Quick Overview

SBI Life Insurance began operations in 2001 as a joint venture between India’s largest public-sector bank, SBI, and French insurer BNP Paribas Cardif. Being backed by a large banking institution lends it financial credibility and brand strength, though it operates as a separate life insurance company with its own products and underwriting processes.

Over the years, SBI Life Insurance Company Limited has built a large customer base and diversified portfolio catering to protection, wealth creation, and retirement needs. Its strength lies in strong brand recall and operational scale rather than highly customizable product design.

SBI Life Performance Metrics

Note: SBI Life demonstrates strong operational scale, healthy claims-paying ability, and relatively low complaint levels, supported by adequate solvency. Its metrics indicate financial robustness and operational reliability. However, its CSR remains broadly in line with the industry’s top performers rather than standing significantly ahead of them.

Top Plans Offered by SBI Life: Comparison Table

Types of Plans Offered by SBI Life Insurance

- Term Plans: eShield Insta, Smart Shield Plus, Smart Shield Premier, Saral Jeevan Bima.

- Return of Premium Term Plans: Smart Swadhan Supreme, Saral Swadhan Supreme.

- ULIPs: eWealth Plus, Smart Privilege Plus, and Smart Wealth Builder.

- Savings & Endowment Plans: Smart Platina Plus, Smart Bachat Plus, Smart Money Back Gold, and New Smart Samriddhi.

- Child Plans: Smart Champ Insurance, Smart Scholar Plus.

- Retirement Plans: Saral Pension, Retire Smart Plus, Smart Annuity Plus.

- Group Plans: Group Term Insurance, Group Credit Protection, and Group Immediate Annuity.

Premium Comparison for SBI Life Insurance Flagship Term Plans

Profile Considered: Premiums are illustrative for a ₹2 crore sum assured, coverage up to age 70, for a non-smoking male and female, without riders or first-year discounts.

Premiums vary based on age, smoking status, coverage term, and underwriting profile. You can complete your SBI Life insurance premium payment through online banking, auto-debit, or branch channels.

Riders Available in SBI Life Plans

Across its term portfolio, SBI Life primarily offers accident-linked rider support, with broader add-ons available only under select variants like Smart Shield Plus.

1) SBI Life Accident Benefit Rider

- Under Option A: Accidental Death Benefit (ADB), if the life assured dies due to an accident during the rider term, an additional lump sum equal to the rider sum assured is paid over and above the base policy cover. The accident must occur during the rider term, and death is required to happen within a specified time frame (often 120–180 days) from the date of the accident. The rider sum assured is capped as per underwriting guidelines and is subject to exclusions such as self-inflicted injury, intoxication, or participation in hazardous activities, depending on policy terms.

- Under Option B: Accidental Partial Permanent Disability Benefit (APPD), if the life assured suffers a permanent but partial disability due to an accident, a defined percentage of the rider sum assured is paid based on the severity of the disability. For instance, loss of one eye or one limb may trigger a specified payout percentage. Only disabilities listed in the policy schedule are covered; temporary disabilities are excluded, and the total payout cannot exceed the rider sum assured.

2) Other Plan-Specific Add-ons

- Better Half Benefit, offered under Smart Shield Plus, allows the spouse to receive life cover without paying future premiums if the life assured passes away during the policy term. The coverage continues until a specified age (often 60 years) or the end of the original policy term, whichever is earlier. This benefit is subject to defined caps and conditions and does not apply in certain cases, such as suicide within the initial policy period.

- Future Proofing Benefit, also available under Smart Shield Plus, enables the policyholder to increase the base sum assured during major life events such as marriage, birth or adoption of a child, or purchase of a home. The increase is allowed within specified limits and time windows, and the total enhancement is capped at a percentage of the original cover. While this feature provides flexibility, it remains subject to predefined maximum limits.

While Smart Shield Plus offers broader flexibility through the Better Half and Future Proofing features, most other plans, such as Smart Shield Premier, Smart Swadhan variants, eShield Insta, and Saral Jeevan Bima, are more limited in rider depth.

Notably Missing in Most Plans:

- Comprehensive Health Management Services

- Waiver of Premium Rider (in case of disability or critical illness)

- Critical Illness Rider

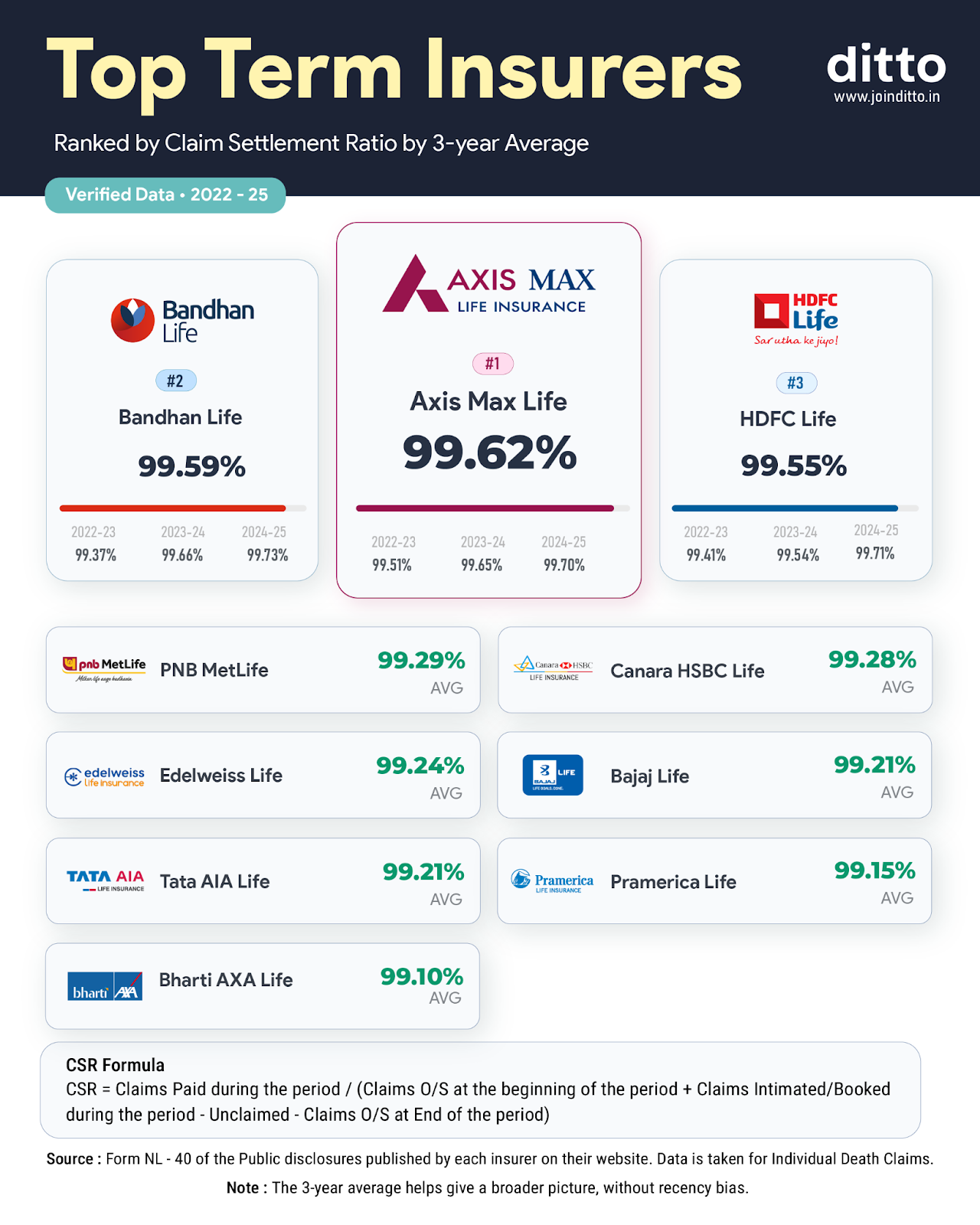

Top 10 Life Insurance Companies in India by Claim Settlement Ratio

Disclaimer: CSR reflects the overall claim settlement performance of the insurer across all life insurance products, including term plans, and is not specific to any single policy. For complete exclusions, benefits, and conditions, always refer to the official policy brochure for accurate SBI Life Insurance policy details before making a decision.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now or chat on WhatsApp with our expert IRDAI-certified advisors.

Ditto’s Take

SBI Life Insurance brings institutional trust, strong brand credibility, and stable claims performance. Being backed by a large banking institution adds to its perceived financial strength, though it operates independently as a life insurance company.

However, from a product evaluation standpoint, certain considerations remain important. Term plans offer limited rider depth and customization options. Some products continue to follow a more traditional structure rather than adopting the evolving, protection-focused designs seen in parts of the market. Buyers who prioritize flexibility and comprehensive feature sets should compare alternatives carefully before making a decision.

Disclaimer

Frequently Asked Questions

Last updated on: