| What are the ULIP Tax Benefits? ULIPs offer three main tax benefits: you can save tax on premiums under Section 80C (up to ₹1.5 lakh a year under the old tax regime); your maturity amount is tax-free under Section 10(10D) if your total annual ULIP premiums don’t exceed ₹2.5 lakh; and your family receives the full death benefit tax-free under Section 10(10D). |

Investing in Unit Linked Insurance Plans (ULIPs) has long been a popular choice for those seeking the dual benefits of insurance protection and market-linked returns. But here’s the catch: the tax rules around ULIPs have evolved, especially after February 2021, and again with the 2025 GST exemption. With recent changes in tax laws, it's more crucial than ever to know exactly how your ULIP contributes to your tax-saving strategy in today’s date.

At Ditto, we believe in simplifying financial complexities. So, here it is: a complete guide where we break down the ULIP tax benefits so that you can leverage them in the current tax landscape.

For personalized guidance and to make sure your insurance decisions are always on track, book a free call with our experts today.

What are the ULIP Tax Benefits in 2025?

ULIPs primarily offer tax benefits under three sections of the Income Tax Act, 1961:

1. ULIP Tax Benefits on Premium Paid: Section 80C (Under Old Tax Regime)

This is the most widely known tax benefit. You can claim a deduction on the premiums you pay towards your ULIP policy.

- Deduction Limit: You can deduct up to ₹1.5 Lakh from your taxable income in a financial year under Section 80C. This limit is an aggregate for various tax-saving instruments (like Public Provident Fund (PPF), Employees’ Provident Fund (EPF), Equity-Linked Savings Scheme (ELSS), home loan principal repayment, etc.).

- Key Condition: To avail of this deduction, the annual premium paid for your ULIP must be less than 10% of the Sum Assured. This condition applies to policies issued after April 1, 2012. If the premium exceeds this limit, the deduction will be capped at 10% of the Sum Assured.

Ditto’s Tip: Always ensure your premium falls within this 10% limit to maximize your 80C deduction.

Important notes:

- Most people are now opting for the new tax regime, which has a higher tax-exempt income threshold but does not allow deductions for life insurance premiums.

- 80C reversal on early exit: If a ULIP is terminated before 5 years, any 80C deductions claimed earlier are added back to your income in the year of termination; no deduction can be claimed that year.

For official details, you can check the Income Tax Act – Section 80C

2. ULIP Tax Benefits on Maturity/Withdrawal Proceeds: Section 10(10D)

This is where the most significant changes have occurred for ULIPs. Historically, ULIP maturity proceeds were completely tax-free. However, the Finance Act 2021 introduced a crucial amendment.

The "₹2.5 Lakh Premium" Rule:

- For Policies Issued On or Before February 1, 2021:

- In this case the maturity amount (including partial withdrawals after the lock-in period) remains completely tax-free under Section 10(10D), provided the premium did not exceed 10% of the Sum Assured.

- For Policies Issued On or After February 1, 2021:

- Scenario 1: Aggregate Annual Premium

- If the total (aggregate) annual premium paid across all your ULIP policies is ₹2.5 Lakh or less in any financial year, then the maturity proceeds (including partial withdrawals after the lock-in period) will remain completely tax-free under Section 10(10D).

- Scenario 2: Aggregate Annual Premium

- If the total (aggregate) annual premium paid across all your ULIP policies issued on or after February 1, 2021, exceeds ₹2.5 Lakh in any financial year, then the maturity proceeds will become taxable.

- How it's taxed: The gains from such ULIPs will be treated as Capital Gains, similar to how equity mutual funds are taxed.

- Long-Term Capital Gains (LTCG): If your ULIP investment is held for more than 12 months, gains exceeding ₹1.25 lakh in a financial year are taxed at 12.5% (plus applicable cess) for equity or equity-oriented units.

- Short-Term Capital Gains (STCG): If your ULIP investment is held for 12 months or less, gains on equity or equity-oriented units are taxed at a special rate of 20% (plus applicable cess), instead of your regular income tax slab. For official details, see the Press Release by PIB.

Ditto’s Tip: This ₹2.5 Lakh rule applies to the aggregate premium across all ULIPs you own that were issued on or after February 1, 2021. If you have multiple ULIPs, keep a strict check on your total annual premium.

3. ULIP Tax Benefits on Death Benefit: Section 10(10D)

This benefit remains unchanged and is a key advantage of all life insurance products.

- Status: The amount paid to your nominee upon your unfortunate demise (the death benefit) is completely tax-exempt under Section 10(10D).

- Applicability: This exemption applies regardless of the annual premium amount paid or the policy's issue date. It ensures that your family receives the full financial protection without any tax deductions.

How Do ULIP Tax Benefits Work?

Let's illustrate the tax impact for a policy issued after February 1, 2021:

| Particulars | Policy A (Tax-Exempt) | Policy B (Taxable) |

|---|---|---|

| Annual Premium (AP) | ₹1,50,000 | ₹3,00,000 |

| Sum Assured (SA) | ₹15,00,000 (10x AP) | ₹30,00,000 (10x AP) |

| Term | 15 years | 15 years |

| Total Premium Paid | ₹22.5 Lakh | ₹45 Lakh |

| Maturity Value (Estimated Gain) | ₹40 Lakh | ₹80 Lakh |

| Total Gain (LTCG) | ₹17.5 Lakh | ₹35 Lakh |

| Tax on Maturity Payout | ₹0 | ₹4,38,750 [Calculated as: Tax @12.5% = ₹4,21,875 + 4% cess ≈ ₹16,875 on taxable gain ₹33,75,000 (₹35,00,000 - ₹1,25,000)] |

Explanation: Policy A enjoys the full tax-free maturity benefit on the entire ₹40 Lakh because its premium is under the ₹2.5 Lakh cap. Policy B, despite being a life insurance product, is treated as a capital asset.

The ₹35 lakh gain is taxed at 12.5% on the portion exceeding ₹1.25 lakh (for equity or equity-oriented units held over 12 months), which can significantly impact the net return.

What Are the Tax Implications of ULIP Partial Withdrawals and Fund Switching?

Tax Exemption on Partial Withdrawals (Section 10(10D) Rules)

- Partial withdrawals are generally tax-free provided the policy remains "in force" and the maturity proceeds of the policy are eligible for tax exemption under Section 10(10D).

- If the policy does not qualify for the 10(10D) exemption, any partial withdrawal will be subject to Capital Gains Tax on the gains component, similar to the maturity taxation rules described above.

Tax Saving on Switching (Free Switching)

One major tax advantage of ULIPs over external investments (like mutual funds) is the flexibility to manage your portfolio without incurring immediate tax liability.

- You can move your investment between ULIP funds (e.g., Equity to Debt) without triggering capital gains tax, unlike mutual funds where switching is treated as a redemption and taxed.

New GST Benefits for ULIPs (Effective September 22, 2025)

From September 22, 2025, the 56th GST Council exempted GST on all individual life and health insurance policies, including ULIPs. Earlier, an 18% GST was levied on components such as mortality charges, premium allocation, fund management, surrender/discontinuation, switching, and administrative fees.

So, how does it benefit policyholders now?

- With the new exemption, they no longer pay GST on these components, which reduces the total premium outgo.

- This change makes ULIPs more cost-efficient, as a higher portion of the premium goes directly toward investment in the chosen fund, enhancing compounding potential and maturity value.

- It also improves affordability and net returns over time, since recurring charges no longer carry GST.

- The exemption applies to all new policies and renewal premiums from the effective date. However, group insurance policies like the ones provided by your employer continue to attract 18% GST.

Key Considerations for ULIPs and Taxation in 2025

- Understand Your Policy's Issue Date: This is the most critical factor in determining the taxability of your maturity proceeds.

- Investment Horizon: ULIPs have a mandatory 5-year lock-in. While you can stop paying premiums during this period, withdrawals are only allowed after 5 years. So, to maximize returns and take full advantage of potential long-term tax benefits, it is generally recommended to stay invested well beyond the lock-in period.

- Fund Performance: While tax benefits are attractive, regularly review the performance of the funds you've chosen within your ULIP to ensure they align with your financial goals.

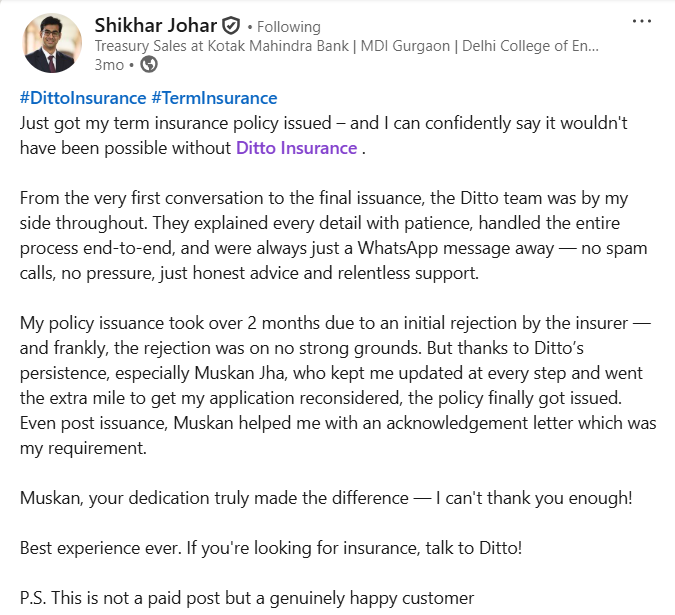

Why Choose Ditto for Insurance?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Srinivas below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

Conclusion

ULIPs offer a blend of insurance coverage and market participation, coupled with significant tax benefits under Section 80C and 10(10D). However, for policies issued after February 1, 2021, diligently managing your aggregate annual premium to stay within the ₹2.5 Lakh threshold is important to enjoy tax-free maturity.

It is crucial to remember the core principle of financial planning, i.e., Insurance is protection first; tax savings are auxiliary benefits. For pure, high-value life protection, a Term Insurance plan remains the ideal and most cost-effective choice. ULIPs are best suited for individuals who may not be eligible for a term plan or who specifically desire a combination product and are comfortable with the associated charges.

As always, it's wise to consult with a financial advisor or tax expert to understand how ULIP tax benefits specifically apply to your financial situation and investment portfolio. For personalized guidance and to make sure your insurance decisions are always on track, book a free call with our experts today.

FAQs

What tax benefits do ULIPs offer on premiums paid?

You can claim up to ₹1.5 lakh annual deduction under Section 80C on ULIP premiums paid, subject to a 10% sum assured cap for recent policies.

Are ULIP maturity proceeds tax-free?

Maturity proceeds are tax-free under Section 10(10D) if the total annual premium across all policies is ₹2.5 lakh or less. Note that gains on equity or equity-oriented units held >12 months are taxed at 12.5% over a ₹1.25 lakh annual threshold.

Is the death benefit from a ULIP taxable?

No, the death benefit paid to nominees is completely tax-exempt under Section 10(10D) regardless of premium limits or policy dates.

How are partial withdrawals taxed in ULIPs?

Partial withdrawals after the 5-year lock-in are tax-free if the policy qualifies for Section 10(10D) exemption; otherwise, gains from withdrawals are taxed as capital gains.

Last updated on: