| What is a Claim Rejection in Term Insurance? A claim rejection in term insurance occurs when the insurance company refuses to pay the death benefit to the nominee or beneficiary upon the policyholder’s demise. This usually happens due to non-compliance with the policy terms or non-disclosure or misrepresentation in the application and claim process. Knowing these common grounds for claim rejection can help policyholders and beneficiaries avoid surprises and ensure the intended financial protection is delivered when needed. |

Paying for term insurance is supposed to bring peace of mind, but what if the claim doesn’t go through? As per the IRDAI’s FY 2023–24 annual report data, insurers settled 95.51% of death claim amounts valued at ₹28,868 crore under individual life insurance. Out of 10,00,045 policies that filed claims, 9,82,615 were approved, reflecting a claim settlement ratio of 98.26%.

Still, that small percentage of claims left unsettled on time can leave families in distress. At Ditto, we’ve analyzed countless claim cases and spoken directly with families caught on the wrong side of disputes stemming from non-disclosures, documentation issues, and technical errors.

In this article, we’ve combined IRDAI reports, policy wording analyses, and our own claims team’s insights to pinpoint the most reasons for term insurance claim rejections.

Heads up! We know that life insurance can be overwhelming – but it doesn’t have to be! Our IRDAI-certified advisors at Ditto assess your requirements and can help you pick the right policy. And the best part? We don’t spam or pressure you to buy.

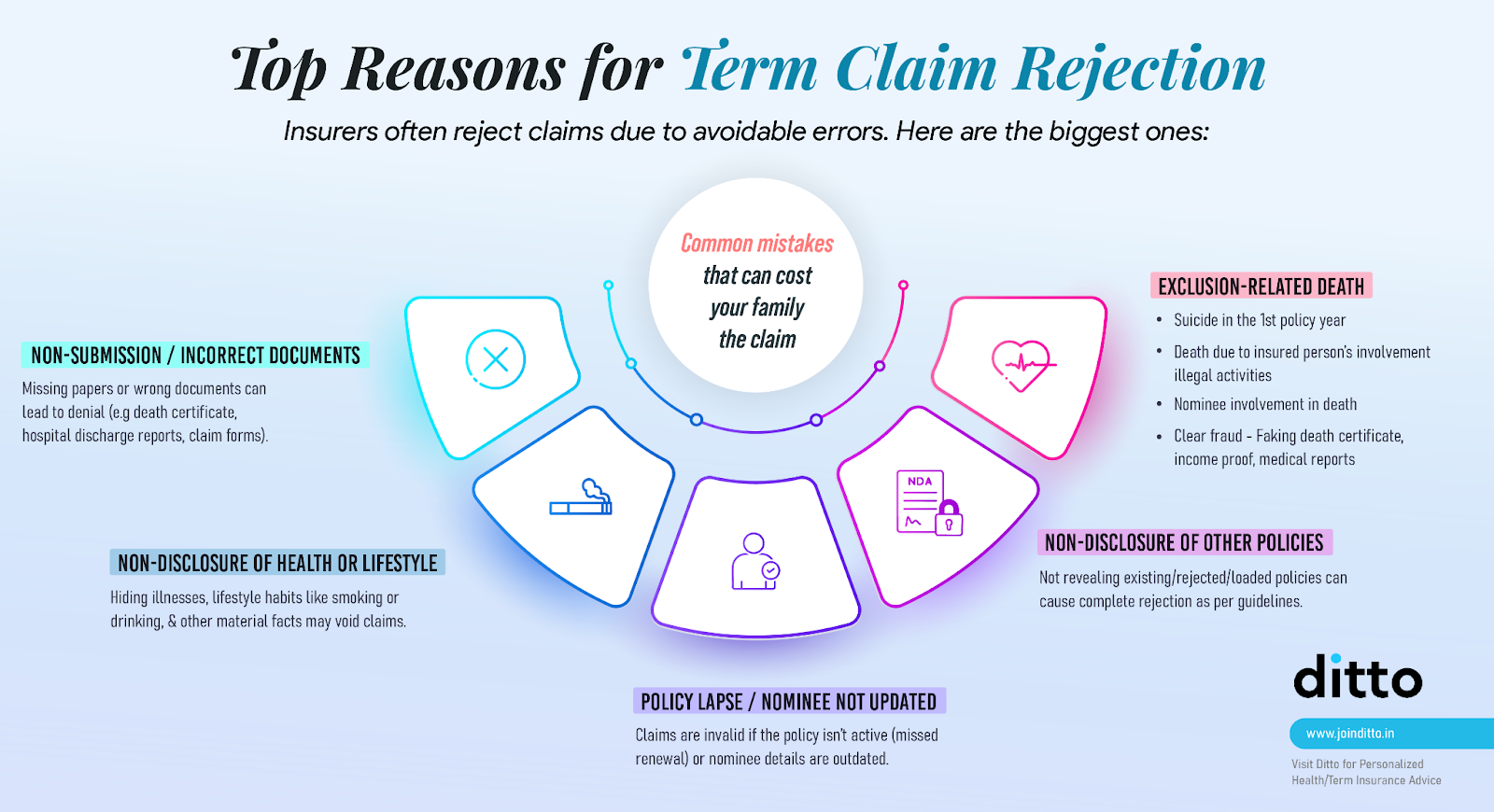

What Are the Reasons for Claim Rejection in Term Insurance?

To make it easier to understand, we’ve grouped the term insurance claim rejection reasons into six main categories:

1. Application-Stage Issues

- Non-disclosure of Material Facts: Hiding or misrepresenting health conditions (e.g., diabetes, hypertension, cancer history).

- Incorrect Personal Information: Wrong details about age, occupation, income, or smoking/drinking habits.

- Undisclosed Existing Policies: Not mentioning previous applications or existing insurance policies

According to IRDAI’s Master Circular on Protection of Policyholder Interest:

- Claim Settlement Timelines

- Death claim (no investigation): 15 days

- Death claim (with investigation): 45 days

In case there’s a delayed settlement, insurers must pay bank rate + 2% interest, from the date of intimation till payment - suo motu.

Key Documents: Claim form, death certificate, survival certificate (for annuities), FIR & post-mortem (for accidental deaths), hospital discharge summary, etc. (full list is stated in the policy and on the insurer’s website).

For Assigned Policies: If linked to a loan, insurers first pay the lender’s outstanding dues. Any surplus goes directly to the nominee’s bank account.

2. Policy-Related Issues

- Policy Lapse Due to Non-Payment: Claim rejected if premiums were unpaid and grace period expired.

- Policy Exclusions: Claims arising from excluded causes (e.g., death due to participation in war, terrorism, or hazardous activities if specifically excluded).

- Suicide Clause: Death by suicide within the first 12 months is not covered.

3. Cause of Death-Related Issues

- Death Due to Criminal Activity: If the insured dies while committing a crime like robbery/terrorism.

- Substance Abuse: Death due to alcohol, drugs, or narcotics abuse.

- Death in Hazardous Situations: High-risk jobs or adventure sports not disclosed at application stage.

- Pre-existing Condition Not Disclosed: Death linked to an illness that was intentionally hidden during policy purchase.

4. Claim Process Issues

- Incomplete Documentation: Missing death certificate, medical records, hospital reports, or nominee details.

- Nominee Issues: Nominee not updated after marriage/divorce/other life events. Claim filed by someone not legally entitled.

5. Fraudulent / Suspicious Claims

- Staged Death or Fake Death Certificates: Attempting to claim while the insured is alive.

- Beneficiary Malpractice: Murder/Poisoning of the insured by the nominee (in which case, claim payout is made to other legal heirs, not nominee).

6. Legal and Regulatory Issues

- Non-compliance with KYC/Anti Money Laundering Norms: Claim may be rejected if identity or premium paid sources aren’t verified.

- Pending Criminal or Civil Cases: If the insured or nominee is involved in fraudulent/illegal activities.

- Jurisdiction Issues: Death occurring in a country not covered under the policy terms like war zones, conflict areas.

How to Avoid Claim Rejection in Term Insurance?

To avoid claim rejection in term insurance, policyholders should follow these key practices:

1) Disclose Complete and Accurate Information

Provide full details about medical history, lifestyle habits (e.g., smoking, alcohol use), occupation, past insurance policies, and any changes during the policy term.

2) Maintain Timely Premium Payments

Missing premium payments beyond the grace period can lead to policy lapse and cause rejection of claims. Using auto-debit facilities reduces this risk.

3) Regularly Update Nominee Information

Keep nominee details accurate and updated to prevent disputes or delays during claim settlement. Include guardian details if a nominee is a minor. Ensure your nominee (spouse/children/parents) knows the policy details, insurer contact, and claim process.

4) Collect Essential Documents at the Time of Death

Obtain an official death certificate issued by the local authority or municipal corporation as it is a mandatory claim document.

- Gather news clippings or death announcements especially when death is due to accidents or unnatural causes to substantiate the claim.

- If a claim is scrutinized (especially in the first 3 years), provide all medical/hospital/doctor details without hesitation.

5) Own the Application Process :

Fill out the insurance application personally rather than relying entirely on agents, ensuring all disclosed data is truthful and complete to the best of your knowledge, verify by checking the proposal form attached to the policy copy.

6) Communicate Changes Promptly :

Inform the insurer about any major changes in health status, location (especially if moving abroad), occupation, or lifestyle changes during the policy tenure proactively so as to avoid issues during claims in the future, if any.

Section 45 – A Regulatory Safeguard

Section 45 of the Insurance Act, 1938 (as amended in 2015) provides strong but balanced protection to policyholders:

After 3 Years:

A life insurance policy cannot be questioned on any ground except fraud once 3 years have passed from the latest of:

- Policy issuance

- Commencement of risk

- Revival of policy

- Addition of rider

This means misstatements or omissions (without fraudulent intent) cannot be used to deny claims after 3 years. However, if fraud is proven, insurers may still repudiate even after 3 years with written reasons shared with the nominee or legal heir.

Grounds for Repudiation Within the First 3 Years

- Fraud (Deliberate & Intentional Deception)

Example 1: Submitting fake medical reports to hide a cancer diagnosis.

Example 2: Faking death to wrongfully trigger a claim.

Insurers can repudiate within 3 years, and even after this period, if fraud is later established.

- Misrepresentation / Innocent Mistake (Non-Fraudulent)

Example 1: Mistakenly declaring weight as 67 kg instead of 70 kg.

Example 2: Forgetting to mention a childhood surgery like appendectomy that has no impact on current health.

Policy can be questioned within 3 years, but the insurer must refund premiums collected if cancelled(within 90 days).

Note: After 3 years, such errors cannot be used to deny claims.

Why It Matters:

- Honesty is non-negotiable: Fraud will void protection even after 3 years.

- Small mistakes aren’t fatal: Innocent misstatements are forgiven after 3 years, ensuring policyholders and their families get rightful claims.

Documents Required for Term Insurance Claims

There are zero chances of term insurance claim rejections if you have the proper documents in hand. These include:

1. Basic/Mandatory Documents (For all Claims)

- Duly filled and signed Claimant Statement Form (Claim form, including NEFT/bank details)

- Original Policy document

- Death Certificate of the Life Assured (issued by Municipal Authority / Gram Panchayat / Tehsildar, attested if copy)

- Claimant’s identity proof (PAN, Aadhaar, Passport, Voter ID, etc.)

- Claimant’s address proof (Utility bill, Aadhaar, Passport, etc.)

- Recent photograph of claimant

- Bank account proof (Cancelled cheque / bank statement / bank passbook with printed name & account number)

- Duly filled and signed Payout mandate form with bank details

- Copy of PAN card or Form 60 of the claimant

2. Additional Documents (Based on the Cause of Death)

A. Natural Death (e.g., at home, in hospital, medical causes)

- Medical cause of death certificate (attested by hospital/doctor)

- Past medical records & treatment papers

- Hospitalization records, such as admission forms, indoor case papers (ICPs), discharge summary, and diagnostic/lab test reports (USG, Pathology, etc.)

- Doctor’s Certificate (duly filled)

- Medical/Hospital Attendant Certificate

B. Unnatural Death (e.g., Accident, Murder, Suicide, Road/Rail incidents)

- Medico-legal cause of death certificate

- First Information Report (FIR) from police

- Inquest / Panchnama Report from police/authority

- Final police investigation report (Chargesheet/Closure report)

- Post-mortem Report (PMR) issued by hospital

- Viscera / Chemical Examination Report (if applicable)

- Driving License (if death due to road accident and the Life Assured was driving)

- Hospitalization/treatment records (if any before death)

- Newspaper cutting (if available / relevant, e.g., major accident reported)

- Employer’s Certificate (only if life assured was salaried and accident occurred in course of employment)

| Things to Note: 1) If original documents are submitted, attestation is not required. 2) If copies are submitted, they must be attested by issuing authorities (police, hospital, municipal authority). 3) Claim must be intimated within 90 days of death (delay may be condoned if reasons are genuine). |

Case Study: Claim Rejection and How We Helped Fix It

Quick Note: While we do not have a death claim rejection story, here is one where a critical illness rider is involved.

A customer was facing multiple hurdles when claiming a critical illness benefit under his term insurance policy. Despite having a ₹20 lakh coverage, his claim was stuck for over a month. The insurance company repeatedly requested extensive documentation, some of which weren’t ready due to the emergency nature of his heart bypass surgery.

There was also confusion around some precautionary medications that he took for blood pressure and diabetes, although he did not have any pre-existing conditions. This led to delays and risks of claim rejection.

Our team intervened by coordinating directly with the insurance company and the treating doctor. We clarified the emergency situation, provided necessary certifications, and justified the precautionary medications.

Outcome: Within a few days, the customer received the full ₹20 lakh critical illness payout, without any tax deduction.

Note: Although the insurer processed the claim in this case, there was a real risk that it could have been rejected due to missing documentation and confusion around precautionary medications.

Ditto’s Take on Term Insurance Claim Rejections

Most exclusions (specific circumstances or conditions not covered by the insurer) are logical if you look at them from the insurer’s perspective. While suicide in the first year is the only standard exclusion explicitly mentioned across most term plans, other situations can still impact claim validity.

Here’s what you should know:

- Always read the policy wording carefully to understand coverage and exclusions.

- Ensure your family knows the policy details and keeps all necessary documents handy.

- Edge cases like fraud or non-disclosure matter, but remember death during the policy term is statistically rare, especially for young, healthy individuals.

- The vast majority of claims are settled smoothly when disclosures are truthful and complete.

- Insurers are strictly regulated by IRDAI and must follow stringent claim settlement norms.

- Maintaining a high Claim Settlement Ratio (CSR) is crucial for insurers as it builds credibility and directly affects customer trust.

Bottom line: If you are honest at purchase, your family is extremely likely to receive the financial support you intended for them, exactly when they need it most.

Why Choose Ditto for Term Insurance

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right term insurance policy. Here’s why customers like Manoj love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Term Insurance Claim Rejection Reasons: Key Takeaways

Term insurance claim rejections can be quite stressful. However, most of them stem from avoidable issues like documentation gaps, non-disclosures, and technical errors.

Remember:

- Everything may not be an outright rejection; it’s a way for the insurer to investigate whether the information provided is correct.

- Try to understand your policy inside out and maintain complete transparency

- With the right guidance and preparation, you can reduce the chances of rejection, and even if it happens, there’s always a way to fight back.

Still confused about the term insurance claim process? WhatsApp us or book a call to get better guidance from IRDAI-certified advisors.

FAQs

Which death is not covered in term insurance?

Suicide during the first policy year, death due to participation in adventure activities which were not declared, undisclosed pre-existing diseases, intoxication or substance abuse, or while commiting a criminal act are not covered in term insurance.

What is the minimum time to claim term insurance?

Insurers generally prefer intimation of death as early as possible even if documents and other formality is done a bit later. Within 90 days of death is ideal though insurers may allow delay if the reason is genuine, provided the policy is kept active during that time.

Can suspicious or fraudulent claims be denied by insurers?

Yes, suspicious or fraudulent claims can be denied by insurers. Insurance companies thoroughly investigate every claim, especially if there are red flags such as inconsistent medical records, fabricated death certificates, or misrepresentation of facts.

What happens in term insurance if a person goes missing?

In the case of a missing policyholder, life insurance claims cannot be settled immediately since the person is legally considered absent, not deceased. Under Section 108 of the Indian Evidence Act, death can only be presumed after seven years of no contact. During this period, the family must file a missing person’s report and continue paying premiums to keep the policy active. After seven years, a court declaration of presumed death is required before the insurer can process the claim. This rule prevents fraud but can be financially and emotionally challenging for families.

Are deaths by natural calamities covered in term insurance?

Yes, deaths by natural calamities are covered, even if the body is not found. In such cases, authorities, including the police, disaster management, or government bodies, may issue a list of deceased or missing persons presumed dead, based on the specific situation, which can be used to file a claim.

Are pandemic-related deaths covered in term plans?

Yes, modern term plans cover deaths due to pandemics like COVID-19.

Last updated on: