Quick Overview

Higher education costs in India have been rising rapidly, often faster than general inflation. As of November 2025, the year-on-year education provisional inflation rate stands at 3.38%, reflecting combined inflation across both rural and urban sectors. Without a clear plan, parents may find it difficult to fund major milestones, such as college admissions or professional courses, when the time arrives.

A child education plan aims to solve this problem by helping parents systematically build a dedicated corpus for future education while adding a layer of financial protection. This guide walks you through what a child education plan is, how it works, its benefits, and how to choose the right approach based on your financial goals and risk appetite.

What is a Child Education Plan and How Does it Work?

A child education plan is meant to ensure that a predetermined amount of money is available when a child reaches higher education age. The two components that the plan addresses are financial protection and wealth creation.

Financial protection ensures that the child’s education money is still available if the earning parent dies before the child becomes financially independent. On the other hand, wealth creation addresses whether the money is invested in a way that keeps pace with or exceeds education inflation.

Take Note: In India, child education plans are usually life insurance products designed to serve two purposes: building an education corpus and financially protecting the child’s future if the parent passes away. They may offer guaranteed/bonus-linked returns or market-linked growth.

Unlike education loans or mutual funds, these are insurance contracts regulated by IRDAI, and they come with lock-ins, surrender values, and policyholder protections.

Benefits of Investing in the Best Child Education Plan

Financial Security for Your Child

Many plans continue contributions or provide a payout to ensure studies are not disrupted. If the parent dies during the policy term, the insurance company may either continue the future contributions on behalf of the parent or provide a lump-sum payout.

Long-term Wealth Growth

Market-linked options allow your investments to grow over time. This helps build a larger corpus to handle rising education costs.

Tax Advantages

Many child education plans offer tax benefits under applicable sections, which help you save for your child’s future while reducing your tax liability. The premiums you pay towards a child's education insurance plan qualify for tax deductions under Section 80C of the old regime.

Additional Riders

Many plans offer riders such as accidental death, disability, and critical illness benefits that provide enhanced financial protection beyond the base policy.

Loan Benefit

The accumulated policy value can sometimes be used as collateral for education loans, helping parents manage large academic expenses more easily.

Types of Child Education Plans in India

Unit-Linked Insurance Plans (ULIP) vs Traditional Savings Plans

Government Child Education Plan Options

India offers two strong government child education plan options: the Public Provident Fund (PPF) and the Sukanya Samriddhi Yojana (SSY). Both offer Exempt-Exempt-Exempt (EEE) tax treatment, meaning contributions, interest, and maturity proceeds are all tax-free.

ULIPs and government education schemes both aim to support long-term savings for a child’s future, but they differ in structure. Here’s a quick comparison to understand the differences.

ULIPs vs Government Schemes

Insurance Plans vs Mutual Fund Alternatives

Equity mutual funds via a Systematic Investment Plan (SIP) have delivered 12% to 15% annualized returns over 10 to 15-year periods historically.

A ULIP or traditional child plan targeting similar equity exposure typically delivers 2% to 4% percentage points less per year after charges. Over a long-term investment horizon, even a small reduction in annual returns can significantly shrink the final corpus by a substantial margin.

Suppose you invest ₹10,000 per month for 15 years in a child education plan. This means you invested a sum of ₹18 lakh over the time period. Here’s how your final corpus will look as returns fluctuate:

Final Corpus Fluctuations

Thus, a small 2–4% reduction in annual returns due to policy charges can significantly reduce the final corpus over a long-term horizon.

Having said that, the need for term life insurance is real and non-negotiable. Term insurance is the most cost-effective way to provide the financial protection component. It keeps insurance and investment separate, transparent, and optimized independently.

If you are looking for a term plan from insurers with established track records and affordable riders, we recommend the best term insurance policies, which align with your long-term goals.

Popular Child Education Plans

How to Choose the Best Child Education Plan?

1. Premium, Tenure, and Flexibility: Most child education goals have a time horizon of 12 to 18 years. It helps you choose a plan that allows flexibility as your income grows. Investment options like mutual fund SIPs allow you to increase contributions gradually. PPF and SSY also allow variable yearly deposits within limits. Plans with rigid premium structures may become difficult to maintain during financial stress.

2. Plan for Education Inflation: Education costs in India rise by about 8% to 10% every year. Investment options that deliver only 6% to 7% returns may struggle to keep up. Equity mutual funds are often better suited for goals that are more than 10 years away. As the education goal gets closer, shifting part of the corpus to debt funds or fixed deposits can help protect it from market volatility.

It is important to distinguish between Consumer Price Index (CPI) education inflation, which measures general education costs in a broad consumer basket, and actual fee inflation. In reality, fees for private schools, coaching, professional courses, and overseas education often rise much faster than the CPI estimate.

3. Match Investments to Risk and Time Horizon: Parents with over 10 years until their child starts higher education can allocate a larger portion to equity SIPs, since they have time to ride out market cycles. Those with shorter horizons or lower risk tolerance may prefer a mix of PPF and debt mutual funds. SSY can also be a useful option for parents of girl children under 10 years old.

A Simple Framework for Planning Your Child’s Education Fund

Government Child Education Plans in India

When are Government Schemes Better Options?

Government schemes like SSY and PPF are typically preferred when parents prioritize capital safety, tax-free returns, and disciplined long-term savings. With sovereign backing and EEE tax benefits, they suit conservative investors, especially parents of a girl child eligible for SSY, who want a low-risk way to build an education corpus.

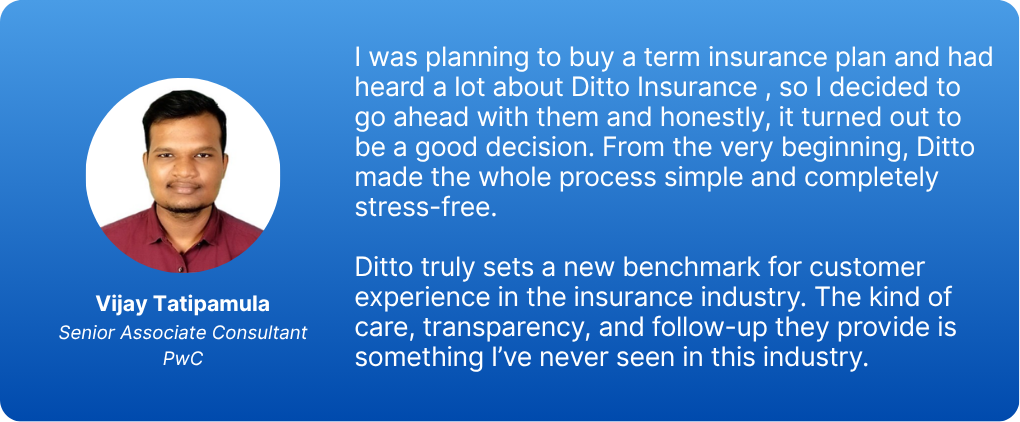

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Vijay below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now or chat with us on WhatsApp!

Conclusion

The best child education plan is a deliberate combination of two separate decisions:

- A term life insurance policy on the earning parent's life to ensure the education corpus is built, regardless of what happens.

- A low-cost investment strategy using SIPs, fixed deposits, or the National Pension System (NPS) based on the time horizon and risk appetite.

This approach separates protection from wealth creation, keeps costs low, and gives each rupee invested the best chance of compounding into the corpus your child will actually need. The sooner you make these financial decisions, the more time your money has to grow through compounding.

Disclaimer: At Ditto, we do not recommend ULIPs or traditional investment-plus-insurance type products because they tend to be less efficient than buying a term plan and investing separately. This article is for informational and educational purposes, based on official insurer documents, IRDAI regulations, and publicly available data.

Frequently Asked Questions

Last updated on: