| What is Term Insurance for Young Adults? Term insurance for young adults is a cost-effective way to secure long-term financial protection. Since insurers base premiums on age and health, younger buyers typically benefit from lower rates and can lock in these premiums for the entire policy term. This makes term insurance an ideal starting point for a financial planning journey, offering affordable coverage while protecting against unforeseen risks early in life. |

Term insurance is a simple policy where buyers pay a fixed premium in exchange for a large payout to their family if anything happens during the coverage period. Buying the policy as a young adult makes it even more affordable. At 25, ₹1 crore coverage can cost just ₹850–₹1,000 per month, while waiting until 35 nearly doubles the price.

Plus, with the recent removal of GST, premiums are now even lower and stay fixed for the entire tenure. This makes term insurance a cost-effective safety net for anyone, especially young adults, with loans or dependents.

In this guide, you'll learn about the benefits of term insurance for young adults, the most popular plans available, and how to choose the right cover for your needs.

Friendly reminder: It’s easy to get lost comparing policies and premiums. Instead of spending hours on it, why not get personalized insurance advice from Ditto? We offer free consultations with zero spam! Just 30 minutes to clarify all your doubts. So book a call now.

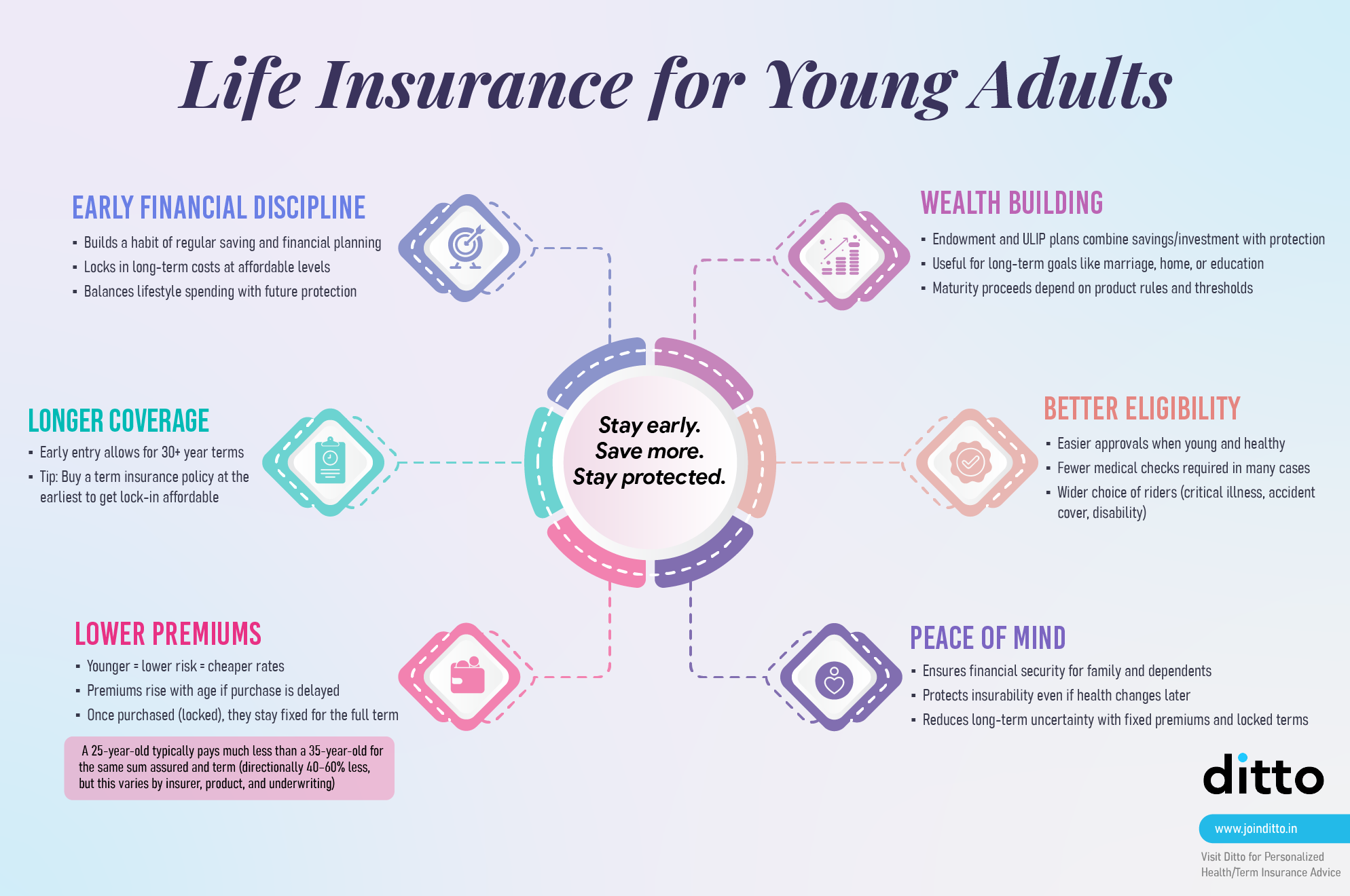

Benefits of Getting Life Insurance as a Young Adult

When you’re in your 20s or early 30s, insurance often feels like something you can “deal with later.” But the truth is, buying term insurance early comes with unique advantages that can save you money and protect your family for decades. Here are the key reasons why getting covered young is one of the smartest financial moves you can make:

1. Low Premiums for Life: The earlier you buy, the cheaper your premiums. Insurers calculate costs based on age and health, both of which are in your favor when you’re young.

For example, under HDFC Click 2 Protect Supreme, a 25-year-old non-smoker pays about ₹11,525 annually for a ₹1 crore cover till age 65. The same plan costs ₹18,803 annually at age 35.Over 30 years, the younger buyer saves several lakhs in premiums, since starting early helps lock in today’s rates for the entire policy term.

2. Financial Security for Dependents: Even if you don’t have a spouse or kids yet, you might be supporting your parents, siblings, or contributing to household expenses. If something happens to you, term insurance ensures your family receives a lump sum to continue their lifestyle, cover bills, and avoid financial stress.

3. Debt Protection: Loans don’t vanish with you. Education loans, car loans, or EMIs for your first home can easily become a burden on your family. Term insurance takes care of these liabilities, so your loved ones don’t inherit debt alongside grief.

| Why Term Insurance Beats Home Loan Insurance? Home loan insurance covers only your outstanding home loan, meaning protection ends once that loan is paid off. Term insurance, on the other hand, offers much broader financial security. It protects your family not just against your home loan but also against other liabilities, both current and future. This includes debts you may not have yet but are likely to take on, such as a planned home or plot purchase, higher education loans, car loans, or personal loans. Term insurance also covers everyday financial needs, ensuring your family can maintain their lifestyle without disruption. |

4. Flexibility for the Future: Life changes, and so do your financial needs. A term insurance policy bought at 25 can adapt as responsibilities grow, such as increasing coverage after marriage, adding protection for children’s education, or adjusting for a home purchase or business investment. This ensures your insurance evolves with your life, providing peace of mind at every stage.

5. Tax Benefits: Besides protection, term insurance also helps you save on taxes. Premiums qualify for deductions under Section 80C of the Income Tax Act (old regime), and the death benefit your family receives is exempt under Section 10(10D). This means you’re not just securing your family, you’re also making your financial plan more tax-efficient. Insurance doubles up as both financial protection and a smart tax-saving tool.

Types of Life Insurance Policies for Young Adults

Young adults often get confused between term insurance and other types of policies. Here’s a quick guide:

| Type of Life Insurance | Key Features | Best For |

| Term Insurance | Pure protection, affordable, high coverage | Young individuals with dependents or loans |

| Whole Life Insurance | Lifetime coverage plus savings component | Those seeking lifelong protection and cash value buildup |

| Endowment Plans | Guaranteed payout, survival or death | Individuals who prefer certainty over higher returns |

| ULIPs | Combines insurance with market-linked investment | Risk-tolerant buyers looking for protection plus growth |

| Money Back Policies | Periodic payouts during policy term | People needing liquidity alongside insurance |

For most young adults, pure term insurance is the smartest choice, maximum cover at minimum cost. Other options suit niche needs.

Popular Life Insurance Plans Available for Young Adults

Below is a table that clearly describes the most popular term insurance plans for young adults in India, along with estimated yearly premiums and key features for a healthy 25-year-old non-smoker seeking ₹1 crore coverage (till age 65).

| Before we discuss the list, here’s how we decide what plans to feature. At Ditto, every term plan goes through our six-point evaluation framework. It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars. You can learn more about how we evaluate health insurance plans here. |

| Insurer | Yearly Premium (₹): Male | Yearly Premium (₹): Female |

Key Features |

| HDFC Life Click 2 Protect Supreme | ₹10,945 | ₹9,303 | Accidental Death Benefits, Disability & Critical Illness Premium Waiver, Accidental Total Permanent Disability rider, Inflation-linked cover increase, Critical Illness Cover (60 illnesses), Terminal Illness Benefit, Premium Break. Free inbuilt wellness benefits - discounted health checkups, doctor and nutritionist consults, grief counselling for nominees) |

| Axis Max Life Smart Term Plan Plus | ₹9,864 | ₹8,385 | - Accidental Death & Dismemberment Benefit, Critical Illness Cover (64 illnesses), Regular or Smart Cover variants (1.5X coverage for first 15 years), Women's Perks (Lifeline Plus & premium discounts), Waiver of Premium on Disability or Critical Illness, Zero-Cost Exit Option, Premium Break & Instant payout on claim intimation. |

| ICICI Pru iProtect Smart Plus | ₹10,273 | ₹8,733 | Accidental Death Benefits, Life Stage Benefit (increased coverage after milestones like marriage/childbirth), Terminal Illness Payout for entire S.A, Critical Illness Cover (60 illnesses), Zero Cost Option, Premium Break & Instant payout on claim intimation. |

| Bajaj Allianz eTouch II | ₹9,524 | ₹9,044 | - Accidental Death Benefit, Terminal Illness cover, Life Stage Benefit (increased coverage after marriage, childbirth, or home loan), Critical Illness Coverage (60 illnesses), Inbuilt Waiver of Premium on Permanent Disability (accident-related), Zero Cost Option, Premium Break option & Instant payout on claim intimation. |

These premiums are illustrative (male vs female, age 25, non-smoker, 1 crore cover, 40-year term) and without discounts.

How to Get Life Insurance for Young Adults?

Getting life insurance as a young adult is a smart financial decision that starts with understanding your coverage needs. Assess your financial obligations, such as outstanding loans, daily expenses, and any dependents relying on your income. This evaluation helps determine the appropriate sum assured that will adequately protect your family in case of unforeseen events.

Next, compare insurance plans online to explore differences in premiums, policy tenure, and features offered. While doing so, consider insurers with strong claim settlement ratios, as these reflect reliability in paying claims promptly.

Complement this research with customer feedback and reviews to gain insights into service quality. Finally, prepare for any required medical examinations, as accurate health disclosures and readiness for tests can help you secure more favorable premium rates.

At Ditto, we make buying your life insurance policy simple and convenient. You can choose to purchase your plan online for ease and possible discounts or consult our professional advisors for personalized guidance tailored to your unique financial situation. Our expert advice helps simplify your decision-making, ensuring the plan you select balances affordability, coverage, and peace of mind perfectly.

Get personalized term insurance advice in just 30 minutes. Chat with a Ditto expert for free to find the best coverage at the right price. Book your call now!

Why Talk to Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Tharun below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

Ditto’s Take on Term Insurance for Young Adults

Term insurance is essential for young adults who want to protect their families from unexpected financial burdens. Buying early helps lock in low premiums and secure high coverage without adding unnecessary savings components.

We believe insurance is the foundation of any financial plan. Before investing in stocks, mutual funds, or crypto, it is important to first plan your term and health insurance. This ensures your downside is covered and gives you the freedom to take risks in other areas.

We help young adults assess their responsibilities and choose plans from reliable insurers with strong claim records. Our team guides you through the process, from understanding coverage to completing medical exams and deciding whether to directly buy online or with expert support.

Insurance should adapt as life changes. That is why we highlight plans with flexible tenures, critical illness benefits, premium waivers, and riders that fit evolving needs.

At Ditto, our focus is on simple and personalized consultations that balance coverage and cost. With us, securing your family’s future is affordable, straightforward, and tailored to your lifestyle and goals.

Frequently Asked Questions (FAQs)

What does young adult life insurance cover?

It covers death benefit payouts for your family if you pass away during the policy term. Riders can add coverage for accidents or illnesses.

Which should young people buy first: Health Insurance or Term Insurance?

Health insurance comes first; it protects you from rising medical costs right away. Term insurance should follow soon after to lock in low premiums and secure your family’s financial future.

Is life insurance worth it at a young age?

Yes. Premiums are lowest when you’re young and healthy, and you get financial protection early.

Can I change my coverage later?

Many insurers allow you to increase your coverage or add riders as your life responsibilities grow. You can also purchase an additional plan to enhance your protection further.

Do young adults really need term insurance if they don’t have dependents?

Yes, if you have loans or want to lock in cheaper premiums for future dependents.

Last updated on: