At Ditto, we have helped 8,00,000+ people find their best coverage. In the countless conversations we've had with our clients, a question comes up quite often: "Will I get nothing back if there is no claim from my term insurance?" It is a genuine doubt, considering that we tend to mix insurance and investments in India.

This is where the ROP feature comes in. It promises to refund your paid premiums to you, minus taxes, add-on premiums, and certain charges, if you don't claim till maturity. While it may sound enticing, it does come with its disadvantages.

On this page, we will learn about ROP in detail, the plans that offer this add-on, its pros and cons, and whether it is a good choice for you.

Popular Term Insurance Plans With Return of Premium

1) HDFC Life Click2Protect Supreme (With ROP Add-on)

HDFC Life’s Click 2 Protect Supreme might cost a bit more than some other term insurance plans, but it gives you a solid set of features for that price. One useful feature is a smart exit option that lets you end the policy early and get back the premiums you’ve paid, as long as you meet certain conditions (Not available if ROP is selected). The plan also includes a built-in terminal illness benefit, under which the sum insured is paid out if you’re diagnosed with a terminal condition. On top of that, Click 2 Protect Supreme comes in several variants.

Features

- ROP add-on returns 100% of base premiums, if no claims are made till maturity, with a maximum possible policy tenure of 40 years.

- Accidental Death Add-on

- Disability & Critical Illness Premium Waiver

- Income benefit on Accidental Disability

- Inflation-linked cover increase

- Critical Illness Cover (60 illnesses)

- Life Stage Increase Option

- Terminal illness cover (up to ₹ 2 crores)

Drawbacks

- Premiums are higher compared to other ROP-enabled plans

2) Axis Max Life Insurance Smart Term Plan Plus (Return of Premium Variant)

Axis Max Life’s Smart Term Plan Plus is a modern and flexible term insurance plan that comes with six different variants, including a Return of Premium option. It works well for people who want features like early premium refunds, temporary increases in cover, or flexible income payouts. All of this is backed by a brand known for strong claim performance, with a 99.62% claim settlement ratio over the last 3 years , which adds an extra layer of confidence.

Features

- Returns 100% of base premium paid if no claims are made till maturity (including extra underwriting premiums paid or loading for modal premiums, if any)

- Accidental Death & Disability Benefit Option

- Critical Illness Cover (up to 64 illnesses)

- Regular (Level) or Smart Cover (1.5X coverage for first 15 years)

- Waiver of Premium on Disability or Critical Illness

- Terminal Illness Benefit (up to ₹1 crore)

- Additional features like Zero-Cost Exit Option and Women's Perks (Lifeline Plus & Discounts)

Drawbacks

- ROP premiums are high, often close to twice that of regular term plans

- The critical illness rider has term limits and is not available with all pay modes

- There is no Top-Up feature to increase your coverage, unlike some competing plans

3) Bajaj Life eTouch II (Life Shield ROP Variant)

Bajaj Life’s eTouch II is available in three variants: Life Shield, Life Shield Plus, and Life Shield ROP, with each variant offering a different options.

Features

- Returns 100% of base premium paid if no claims are made till maturity

- Accidental Death Benefit

- Life Stage Benefit (increased coverage after marriage/childbirth)

- Critical Illness Coverage (60 illnesses)

- Waiver of Premium on Accidental Total & Permanent Disability

- Terminal Illness cover and Zero Cost Option

Drawbacks

- It does not offer an increasing cover variant

- The insurer is still growing, does not have the same brand value like HDFC or ICICI in insurance.

4) ICICI Prudential iProtect Smart Return of Premium Plan

ICICI iProtect Smart ROP is a term plan packed with useful features. It offers flexible policy and premium payment terms, multiple death benefit payout options (lump sum, income, or both), and optional accidental death and disability riders, with a 15% lower premium for women.

Features

- You can choose flexible policy terms and premium paying terms, including Limited Pay options like 5, 7, 10, 12, or 15 years and Regular Pay, with overall policy terms from 20 to 40 years.

- The plan offers multiple death benefit payout choices, such as lump sum, income over 5 years, or a combination of both.

- Optional riders are available, including an Accidental Death Benefit rider and an Accidental Total & Permanent Disability rider for extra protection.

Drawbacks

- iProtect Smart ROP plan does not offer an option to increase your cover with inflation.

- The insurer has slightly higher complaints volume than the other insurers discussed in the article

5) Aditya Birla Sun Life Super Term Plan (‘Level Cover with Return of Premium’ Variant)

Aditya Birla Super Term Plan comes with multiple coverage options, income-based payout choices, and optional riders. While premiums may be slightly higher for younger buyers, they are supported by the plan’s strong built-in features and long-term flexibility.

Features

- Returns 100% of base premiums, if no claims are made till maturity

- Accelerated Critical Illness Benefit (42 illnesses)

- Waiver of premium on Accidental Total & Permanent Disability

- Life Stage Flexibility and Terminal Illness payout

- Cover Continuance (premium deferment up to 12 months)

- Early Exit Value (specific age/tenure bands) - Non ROP variants only.

Drawbacks

- Limited rider flexibility. Not all benefits are available with the ROP option, which can restrict customization.

Talk to an expert

today and

find

the right

insurance for you.

Benefits of Term Insurance With Return of Premiums

Guaranteed Payout

Tax Benefits

Suitable for Risk-averse Individuals

Building Financial Discipline

Drawbacks of Term Insurance With Return of Premium

- Risk of Having to Lower Coverage: Since ROP riders push premiums higher, many people compensate by choosing a lower sum assured. This weakens the main purpose of term insurance, which is to provide strong financial protection for your family if something happens to you.

- Inflation Risk: The refunded amount does not account for inflation. So even though you receive your premiums back, their real purchasing power may be much lower by the time the policy ends, reducing the actual financial value of the payout.

- Stringent Conditions: The refund is not automatic. Insurers may attach specific conditions that must be met for the payout to happen. Missing even one of these can make you ineligible, which makes the rider less straightforward than it initially appears.

- Higher Premiums: The promise of getting your money back sounds attractive, but it comes at a steep price. ROP riders significantly increase the overall premium, often defeating the affordability advantage that makes term insurance popular in the first place.

Return of Premium Variants or Base Plans: Which Is Better?

The sample premiums are for a 25-year-old individual.

Key Insights: The above premiums are for a 1 crore cover, coverage till age 65, for a non-smoker profile, male, without first year discounts.

As you can see above, the premiums for ROP variants are much higher than the premiums of a pure term plan. This extra premium is not going towards increasing your cover. Alternatively, the extra amount could’ve been used to opt for more add-ons or increasing your cover, providing more protection to your family.

You’d also be much better off investing the differential amount. Even in the case of Bajaj Life eTouch II, the plan with the lowest difference between both premiums, a SIP of the differential amount with a 7% return would fetch you roughly ₹17.23 Lakhs at the end of the 40 year term. In comparison, the ROP variant would return just ₹7.03 Lakhs, all for the same amount of investment. The return itself would have lost a big chunk of it’s value due to inflation.

Why Choose Ditto for Term Insurance?

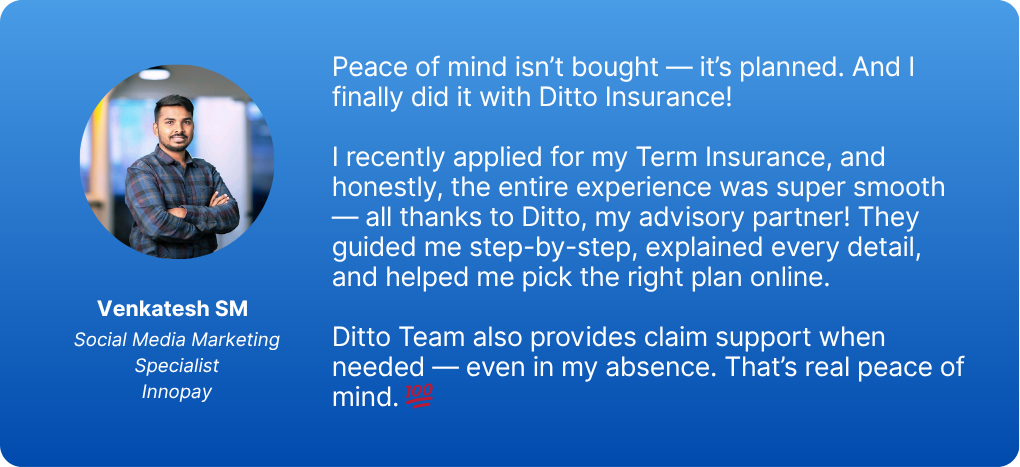

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Ventatesh below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now or chat over WhatsApp, slots fill up fast!

Conclusion

Return of premium options seem quite attractive because you may get your paid premiums back if you don't make any claims until maturity. However, a deeper look demonstrates that it is always better to go for a pure term plan and invest the differential amount elsewhere. This will also help you avoid overspending on term coverage premiums without tangible benefits. If you want the flexibility to get your premiums back in the future, a zero-cost term plan might be a better option.

Whether the ROP feature suits you depends on the risk you're willing to take. Before purchasing, always compare the best insurers and plan options with and without the ROP feature.

Disclaimer

Frequently Asked Questions

Last updated on: