Quick Overview

SBI Life has long been recognized for extending life insurance to the masses. Backed by State Bank of India and BNP Paribas Cardif, it has built strong credibility across India. In fact, SBI Life is the second-largest life insurer in the country by market share, next only to LIC.

In this detailed SBI Life eShield Next review, we break down everything you need to know: insurer background, claim metrics, features, riders, pricing advantages, and who this plan suits best.

SBI Life’s Operational Metrics

Note: The metrics indicate an insurer with operational stability, improving service outcomes, and adequate capital strength, with no material red flags in claims behaviour across the observed period.

What are the Features of SBI Life eShield Next?

1) Comprehensive Coverage Options

The plan provides three distinct benefit structures to match your evolving life stages:

- Increasing Cover Benefit: The sum assured grows by 10% (simple interest) of the basic amount every 5 years to combat inflation, capping at 100% of the initial sum. This growth stops once you reach 71 years of age.

- Level Cover Benefit: Your sum assured remains fixed throughout the entire policy term.

- Level Cover with Future Proofing: You can increase your cover at key milestones without new medical tests:

- Home Purchase: 50% increase (max ₹50 lakh or loan amount).

- Child Birth/Adoption: 25% increase for each of the first two children (max ₹25 lakh each).

- Marriage: Up to 50% increase (Max ₹50 lakh).

2) In-Built & Custom Benefits

- Better Half Benefit: An optional feature that provides a ₹25 lakh life cover for your spouse upon your death, with all future premiums for this benefit waived.

- Terminal Illness Benefit: Included in all variants, it pays the sum assured (up to ₹2 crore) if you are diagnosed with a terminal illness before age 80.

- Death Benefit Payment Modes: You can choose how your family receives the payout as a lump sum, monthly instalments, or a combination of both.

3) Eligibility and Terms

- Sum Assured: Minimum of ₹50 lakhs for online purchases, with no defined upper limit for non-smokers (subject to underwriting).

- Age Limits: Entry from 18 to 65 years, with coverage extending up to 100 years (Whole Life) or 79 years (standard options).

- Flexible Payments: Choose from Single Pay, Limited Pay (5 to 25 years), or Regular Pay frequencies (Yearly, Half-yearly, or Monthly).

4) Additional Riders

You can enhance your coverage with the SBI Life Accident Benefit Rider, which includes Accidental Death Benefit (ADB) and Accidental Partial Permanent Disability (APPD) benefit.

5) Life Stage Benefit (Future Proofing)

Under the Life Stage Benefit, your death cover increases at key milestones as follows:

- Second Child (birth/adoption): +25% of Basic Sum Assured (maximum ₹25 lakh)

- First Child (birth/adoption): +25% of Basic Sum Assured (maximum ₹25 lakh)

- First Marriage: +50% of Basic Sum Assured (maximum ₹50 lakh)

- Home Purchase (once during policy term): +50% of Basic Sum Assured, capped at the lower of the home loan amount or ₹50 lakh

What are the Eligibility Criteria for SBI Life eShield Next?

SBI Life’s Operational Metrics

Note: This table shows indicative annual premiums for level term cover under the regular payment option, based on age and gender for healthy non-smokers, highlighting how premiums rise with age and tenure.

What are the Riders Available with SBI Life eShield Next?

To enhance your protection, the SBI Life eShield Next offers two primary accidental riders.

1) SBI Life - Accidental Death Benefit (ADB) Rider

This rider provides an additional payout (the Rider Sum Assured) to your nominee if death results from an accident.

- Condition: The death must occur within 180 days of the accident date.

- Benefit: It doubles the financial support for your family in high-risk scenarios, though, as noted, increasing your Base Sum Assured may provide broader coverage for all causes of death.

2) SBI Life Accidental Partial Permanent Disability Benefit (APPD)

While the plan covers partial disabilities (APPD), it primarily focuses on Total & Permanent Disability.

- Accidental Partial Permanent Disability (APPD): Pays a specific percentage of the rider sum assured based on the injury (e.g., 50% for loss of one eye or 75% for total hearing loss).

- Accidental Total & Permanent Disability (ATPD): Provides a lump sum if the insured becomes totally and permanently disabled due to an accident, helping to replace lost income.

Note: SBI Life eShield Next does not offer a Critical Illness Rider or a Waiver of Premium Rider. This means there’s no additional payout on major illness diagnosis and no premium waiver in case of disability or critical illness (except for limited conditions under the Better Half Benefit).

What are the Inclusions and Exclusions of SBI Life eShield Next?

What Is Included: Term insurance plans cover death due to natural causes (for example, cardiac arrest), death resulting from terminal or critical illness, death caused by natural disasters or pandemics, and accidental death. It is recommended to check the specific policy wordings for exact inclusions.

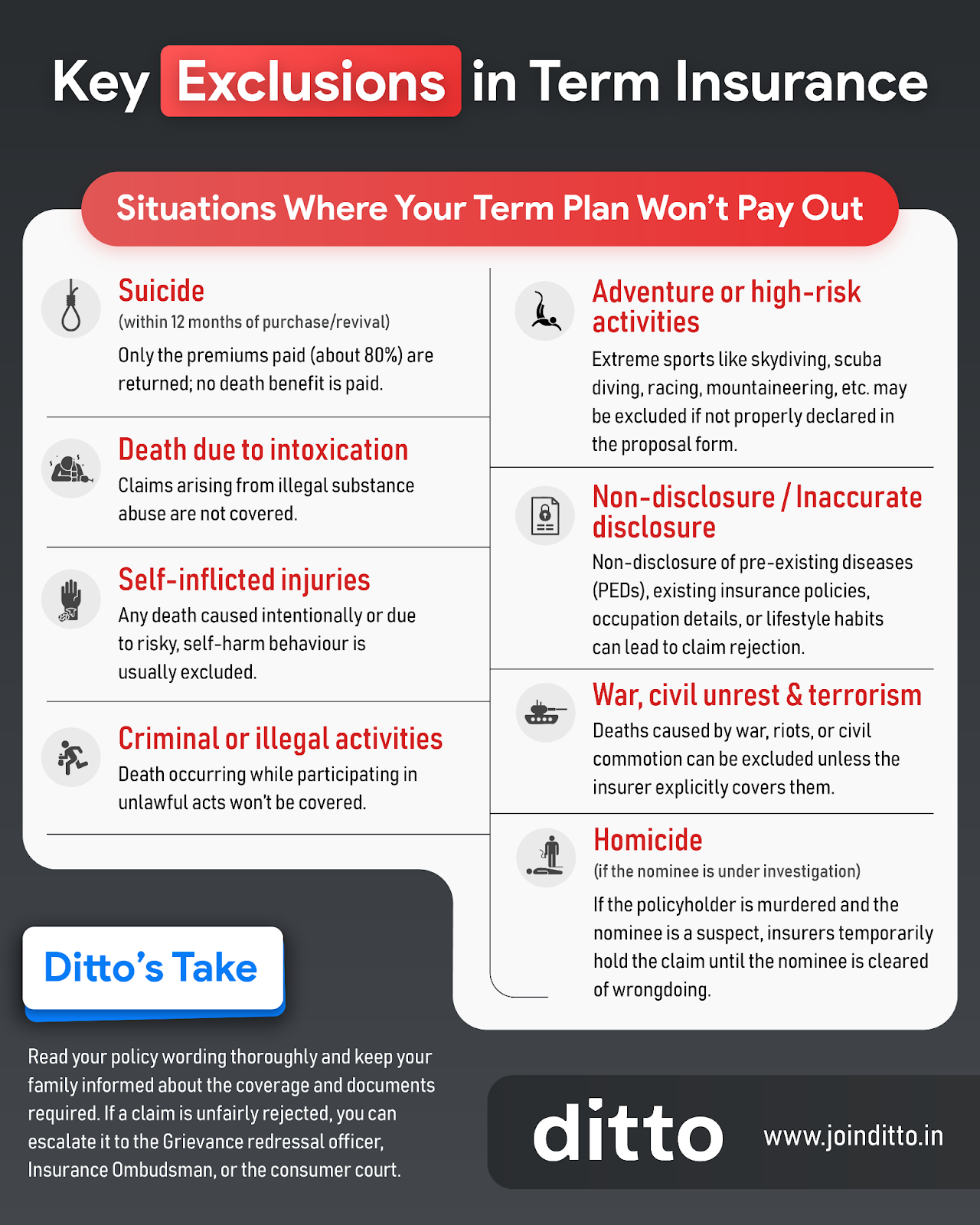

What Is Not Included: The key exclusions are highlighted in the infographic below and are generally applicable across term insurance products.

Documents Required to Buy SBI Life eShield Next

To buy the SBI Life eShield Next, you'll need to keep digital copies of these documents ready for the online application process:

- Identity Proof: PAN Card (mandatory) & Aadhaar Card.

- Age Proof: Birth certificate, Passport, or your 10th/12th school leaving certificate.

- Address Proof: Recent utility bills (electricity/telephone), Voter ID, or a valid Passport.

- Income Proof:

- Salaried: Salary slips for the last 3 months and Form 16.

- Self-Employed: Income Tax Returns (ITR) with computation of income for the last 2–3 years.

- Photographs: Recent passport-sized digital photos.

Note: Depending on your age and the Sum Assured chosen, SBI Life may also require a Medical Examination Report from an authorized diagnostic centre.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now or chat on WhatsApp with our expert IRDAI-certified advisors.

Ditto’s Take on SBI Life eShield Next

While SBI Life has strong financial backing and stable claim metrics, some customers may find private insurers more responsive in digital servicing and post-sales support.

The plan also does not position itself as a “feature-heavy” product. If you prefer minimal complexity and are comfortable with a straightforward structure, this can work well. But if you anticipate needing advanced customisation over time, you may outgrow the plan’s flexibility.

Note: SBI is not a partner insurer of Ditto. The information outlined in this article is sourced directly from the insurer’s website and other publicly available sources. If you are looking for a health insurance plan from companies with established track records, we recommend comprehensive plans for 2026. Learn more about how our experts evaluate health plans through Ditto’s cut.

Frequently Asked Questions

Last updated on: