Did you know that 6 in 10 Indians who buy insurance online never fully read their policy? And almost four-fifth of policy buyers say they don’t understand their coverage.

We get it. Reading through a policy document is tedious. But that’s a risk you don't want to take for obvious reasons.

One small error in your term insurance policy document can put your family’s financial security in jeopardy. Not getting coverage when you need it the most hurts in many ways, especially when you’re not around.

That’s why Ditto highly recommends customers to go through their policy document thoroughly, especially during the free-look period. Read every clause, terms and conditions, spot errors, if any, and get things rectified. Because once the period ends, you're locked in with an erroneous policy.

So before you stash your term policy document in the drawer, here are five essential things to check.

Still not sure? Talk to Ditto’s expert advisors today and get unbiased, personalised guidance - absolutely free.

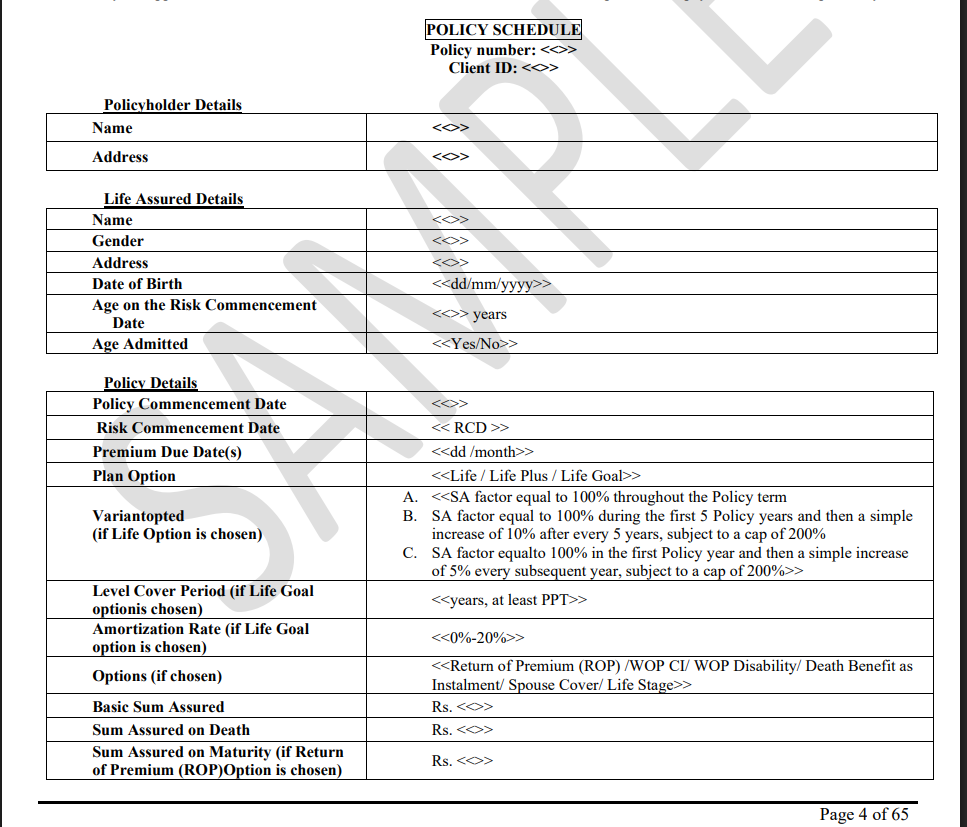

1) Personal Information and Term Insurance Details

Your personal and policy details should be 100% accurate. That’s the foundation of your entire cover, and your nominee will rely on it during a claim.

So, always double-check the following in your term policy document once you receive it.

- Your full name, address, date of birth (DOB), and contact details

- The policy number, date of issue, and coverage start date

- Spelling errors or incorrect dates lead to claim delays and rejections

- Clearly printed insurer's name and IRDAI registration number

Smart tip: Save a soft copy of your policy on your phone and keep it shared with your family. This makes it easy to access during emergencies.

Are you a first-time term insurance buyer? Check out how you can avoid 7 common mistakes while buying term insurance in India.

2) Watch Out For Coverage Summary And Rider Details

It's important to check what you’re paying for and what your family will get when they raise a claim. Take time to go through every detail to understand if you’re getting the expected coverage.

Besides the premium amount and frequency, check other core offerings of a term insurance:

- The sum assured (how much your nominee will get): Check whether the payout amount is mentioned correctly

- The policy term (duration of coverage): Check whether the coverage duration matches

- The claim payout option (important for families managing long-term expenses): Check whether it's a lump sum, staggered monthly income, or hybrid.

- Check for the term insurance riders opted for, like accidental death benefit, critical illness rider, and waiver of premium.

Remember: Each rider benefits and other coverage details (along with final premium) are clearly mentioned in your term policy document. Skim through them carefully to avoid claim rejections.

3) Read the Fine Print (Exclusions, Grace Period, Free‑Look & Lock‑In Period)

If you skip this, you may end up with an insurance policy that fails you when your family needs it the most.

Here’s what to look out for:

- Exclusions and waiting period: These are the built-in limits of your policy. Exclusions are events the insurer will never cover, like suicide in the first year, death due to war or terrorism, or illegal activities. The waiting period, on the other hand, is the initial time frame after purchase during which specific benefits won’t apply. For instance, suicide cover usually starts only after 12 months. Knowing both helps avoid unpleasant surprises when making a claim.

- Free-look period: Every insurer offers a 30-day period (from the date of receiving the policy) to review the document. During this time, one can cancel their policy and get a refund.

- Lock-in period and surrender terms: Term plans generally don't have any surrender benefits. However, in some cases, features like early exit, return-of-premium, or limited payment term may exist. So, always check when and how you can exit and the applicable charges.

- Grace period: Most insurers offer a 15-day (for monthly payments) or 30-day (for annual payments) grace period before the term policy lapses. Additionally, check the option to revive your term policy for missed premiums.

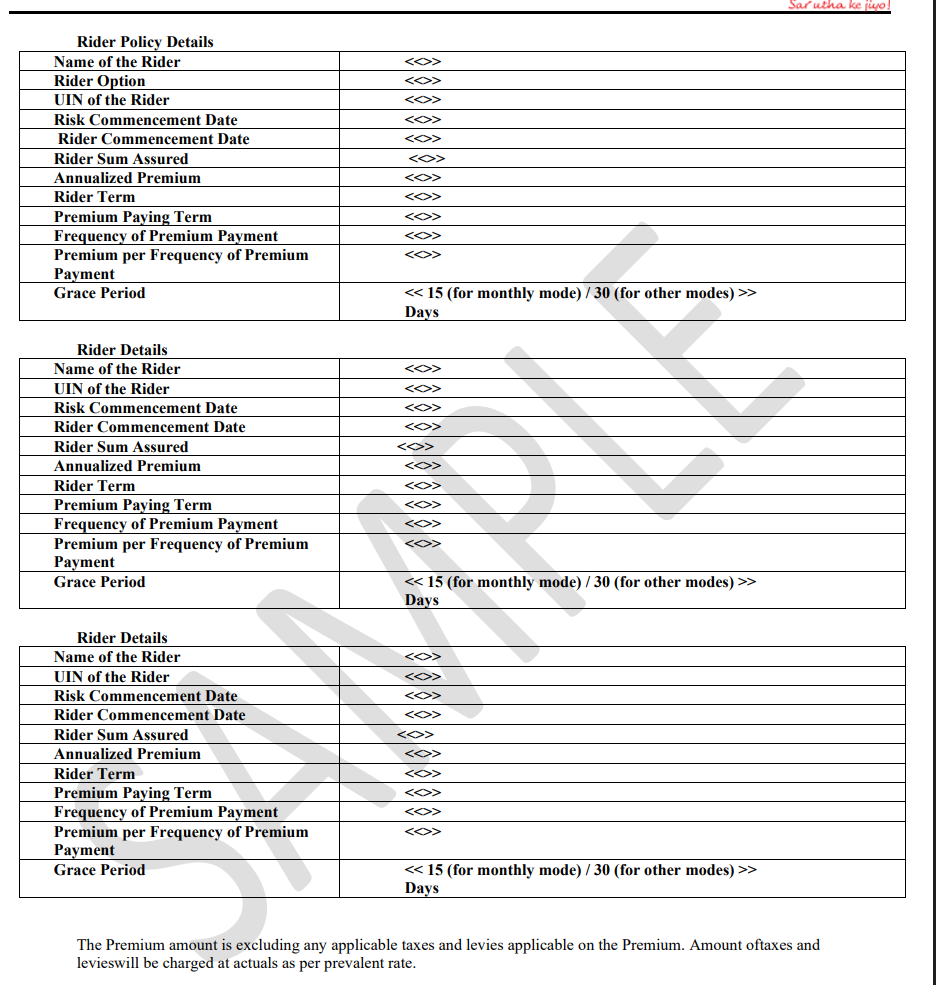

4) Nominee & Beneficiary Accuracy

Imagine your family’s claim getting rejected because of a simple mistake in naming the beneficiary. It’s a nightmare no one wants to face, yet it happens more often than you’d think. To avoid delays, or worse, a denial, here are the key things you must check in your term insurance policy.

- Guardian details for minors: If the nominee is under 18, a guardian must be appointed to handle the payout.

- Share allocation: If there are multiple nominees, one has to specify how the amount should be split. Give exact instructions here.

Pro Tip: Always update the nominee and beneficiary after any major life changes, like marriage, childbirth, divorce, and death. Note: In case of a change of nominee, the insurer may not update the main policy document, but give you an endorsement/acknowledgement. Make sure to keep it attached to the policy doc and in soft copy as well.

The following is how a sample nomination schedule looks in a term insurance policy document:

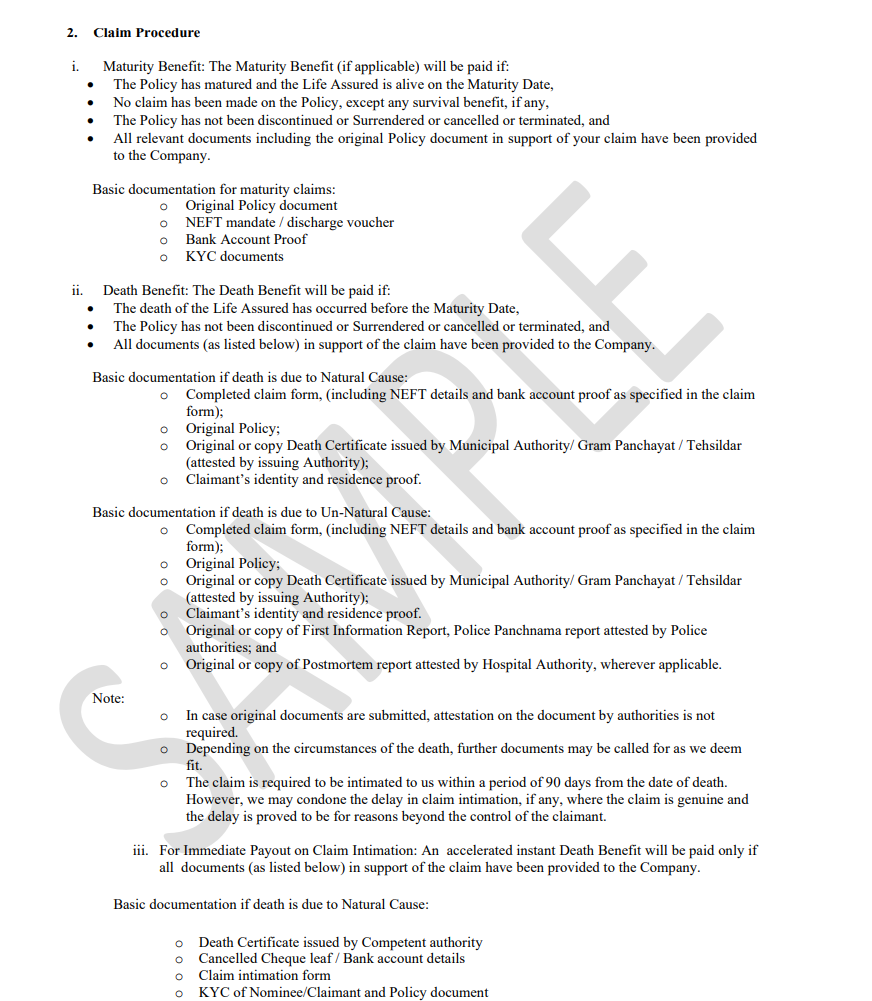

5. Claim Settlement Process & Servicing Details

Knowing the claim settlement process ensures your family can act quickly when it’s needed the most. Ideally, you should check for:

- Claim Procedure: Know what documents are required, who to contact, and how to submit the claim.

- Check the Timeline: The IRDAI mandates strict claim settlement timelines for various types of claims.

- Death claim (with no investigation): within 15 days of intimation

- Death claim (with investigation): within 45 days of intimation

- Surrender / partial withdrawal: within 7 days of request

- Maturity, survival, annuity payouts, income benefits: on the due date

- If insurers miss these deadlines, they must pay interest (bank rate + 2% from the date of intimation till payment). Penalty for delays is paid automatically with the claim amount.

- Supporting Contacts: Ensure your nominee has all necessary email addresses and phone numbers readily available.

- Servicing Details: Check how the insurer communicates about renewals, premium reminders, or policy changes.

Pro Tip: Don’t leave the claim process section unread. Also, please share all policy details directly with your nominee to avoid any delay or confusion. For more clarity, read our extensive guide on how to claim term insurance after death.

Here’s a sample claim form with all terms and conditions:

| What Most People Miss Checking in Their Term Insurance Policy Document : Coverage that’s lower than what was discussed Riders they didn’t add (or don’t understand) Outdated nominee or contact details Changes in financial responsibility |

Note: Often, policy wordings can include a lot of boilerplate language or just a pro forma of things you have not opted for. If you’re confused, always ask your insurance provider or agent. Alternatively, you can also reach out to Ditto’s IRDAI-certified advisors.

Why Choose Ditto For Your Term Insurance?

At Ditto, we’ve guided 7,00,000+ customers to buy the right insurance policy, and there’s more than one reason why customers like Shikar trust us.

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

✅Personalized recommendations

✅Real-time claim support

Final Thoughts

Most people never read their term insurance document closely, and that’s where costly mistakes happen. So, always double-check your personal details, coverage, exclusions, waiting periods, nominee information, and claim process during the free-look period. A little attention now can save your family from claim delays or outright rejection later.

Before you file it away, go through the five key sections:

✅ Personal and policy details

✅ Coverage and riders

✅ Fine print and exclusions

✅ Nominee information

✅ Claim process and servicing

If anything looks off, raise the issue during the free-look period while changes are still possible. Feeling stuck or unsure, talk to a Ditto advisor. It’s free, no pressure, and could save your family a lot of stress later.

FAQs

What if my personal details are wrong in the term policy document?

No worries! You can always get them corrected, but only within the free-look period. After that, it would require additional documentation and approvals.

How do I update beneficiaries in my term insurance policy?

You need to talk to your insurer to update beneficiaries in your term policy. They would ask for some details, ID proof, and ask you to fill and sign a form as procedure.

Can I cancel my term insurance policy within the free-look period?

Yes, you can! Once you cancel your term policy within the free-lock period, your money will be refunded after some basic deductions for stamp duty charges and medical tests conducted if any.

What are some usual exclusions for a term policy ?

Some of the usual exclusions for a term policy exclude suicide (within the first year), deaths due to war or terrorism, and anything that arises out of any illegal actions.

What documents are needed for a claim?

Typically, the documents you need to file a term claim include the death certificate of the insured, ID proof, policy copy, medical records, and the filled claim form.

Last updated on: