What is ULIP vs Term Insurance at a Glance?

A Unit Linked Insurance Plan (ULIP) is a life insurance product that also invests part of your premium in market-linked funds involving equity or debt instruments, which helps you grow wealth over time. In contrast, a Term Insurance Plan offers cost-effective pure life cover, which provides your family with a lump-sum payout if you pass away during the policy term, but no maturity or investment benefit.

Introduction

Imagine standing at a crossroads: one path offers steady protection, the other promises potential growth. Choosing between them depends on what you value more, security or opportunity. That’s the essence of ULIP vs Term Insurance.

At Ditto, we talk to thousands of insurance buyers and policyholders every month, and the ULIP vs term insurance debate is one we have resolved numerous times.

Our advisors always side with term insurance plans because Ditto operates with the guiding philosophy: “Insurance should never be perceived as an investment that will bring you returns but as a safety net that protects your family in your absence.”

In this blog, we’ll:

- Break down the differences between ULIP vs Term Insurance

- Understand the key features of each, and

- Explore our 500+ team of IRDAI-certified advisors recommendations

Thinking of investing in a ULIP? Before locking in your money for 5 years, speak to Ditto’s IRDAI-certified advisors to compare returns, costs, and better alternatives — all for free!

What is a Unit Linked Insurance Plan (ULIP)?

A ULIP (Unit Linked Insurance Plan) combines life insurance with market-linked investments. A portion of your premium goes toward life cover, while the rest is invested in funds of your choice: equity, debt, or hybrid. You can switch between funds and track returns via Net Asset Values (NAVs). The plan has a 5-year lock-in period, after which partial withdrawals are allowed.

Features of a Unit Linked Insurance Plan (ULIP)

Here’s a quick breakdown of the features of a ULIP:

Key Benefits:

- A ULIP offers the dual advantage of life insurance protection and market-linked investment growth in a single plan. Examples: HDFC Life Click 2 Wealth and ICICI Pru Signature.

- It lets you choose your investment style: aggressive (small- or mid-cap funds), balanced (large-cap or hybrid funds), or conservative (debt funds), based on your risk appetite.

- You also have the flexibility to switch between equity, debt, and hybrid funds, with free switch limits that vary by insurer.

- Additionally, ULIPs provide tax benefits under Section 80C (up to ₹1.5 lakh per year) and Section 10(10D) on maturity proceeds, subject to applicable conditions.

Key Charges:

- The Fund Management Charge is typically up to 1.35% per annum and covers the cost of managing your investment funds.

- The Mortality Charge depends on your age and the sum at risk, and in some ULIPs, it may be refunded at maturity.

- The Policy Administration Charge is a fixed periodic fee deducted to cover administrative expenses.

- The Premium Allocation Charge is often zero in online ULIPs but may apply in offline or traditional versions.

- The Discontinuance or Surrender Charge applies if you terminate or surrender the policy during the mandatory 5-year lock-in period.

- The Switch or Withdrawal Fee may be free for a limited number of transactions, with nominal charges for additional ones.

- The Rider Charge is levied for optional add-ons like Accidental Death Benefit or Waiver of Premium riders.

Best For:

Long-term investors (7–10+ years) seeking market exposure, life cover, and flexibility to rebalance as goals or markets change.

What is a Term Insurance Plan?

A Term Insurance Plan is a pure life cover policy that provides financial protection to your family in the unfortunate event of your death during the policy term.

Unlike ULIPs, term plans do not have an investment component or a maturity benefit, which allows them to offer high coverage at affordable premiums. These plans will enable you to customize coverage with riders such as waiver of premium, accidental disability, and critical illness protection, which ensures that your loved ones remain financially secure.

Features of a Term Insurance Plan

Its simplicity and affordability make it one of the most popular insurance options. Key features include:

- High Sum Assured for Low Premiums:

For example, a ₹1 crore cover for a 25-year-old person can cost as low as ₹870 per month. - Customisable Riders for Enhanced Protection:

These add-ons help cover unforeseen events such as accidents or serious illnesses, providing a comprehensive safety net. - Flexible Policy Tenure and Premium Payment Options:

Insurers allow you to choose the tenure and frequency of premium payments to match financial goals. Some term plans offer policy terms ranging from 10 to 40 years, with maturity ages up to 85 years, and some extend to whole life (99/100 years), accommodating different life stages. - Comprehensive Inbuilt Features:

Many term plans, such as HDFC Life Click 2 Protect Supreme and ICICI Iprotect Smart Plus, now include built-in benefits such as terminal illness coverage, life stage sum assured increase, instant payout on claim intimation, premium break options, and health management services for enhanced protection and flexibility.

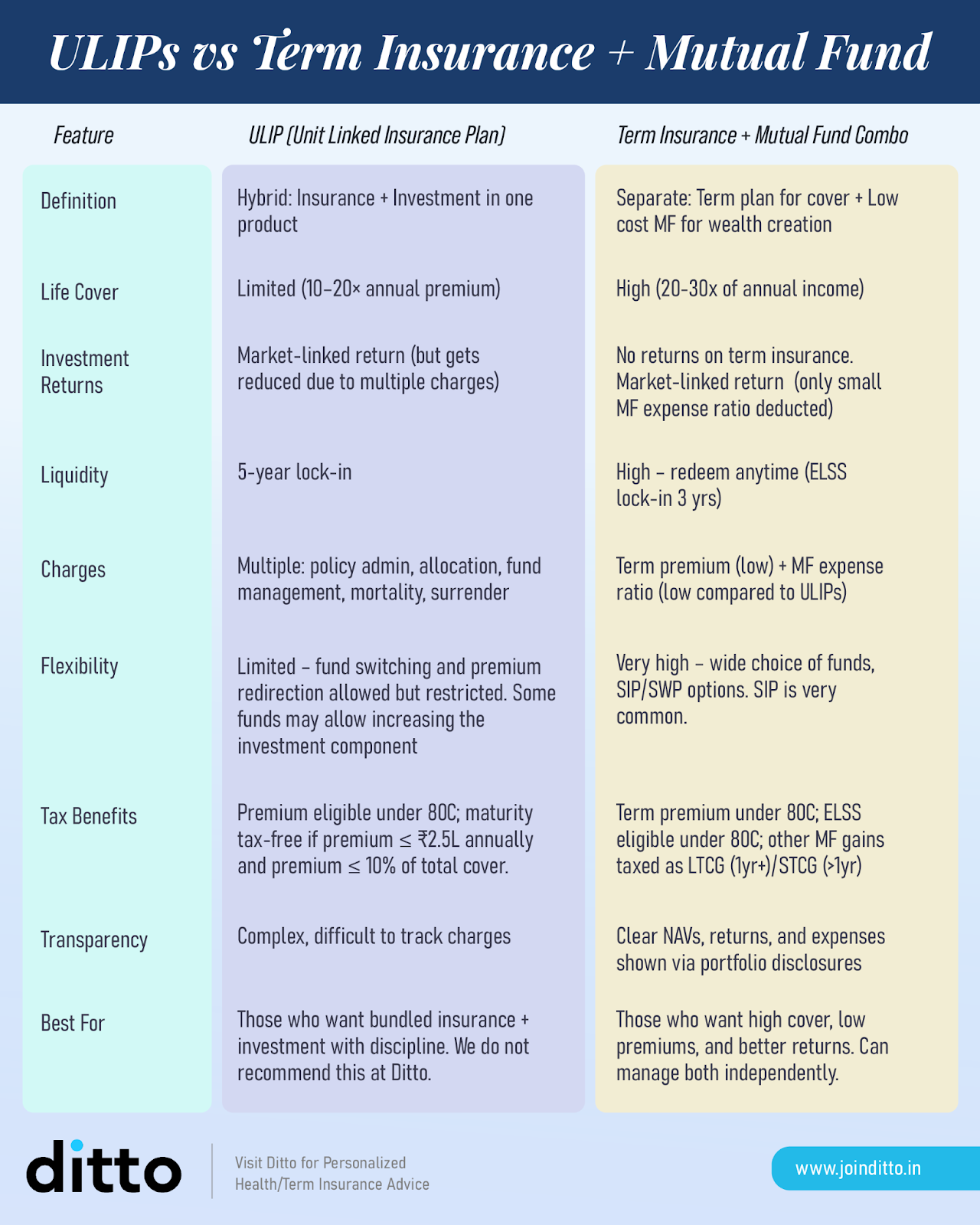

ULIP vs. Term Insurance: Key Parameters

ULIP Vs Term Insurance: Which Is Better? (Ditto’s Take)

When comparing ULIP vs Term Insurance, it really comes down to your goals and risk appetite.

For most individuals, a combination of a term plan and mutual fund investments is ideal. The term plan provides your family with security, while mutual funds offer flexible, transparent, and potentially higher long-term returns.

With mutual funds, you can choose from equity, debt, or hybrid options, adjust your investments as your financial goals evolve, and redeem units when needed. This provides liquidity and control that ULIPs often lack.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Ganesh below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

Choosing between ULIP and Term Insurance doesn’t have to be complicated. Insurers often promote ULIPs due to higher commissions, but their complexity can dilute both protection and investment purposes.

At Ditto, we advocate an unbundled approach: secure a pure term plan for protection (10–20× income + liabilities − existing cover) and invest separately in mutual funds for growth. This method is transparent, flexible, cost-effective, and puts control in your hands.

ULIPs should be considered only when pure term plans aren’t accessible. With clarity and proper planning, you can confidently balance protection and wealth creation.

If you are looking for comprehensive term coverage that align your long-term goals, we recommend the best term insurance companies for 2026. Explore more about how our experts evaluate term plans through Ditto’s cut.

FAQs

Is ULIP and term insurance the same?

No. A ULIP is a life insurance product with an investment component, allowing your premiums to grow in market-linked funds. Term insurance is pure protection, providing a high payout to your family in case of death during the policy term, without any investment benefits.

What are the disadvantages of ULIP?

ULIPs have higher premiums due to the investment portion, come with a mandatory 5-year lock-in, and are subject to market risks. Additionally, charges like fund management and policy administration fees can reduce net returns.

Can I switch funds in a ULIP?

Yes. Most ULIPs allow policyholders to switch between equity, debt, or balanced funds, helping optimize returns based on market conditions and personal risk appetite.

Can I customize my term insurance plan?

Absolutely. You can add riders such as critical illness cover, accidental death benefit, or waiver of premium to enhance protection beyond the base sum assured.

Which is better for long-term goals—ULIP or term insurance with mutual funds?

For most individuals, a combination of term insurance for protection and mutual funds for investments is ideal. It separates insurance and investment goals, reduces costs, provides greater liquidity, and allows flexibility in fund allocation.

Last updated on: