What is the Bajaj Life Insurance Claim Settlement Ratio?

Bajaj Life has a strong claim settlement ratio (CSR) of approximately 99.32% for the year 2024–25. Out of the present CSR, 93.94% were settled within 30 days, which shows that most claims by policyholders are settled quickly and fairly. CSR shows how often the insurer pays out claims. The company utilizes a straightforward digital claim process and clear documentation to maintain consistency and operational efficiency.

Introduction

Buying a term plan is not just about low premiums, it is about choosing a reliable insurer. Bajaj life insurance has maintained a consistently high Claim Settlement Ratio over the past years. At Ditto, we explain what that means in simple terms and help you find a plan that best suits your family.

This guide helps you understand:

- What is a CSR and how to calculate it?

- Where to find your insurer’s CSR and their past records?

- What you should keep in mind when purchasing a term plan?

What is the Claim Settlement Ratio?

When evaluating the reliability of a term insurance company, the Claim Settlement Ratio is a key factor to consider. In simple terms, a higher CSR indicates that the company has a good record of fulfilling its promises to support families when a policyholder passes away.

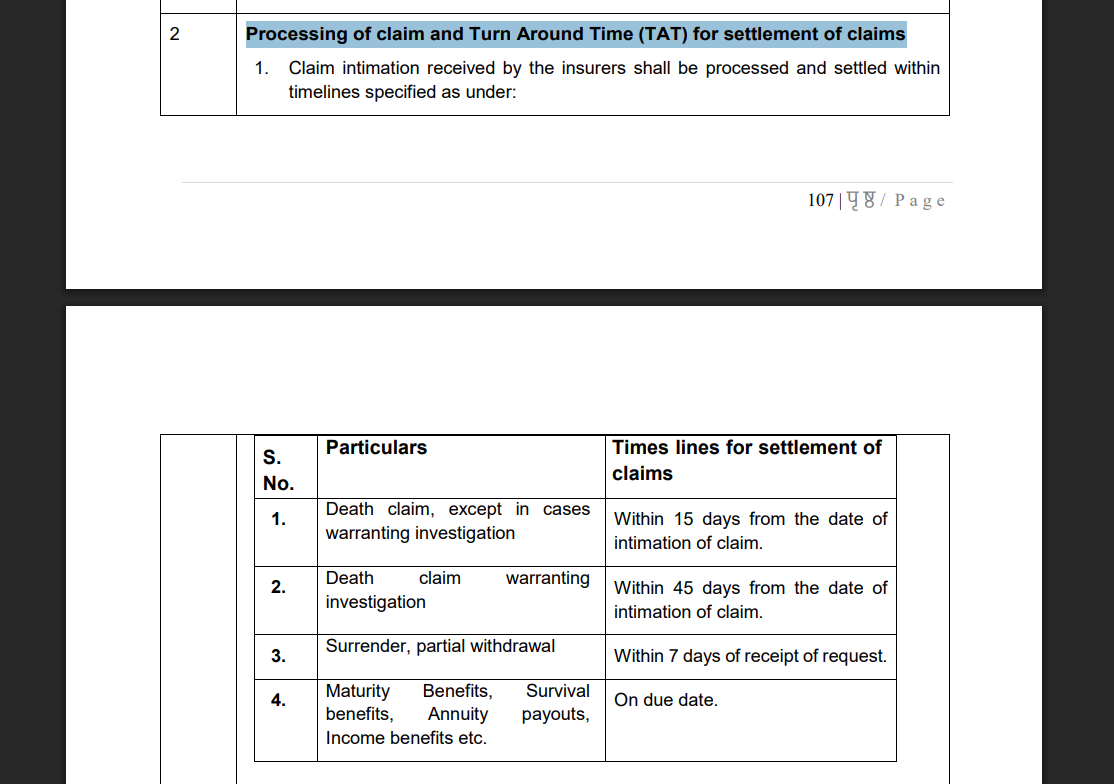

Here’s a snippet from IRDAI’s Master Circular 2024 regarding claim settlement timelines:

How to Calculate the Bajaj Life Insurance Claim Settlement Ratio?

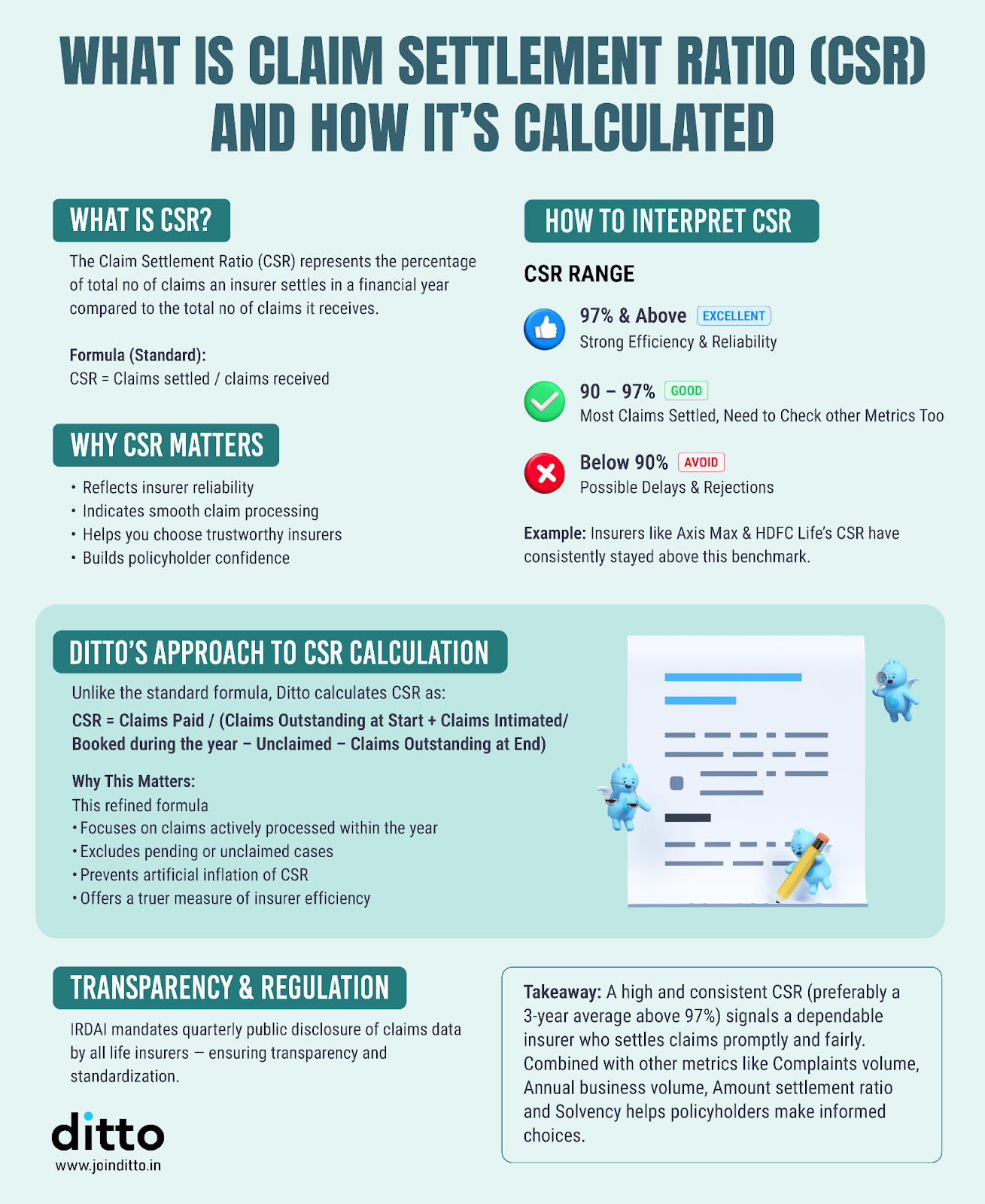

The IRDAI and most insurers calculate the Claim Settlement Ratio by dividing the total number of claims settled by the total claims received in a financial year. To know more about how Ditto calculates CSR, check out this infographic:

Where Can I Find the Bajaj Life Insurance Claim Settlement Ratio?

- Insurer's Public Disclosure Section: Check the Public Disclosures tab on your insurer's website for claim data.

- Insurer's Website: Many insurers share their yearly claim reports in the claim or annual report section of their website.

- IRDAI Reports: The IRDAI's statistics handbook lists verified claim settlement ratios for all insurers.

- Trusted Platforms: Websites like Ditto also share updated CSR comparisons. At Ditto, our experts utilize primary sources, such as those from IRDAI, and compile them into our articles to make your work easier.

Note: You can also receive guidance on your claim settlement by calling their helpline at 020-6712-1212 or emailing them at claims@bajajlife.com for assistance.

What Is the Bajaj Life Insurance Claim Settlement Ratio in the Past 5 Years?

Ditto’s Take on Claim Settlement Ratio

When you buy a term plan, the claim settlement ratio can tell you how reliable an insurer is. Ideally, look for a 3-year average CSR above 97% and check if most claims are settled within 30 days. That’s a good sign of quick and fair processing. You can also check out the top term insurers ranked by CSR.

However, don’t rely solely on CSR. At Ditto, we also consider the amount settlement ratio (ASR), complaint numbers, solvency, annual business volumes, and policy benefits. The best term plan is one that not only has a good CSR but also offers valuable features, affordable premiums, and trustworthy service.

What Are the Other Key Metrics to Consider for Bajaj Life Insurance?

Why Talk to Ditto for Your Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Ankit below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 5,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Bajaj Life Claim Settlement Ratio: Final Thoughts

Bajaj Life has a strong Claim Settlement Ratio, well above the ideal 97% mark. However, the company is still growing in the term insurance space. Its plans are affordable but may miss some key features. If you prefer Bajaj Life, the e-Touch II policy is a solid choice for those seeking an affordable plan and are willing to skip the waiver of premium on critical illness features.

Frequently Asked Questions

Last updated on: