| A non-cancellable insurance policy (popular in the US) is one in which the insurer cannot cancel coverage, raise premiums, or reduce benefits as long as the policyholder continues to pay premiums. In India, pure non-cancellable policies aren’t offered; however, similar protections are available through lifetime renewable health insurance, fixed-premium term life insurance, and certain riders. |

What if your insurance could never be taken away, no matter how sick you get, how many claims you make, or how long you live? That’s the promise behind non-cancellable insurance.

In this article, we break down what “non-cancellable” really means, why it matters, and how Indian consumers can still protect themselves with policies that offer comparable peace of mind, even if the terminology differs.

Noncancellable Insurance Policy Works?

At its core, a noncancellable insurance policy offers one powerful promise: your insurer cannot change the rules mid-game. Once a policy has been issued, the insurer cannot raise your premiums, reduce the benefits, or cancel it. This structure protects you from surprises driven by deteriorating health, frequent claims, or insurer decisions.

While India doesn’t offer pure non-cancellable policies like in the US, various regulations and product features provide similar protections. Let’s look at some of these in detail:

Want to make sure you're choosing the right plan for stable, long-term coverage? Book a free call with Ditto today to get expert guidance and explore your options. Let us help you navigate the best alternatives available to secure your future.

Health Insurance in India

| Before we discuss the list, here’s how we decide what plans to feature. At Ditto, every health plan goes through our six-point evaluation framework. It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars. You can learn more about how we evaluate health insurance plans here. |

Popular Non-Cancellable Health Insurance Plans in India:

1.Renewability

Indian retail/ individual health insurance is renewable for life by law. Insurers can’t deny renewal unless there’s fraud, misrepresentation, or product discontinuation. In the event of discontinuation, migration to another product, or portability to a different insurer’s product is typically offered.

2.Premiums

Premiums can increase due to age or medical inflation, but not because of your individual claims or new health conditions diagnosed post-purchase. This differs from US-style non-cancellable plans, where premiums are fixed.

3.Benefits

Once benefits are added to your policy, the insurer can’t reduce them mid-term for just you. However, if a product is revised, changes apply only prospectively at renewal and class-wide after approval by the IRDAI.

| Did you know? Instead of calculating a premium individually for each person, a standard premium is determined for all members of a particular ""class"" or group. For example: Age, gender, location. |

Health insurance in India is closest to being “guaranteed renewable with class-wise pricing.” While not strictly "non-cancellable," it offers similar protections against unilateral changes by the insurer.

Term Insurance in India

Best Non-Cancellable Term Insurance Plans in India:

- Premium

For term life policies in India, premiums are fixed and level for the chosen term at the time of purchase. This ensures that your premiums won’t increase during the policy term.

- Cancellability

The insurer cannot cancel the policy or change the benefits unless you stop paying premiums or have provided false information at the time of proposal. Note: If a product is discontinued, it cannot be sold to new customers. However, existing customers can still renew their plan without worry.

- Health/Lifestyle Changes

Unlike some other types of policies, your health or lifestyle changes (e.g., developing a medical condition) won’t affect the premiums or the coverage during the term of the policy.

Term life insurance in India behaves similarly to “non-cancellable” insurance policies in the US, offering fixed premiums and coverage that can’t be changed during the policy term.

Disability Income Insurance

Actual US-style non-cancellable disability income policies, where the insurer cannot cancel or raise premiums, are pretty rare in India. However, some products can offer some of the same benefits:

- Standalone Accident/Critical Illness Policies

These are typically annual policies that are guaranteed renewable with class-wise pricing, though premiums can increase with age and inflation.

- Income Protection Riders (Critical illness/ accidental disability)

These are often attached to life & health insurance policies, with premiums based on the terms of the rider.

While pure disability income “non-cancellable” products are not standard in India, you can still get similar protection through insurance riders or critical illness policies.

What Are the Advantages and Disadvantages of Noncancellable Insurance?

Advantages

- Guaranteed Renewability

For health and life insurance policies, your insurer cannot cancel your coverage as long as you continue paying the premiums. This protection is crucial as you get older and may face health challenges that could make it harder to find new coverage.

- Protection Against Insurer’s Financial Risk

In case of a claim or worsening health, you don’t need to worry about the insurer raising your premiums or altering the benefits. This ensures that your policy stays consistent, regardless of changes in your health.

- Long-Term Financial Planning

Since your premiums and coverage remain locked in, non-cancellable insurance helps you with long-term financial planning, providing peace of mind that your coverage will remain intact throughout the policy's life.

- Avoid Premium Increases Due to Claims

With non-cancellable policies, insurers cannot increase your premiums after you’ve made a claim personally. This ensures that policyholders who need insurance the most aren’t penalized financially due to health conditions or claims.

Disadvantages

- Higher Initial Premiums

Non-cancellable policies often come with higher premiums than cancellable ones because the insurer assumes a greater risk of loss. Since they can’t change the terms once the policy is issued, they build in a higher cost to offset that risk.

- Limited Flexibility

If your needs change, such as wanting to switch policies or adjust coverage, non-cancellable insurance can be less flexible. It may be more challenging to modify your policy compared to other types that allow for more adjustments.

What Are the Factors Affecting the Cost of Non-Cancellable Insurance?

The cost of non-cancellable insurance is influenced by various factors, which determine the premiums you’ll pay for the coverage. These include:

1) Age

Insurers base premiums on the risk they assume, and the younger and healthier you are, the lower your premiums will be.

2) Health Status

Insurers assess your current health condition, including any pre-existing conditions. The healthier you are when purchasing the policy, the lower your premium will be. If you have existing health conditions, insurers may charge higher premiums (loadings) or even refuse coverage in some cases.

3) Occupation and Lifestyle

Certain occupations and lifestyles carry higher risks, which can lead to increased premiums. If you work in a hazardous job or engage in risky hobbies (e.g., skydiving, scuba diving), insurers may charge more to offset the potential for claims.

4) Coverage Amount

The higher the coverage or sum assured you seek, the more expensive your premiums will be. This is particularly true for life or disability income insurance, where a higher payout will mean more significant premiums.

5) Policy Type

The specific type of insurance you choose (health, life, or disability) will influence the price. Health and disability policies, for example, are generally more expensive than term life policies due to the broader scope of coverage they offer and the increased likelihood of claims.

6) Insurer’s Underwriting Guidelines

Different insurance companies have varying underwriting guidelines, which can affect premiums. Some insurers may offer lower premiums but provide more restrictive terms, while others may have higher premiums but more comprehensive coverage.

7) Policy Term and Payment Mode

A longer-term policy or one with premiums paid annually may cost more upfront, but some insurers offer discounts if you choose to pay premiums in lump sums or opt for longer-term coverage.

8) Inflation and Medical Inflation

In health insurance, the rise of medical costs (inflation) is an essential factor. Insurers may adjust premiums to reflect the increase in medical treatment costs, although this adjustment may still be within class-wide pricing and not directly tied to individual claims.

What Are the Alternatives to Non-Cancellable Insurance?

Here are some of the best alternatives available in the Indian insurance market:

1) Policies with Fixed Premiums Until a Claim is Made

Specific health insurance policies in India, such as the Niva Bupa Reassure 2.0, offer a long-term pricing guarantee that functions similarly to non-cancellable insurance. Note: The insurer can still discontinue or adjust the policy based on broader market conditions.

- How it works

With policies like Niva Bupa Reassure 2.0, once you buy the plan, your premium remains fixed until you make a claim. This provides the security of knowing that your premiums won’t increase due to your age or any health conditions that may arise, offering some of the stability of a non-cancellable plan.

- Why it’s a good alternative

These plans offer long-term financial predictability and prevent sudden price hikes, much like non-cancellable policies. The only significant difference is that the insurer could revise premiums for the entire class at a future date (due to inflation or changes in the risk pool). Still, your individual premiums remain stable until you make a claim.

| Did you know? IRDAI has capped the senior citizen premium increase to a maximum of 10% per annum, and any increase beyond that requires direct consultation with the regulator. |

2) Guaranteed Renewable Policies

As mentioned earlier, guaranteed renewable policies ensure that you can renew your coverage year after year, as long as you continue paying the premiums.

This clause will be clearly stated in all retail health insurance plans on the market, as mandated by the IRDAI.

However, unlike non-cancellable policies, the insurer has the option to increase premiums for the entire class (but not for individual policyholders based on personal claims history or health changes).

- How it works

These policies typically offer renewal at the end of each policy year without medical underwriting (unless there is an increase in coverage or riders are being added). While premiums may rise due to market factors, they remain affordable if you don’t make any claims, and the insurer can’t arbitrarily cancel the policy.

- Why it’s a good alternative

Guaranteed renewal policies provide a similar level of protection against policy cancellation, although they don't guarantee that your premiums will never change.

3) Term Life Insurance

For life insurance, term life policies in India often closely match the concept of “non-cancellable” policies, particularly in that they offer fixed premiums for a predetermined term (e.g., 10, 20, or 30 years). The insurer cannot cancel your coverage as long as you continue to pay premiums, and the premiums remain fixed for the entire term.

- How it works

When you purchase term life insurance, your premiums are fixed for the term of the policy. This means that if you buy a 20-year policy, your premiums won’t increase during that period. The insurer cannot change your coverage or increase premiums due to age or any health issues you develop during the policy's life.

- Why it’s a good alternative

While not exactly “non-cancellable,” term life policies are still a good alternative if you're looking for fixed costs and guaranteed coverage over a specific period, which provides a similar sense of stability.

4) Critical Illness and Accident Insurance with Fixed Premiums

Another alternative is critical illness (CI) and personal accident (PA) insurance, which often comes with fixed premiums for the entire policy term. These plans may be renewable, but the premiums for the chosen sum insured are typically fixed for the term, similar to the concept of “non-cancellable” coverage.

- How it works

Critical illness policies provide a lump sum payout if you're diagnosed with a covered illness, and personal accident policies offer compensation for accidents. Many insurers offer policies with fixed premiums for the entire policy term, meaning your premiums will not change due to the occurrence of a claim.

- Why it’s a good alternative

These policies offer a similar sense of stability as non-cancellable insurance because they prevent the insurer from changing your premium rates based on health claims. However, keep in mind that while they offer fixed premiums, they don’t guarantee lifelong coverage like some non-cancellable policies would.

Why Choose Ditto?

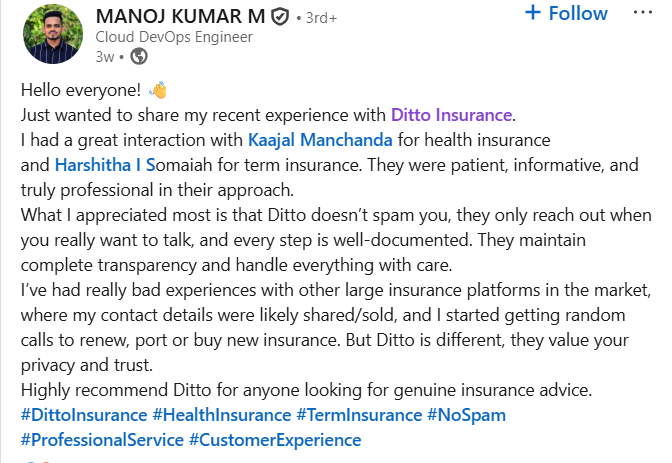

At Ditto, we’ve assisted over 7,00,00 customers with choosing the right insurance policy. Why customers like Manoj love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 5,000+ to 9000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

In India, although actual non-cancellable policies are rare, several alternatives offer similar benefits, including fixed premiums, guaranteed renewability, and stable coverage. Policies like Niva Bupa Reassure 2.0 provide an excellent option for health insurance with fixed premiums until a claim is made, providing long-term predictability.

Other alternatives, such as guaranteed renewable policies, term life insurance, and a critical illness rider with fixed premiums, can also offer peace of mind and financial stability. However, they may not offer the same guarantees as non-cancellable policies.

If you're looking for a policy that provides stability and protection, exploring these alternatives in the Indian market can help you make an informed decision based on your needs and preferences.

FAQs

What are the different types of non-cancellable insurance?

Non-cancellable insurance policies typically include health, life, and disability income insurance. In India, the equivalent protection is provided through lifetime renewability for health plans, fixed premiums for term life policies, and guaranteed renewability for specific riders.

Can I get non-cancellable disability insurance in India?

While pure non-cancellable disability insurance isn’t mainstream in India, you can get similar protection through accident/critical illness policies or income-protection riders attached to life policies.

What is the advantage of a non-cancellable policy?

The most significant advantage is the peace of mind that comes with knowing your premiums and benefits won’t be changed by the insurer, even if you develop health issues or make a claim.

Last updated on: