Quick Overview

Wondering what types of death are covered under your term insurance? Some situations are covered, others are not, and knowing the difference helps you avoid surprises later. This guide breaks it down in simple, clear terms so you know exactly what to expect.

What Kind of Deaths Are Not Covered in a Term Insurance Plan?

Not all deaths guarantee a payout from your term insurance policy. Here are the types of death excluded in term insurance:

- Suicide Within the First Policy Year

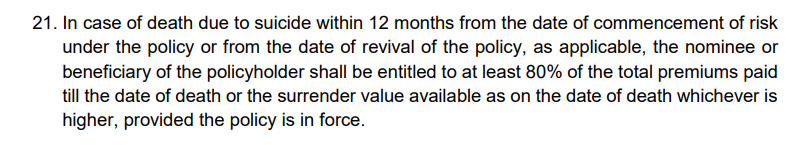

This is one of the most common exclusions. Term insurance does cover suicidal death, but only after 12 months from the date of policy purchase/renewal. If the policyholder dies by suicide within the first year of buying or reviving the policy, the insurer will reject the claim and refund around 80% of the first-year premium.

Here’s a snippet from the IRDAI master circular regarding the suicide exclusion within 12 months of policy purchase :

- Death Due to Participation in Hazardous or Extreme Sports

If the policyholder dies while doing high-risk activities like paragliding, rock climbing, or deep-sea diving, the insurer may reject the claim if such hobbies/profession is not declared while buying.

This is more likely if these activities are regular hobbies or part of their profession, and the policy lists them as exclusions.

- Death Due to Intoxication or Substance Abuse

Deaths caused by drug overdose or substance abuse are usually not covered. If your term policy excludes alcohol or narcotic use, any claim for death from these causes will be denied.

- Death While Committing a Criminal Act

If the insured dies while involved in an illegal activity, like theft, assault, or evading the police, the insurer has the right to deny the claim.

In general, traffic violations like not wearing helmets/ seat belts, etc, are not considered reasons for claim rejections.

- Death Due to Self-inflicted Injuries

If death happens due to intentional self-harm that is not counted as suicide, the claim may be denied. Insurers look closely at intent and policy terms, especially if you opt for rider benefits like accidental death cover with your base cover.

Claims teams review medical reports, police records, witness statements, and hospital notes to understand whether the harm was intentional or truly an accidental.

Quick Note

- Death Due to Pre-existing Diseases/Medical History not Disclosed

If someone knowingly hides major health issues or habits like smoking while buying the policy, the insurer can reject the claim even after many years. The moratorium (Section 45) rule protects only honest buyers, not intentional fraud.

If evidence shows the policyholder hid important facts on purpose, the claim can still be denied. This highlights the need to give accurate information right from the start to avoid problems later.

Example of Claim Denial

Bottom Line: Always disclose past illnesses. Hiding medical history can void the moratorium protection and lead to a denied claim.

- Death Due to Involvement in Causing War, Civil Unrest, or Terrorism

Some term plans exclude deaths caused by war, terrorism, or civil unrest if the insured person was involved in causing the event. While most policies include such coverage if the life assured is the victim, it’s best to check the fine print.

Note: According to recent reports, many Indian insurers cover deaths caused by war or terror attacks, but this applies only when the insured is a civilian and not involved in the conflict.

- Homicide (if Nominee is Under Investigation)

If the policyholder is murdered and the nominee is a suspect, the insurer will pause the claim until the investigation is complete.

If the nominee is found guilty or involved in the murder to obtain the payout, the claim will be rejected, and no benefit will be paid. The death benefit amount would go to other legal heirs instead.

Example of Claim Denial

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why do customers like Vijay below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Ditto’s Take on Policy Exclusions

Always go through the terms and conditions carefully before buying a term plan. If anything feels unclear, speak to your insurer or advisor. Understanding these rules up front helps you avoid surprises later and choose a plan that truly protects your family.

Still unsure about purchasing a term plan? Book a free call with us and let our experts guide you to make an informed decision.

Frequently Asked Questions

Last updated on: