treatments along with a few other premium perks.

However, opting for a ₹ 1 Crore health insurance policy incurs a significant premium. Hence, making an informed decision about whether you should get it, what the top health insurance policies offering ₹ 1 Crore coverage, and tips for choosing the same - are essential.

What are the Best ₹ 1 Crore Health Insurance Plans?

| Top Health Insurance Plan | Room Rent Restrictions | Copayment | Disease-wise Sub-limits | No Claim Bonus/Loyalty Bonus | Other Perks | Drawbacks |

|---|---|---|---|---|---|---|

| HDFC ERGO Optima Secure | No restrictions | No mandatory copayment | No | 50% per year (up to 100%) | Secure Benefit doubling base coverage from day one; extensive hospital network; add-on for unlimited restoration | Higher premium compared to other plans; no add-ons to reduce the 3-year waiting period for pre-existing diseases |

| Care Supreme | No restrictions | No mandatory copayment | No | 100% per year (up to 500%) | Super Credit benefit offering up to 500% loyalty bonus; HealthReturns program rewarding active lifestyle with discounts on renewal premiums; unlimited restoration | There is a slight increase in complaint volume |

| Niva Bupa ReAssure 2.0 (Titanium +) | No restrictions | No mandatory copayment | No | Booster+ carry-forward bonus multiplying coverage up to 11 times | Lock the Clock feature locking premium at entry age until the first claim; ReAssure Forever provides unlimited restoration | Insurer's claim settlement ratio and complaint volume could be better |

| ICICI Lombard Elevate | Single Private Room (Add-on available to remove restrictions) | No mandatory copayment | No | 20% per year (up to 100%) | Add-ons for unlimited coverage, maternity & inflation-adjusted cover amount | Insurer's claim settlement ratio & network of hospitals have room for improvement |

| Aditya Birla Activ One VIP Plus | No restrictions | No mandatory copayment | No | 50% per year (up to 100% or ₹4 cr, whichever is lower) | Comprehensive international coverage including USA and Canada; in-built travel insurance; maternity coverage up to ₹2 lakhs | Higher premiums due to specific benefits like maternity and international coverage |

A Quick Word: Did you know that going through insurance policy wordings means simultaneously scanning a financial, medical, and legal document? And well, that sounds taxing!

Here's what we suggest — leave that part to us! with us and get solid insurance advice from IRDAI-certified advisors! No spam, no cold calls - just a conversation for your customised policy!

Limited slots! Book today!

Should You Opt for ₹ 1 Crore Health Insurance Policies?

If you take a quick look at the hospitalisation expenses, surgery costs, doctor visits, and diagnostic tests from a decade ago and compare them with the current prices, you will be looking at quite a significant difference.

Against the backdrop of a track record of price hikes and an ever-shooting inflation rate, opting for a high coverage of ₹ 1 Crore guarantees a massively comprehensive financial protection to shield your savings in times of medical emergencies.

Say you have opted for a family health insurance plan. In that case, ₹ 1 Crore coverage will be adequate to cover the expenses incurred by the adults (even if there are senior citizens in the plan who require frequent hospitalisation and are susceptible to multiple ailments) and the children in the plan.

Now, if you are looking at a ₹ 1 Crore health insurance policy, there are two ways to avail of the coverage -

| Types of ₹ 1 Crore health insurance plan | Benefits | Drawbacks |

|---|---|---|

| Single comprehensive health insurance policy with ₹ 1 Crore coverage | When you opt for a single plan, the management and renewal of the policy become smooth and convenient. | Single plans with ₹ 1 Crore coverage can surely incur a significant premium that will take a toll on your savings. |

| A combination of a base health insurance plan and a super top-up | A combination of base plan and super top-up that yields ₹ 1 Crore coverage is a much more affordable option. This is because super top-ups are extremely pocket-friendly despite offering significant coverage. So, you can opt for a ₹10 - 20 lakhs base health insurance plan and purchase a super top-up policy for the residual coverage. If your base policy cover is exhausted, your super top-up plan will kick in, thus ensuring that you don't end up paying from your pocket. | Management of multiple plans can be a hassle. Super top-up health insurance plans are not usually comprehensive. They come with a list of restrictions, including room rent restrictions. |

Now, the question of "whether you should opt for a ₹ 1 Crore health insurance plan?" needs to be answered across 1 more front - do you need the ₹ 1 Crore cover?

Health insurance plans, as you know, are not a "one-size-fits-all" financial product. Determining the right health insurance coverage is a customised decision that depends on multiple factors -

How do you calculate the right health insurance coverage?

The ideal coverage of your health insurance policy depends on the following factors -

- Age of the policyholder: The insured individual's age significantly impacts the chosen ideal cover. The higher the age, the more the chances of acquiring ailments quicker, requiring you to opt for a higher cover amount. On the other hand, if you opt for a health insurance plan at a younger age (less risky profile since there are lower chances of payouts because the insured is healthier), you can go ahead with a lower cover amount and hence pay a lower premium.

- Number of members in the policy: If you are looking for ₹ 1 Crore coverage for family health insurance, you must factor in the number of policyholders to be covered under the plan, their health conditions, and respective medical requirements.

- Pre-existing medical conditions: In case you or any member to be covered under the health insurance policy has a pre-existing ailment or a genetic predisposition towards a disease (not yet diagnosed with), you will need to disclose this. While the insurer will increase your premium based on this as they add on a loading charge, you will need to boost your coverage, too.

(Please note: Computing the ideal health insurance coverage is a cumbersome task since different ailments incur a wide range of costs. Hence, it is always advisable to who can not only help you out with an ideal cover amount but can also guide you about the best possible health insurance plans that will offer you ₹ 1 Crore coverage, will require less waiting period, cover your pre-existing ailments, and nominal restrictions.

Accordingly, you can compare the best health insurance plans for free and decide upon the most affordable and comprehensive policy that caters to your customised requirements.)

What Should You Look for in a ₹ 1 Crore Health Insurance Plan?

Say you have opted for a ₹ 1 Crore health insurance policy. Subsequently, you will be paying a substantial amount as a premium. Under such circumstances, the least expectation you can have is that your health insurance policy must have all of the state-of-the-art insurance features that will prevent you from spending any more out of your pocket.

So, here are a few features you should be seeking in your ₹ 1 Crore health insurance policy -

Talk to an expert today and

find the right insurance

for you.

Minimum to no restrictions

- Copayments: Your ₹ 1 Crore health insurance plan must not have copayments that will require you to pay a share of the hospital bill. Otherwise, you will end up paying a substantial amount as bills despite paying a hefty premium towards your policy.

- Room rent: Exceeding room rent restrictions incurs a pro-rata charge of the total hospital bill. Hence, opt for a plan that has no room rent restrictions.

- Disease-wise sub-limits: If you have opted for a health insurance plan that offers coverage of ₹ 1 Crore, the least you would want is that your policy covers the total cost of any and all procedures, treatments, and surgeries. This requires you to have a plan that has no disease-wise sub-limits.

Unlimited restoration

It is highly unlikely that you will exhaust the amount despite having a ₹ 1 Crore cover in your health insurance plan. However, say you have a treatment/procedure/surgery in mind that will require you to contact a foreign specialist. Since offshore medical treatments incur quite an extensive bill, the ₹ 1 Crore coverage might just be adequate. In that case, having an unlimited restoration perk would be extremely beneficial to ensure convenient financial coverage of medical treatments for the rest of the year.

Nominal waiting period

- As per IRDAI's latest updates, the maximum waiting period for pre-existing conditions is 3 years. Ideally, the best health insurance plans will offer you the lowest waiting periods or an add-on to reduce them.

- On the other hand, standard health insurance policies won't require you to wait out for coverage of accidental injuries (they are covered from Day 1) and a 2-year waiting period for specified illnesses, as mentioned in the policy document.

- However, if you opt for maternity coverage, make sure that the waiting period is between 9 months to 2 years.

Coverage for lifestyle ailments

Some lifestyle ailments (such as Asthma, Blood Pressure, Cholesterol, and Diabetes) are extremely common among the masses. Taking a cue from this, insurers now offer a few top health insurance plans that cover these lifestyle ailments immediately post-purchase or after a month instead of the standard 3-year waiting period. So, if you have a pre-existing ailment, make sure to check if the preferred plan offers coverage for the same, either as an inbuilt feature or an add-on. With a ₹ 1 Crore coverage in hand, you would want no such exceptions or delays in coverage.

Solid No-Claim Bonus

A No-Claim Bonus boosts your cover amount during renewal without having to up your premiums. This is a solid and affordable way to boost the existing coverage. Now, while a good No-Claim Bonus can be anywhere north of 100%, nowadays insurers also offer bonuses that are capped at 500%. Maybe shop around a bit for this perk?! (imagine getting your ₹ 1 Crore coverage pumped into 5 Crore coverage without paying a single penny, considering you don't make claims and cause a clawback or pause in your bonus growth graph).

Friendly reminder: It's easy to get lost comparing policies and premiums. Instead of spending hours on it, why not get personalised insurance advice from Ditto? We offer free consultations with zero spam! Just 30 minutes to clarify all your doubts.

Premium features

International Coverage: In case you have a planned surgery or treatment that is available only outside India or are a frequent traveller (ailments can hit at any time), the ₹ 1 Crore coverage would come pretty handy with international coverage. Remember, international treatments are pricier and hence would incur a hefty total bill.

NOTE: With health insurance plans that offer international coverage, the premiums are significantly high. So, it's only a good perk to go ahead with if you are an entrepreneur who frequents foreign lands or has a treatment/surgery in mind that can be done only outside India.

OPD coverage: In some of the popular health insurance policies, insurers offer OPD coverage that takes care of the doctor's fees, diagnostic tests, pharmacy bills, etc. However, this coverage always comes with a sub-limit that varies based on the base sum insured. However, in the case of the ₹ 1 Crore health insurance plans, the cap shouldn't be a hurdle since the base sum insured is ample.

NOTE: More often than not, the cap on the OPD feature isn't adequate, and the perk earned doesn't justify the additional amount to be paid off as a hiked premium.

Maternity coverage: C-sections and regular deliveries incur quite a lot. Add on to this the pre-and post-natal charges, and you will have a hefty expense on your hands. Maternity coverage in your ₹ 1 Crore health insurance policy might be a solid resolution. The perk will offer you a capped amount to meet the treatment charges of the mother and the newborn.

NOTE: The maternity perk comes with a limit on its coverage. This sub-limit may prove to be restrictive since it might not cover all expenses for the occasion. On the other hand, the maternity perk can be banked only twice in a policy lifetime in most cases, and yet you will have to continue the high premiums across the entire policy tenure.

What are the Top ₹ 1 Crore Health Insurance Plans?

HDFC ERGO Optima Secure

- Features: HDFC ERGO Optima Secure provides a unique Secure Benefit that instantly doubles your base coverage amount from day one, offering twice the sum insured immediately without any extra premiums. This means that if you purchase the policy with a ₹ 1 Crore base cover amount, it instantly becomes ₹ 2 Crore. The plan ensures comprehensive protection by covering modern treatments and a wide array of medical expenses, making it a good option for those needing extensive coverage. Additionally, it includes access to an extensive network of hospitals across the country, facilitating cashless treatments.

- Drawbacks: One potential drawback is the higher premium compared to other plans. There is also the fact that HDFC does not offer any add-ons to reduce the pre-existing disease waiting period from 3 years down to 2/1 years or 30 days like the ones offered by its competitors

- Final Verdict: In our opinion, HDFC ERGO Optima Secure is ideal if you're looking for extensive coverage with the added benefit of immediate enhancement of the sum insured. This plan, coupled with HDFC ERGO's excellent metrics, provides substantial protection from the outset, making it a great choice for those who desire comprehensive coverage without needing to wait for benefits to increase.

Care Supreme

- Features: Care Supreme offers a substantial ₹ 1 Crore sum insured, providing extensive financial protection against high medical expenses. A notable feature is the Unlimited Automatic Recharge, which replenishes your cover amount an unlimited number of times within a policy year if it's exhausted due to claims. The plan includes a Cumulative Bonus Super add-on, apart from the base loyalty benefit, allowing your sum insured to increase by up to 600% over time. Considering the fact that a ₹ 1 Crore base sum insured becomes ₹ 7 Crore after just 5 years, this significantly enhances your coverage. Additionally, Care Supreme provides unlimited e-consultations and modern treatments, ensuring access to the latest medical care. The insurer also offers wellness benefits that encourage a healthy lifestyle by providing discounts on renewal premiums.

- Drawbacks: While Care Supreme is a good & affordable policy, the insurer's complaint volume could be better. Apart from this, the insurer doesn't offer free health check-ups by default. While this may not be a deal-breaker, we feel it is a good feature to have.

- Final Verdict: Care Supreme is ideal if you're seeking extensive coverage with a high sum insured. The insurer offers multiple add-ons, which is certainly beneficial. The Unlimited Automatic Recharge and the Cumulative Bonus Super add-on make it a robust plan for those desiring comprehensive protection and continuous coverage, even if the sum insured is exhausted. While the premiums may be higher, the extensive benefits and high coverage limit provide significant value.

Aditya Birla Activ One Max

Features: Aditya Birla Activ One Max is a comprehensive plan that offers a base cover amount of up to ₹6 Crore – something that we do not see with many insurers. The plan provides extensive coverage such as unlimited restoration, no room rent restrictions & co-payment. This, combined with wellness incentives, makes it a compelling choice.

Another compelling choice to opt for this plan is the Health Returns program. This rewards you for staying active by offering up to a 100% discount on the premium the following year. Apart from these stand-out features, the insurer also offers the standard unlimited restoration, no room rent restrictions or disease-wise sub-limits. The insurer also offers an add-on for OPD teleconsultations, which is convenient. All in all, this is a great policy.

- Drawbacks: While the benefits of Activ One Max are attractive, and the insurer boasts good CSR & ICR, Aditya Birla's complaint volume is slightly higher. While the increase is not significant, it is worth keeping an eye on it.

- Final Verdict: Aditya Birla Activ One Max is a solid option for those seeking a ₹ 1 Crore health insurance plan. Its HealthReturns program is especially ideal if you are committed to an active lifestyle. While Aditya Birla is a relatively new insurer, the plan remains solid for those seeking a broad range of benefits with affordable premiums.

Niva Bupa ReAssure 2.0

- Features: The Niva Bupa ReAssure 2.0 Titanium+ variant offers a premium suite of features designed to provide extensive coverage and innovative benefits for policyholders seeking a ₹ 1 Crore health insurance plan. An interesting feature of this plan is Lock the Clock – which locks the premium at the entry age until the first claim is made. This allows younger people to secure lower premiums until they make a claim. Another standout feature is ReAssure Forever. This is Niva Bupa's version of unlimited restoration, where once you make the first claim, the restoration is triggered and will stay active throughout the policy's lifetime.

- Drawbacks: We feel the insurer can have slightly better metrics – such as their claim settlement ratio and complaint volume.

- Final Verdict: The Titanium+ variant of Niva Bupa ReAssure 2.0 is a good choice if you're seeking a ₹ 1 Crore health insurance plan with extensive features. Its combination of age-locked premiums, unlimited restoration, and the Booster+ carry-forward bonus, which can multiply coverage up to 10 times, makes it a highly attractive option. Although the insurer's performance could be improved, the plan's unique restoration and cumulative bonus features provide substantial support for you as the policyholder.

Talk to an expert

today and

find

the right

insurance for you.

ICICI Lombard Elevate

Features: ICICI Lombard Elevate is designed to meet a wide range of healthcare needs, covering modern treatments and critical illnesses, with additional wellness programs that reward you for staying active and maintaining a healthy lifestyle. The plan also has no restrictions on room rent (with an add-on), disease-wise sub-limits or co-payment. One unique aspect of ICICI Lombard Elevate is that they cover the expenses of your oocyte donor in case you have to opt for assisted reproduction. Not many health insurers offer this option, which makes it particularly beneficial for a niche audience.

For those seeking coverage greater than ₹ 1 Crore, the Infinite Care add-on offers unlimited coverage for any one claim in the policy lifetime, which very few insurers currently provide. Furthermore, the plan's optional add-on that offers inflation-adjusted cover amount ensures that the base sum insured increases annually in line with the Consumer Price Index (CPI), offering protection that grows with rising medical costs.

- Drawbacks: While ICICI Lombard Elevate is a good health insurance plan, some of its most attractive features are accessible only through optional add-ons. For example, maternity coverage and the Infinite Care add-on, which allows for unlimited coverage, come at an additional cost. Additionally, we feel that ICICI Lombard's overall performance metrics, such as its CSR and network of hospitals, have room for improvement compared to its peers.

- Final Verdict: ICICI Lombard Elevate is well-suited if you're looking for a health insurance plan with added wellness benefits and the flexibility to include extended family members With the option for inflation-adjusted coverage, the plan provides a financial cushion that grows over time. Although some of the plan's key features are accessible only as add-ons, ICICI Lombard Elevate stands out as a comprehensive and customisable choice.

Aditya Birla Activ One VIP Plus

- Features: Aditya Birla Activ One VIP Plus is a premium health insurance plan tailored for individuals seeking extensive global coverage. Another unique highlight of the VIP Plus variant is its comprehensive maternity coverage, which supports you through maternity-related treatments up to ₹2 lakhs after a 2-year waiting period. Apart from this, Activ One prioritises preventative care, covering a broad range of hospital accommodations without room rent caps and offering annual health check-ups as part of its wellness package. As with all Activ One variants, VIP Plus also incorporates the HealthReturns program, rewarding you for maintaining an active lifestyle by returning up to 100% of the premium based on your health activity levels. Another interesting highlight is the teleconsultation add-on, enabling easy access to OPD services.

- Drawbacks: While the Activ One VIP Plus variant provides comprehensive coverage and numerous benefits, this variant does come at a premium price point. These high costs may not be justifiable if you do not prioritise maternity or international coverage, as these specific benefits contribute significantly to the premium.

- Final Verdict: Aditya Birla Activ One VIP Plus is an excellent choice if you're looking for extensive international coverage and maternity benefits. While the higher premium might deter some, the plan's benefits make it a strong contender for a niche section of people who are looking for maternity and international coverage.

Base + Super Top-up Combinations

Purchasing a full-fledged health insurance policy for ₹ 1 Crore cover amount can be an expensive affair. However, combining a base health insurance plan with a Super Top-Up plan (ideally from the same insurer) can be a cost-effective way to achieve higher coverage while managing premiums effectively. Here are some combinations that we feel are good:

Aditya Birla Activ One Max (₹10 lakh cover amount) + Super Health Plus Super Top-Up (₹90 lakh cover amount)

- Features: This could be your pick if you're budget-conscious and want to purchase a ₹ 1 Cr plan. The base plan is quite comprehensive, as mentioned earlier, and the Super Top Up plan doesn't restrict the kind of room you pick, nor does it have any other significant restrictions. In fact, there is also an option to get rid of the deductible in the Super Top-Up, which many insurers don't offer.

- Drawbacks: Aditya Birla is a good insurer, but their complaint volume is slightly high. While this is not a significant rise, it is certainly worth keeping in mind.

- Verdict: This is an excellent option if you're comfortable managing multiple policies. It offers significant coverage at a more affordable premium. All in all, a good pick.

Friendly reminder: It's easy to get lost comparing policies and premiums. Instead of spending hours on it, why not get personalised insurance advice from Ditto? We offer free consultations with zero spam! Just 30 minutes to clarify all your doubts.

Niva Bupa ReAssure 2.0 (₹10 lakh cover amount) + Health Recharge Super Top-Up (₹90 lakh cover amount)

- Features: As discussed earlier, ReAssure 2.0 is a good health insurance policy that covers all the basics and even has some extra bells and whistles. The Health Recharge Super Top-Up only takes this to the next level by extending your coverage up to ₹1 Crore. This setup ensures ample coverage for significant medical expenses without the steep premiums.

- Drawbacks: Health Recharge comes with disease-wise sub-limits, which restrict the amount you can claim for specific treatments. This can potentially leave you with out-of-pocket expenses. Additionally, this has a room rent restriction of a single private room, meaning you may have to bear part of the costs if you opt for a higher-category room than what is allowed under the Super Top-Up.

- Verdict: The combination of Niva Bupa ReAssure 2.0 and the Health Recharge Super Top-Up strikes a balance between affordability and industry-first features. However, it's also important to weigh the drawbacks, such as the disease-wise sub-limits and room rent restrictions.

Why Talk to Ditto for Your Health Insurance?

At Ditto, we've assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Bikram below love us:

No-Spam & No Salesmen

Rated 4.9/5 on Google Reviews by 10,000+ happy customers

Backed by Zerodha

100% Free Consultation

You can with our team. Slots are running out, so make sure you book a call now!

Tips to choose the top ₹ 1 Crore Health Insurance Plans

How do you choose an ideal health insurance provider?

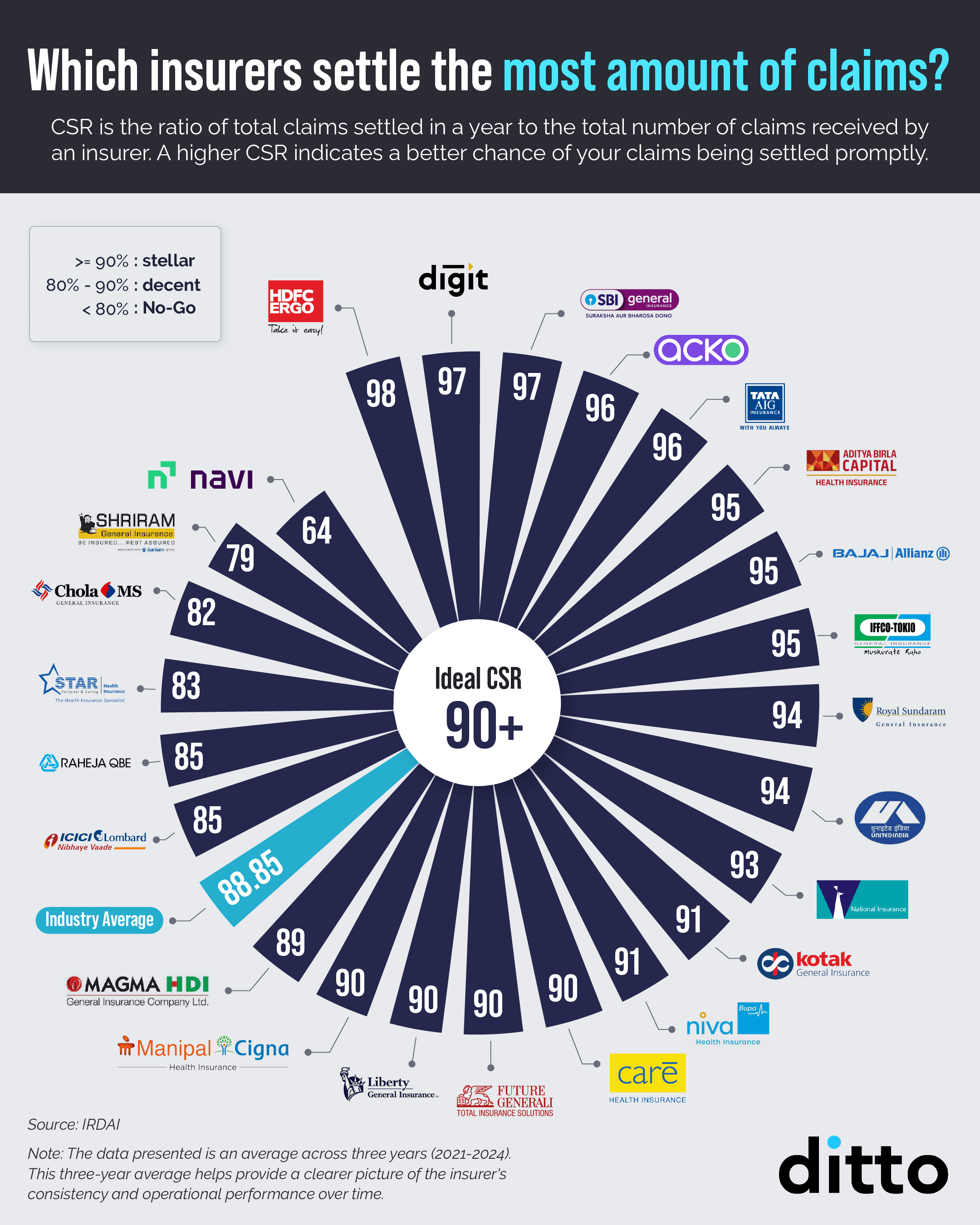

- Claim Settlement Ratio: This is one of the primary metrics used to determine an insurer's credibility. It measures the number of claims settled by an insurer across a year against the number of claims raised to the insurer for the year. A credible insurer's rating should be 90 or above. On the other hand, any insurer with a CSR of 80 or below is not worth approaching!

While CSR is a crucial metric, it can often be misleading if considered solely when determining the top health insurance providers.

Here is a quick look at the CSR (average of the last 3 years) of all the health insurance players in the industry -

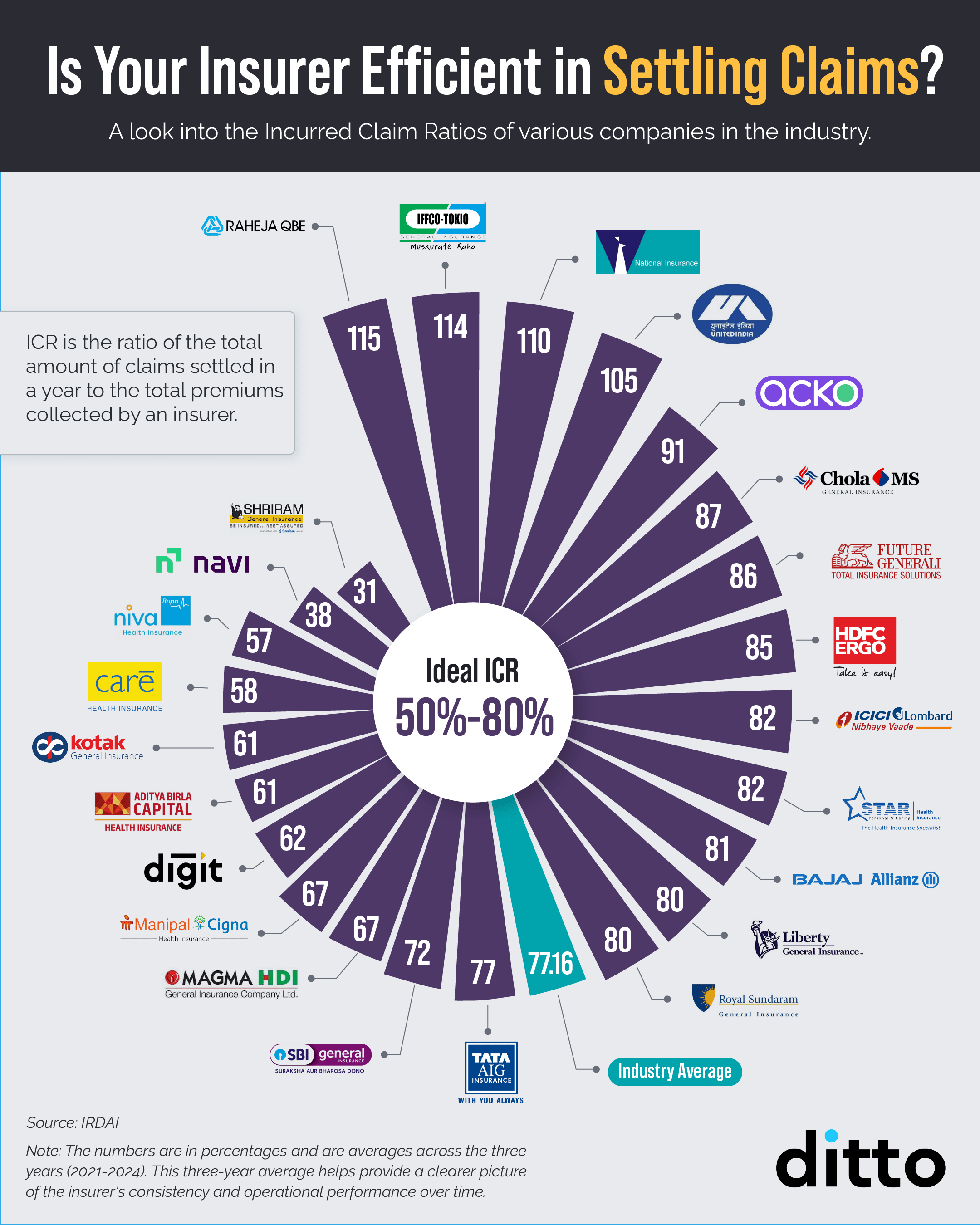

- Incurred Claim Ratio (ICR): When choosing a health insurance provider, a quick look at the company's incurred Claim Ratio (ICR) can save time and help you consider the insurer's future financial sustainability and claim settlement potential.

The ICR of a health insurer is computed by dividing the total amount paid in claims by the total amount earned by the insurer in premiums over a year.

A credible insurer with transparent and steady future sustainability should have an ICR between 50 and 70; any number below 50 indicates that the insurer is heavily leaning towards setting its business profits straight, and that would indicate higher chances of partial or rejected claims. Again, any provider with an ICR of 80 or higher might seem like an excellent choice for the short term since they are settling claims in full, but in the longer run, such brands (unless they have an extensive track record that proves otherwise) might run into some financial crunch.

Here is a quick look at the ICR (average of the last 3 years) of the current health insurance players in the industry -

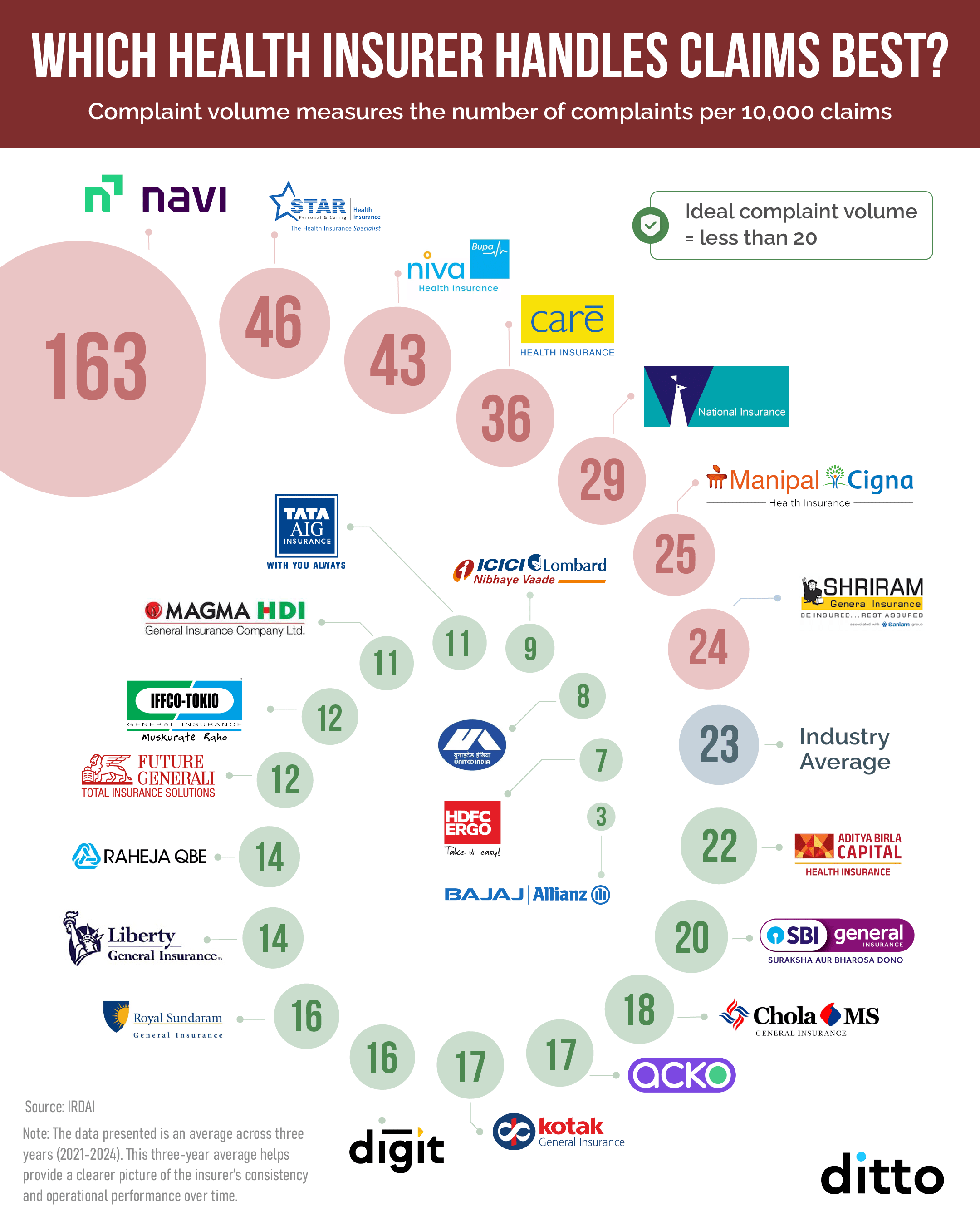

- Complaint Volume: The complaint volume of a health insurance provider records the number of claims filed against the insurer across a year per 10,000 claims. This can be the perfect metric that will help you gauge the quality of the claim settlement experience for the existing policyholders of the insurer (since most complaints stem from issues across the claim settlement process/amount).

In short, the lower the complaint volume (preferably lower than 20), the better the insurer. Here is a quick look at the complaint volume of the health insurance providers across the industry -

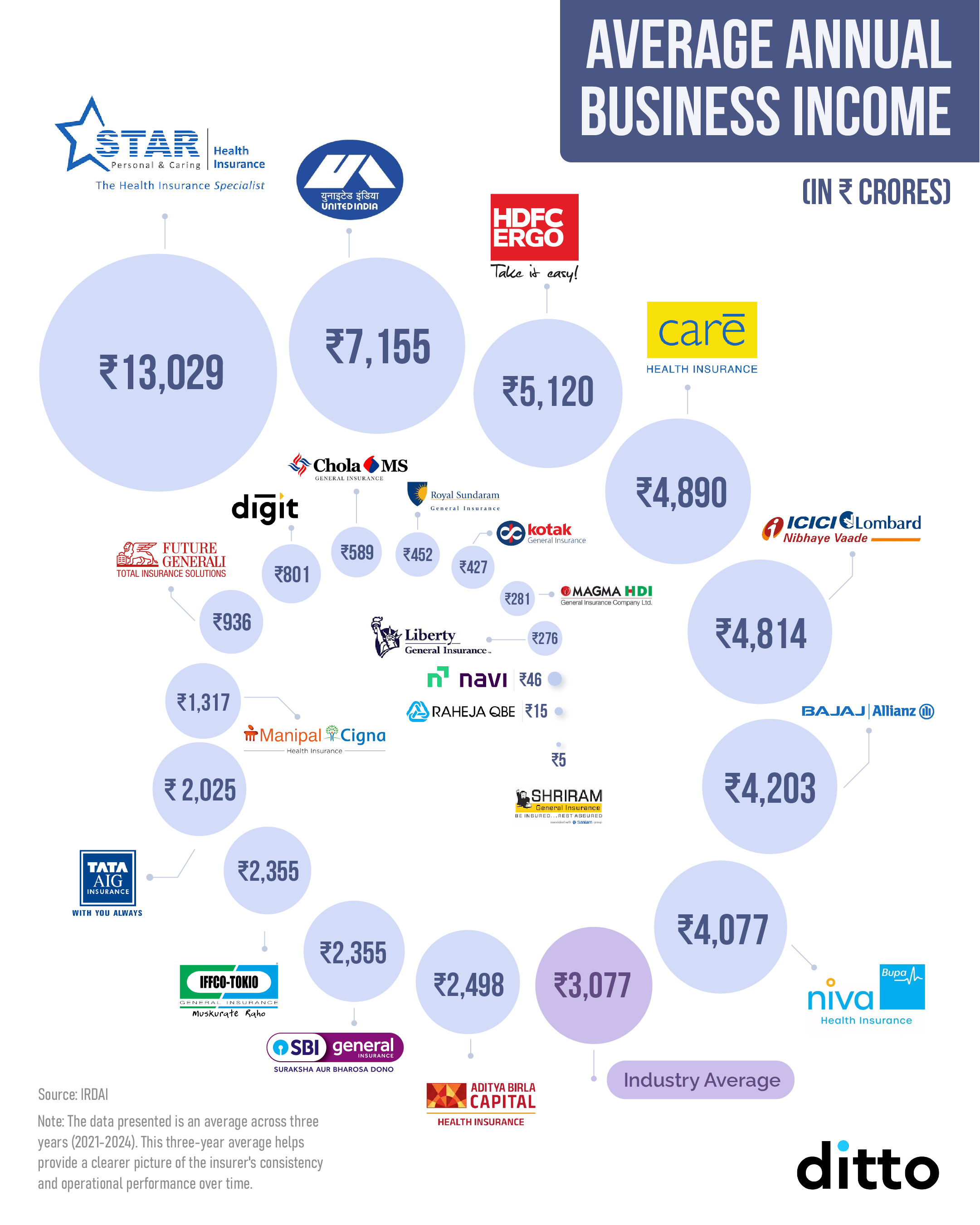

- Annual Average Business Income: Now, traditionally, an insurer's annual average business income is not listed as its credibility-checker. Nevertheless, this metric sheds light on the insurer's business vertical - whether you are dealing with a small-sized, medium-sized, or large-sized company. A larger business capital-holding insurer can seem more promising, considering it appears to be financially stable to clear your claim settlement requests.

However, as mentioned before, multiple other metrics must be considered before finalising that choice.

Here is a look at the top health insurance providers with their annual average business income (average of the last 3 years) -

How do you choose the best health insurance plan offering ₹ 1 Crore coverage?

- Choose a plan with no room rent restrictions.

- Ensure that your ₹ 1 Crore health insurance plan has no copayments involved.

- Opt for a plan with no disease-wise sub-limits.

- Avail of a plan with unlimited restoration.

- Choose a plan with a maximum of 2-3 years waiting period for PEDs with an option to reduce them and a 2-year waiting period for maternity coverage.

- The plan should cover significant lifestyle ailments – Asthma, Blood Pressure, Cholesterol, and Diabetes immediately via inbuilt covers or add-ons.

- If you can get your hands on a health insurance plan offering international, maternity, and OPD coverage features at affordable prices - that would be the cherry on the top.

Talk to an expert

today and

find

the right

insurance for you.