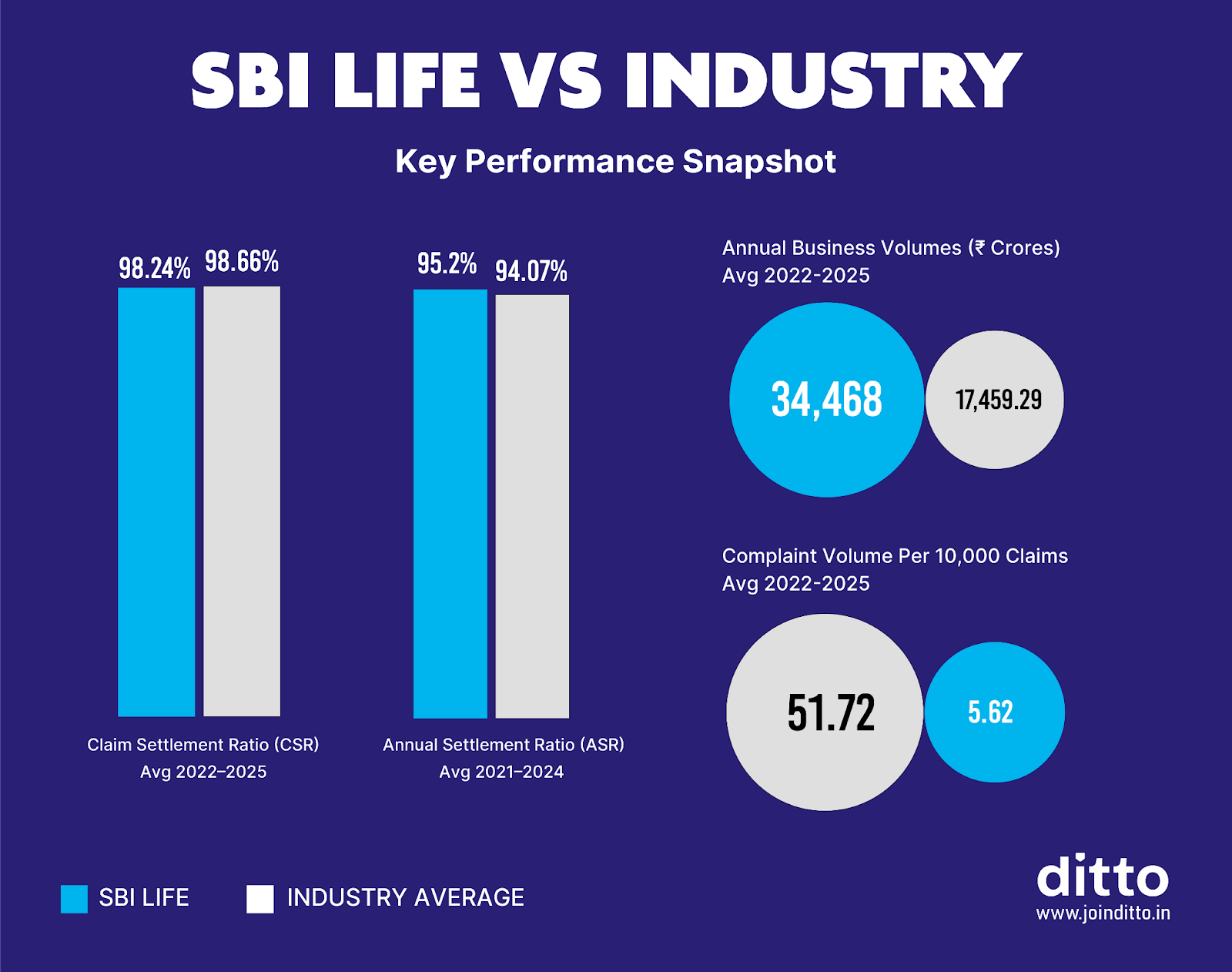

SBI Life reported a Claim Settlement Ratio (CSR) of 98.83% in FY 2024–2025 and an average of 98.24% over 2022–2025. This reflects strong and consistent claims performance, making it one of India’s more reliable life insurers. However, a few competitors, such as Axis Max Life (99.62%) and HDFC Life (99.55%), have shown slightly higher average CSRs during the same period.

Introduction

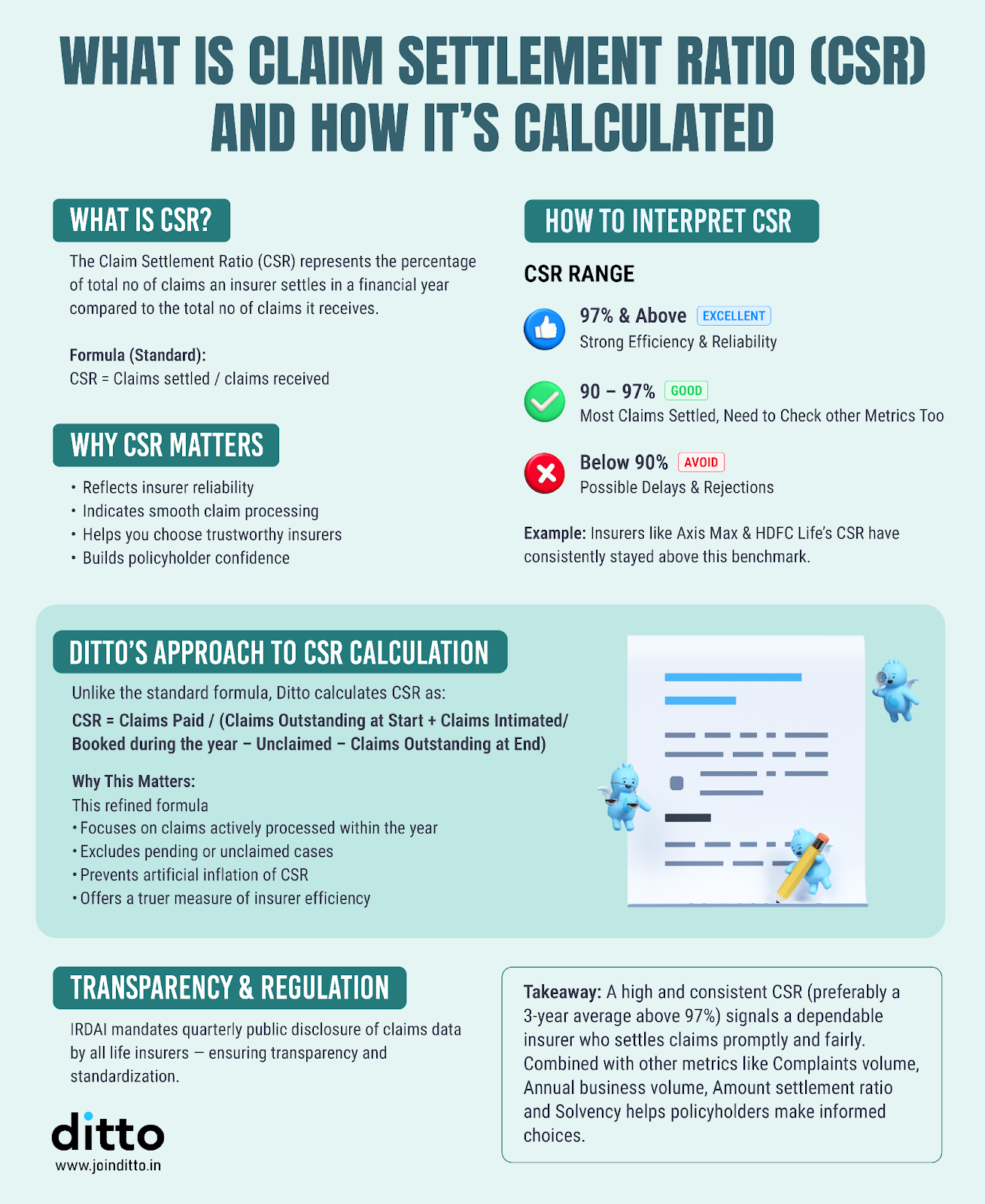

The first step in choosing the right term insurance plan is finding a trustworthy insurer, and the CSR is a key indicator of trustworthiness. In this blog, we’ll cover what CSR means, how it’s calculated, and how SBI Life has performed over the years. Let’s dive in.

Compare the best term insurance plans in India and understand exactly which one fits your family’s needs. Book a FREE call with a Ditto expert and get personalised, unbiased guidance.

What is the Claim Settlement Ratio?

If you’d like to learn more about the claim settlement ratio in detail, you can check out our comprehensive guide on the same.

SBI Life Term Insurance Past 5 Years Claim Settlement Ratio

Ditto’s Note: The Claim Settlement Ratio reported by IRDAI is not specific to term insurance alone. It is calculated for the entire life insurance segment, including term insurance, ULIPs, whole life plans, endowment plans, and other life insurance offerings.

What Does SBI Life’s CSR Mean For You?

SBI Life has significantly improved its performance in the post-COVID era, consistently surpassing the 98% mark. Its improvement from 93.09% (FY20-21) to 97.05% (FY21-22) indicates stronger processes and faster claim settlements.

Although SBI Life isn’t a partner insurer of Ditto, we can say for sure that their CSR over the years is a green flag. However, when choosing an insurer, just the CSR isn’t enough. You also need to consider other metrics, such as the Amount Settlement Ratio (ASR), Complaint Volume, Business Volume, and Solvency Ratio, among others.

If you’d like to learn more about this in detail, we’ve covered it in our blog on SBI Life Insurance Review.

How Does SBI Life’s CSR Compare with Other Top Insurers?

While SBI Life’s improvement is commendable, to truly understand its standing, it’s essential to compare it with other leading life insurers in India.

Below is a ranking of the top 10 insurers based on their three-year average CSR from FY 2022 to 2025.

As you can see, while SBI Life’s average CSR of 98.24% is strong, it appears not to make it to the list of Top 10 Life Insurers ranked by their CSR. This is mainly because the competition’s CSR numbers have become extremely tight in recent years, with many insurers consistently crossing the 99% mark.

How to Calculate The Claim Settlement Ratio of SBI Life Term Insurance?

As discussed in the infographic at the start of the guide, Ditto examines an insurer’s three-year average CSR score for consistency, as a single good year doesn’t provide the whole picture. An insurer may have had an unusually good or bad year due to exceptional circumstances, such as a pandemic spike or an operational shutdown. Taking the three-year average CSR rules out all anomalies.

Where Can I Find The Claim Settlement Ratio of SBI Life Term Insurance?

You can check SBI Life’s CSR from:

- IRDAI’s Handbook on Indian Insurance Statistics

- SBI Life’s Public Disclosures

- Trusted Comparison Platforms like ours that regularly update the data from IRDAI

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

SBI Life’s Claim Settlement Ratio is undeniably strong, but to properly evaluate an insurer’s reliability, it’s essential to look beyond claim numbers and consider other metrics.

At Ditto, we’ve also reviewed SBI Life’s term plan offerings in detail, including Smart Shield Plus and Smart Shield Premier. While SBI Life is a good and reliable insurer, our assessment shows that competitors such as Axis Max Life and HDFC Life outperform it not only in CSR but also across key metrics.

So, to conclude, there’s nothing wrong with choosing SBI Life. However, if you're seeking the absolute best in terms of claim performance, plan design, and overall value, there are better options available today.

Frequently Asked Questions

Last updated on: